Stocks Soar Near Record Highs Despite Bond Bloodbath, Momo Meltdown

Quite a week…

The biggest quant quake since 2009 (and 2002)

Source: Bloomberg

…as Momentum collapsed…

Source: Bloomberg

And the antithesis of the momo massacre, value had its best week on record…

Source: Bloomberg

And relative to one another, it was a bloodbath…

Source: Bloomberg

And linked to this destruction, 30Y yields (amid record issuance) soared a stunning 33bps this week – second biggest yield spike since 2009…

Source: Bloomberg

…while Treasuries & Momentum stocks maintain a perfectly reasonable ~90% correlation. 🔥💵🔥 pic.twitter.com/fLN9i4EALc

— Monday Morning Macro (@MacroMorning) September 13, 2019

But apart from that – global stocks rallied.

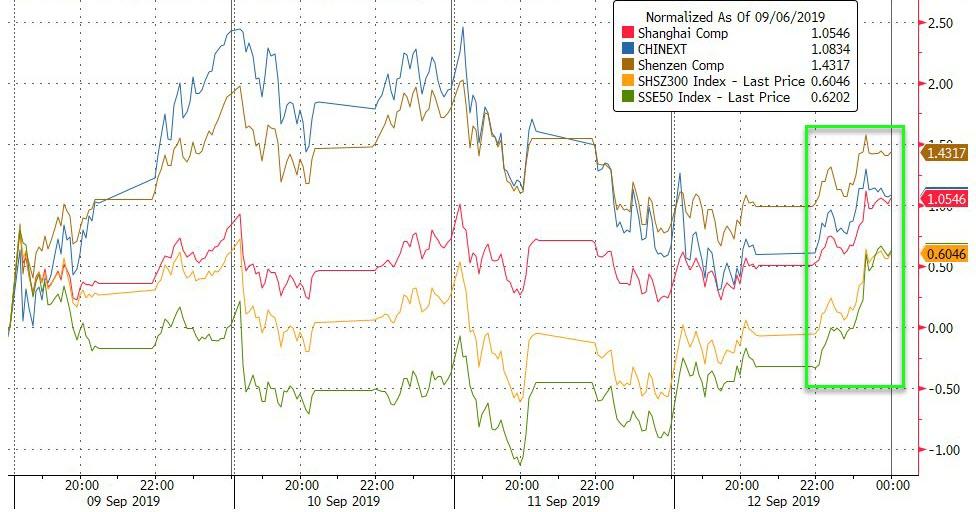

China ended higher…

Source: Bloomberg

Europe soared…

Source: Bloomberg

And US equities surged led by Trannies and Small Caps, each of which was panic-bid at every day’s open. The Dow is up 8 days in a row. Nasdaq underperformed on the week…

That is the best week for Small Caps since Dec 2016 (and best for Trannies since Dec 2017)

Very narrow range in Dow futs in the day session (having tried and failed to break to new highs numerous times)…

