Full ECB Preview: Draghi Parting Gift – A Bazooka Or A Water Pistol?

Submitted by RanSquawk

Tomorrow, at 13:45am CET (7:45am ET) the will unveil its Draghi “Swan Song” Monetary Policy Decision, with a press conference Due At 13:30BST, (08:30ET)

- Surveyed analysts look for the ECB to cut the deposit rate by 10bps with the Main Refi and Marginal Lending rates seen unchanged

- Markets currently price in around a 40% chance of a deeper cut to the deposit rate of 20bps

- Focus will be on any potential complimentary easing measures alongside expected rate reductions

- ECB staff economic projections will likely reflect the downbeat prospects for the Eurozone economy

INTRODUCTION

Will outgoing ECB president Mario Draghi’s “swan song” decision – the one in which he is widely expected to cut rates deeper into negative territory and resume sovereign and/or corporate QE – be a bazooka or a waster pistol? That’s the question.

Markets currently fully price in a 10bps reduction in the deposit rate to -0.5% with just over a 40% chance of a deeper cut of 20bps.

Of the 70 economists polled by Reuters, around a quarter look for a 20bps reduction with the remainder looking for 10bps. Elsewhere, the survey noted that almost 90% of respondents expected a resumption of bond purchases as of October with a touted monthly amount of EUR 30bln”. In order to mitigate the impact of deeper negative rates on the Eurozone banking sector, around 90% of those surveyed look for some form of tiering system.

BACKGROUND

- PREVIOUS MEETING: Policymakers opted to stand pat on rates, however, the Bank paved the way for an eventual rate cut by tweaking its forward guidance on rates to include an “or lower” option. Furthermore, the Governing Council tasked the relevant Euro system Committees with examining options, including ways to reinforce forward guidance on policy rates, the design of a tiered rate system, and options for the size and composition of potential new net asset purchases. Draghi suggested that a rebound in the second half of the year looks “less likely” with the outlook looking “worse and worse”. Draghi suggested there was a broad discussion with “broad convergence” to the decision whilst noting that some board members had reservations about a two-tiered rate system. It was also revealed that no discussion took place on an imminent rate cut or the size of such a prospective move.

- ECB MINUTES: The account from the July meeting echoed the tone struck in the press conference which underpinned the Bank’s decision to pave the way for an eventual rate cut as well as other prospective easing measures. This was exemplified by policymakers’ view that the slowdown is seen as more protracted than previously thought with downside risks more pervasive. Furthermore, from an inflation perspective, “the recent declines in both actual inflation and longer-term inflation expectations were “a matter of concern”. With this in mind, members “broadly supported the proposal made by Chief Economist Lane to task the relevant Eurosystem Committees with examining options for future policy measures”. In terms of the scope and sequencing of potential further measures, the account noted “experience had shown that a policy package – such as the combination of rate cuts and asset purchases – was more effective than a sequence of selective actions”. However, “Some concerns were raised regarding possible unintended consequences of a tiered system and its ability to fully mitigate the potential effects of negative policy rates on bank intermediation”.

- ECB RHETORIC: Finland’s Rehn set the stage for the September meeting by suggesting that the Bank needs to deliver a “significant and meaningful” easing package this month, adding that it is better to overshoot than undershoot on stimulus. VP de Guindos took a slightly different stance and instead argued that the central bank must base its decisions on macroeconomic data, and be critical of market expectations, albeit, conceded that the ECB must act with “determination”. Incoming ECB chief Lagarde (not sitting President at the September meeting), stated that the Bank has not hit the lower bound on interest rates, adding that the ECB has the tools to tackle a downturn, and must be ready to use them. Elsewhere, hawks at the ECB have been vocal with Klaas Knot from the Netherlands suggesting there is no need to resume a QE program at present, adding that market expectations for the September meeting are overdone. Germany’s Lautenschlaeger added additional weight to the hawkish argument by stating that it is much too early for a huge package; a viewpoint that was later echoed by newly appointed Müller from Austria.

