At the heart of Elizabeth Warren’s campaign for president—and of her entire career as a politician and public intellectual, really—are two simple ideas.

The first is that the economy is fundamentally broken. This downer of an idea was present in the speech that launched her presidential campaign on February 9, 2019, in which she declared that “millions and millions of American families are also struggling to survive in a system that has been rigged by the wealthy and the well-connected” and in which she insisted that the only response was to fight for “big structural change.”

It was present at the first Democratic primary debate, in which she inveighed against corporate profits and monopolistic businesses and corrupt lawmakers who have “made this country work much better for those who can make giant contributions, made it work better for those who hire armies of lobbyists and lawyers, and not made it work for the people,” and in which she scored the opening night’s standout moment by offering a full-throated argument for the elimination of private health insurance.

It was present in the 2007 essay that imagined what would eventually become the Consumer Financial Protection Bureau, a federal agency premised on the notion that American families were being “steered into overpriced credit products, risky subprime mortgages, and misleading insurance plans” and that many of these products needed to be regulated as pervasive dangers to the American family.

It was present in the very title of her breakout 2004 book, The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke, which promoted a systemic view of America’s economic fragility, driven by data that Warren had compiled during her career as an academic bankruptcy researcher.

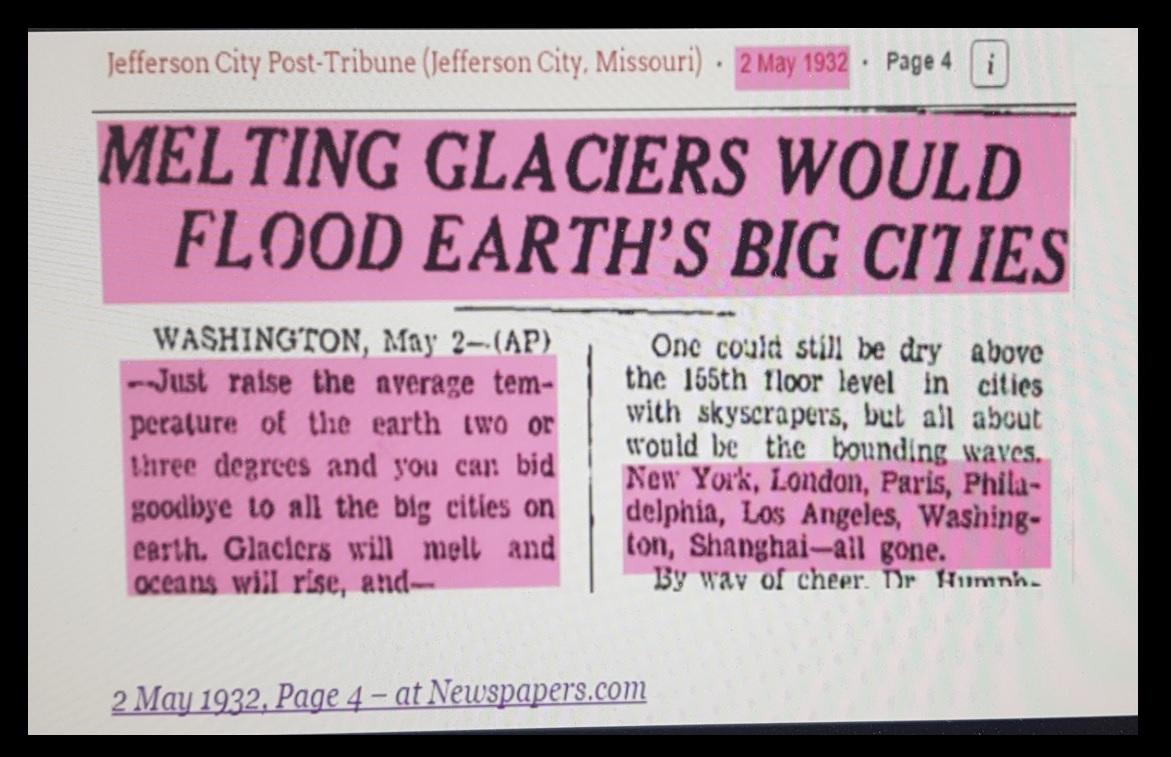

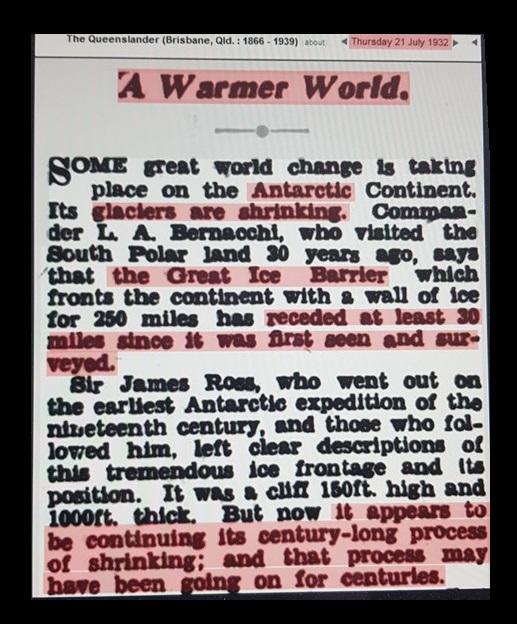

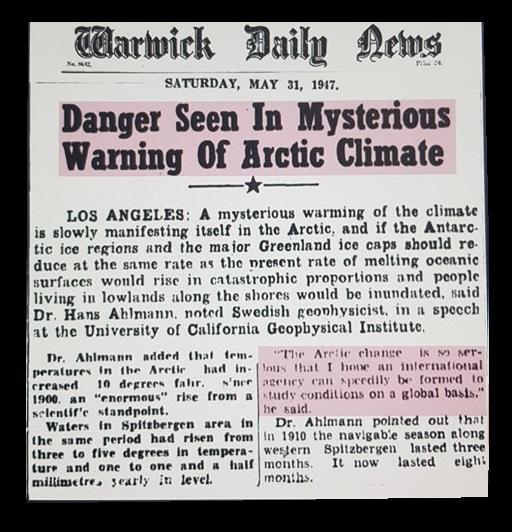

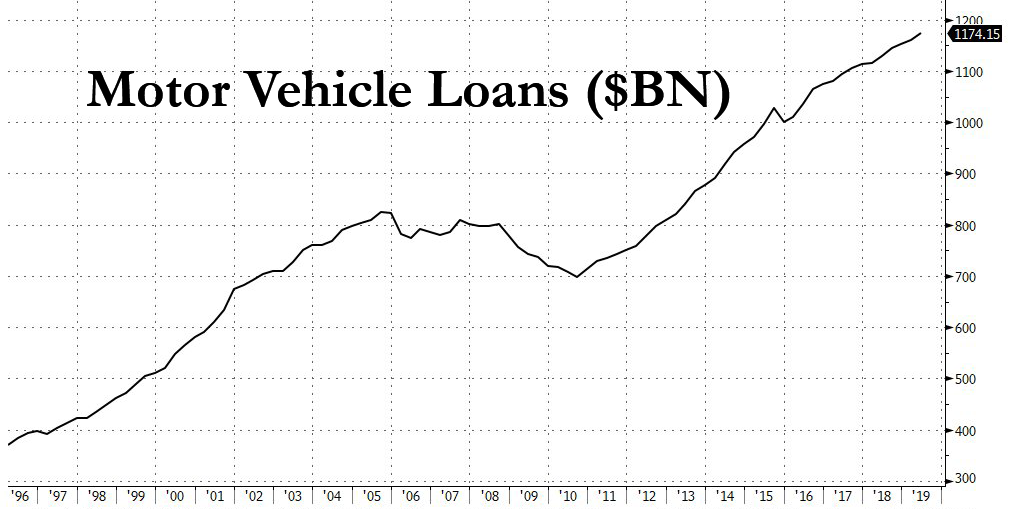

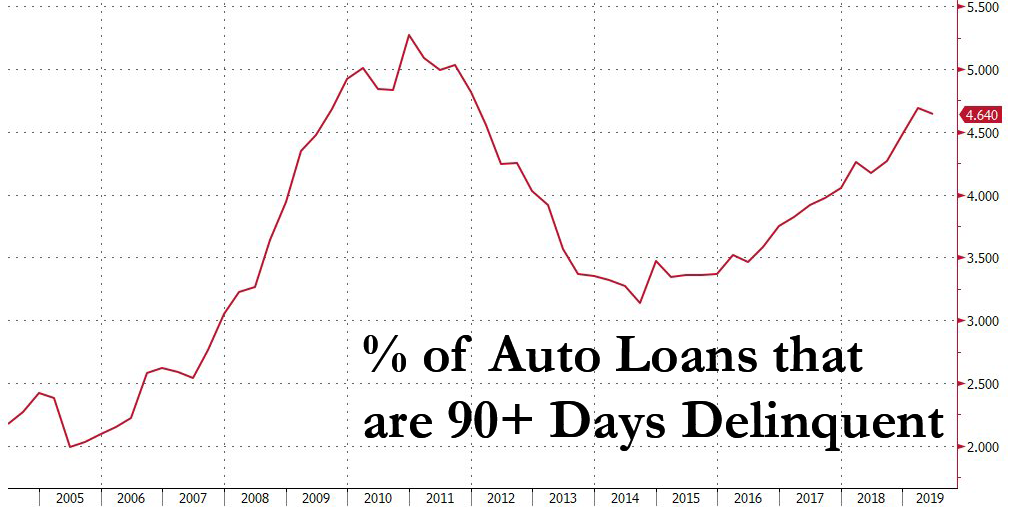

It was explicit in her campaign’s July broadside, “The Coming Economic Crash—And How to Stop It,” which cast Warren as a prophet of economic collapse and proposed an array of economic policies, from a $15 minimum wage to enforcing restrictions on certain bank loans, that she argued could stave off the crisis.