The driver of the Trannies/Small Caps surge was a huge short-squeeze…

Source: Bloomberg

The biggest weekly squeeze since Trump’s election…

Source: Bloomberg

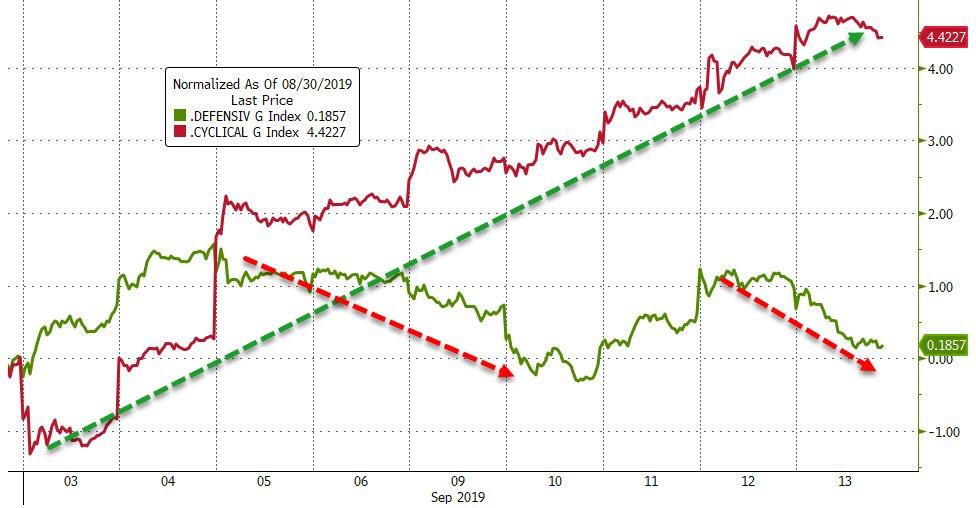

September has seen a massive shift into cyclical stocks…

Source: Bloomberg

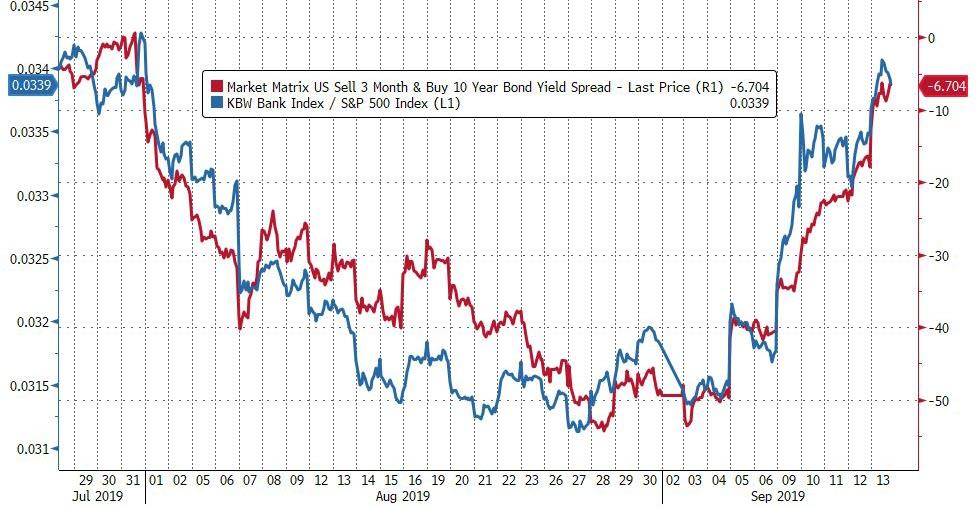

Bank stocks soared this week (as rates rose and the curve steepened)…

Source: Bloomberg

…but note below they are merely back at a critical level of resistance…

Source: Bloomberg

The week was an utter bloodbath for bondholders (yields are up 8 days in a row)…

Source: Bloomberg

Just as the start of August sparked a panic-buying period for bonds, so September has seemingly sparked the exact opposite with a huge retracement so far…

Source: Bloomberg

The 10Y Yield is testing critical technical levels…

Source: Bloomberg

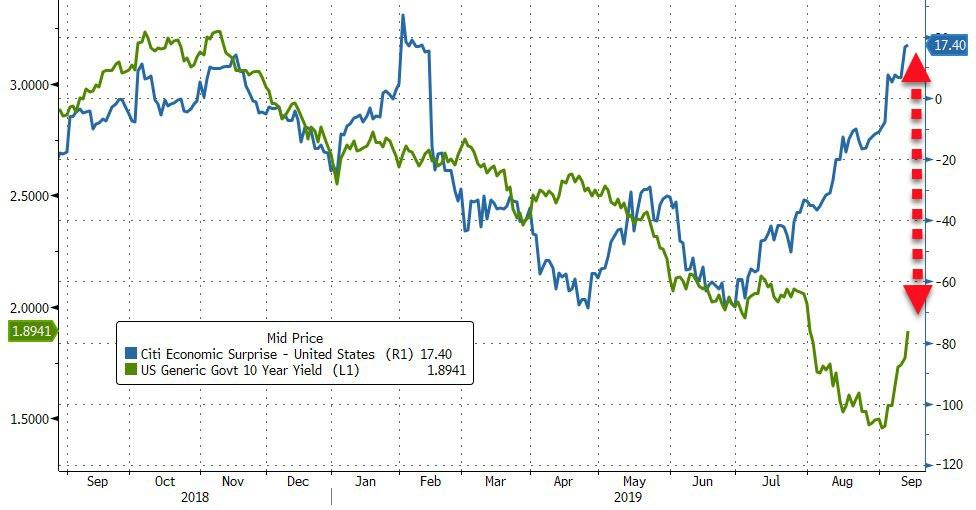

Some might argue the 10Y has a long way to go…

Source: Bloomberg

But don’t listen to Jamie Dimon: In 2018, he predicts 10Y yields will hit 4%, 10Y yield drops to all time low. In 2019, he says JPM preparing for 0% rates on 10Y, 10Y yield soars most in years.