- SOURCE REPORTS: Following the July meeting, sources indicated that a deposit rate cut in September is almost certain, whilst more government bond buys and guidance change is also likely, policymakers still need to be convinced about the tiering system and purchases of stocks and bank bonds are seen as a non-starter. Thereafter, sources last week suggested policymakers are leaning towards a rate cut and tiering and reinforced guidance. In terms of bond buys, the report noted that many support QE, but opposition from some northern states complicates the discussion, additionally policymakers believe they have room for around 1yr of QE using flexibility under existing rules and there is no immediate need to change the issuer limit.

- DATA: Eurozone inflation remains well below the ECB’s targeted level with Y/Y CPI for Aug at 1.0%, core at 1.1% and super-core 0.9%. Q2 GDP figures were confirmed at 0.2% Q/Q and 1.2% Y/Y. Eurozone composite PMI rose to 51.9 from 51.5 with the report noting “The picture remains very mixed both by sector and country, highlighting how downside risks persist. A fierce manufacturing downturn, fuelled by deteriorating exports and most intensely felt in Germany, continues to be offset by resilient growth in the service sector, in turn propped up to a large extent by solid consumer spending in domestic markets”.

CURRENT ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

- RATES: We expect them to remain at their present or lower levels at least through the first half of 2020, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to our aim over the medium term. (Jul 25th)

- ASSET PURCHASES: We intend to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when we start raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. (Jul 25th)

- GROWTH/TRADE: The risks surrounding the euro area growth outlook remain tilted to the downside, reflecting the prolonged presence of uncertainties, related to geopolitical factors, the rising threat of protectionism, and vulnerabilities in emerging market. (July 25th)

- INFLATION: Looking through the recent volatility due to temporary factors, measures of underlying inflation remain generally muted. Indicators of inflation expectations have declined. While labour cost pressures have strengthened and broadened amid high levels of capacity utilisation and tightening labour markets, the pass-through of cost pressures to inflation is taking longer than previously anticipated. (Jul 25th)

- TIERED RATES: The Governing Council has tasked the relevant Eurosystem Committees with examining options, including…mitigating measures, such as the design of a tiered system for reserve remuneration. (Jul 25th)

POTENTIAL ACTIONS/ADJUSTMENTS TO ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

- RATES: As a reminder, Markets currently fully price in a 10bps reduction in the deposit rate to -0.5% with just over a 40% chance of a 20bps cut. Of the 70 economists polled by Reuters, around a quarter look for a 20bps cut with the remainder looking for 10bps. Any adjustments to forward guidance on rates will be contingent on the extent to which rates are lowered and thus potential tweaks to forward guidance remains unclear. That said, one option for the Governing Council could be to remove the “at least through the first half of 2020” time dependent element of the statement whilst leaving the door open to further rate reductions. Additionally, Morgan Stanley float the idea of a ‘chained’ guidance approach whereby policymakers could establish “at least through the first half of 2020”, i.e., a direct link between the rate path and QE, with no hike whatsoever until after the horizon of net asset purchases”.

- ASSET PURCHASES: Almost 90% of respondents to a Reuters survey expect a resumption of bond purchases as of October with a touted monthly amount of EUR 30bln. The expectations surrounding asset purchases are relatively wide-ranging given the lack of specific guidance from ECB members and the potential options that policymakers face (i.e. size, duration and start date). For example, ABN AMRO look for a package of EUR 70bln a month for 12 months, with the Dutch Bank suggesting that anything less than this would make it very difficult for the ECB to “close the gap between the ECB’s projection for inflation at the end of 2021 and the ECB’s inflation aim”. Conversely, RBC “do not forecast the ECB to announce a QE restart at the forthcoming meeting in September, but expect that they will leave this option firmly on the table for future meetings to decide”. Therefore, it is difficult to gauge how exactly the market will react to a specific programme from the ECB (should one be announced), however, the above-mentioned Reuters survey will likely act as an approximate benchmark for the market. Another issue for policymakers in designing such a programme is the issue of scarcity, upon which HSBC suggest that the issuer limit could be raised to 50% from 33%, allowing “a little over three years of QE before constraints start to bind”. In terms of overall composition, UBS suggest that such a package would likely comprise of ABS, covered bonds, corporates and supra-nationals with the Swiss bank pouring cold water the prospect of bank bonds or equities. As with forward guidance on rates, any tweaks to the Bank’s communications surrounding asset purchases will be dependent on what (if anything) is unveiled at the 1245BST announcement.