And it is present, in spirit if not in word, in each and every one of the slew of white papers and policy proposals that have poured forth from Warren’s campaign as if she were running a think tank rather than a presidential bid.

In the space of just a few months this year, Warren released plans for everything from ending drilling on public lands to breaking up Facebook and Amazon to imposing a new industrial policy of “economic patriotism.” She wants to spend $500 billion on affordable housing and trillions more to cancel most student debt, make public college tuition free, and offer subsidies for child care. And she has proposed paying for these costly programs with wealth taxes designed not only to offset the price tag of new government spending but to help reduce economic inequality by shrinking large stores of wealth.

This brings us to Elizabeth Warren’s second big idea: The economy is fundamentally fixable—but only if Elizabeth Warren is manipulating all the levers of power.

Warren’s penchant for wonky policy detail has defined her candidacy: “Elizabeth Warren has a plan for that” has become a rallying cry and a slogan, one her fans have plastered across an array of T-shirts and campaign signs. Warren has happily embraced this persona, joking with crowds that her focus on the details of federal agencies would turn them all into nerds.

Warren is running as a wonk populist, the sort of politician who could give a rousing speech at a picket line in the morning, then stroll into a conference room and offer detailed comments on a new regulatory scheme in the afternoon. Her campaign is an attempt to marry rabble-rousing economic grievance to high-class technocratic solutionism.

The Warren worldview is thus both bloodless and moralizing. It is also dangerous, combining self-righteous certainty about the perils of the economy with dubious data and an instinct for bureaucratic paternalism. Warren wants the federal government to be the American economy’s hall monitor, telling individuals and companies what they can and can’t sell or buy and making some of the nation’s most successful businesses answer to her demands.

It seems to be working. During the first six months of 2019, this strategy vaulted Warren into the top tier of Democratic primary contenders, helping her raise more than $19 million during the year’s second quarter and placing her among the top three or four candidates in the party’s crowded field. Focus groups and political reporting have consistently found that Democratic voters are warming not only to the substance of Warren’s ideas but to the very fact that she has them.

Yet Warren’s wonkery and her populist fury are both based on myths and misdirection, often perpetuated by Warren herself. Although she styles herself as a data-driven champion of the little guy, she has run a campaign based on a dismal representation of the U.S. economy that fails to account for factors that complicate her story. And although she has received kudos for the volume and specificity of her plans, Warren has a history of pushing misleading research and cherry-picked data designed to support politicized conclusions.

So, yes, it’s true that Elizabeth Warren has a lot of plans. The problem is that they don’t all add up.

To understand the deep roots of Elizabeth Warren’s economic pessimism, you have to know a little about her most well-known book, The Two-Income Trap. And to understand The Two-Income Trap, you have to understand Warren’s early work as a bankruptcy researcher.

Warren first rose to prominence as the co-author of a pioneering study of consumer bankruptcy, which was published in book form in 1989 under the title As We Forgive Our Debtors: Bankruptcy and Consumer Credit in America. Warren and her co-authors based the book on a trove of court data from about 1,500 bankruptcy cases in Pennsylvania, Illinois, and Texas during 1981.

The book made a splash, partly because of its reliance on real-world case studies and partly because of its stark language. “Bankrupt,” reads the book’s opening line. “The single word is a body blow, like ‘Dead.'” Warren was an academic, working with other academics to code and statistically analyze a trove of unique data. But she wasn’t just poring through variables and spreadsheet entries. She was telling a story in order to make an argument about politics and policy.

The story was that rapacious credit card companies, rather than consumer overspending, were primarily responsible for a run-up in consumer debt and the resulting sense that household budgets had grown more precarious. The book’s authors saw bankruptcy in broadly sympathetic terms, as a financial safety net for struggling families. In the years that followed, Warren would go on to become one of the nation’s most prominent advocates of making bankruptcy easier, more lenient, and more accessible.

But that story had some notable problems. Among others, it was based on cases from 1981, a recession year when consumers would have looked worse off than usual. It was released years later, after a significant reform to the bankruptcy code in 1984 rendered its picture of American bankruptcy somewhat out of date. And it wasn’t clear whether data from the three selected states could be generalized to the population as a whole.

Within the world of academic bankruptcy research, the book generated controversy. In the 1990–91 edition of the Rutgers Law Review, Rutgers law professor Philip Shuchman, a star of the field who had initially recommended a $110,000 grant to help fund Warren’s research, wrote a scathing and brutal assessment of the book, calling into question the authors’ methods, data, and scholarly ethics. Shuchman, who died in 2004, accused Warren et al. of making “serious errors” and refusing to produce raw data that would allow other scholars to check their conclusions. His review said the research exhibited an “anti-scientific bias” and accused the authors of engaging in “repeated instances of scientific misconduct.”

