Boeing Drags Down Dow, Short-Squeeze Sends Small Caps Soaring

More trade deal “progress” headlines, Kudlow jawboning, Brexit deal optimism fades, continued weakness in macro data but a squeeze proves everything is awesome in stocks as the S&P is lifted back above 3000…

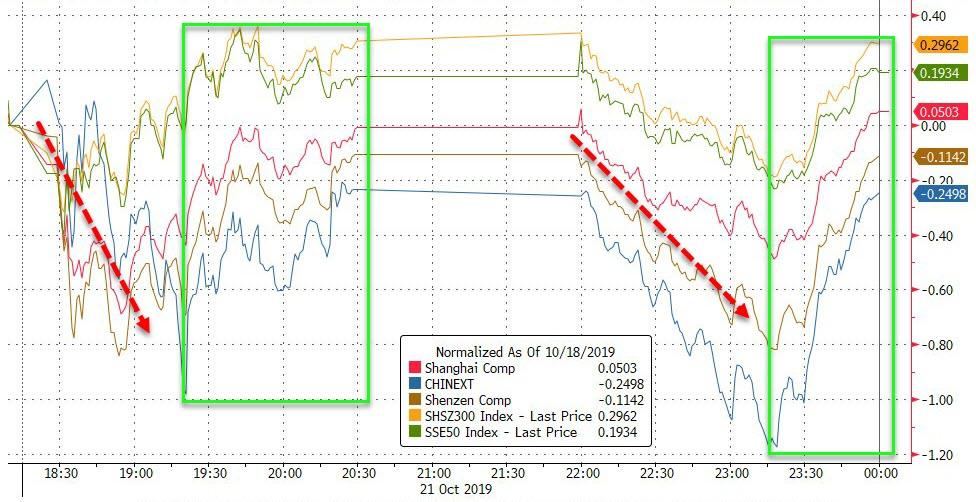

Chinese stocks were mixed on the day with small caps/tech on the losing side and bigger cap names leading (thanks to two buying-panics)…

Source: Bloomberg

European markets ended the day higher, led by Germany (and UK’s FTSE rebounded from a weak open)…