- GROWTH/TRADE: Risks are still expected to be seen as tilted to the downside given the lack of clear improvement in the region’s growth prospects since the July meeting and ongoing threats from protectionism. The previous meeting saw policymakers dampen expectations of a H2 rebound, something which will likely be reflected in the staff economic projections as discussed below.

- INFLATION: Given August inflation metrics, measures of underlying inflation are still likely to be classified as “muted”. The region’s inflation prospects will be detailed in the staff’s economic projections (as discussed below). Another potential talking point could be any work carried out on the Bank’s efforts to revamp its inflation goal, something that was flagged ahead of the prior meeting. This subject was also covered by incoming ECB President Lagarde who recently said she wishes to examine the Bank’s mandate. With this in mind, this matter might be something more for the Lagarde-era, rather than an announcement at Draghi’s last meeting.

- TIERED RATES: Given the almost certain prospect of even deeper negative rates in the Eurozone, the idea of a tiered rate system has been a key talking point for markets given the perceived requirement to protect bank profitability in the region. In the previous policy statement it was revealed that Eurosystem Committees had been tasked with examining potential options on this front. However, the account from that meeting revealed “Some concerns were raised regarding possible unintended consequences of a tiered system and its ability to fully mitigate the potential effects of negative policy rates on bank intermediation”. That said, last week’s source reports suggested that any rate reduction will likely be accompanied by tiering and since, a rate reduction (whether it be 10 or 20bps) is fully priced in, markets will be looking for the details of such a programme or at least to what extent the work of the Eurosystem Committees’ has progressed. In terms of what a potential system could look like, HSBC (who suggest there is no obvious format) floats the idea of a Swissstyle system where banks no longer have to pay the negative deposit rate on some of their excess reserves (determined by a multiple of their required reserves). Alternatively, a ‘Danish’ system could be adopted which applied ‘bank-by-bank thresholds’, however, HSBC highlights that this could be logistically complex for the ECB given that there are over 5000 banks in the Eurozone. SGH Macro suspect that any potential system will be limited (given the impact of negative rates isn’t necessarily a core issue for the Eurozone banking system) and “could be tied to metrics that would ensure that the banks that do receive relief are in turn doing their part in lending money out into the system”. Overall, it remains unclear what system, if any, could be announced however, a lack of action to mitigate the potential consequences of deeper negative rates for Eurozone banks at this stage would likely be seen as a negative for the sector given current communications.

PRESS CONFERENCE

In terms of the press conference (1330BST), the focus for Draghi’s opening remarks and line of questioning from journalists will likely centre around what measures (if any)/tweaks are unveiled at the policy announcement (1245BST), all of which have been discussed above. Should some of the measures (e.g. tiered rates) the markets have been looking for ahead of the meeting, not be unveiled this week, this will likely be a line of questioning for the Q&A section of the press conference, whilst Draghi would also likely outline the conditions needed for such measures to be announced. However, without knowing what is to be released at 1245BST ahead of the press conference, it is difficult to hypothesize on the exact focus of the press conference.

As ever, investors will be looking for specifics as to how policymakers classify the Eurozone’s growth prospects, however, such concerns/views will be largely reflected in the accompanying staff economic projections (released during the press conference).

As such, one of the more interesting aspects of the press conference, given the recent hawkish rhetoric from some members of the Governing Council, will be the unanimity of any decision taken. If the decision was seen to be largely unanimous, this could offer some reassurances to markets that the Bank will implement all the resources they can to reach their inflation mandate, whilst a lack of unanimity and hawkish dissent could suggest that room for further easing is limited. If markets were disappointed by the 1245BST announcement then such an outcome could see a particularly negative interpretation of the Bank’s efforts to stabilise the Eurozone economy.

Finally, parts of the Q&A section could centre around the need for fiscal measures to compliment monetary actions, something which Draghi has called for in the past. However, the ECB President will likely stop short of commenting on specific touted efforts by Eurozone governments such as Germany and Italy. Furthermore, this will likely be more of a focus for the Lagarde era at the Bank given her role in the IMF and relationships with various governments across the world.