The scientific misconduct charge was investigated and dismissed by the National Science Foundation, which provided funding for the work. But the investigators noted that there remained “extreme differences” between the feuding researchers “regarding the interpretation of data.” Warren and her co-authors were given the opportunity to respond to Shuchman but never did.

In retrospect, it’s clear that this research played a significant role in the formation of Warren’s staunchly populist worldview and in her conclusion that the only solution was substantial policy reform. Bankruptcy was a system governed by legal rules, rules that in her view had been rigged to empower one group—financial elites—at the expense of others. The rules could be changed if politicians and bureaucrats were sufficiently committed. But convincing people that change was necessary meant telling a clear and simple story, one that captured the raw feeling of what was happening to ordinary people. That sometimes meant ignoring nuances and complications that made the story less compelling.

Earlier this year, Warren was questioned about the controversy surrounding Shuchman’s review by The Washington Post. She insisted that “the data are rock solid” but did not address specific criticisms: “There’s just nothing else to say.” She claimed she couldn’t remember why she never penned a response to Shuchman’s review. According to the Post, she had pushed aggressively for a retraction. The Rutgers Law Review never withdrew the article.

In the ensuing years, Warren not only stood by her story of predatory financiers exploiting sympathetic middle-class families; she amplified it—and sold it to an eager public.

The Two-Income Trap, which Warren co-authored with her daughter Amelia Warren Tyagi, a business consultant who has served as chair of the liberal think tank Demos, is largely an explication of the worldview underlying her bankruptcy research. Even more than As We Forgive Our Debtors, the book was targeted squarely at a popular audience, free of academic jargon and full of easy-to-digest stories about middle-class struggle.

By the time the book was published, Warren had risen through the academic ranks to become a Harvard law professor. She had also served as an adviser to the National Bankruptcy Review Commission.

Once again, Warren drew on her bankruptcy research to argue that the middle class had been given a raw deal. The number of households filing for bankruptcy had shot up dramatically, she said, and it wasn’t because they were spending too much. Instead, the increasingly high cost of housing, driven heavily by competition for access to good schools, and the pile-up of medical debt were driving families into dire straits.

These effects were compounded by the movement of women into the workforce. Where stay-at-home wives had once served as a safety net—the earners of last resort should a breadwinner husband lose his job—the rise of the working mother had increased financial risk for two-earner families. Using comparisons between a hypothetical 1970s single-earner household making about $39,000 in inflation-adjusted dollars and a hypothetical 2000s dual-earner household making about $68,000, she purported to show that middle-class families weren’t really any better off than they were when men were the primary earners. “Today’s dual income families have less discretionary income—and less money to put away for a rainy day—than the single-income family of a generation ago,” she wrote.

The book and its ideas served as a kind of manifesto for Warrenism in both substance and style. It was accessible, folksy, pessimistic, and wonky, and in the years since its publication it has, if anything, grown in influence, establishing Warren as a policy thinker ahead of her time. In many ways it does feel prescient, not only in its preview of a politics focused on middle-class malaise but in its warnings about the systemic economic risks posed by subprime mortgages granted to borrowers with limited ability to pay.

Yet as with her previous work, the book’s findings were marked by controversy and unanswered questions about the soundness of her methodology. In particular, Warren’s notion that housing prices have been pushed upward by school competition doesn’t fully stand up to scrutiny.

Although research has found that school quality does impact housing prices, the effect is fairly modest. A 2006 study in the Quarterly Journal of Economics found a 2.5 percent increase in home prices for every 5 percent increase in test scores. Additionally, Warren’s comparison budgets aren’t entirely realistic. She adds preschool, for example, to the list of expenses for the modern two-income family (thus detracting from the wages brought in by the second earner)—but that is a cost that is incurred for only a few years. Although the book notes that the price of food and clothing declined between the 1970s and the 2000s, the budget comparison lumps those purchases into a catchall category labeled “discretionary income.” This makes it difficult to see where the cost of living has gone down.

And then there’s the role of taxes. In the book’s hypothetical comparison budgets, Warren presents fixed dollar amounts for every type of expenditure—mortgage, health insurance, car payments, discretionary spending, etc.—except one: taxes. Instead, taxes are presented as a percentage of household income—24 percent in the 1970s, 33 percent in the 2000s—which the book describes as a 35 percent change.

Yet as George Mason University law professor and consumer finance scholar Todd Zywicki has noted, the choice to render taxes only as a percentage of income has the effect of masking the total dollar value. Using Warren’s own figures, Zywicki calculated that the tax increase—owing partly to the hypothetical family hitting a new tax bracket and partly to the imposition of additional state, local, and property taxes over time—was by far the largest factor affecting the modern family’s budget. Warren’s own numbers, in other words, showed that families had been strapped not by increased spending on homes or health insurance but by a bigger tax bill.