Meanwhile, elsewhere in bond land, that 100-year maturity Austrian bond (which was up 85% YTD, is now in a bear market, down 21% from the highs)…

Source: Bloomberg

The US yield curve (3m10Y) remains inverted but had the biggest weekly steepening since June 2013…

Source: Bloomberg

The Dollar slipped lower the second week in a row, testing one-month lows…

Source: Bloomberg

Cable soared this week – its best since May – as BoJo faced defeat and a no-deal brexit was believed to be less likely…

Source: Bloomberg

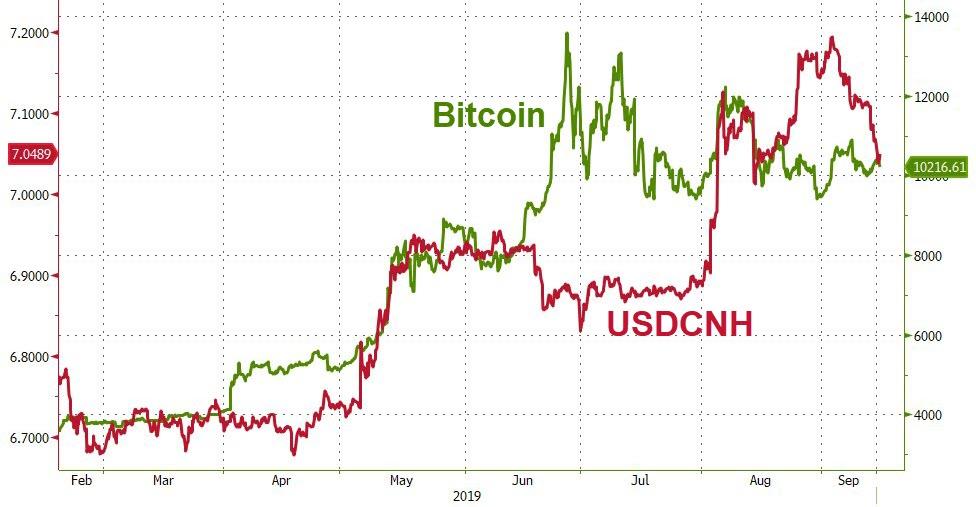

Offshore Yuan ended the week stronger than the Yuan fix

Source: Bloomberg

This is the strongest offshore yuan has been relative to the fix since Dec 2018…

Source: Bloomberg

Yuan appears to have caught up to Bitcoin’s stability…

Source: Bloomberg

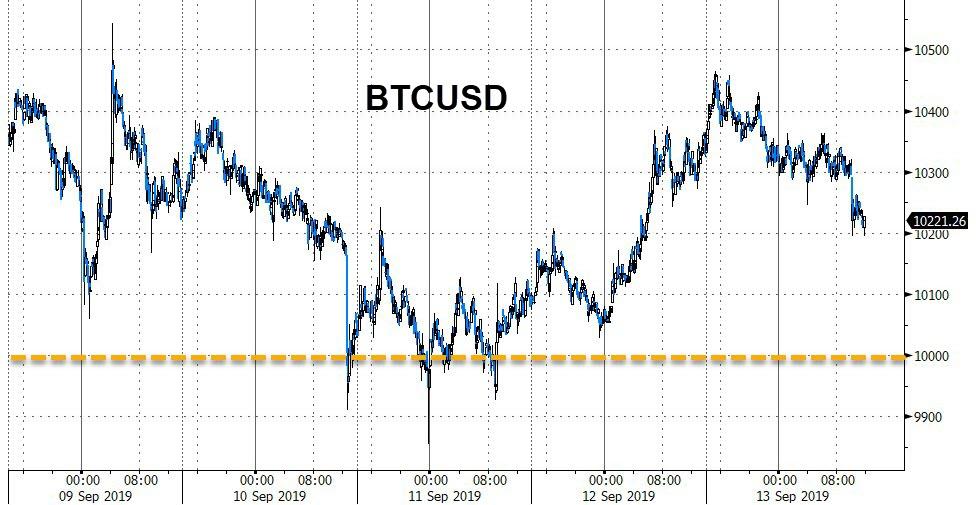

Cryptos were mixed with Bitcoin down on the week and Altcoins up led by Ethereum…

Source: Bloomberg

But Bitcoin held above $10,000 for now…

Source: Bloomberg

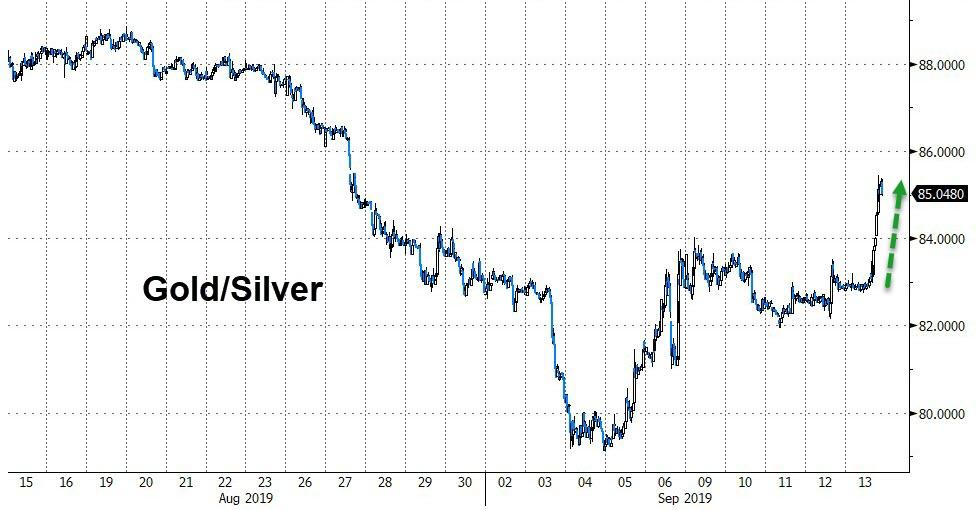

Oil had a volatile week as copper surged but PMs got pummeled today (most notably silver)…