ECONOMIC PROJECTIONS

- Growth: Expectations surrounding Eurozone growth projections will be contingent on the policy package announced at 1245BST. Danske Bank (who look for a comprehensive easing package), suggest that the deterioration in the global economy since the prior round of projections in June will hamper the ECB’s ability to provide a “growth scenario where the economic momentum gains speed in the near term”. With this in mind, Danske look for across the board cuts for 2019-2021 with 2020 trimmed by 0.3pp to 1.1%. RBC take a slightly more favourable approach and look for little changes to the Eurozone’s growth prospects given sharp adjustments lower in March and June and deem it unlikely that the ECB will follow suit once again this month.

- Inflation: Recent inflation metrics in the Eurozone have clearly disappointed and will raise cause for concern at the ECB. HSBC highlights that “The ECB was looking for headline inflation at 1.5% y-o-y in 2Q and 1.1% in 3Q, while it was 1.4% in 2Q and is on track for 0.9% in 3Q”, based on HSBC forecasts. In terms of the underlying assumptions for the projections, HSBC back their view for lower inflation forecasts by noting the circa 15% fall in oil prices for the year and overall relatively unchanged EUR on a trade-weight basis. RBC concur that near-term inflation forecasts will likely be lowered. However, further out, EUR and oil prices will play second-fiddle to the Eurozone’s encouraging wage growth prospects and thus look for unchanged readings for 2020 and 2021.

Please see below for an overview of Danske Bank’s expectations for the ECB’s staff economic projections.

MARKET REACTION

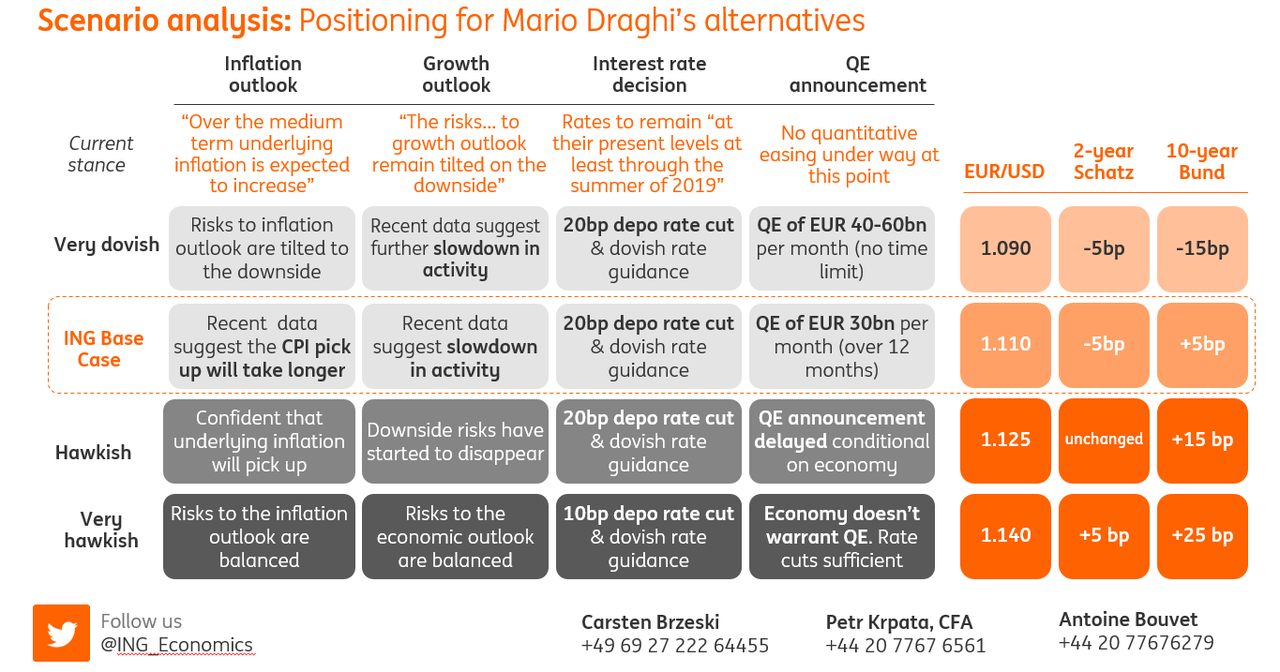

Please see below for ING’s ECB Scenario Analysis

Tyler Durden

Wed, 09/11/2019 – 21:45

via ZeroHedge News https://ift.tt/2NWjIgQ Tyler Durden