“The data is presented in a fashion that makes it very difficult for the reader to understand,” Zywicki says. “It almost seems to be designed to mislead.”

Zywicki is among Warren’s most outspoken critics, and he has made this case—that Warren’s own data do not show what she claims they do about the plight of the middle class—on multiple occasions over the span of more than a decade. Yet Warren has never responded directly to his arguments, he says, and Warren’s campaign did not agree to an interview request for this story.

Warren’s insistence on the prominent role of medical bills in bankruptcy cases has drawn even sharper criticism.

In The Two-Income Trap, Warren says that for families with children, the vast majority of bankruptcy filings are a result of just three factors: medical problems, job loss, and family breakup. The following year, Warren, still a Harvard professor, co-authored a Health Affairs study purporting to show that at least 46 percent of the nation’s bankruptcies were a result of medical bills, a figure she subsequently updated to 62 percent. Her research claimed that medically induced bankruptcies had increased a shocking 23-fold since 1981.

These figures garnered major media headlines and became talking points during the debate over the health care law that passed in 2010. President Barack Obama warned that sky-high medical costs had forced many Americans to “live every day just one accident or illness away from bankruptcy.”

But these numbers, too, relied on dubious methodology and misleadingly presented research. Warren broadly categorized bankruptcy filers as having a “major medical cause,” even if they did not list medical issues as the cause of their bankruptcy, so long as they had incurred $1,000 in personal medical expenses in the two years prior to filing. The alleged dramatic uptick relied on a comparison between this broadly defined group and people who had explicitly described themselves as filing for medical reasons, a much narrower category.

In early 2018, a group of health economists from the Massachusetts Institute of Technology, Northwestern University, and the University of California, Santa Cruz published a study in The New England Journal of Medicine directly countering Warren’s claims. In “Myth and Measurement—The Case of Medical Bankruptcies,” the authors argued that her research suffered from a “basic statistical fallacy.” Her paper’s methodology, they wrote, “assumes that whenever a person who reports having substantial medical bills experiences a bankruptcy, the bankruptcy was caused by the medical debt. The fact that, according to a 2014 report from the Consumer Financial Protection Bureau, about 20% of Americans have substantial medical debt, yet in a given year less than 1% of Americans file for personal bankruptcy, suggests that this assumption is problematic.” Using a more rigorous approach, they estimated that hospital bills cause only about 4 percent of bankruptcies—not nothing, but a far cry from the majority share that Warren’s paper had estimated.

In early 2018, a group of health economists from the Massachusetts Institute of Technology, Northwestern University, and the University of California, Santa Cruz published a study in The New England Journal of Medicine directly countering Warren’s claims. In “Myth and Measurement—The Case of Medical Bankruptcies,” the authors argued that her research suffered from a “basic statistical fallacy.” Her paper’s methodology, they wrote, “assumes that whenever a person who reports having substantial medical bills experiences a bankruptcy, the bankruptcy was caused by the medical debt. The fact that, according to a 2014 report from the Consumer Financial Protection Bureau, about 20% of Americans have substantial medical debt, yet in a given year less than 1% of Americans file for personal bankruptcy, suggests that this assumption is problematic.” Using a more rigorous approach, they estimated that hospital bills cause only about 4 percent of bankruptcies—not nothing, but a far cry from the majority share that Warren’s paper had estimated.

This was not an ideologically motivated attack on Warren’s character or politics; it was an attempt by a group of widely respected health policy researchers to set the record straight on an important matter of fact. And it followed years of criticism of the initial study—criticism that had begun almost immediately with rebuttals in Health Affairs, the journal that published the initial work. Warren and her co-authors responded to early criticism with a letter defending themselves and noting that their critics had received funding from insurance industry sources who were opposed to universal coverage schemes, a tactic she has relied on more than once.

“In Elizabeth Warren’s worldview, there are no good-faith disagreements with Elizabeth Warren,” Zywicki says. “Anybody who doesn’t agree with her is a shill.”

The response by Warren and her co-authors was revealing. In one sense, they were engaged in a conventional academic dispute about interpreting bankruptcy data. But what they were really fighting about—what was really at stake—was public policy. Warren clearly believed that the value of her research was in the story it told and the way that story informed and influenced the real world of politics and public affairs.

Warren had already served as an adviser in the 1990s to the National Bankruptcy Review Commission, fighting a series of bankruptcy proposals that would eventually pass as the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. But in the years after her bankruptcy study’s release, Warren would begin to explore more direct roles in the policymaking process.

In 2007, Warren wrote an essay for the influential liberal policy journal Democracy arguing that many consumer financial products, such as home loans, were dangerous. Titled “Unsafe at Any Rate”—a nod to Ralph Nader’s bestselling 1960s book accusing auto manufacturers of malfeasance—the essay made a case that many financial products posed an active threat to American consumers and should be regulated accordingly. Analogizing home loans to toasters that could burst into flames at any moment, Warren called for “a new regulatory regime, and even a new regulatory body, to protect consumers who use credit cards, home mortgages, car loans, and a host of other products.”