Source: Bloomberg

Soft Commodities soared 5.2% this week, its best rally since May and snapping 10 straight losses in what was the longest losing streak since at least 1991.

Source: Bloomberg

With the surge in rates this week, the volume of global negative-yielding debt tumbled, and gold tracked it lower…

Source: Bloomberg

But it was silver that was monkeyhammered most…

Smashing Gold/Silver dramatically higher this week…

Source: Bloomberg

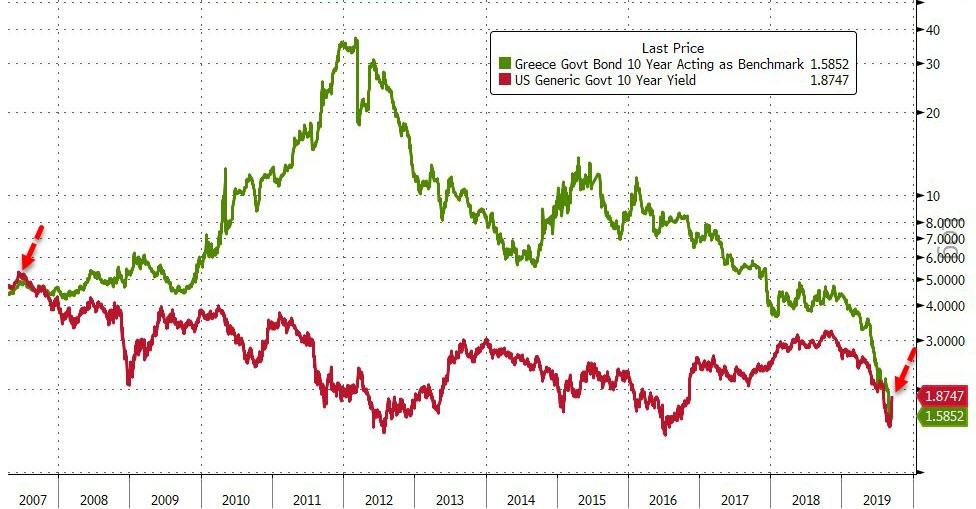

Finally, straight from the WTF world we live in, Greek 10Y Yields are now below US 10Y Yields for the first time since 2007…

Source: Bloomberg

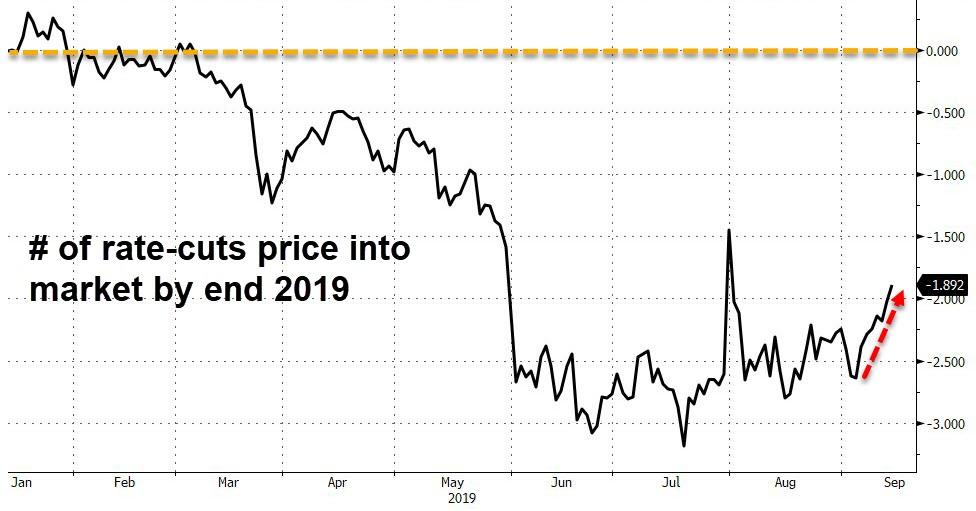

And the market is starting to ease off its pressure on The Fed as it now prices in less than 2 rate-cuts by year-end (from more than 3 in July)…

Source: Bloomberg

Tyler Durden

Fri, 09/13/2019 – 16:01

via ZeroHedge News https://ift.tt/2LtaC9y Tyler Durden