Yergin: Expect Extreme Volatility In Oil Markets

Authored by Tsvetana Paraskova via OilPrice.com,

Rising pipeline takeaway capacity in the Permian and global oil demand growth at its weakest in a decade are set to lead to more volatility in oil prices in the near term, a prominent energy expert said, joining a growing number of analysts who see prices further depressed by slowing economies and crude demand.

“The pipeline bottlenecks are in the process of being resolved, so a lot more oil is going to come onto the market by the end of the year. We expect the U.S. (crude oil output) to be up to 13 million barrels a day,” IHS Markit’s vice chairman Daniel Yergin told CNBC on Tuesday.

While U.S. production will continue to add more supply in an already oversupplied global market, on the demand side, expectations are getting increasingly pessimistic.

“We’re in one of the weakest periods since 2008 and we think demand growth this year is under a million barrels per day. So you have that factor at the same time as you have more oil coming to the market. So expect some volatility,” Yergin told CNBC in an interview on the sidelines of a conference in Abu Dhabi.

Despite expectations of volatility, IHS Markit’s vice chairman sees Brent Crude prices range-bound in the US$55-65 range.

Yergin is not alone in predicting substantially lower oil demand growth this year than originally anticipated.

The International Energy Agency (IEA) revised down its demand growth estimates for 2019 in its latest Oil Market Report, by 100,000 bpd to 1.1 million bpd, after seeing that between January and May demand growth was just 520,000 bpd, the lowest increase for the period since 2008.

Several Wall Street investment banks have already warned that the escalating U.S.-China trade war raises the odds of an economic slowdown and subsequent low oil demand growth. Some banks have already cut their oil demand growth estimates for this year, saying that oil demand could grow at its slowest pace in at least half a decade.

In July, Barclays cut its oil price forecasts for the second half of 2019, saying that demand growth would be just over 1 million bpd this year. Barclays revised down its forecasts by US$2 to US$69 per barrel Brent Crude and US$61 per barrel WTI Crude.

In August, Morgan Stanley said that demand growth continues to soften amid slower economic growth and cut its forecasts for Q3 and Q4 2019 for Brent Crude to US$60 from US$65 per barrel, and for WTI Crude to US$55 from US$58 a barrel.

This week, Goldman Sachs revised down its oil demand growth estimate to 1 million bpd, down by 100,000 bpd from the previous outlook.

“Our oil supply-demand outlook for 2020 calls for additional OPEC production cuts to keep inventories near normal,” Goldman’s analysts said in a note, as carried by Reuters.

In its Short-Term Energy Outlook (STEO) published on Tuesday, the EIA also cut its global demand growth estimate for 2019 to 900,000 bpd, down by 100,000 bpd from the August forecast.

“If realized, 2019 would be the first year when demand growth is less than 1.0 million b/d since 2011,” the EIA said, and slashed its Brent Crude forecast by US$2 from the August outlook to US$63. For 2020, EIA expects annual average Brent Crude prices to slightly drop to US$62 a barrel, which would be US$3/b lower than the forecast in August.

It’s not only demand that will weigh on oil prices for the rest of the year—supply out of the U.S. is expected to increase with reduced takeaway constraints from the Permian to the U.S. Gulf Coast. The Cactus II crude oil pipeline added an estimated 670,000 bpd and the EPIC Midstream natural gas liquids pipeline, which was repurposed for crude oil, added another 400,000 bpd capacity, EIA said.

Thanks to Cactus II and EPIC, outbound shipments of crude oil from Corpus Christi surged to a record in the first week of September, RBN Energy said on Monday, noting that the data may be “suggesting that the expected surge in exports of Permian oil is finally occurring.”

Should the “surge in export volumes continue to build in the weeks ahead, the crude-oil export infrastructure at Corpus may finally get the benefit of the doubt,” RBN Energy said.

Yet, a growing group of analysts believe that U.S. shale production growth will considerably slow down for the rest of the year, giving oil bulls hope that the global oversupply concerns could be overblown.

Supply and demand issues and the unpredictable nature of the ongoing U.S.-China trade war are setting oil prices for an extended period of volatility.

Tyler Durden

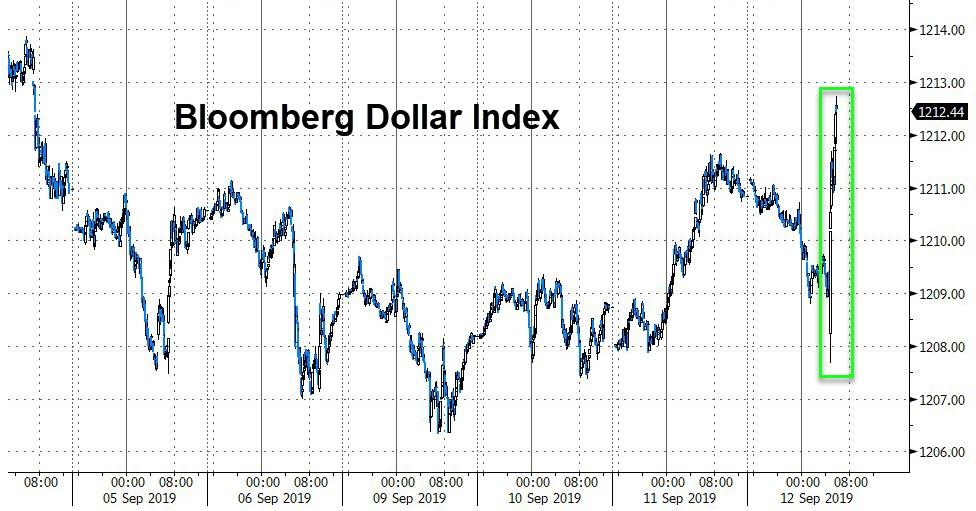

Thu, 09/12/2019 – 09:26

via ZeroHedge News https://ift.tt/2Ae2Sls Tyler Durden