A few years later, Warren got her wish. In the aftermath of the 2007–08 financial crisis, Congress, then controlled by Democrats, passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was billed as a direct response to the economic meltdown and an attempt to make sure it never happened again. A centerpiece of the bill was the creation of a new federal agency, the Consumer Financial Protection Bureau (CFPB), which was modeled on Warren’s original proposal.

It is often difficult to determine how presidential hopefuls would govern, especially when, like Warren, they have no executive experience and only a few years of lawmaking experience. But the CFPB offers a glimpse of what a Warren presidency might look like in practice.

The bureau, as imagined by Warren, was first and foremost a paternalistic enterprise. It was premised on the notion that consumers did not and in some cases could not understand the financial services they relied on, and that only an army of unusually powerful government bureaucrats could save them from blundering into the tricks and traps set by lenders.

Those bureaucrats, meanwhile, would be heavily insulated from both presidential and congressional oversight. Housed within the Federal Reserve, the CFPB has its own funding stream and is thus removed from the congressional appropriations process. And instead of a bipartisan board of commissioners like those that govern comparable independent federal agencies—the Federal Trade Commission, for example—the CFPB was designed with a single agency head who could only be removed by the president for cause, such as neglect of duties or malfeasance.

This design was not just unaccountable. It was, critics said, unconstitutional. Because it vested authority in a single director who was insulated from oversight, it created a law enforcement body outside of the constitutional hierarchy; it was an unchecked superagency with the power to make law. In a series of legal cases, multiple federal courts have agreed, although the issue remains under dispute.

The goal of the structure, supporters said, was to remove the CFPB from the significant pressures that large financial institutions could exert on the regulatory process. The bureau had been created as a check on such financial institutions, the “moneyed interests” that Warren and others argued caused the financial crisis; those interests could not be allowed to capture their regulators.

Yet Warren herself has not been entirely immune from the pressures of wealthy interests: As a U.S. senator, she has pushed for the elimination of a tax on medical device makers (which have a heavy presence in her home state of Massachusetts) using language that closely mirrors industry talking points. And in the 1990s, as a law professor, Warren worked as a legal consultant for a variety of large corporations, helping them navigate bankruptcy proceedings. Among those corporations was Dow Chemical, which was being sued by women who claimed they had been made ill by the company’s silicone breast implants. Warren’s role, according to The Washington Post, was to help a company trying to limit its payments to the women.

The CFPB’s mission, meanwhile, was far more expansive than its origin story might imply. From payday lenders to cash advance services, many of the financial products it was given power to regulate had little or nothing to do with the financial crisis. And while Warren pitched the agency as a purveyor of simple rules for a complex world, it would, in practice, end up specializing in inherently complex rules covering inherently complex products. Which is, itself, a central tenet of Warrenism: She believes every economic problem can be solved by changing the rules. Although she also favors new spending programs, her emphasis is on regulatory mechanisms, especially with regard to credit.

Yet by doing so, she “ends up defending America’s path down the road to a more credit-centric economy,” says Samuel Hammond, a policy analyst at the Niskanen Center, a Washington, D.C., think tank. “Instead of broad-based insurance programs, America did a lot of stuff through credit, making home mortgages artificially cheap.”

But focusing on credit rules, Hammond says, merely entrenches that system and enhances the systemic complexity Warren claims to reject. Her approach results in “much more micromanaging, much more complex interaction effects….For the CFPB, complexity is basically the first word.”

The Consumer Financial Protection Bureau is a powerful, roving agency, created under a flimsy pretense in the aftermath of an economic calamity, subject to minimal outside supervision, and dedicated to a mission that might best be described as unchecked Warrenism. In this sense, it is a reflection of Warren’s own character as both a politician and a public intellectual: self-certain, superior, uninterested in engaging critics. So it was hardly a surprise that the initial expectation was that its first director would be none other than its intellectual brood mother, Elizabeth Warren.

It quickly became apparent, however, that Republican opposition in the Senate would stymie Warren’s appointment. Instead, President Obama in 2010 made her assistant to the president and special advisor to the secretary of the treasury for the CFPB, tasking her with setting up the agency. In 2011, he made it clear that Warren still would not be nominated as director, and she stepped down from her White House role.

The CFPB was the culmination of decades of research and advocacy on Warren’s part. She had imagined it, fought for its creation, and then, from her perch in the administration, ushered it into being. Now she was being shut out.

What looked like a moment of triumph had become a significant personal defeat. Warren’s reputation as a liberal firebrand had rendered her so politically untenable, such a partisan lightning rod, that even Obama would not fight for her. By making herself anathema to the congressional GOP, she had lost the chance to carry out her agenda from a position of unusual power.

And yet there was a kind of victory as well, in the simple fact of the CFPB’s creation. Warren would not be its leader—that role would eventually go to former Ohio Attorney General Richard Cordroy, who was given a recess appointment that caused its own controversy—but she had willed it into being and would continue to provide spiritual guidance. She had not achieved her own political ambitions, but on the policy question, she had triumphed.

In the years that followed, something strange happened: Warren, the icon of progressivism whose political brand had proven too toxic to move through the CFPB nomination process, became the object of a strange new respect from the right.

There had always been an undercurrent of social conservatism to Warren’s politics. Although The Two-Income Trap was written from a position of nominal support for working women, it was, in some ways, a lament about mothers moving into the labor force and about the decline of the male breadwinner economic model. On occasion, Warren seemed alive to the deleterious effects of government subsidies, such as when she opposed government-funded day care, which she argued would “make financial life more difficult” for families with stay-at-home moms. And the book’s best piece of advice—don’t buy more house than you can afford—was fundamentally conservative. (It also conflicted somewhat with its thesis that consumer debt was not driven by irresponsible spending.)

Eventually conservatives, especially those whose focus tended toward family and culture, started to notice. In 2011, Christopher Caldwell published an essay in The Weekly Standard titled “Elizabeth Warren, Closet Conservative: The Most Misunderstood Woman in Washington,” praising the arguments in The Two-Income Trap. Warren had placed the economic stability of middle-class families at the center of her politics. She was a progressive, yes, but at heart she was a woman of the right.

Under President Donald Trump, that overlap has only grown. In July, The American Conservative, long a bastion of immigration-skeptical conservative nationalism, ran an essay extolling Warren’s economics, particularly her plans for a new bureaucracy dedicated to “defending good-paying American jobs,” and saying that in some respects, “Warren may be a bigger economic nationalist than even Trump himself.”

Nor is Warren’s popularity limited to small opinion journals. In June, Fox News’ Tucker Carlson, among the most-watched hosts on cable news and an influence on the Trump administration, opened his show with an extended monologue praising Warren’s domestic jobs plan and its elevation of “economic patriotism,” which calls for, in the senator’s words, “aggressive new government policies to support American workers.”

“Many of Warren’s policy prescriptions make obvious sense,” Carlson said. “She sounds like Donald Trump at his best.” Later, at a conference in July, he praised The Two-Income Trap as “one of the best books I’ve ever read on economics.”

It is hard to imagine the Republican Party ever embracing Elizabeth Warren. Trump frequently mocks her claims of Native American heritage, and the congressional GOP continues to view her with deep hostility. She’ll never be an ally to the party. But in some increasingly influential corners of the right, her ideas and her outlook are winning.

In 2012, Warren challenged Massachusetts Sen. Scott Brown, a Republican whose 2009 special election had caused headaches for supporters of Obamacare, and won. It was hard not to see the move as a steppingstone toward a run for president.

Despite the urging of many progressives, Warren sat out the 2016 race but watched as her fellow senator, Bernie Sanders (I–Vt.), ran a surprisingly strong primary campaign against frontrunner Hillary Clinton on a self-described democratic socialist agenda—one that mirrored Warren’s own in many ways. Given the energy of the Sanders campaign and the closeness of the general election vote, it’s easy to wonder whether Warren, had she run, would have captured the Democratic nomination and perhaps even defeated Donald Trump.

Now she has a second chance. In 2018, Warren soft-launched her 2020 effort with a series of policy proposals, and she has continued to roll out plans since her official announcement early this year. Each works from the themes of economic despair and disillusionment that she has dwelled on for decades, telling a dire-yet-evocative story of ever-more-powerful corporate interests preying on the middle class.

Yet in many ways, her plans still don’t add up.

Her signature policy is a 2 percent wealth tax on households worth over $50 million, with an additional surtax on households worth $1 billion or more. Her campaign claims the change would raise $2.75 trillion over a decade.

Most first-world countries that have implemented wealth taxes in recent decades have abandoned them, however. They’re expensive to enforce, and they encourage rich people to park their money—and the jobs that money might fund—elsewhere. As a result, these taxes rarely raise as much as hoped.

That helps explain the considerable academic skepticism about Warren’s revenue projections. Lawrence Summers, who served as a senior economic official in the Obama and Bill Clinton administrations, has argued that the estimates Warren relies on discount the likelihood that the wealthy would evade the new tax by strategically moving their money.

And in July, a trio of economists from the U.S. Treasury Department, Princeton, and the University of Chicago Booth School of Business presented a paper at the National Bureau of Economic Research finding that the rich simply have less wealth to tax than the estimates assume. This suggests that, even ignoring evasion, a wealth tax would raise only about half what Warren expects. In a survey of economic experts conducted by Chicago Booth, 73 percent said Warren’s wealth tax would be “much more difficult to enforce than existing federal taxes.” (Her campaign says the plan is structured to avoid these pitfalls, partly by imposing hefty fines on those who try to move their money elsewhere.)

Despite all this, Warren has outlined plans to spend the revenue aggressively. She has said her wealth tax could pay for a universal child care plan (which would cost about $700 billion, according to a Moody’s estimate) as well as her free college and student loan forgiveness plan (which would cost about $1.25 trillion). She has further suggested that the same tax could be used to cover a $7 billion plan for minority entrepreneurship, plus “down payments on a Green New Deal and Medicare for All”—an environmental policy that the center-right American Action Forum found could cost as much as $90 trillion (yes, trillion) and a single-payer health care plan that multiple estimates have found would cost more than $30 trillion. Given the likelihood that the wealth tax would not raise as much revenue as her campaign claims, it is probable that she would end up spending more money than she raises.

There are other problems as well. The cost estimate Warren points to for her child care plan relies on “dynamic scoring,” which assumes that the program will have a positive overall effect on the economy. But as Philip Klein of The Washington Examiner has noted, the revenue estimate for Warren’s wealth tax relies on what’s known as a “static” analysis. It counts no growth effects into its assumptions, presumably because taxing the sort of people who are likely to make large, economy-building investments would have a negative impact on growth. As with her early research, Warren has deployed her wealth tax in a slippery manner designed largely to further her policy goals.

It’s also quite possibly illegal, since the U.S. Constitution prohibits “direct taxes,” which probably means taxes that apply to a state of being—as in, the state of being wealthy—rather than an action. The Supreme Court has never offered a precise definition of the term, but there’s little question Warren’s effort would face a lengthy court challenge.

Her announcement speech in February, meanwhile, was peppered with dubious economic factoids such as the notion that “40 percent of Americans can’t find $400 to cover an emergency.” This commonly repeated statistic is based on a misreading of a government survey question about how people would choose to pay a $400 emergency expense: Forty percent said they would use a credit card, not that they couldn’t afford it at all. In fact, 86 percent of respondents said they would either pay with cash or use a credit card that they would pay in full at the end of the month.

Warren’s speech also included an outdated warning that “wages in America have barely budged” since the 1970s. It’s true that wages stagnated in the years after the 2008 recession, especially for workers at the bottom end of the income ladder. But in May, The New York Times reported that “wage growth, long stuck in neutral, has at last found a higher gear.” Furthermore, the article noted, “the recent gains are going to those who need it most. Over the past year, low-wage workers have experienced the fastest pay increases.”

In the midst of the longest economic expansion in American history—an expansion that has particularly benefited minorities and women—Warren’s campaign is structured as an extended argument that, actually, the economic outlook for most Americans is awful. Yet under Warren, things could be even worse: Her economic micromanagement, her heavy-handed approach to regulation, her lack of interest in transparency, her willingness to pursue policies based on dubious and politically motivated data, and her unwillingness to respect the conventional checks and balances of multiparty democratic politics all foretell a presidency that would be dangerous for the economy writ large and potentially fatal for basic economic freedom. The current economy has serious risks and flaws. But the risks of Warrenism are even more severe.

To be sure, the economy could take a nosedive at any moment. Boom times always end eventually, and by the time the Democratic primaries are held next year—let alone the general election—the country could well be in a recession. The overhang of federal debt has added risk to the economy, as has Trump’s tariff-driven trade policy.

But Warren isn’t really arguing about federal debt, which she would almost certainly expand, or about the merits of Trump’s protectionist approach to trade, which her industrial policy would continue in spirit if not in precise detail. And she isn’t warning about the recurring cycle of economic ups and downs. Instead, she is making essentially the same argument she was making in 2004. She wants people to believe the American economy is rotten to the core—that it is irredeemable, at least without her at the helm.

Like so much of Warren’s worldview, it is a simple story, based in part on data that are either erroneous or presented in a misleading fashion. Yet her core conclusions about the struggles of middle-class families have become standard arguments in modern political dialogue on both the left and the right.

The Democratic primary field has adopted much of Warren’s agenda, and it has been forced to play catch-up to her high-volume approach to policy. In April, CNN held back-to-back town hall events with Warren’s rival candidates: Every single one was asked to answer a question about one of her plans.

Bernie Sanders’ success as a proponent of Nordic-style democratic socialism overlaps heavily with Elizabeth Warren’s economic doomsaying. New York Rep. Alexandria Ocasio-Cortez’s blend of personable social media chattiness, economic catastrophizing, and spare-no-expense policy proposals owes much to Warren’s pseudo-wonky populist brand.

Liberal think tanks, many of which were built to serve the Obama administration and the expectation of a Hillary Clinton presidency, have been unusually absent from the 2020 primary debate. But the Democratic Party doesn’t need a think tank to point the way. It has Elizabeth Warren.

from Latest – Reason.com https://ift.tt/2LndcxV

via IFTTT