Source: Bloomberg

While Boeing weighed down the Dow…

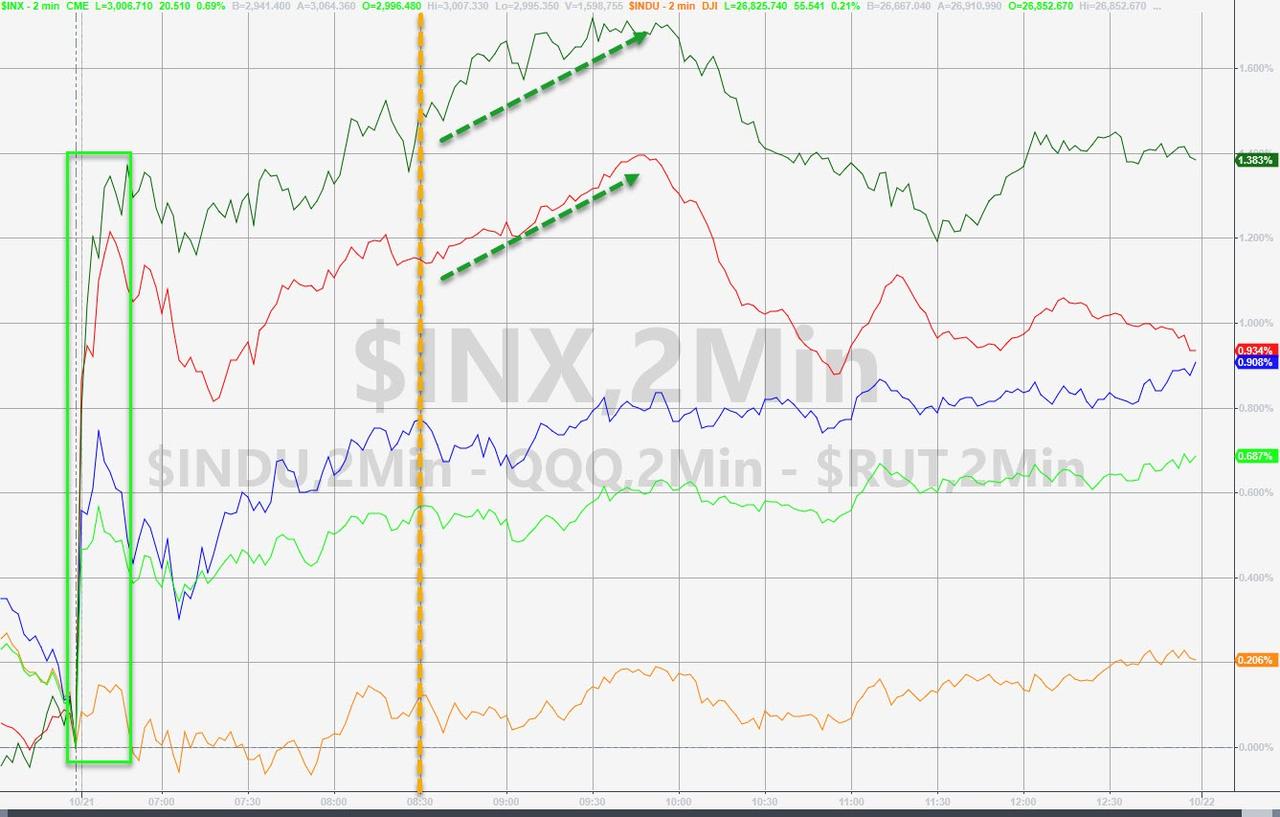

Small Caps and Trannies surged out of the gate and accelerated again after the EU close…

The S&P 500 once again battled with the 3,000 level as various repetitive trade progress headlines attempted to defend the Maginot Line… First close above 3k sine 9/18…

“Most Shorted” stocks were panic-squeezed at the open (and at the EU close)…

Source: Bloomberg

Boeing back at early 2018 lows…

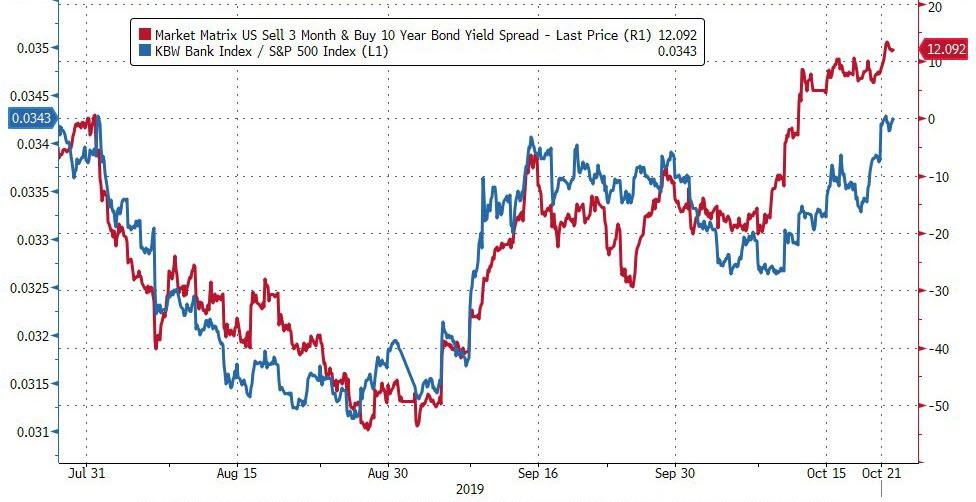

Bank stocks continue to outperform as the yield curve steepens…

Source: Bloomberg

Energy stocks also surged in traday… despite a drop in crude (we’ve seen this before)…

Source: Bloomberg

Treasury yields were uniformly 3-4bps higher on the day…

Source: Bloomberg

Notably, the longer-end of the yield curve has been trading in rather extreme short-term trends…

Source: Bloomberg

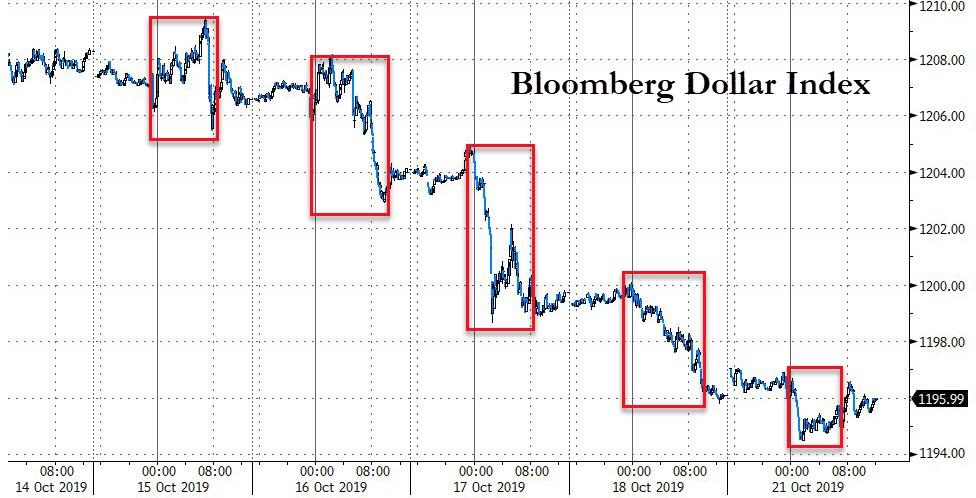

The Dollar Index was flat on the day, rebounding from some overnight weakness once again…

Source: Bloomberg

Cable continues to rise, tagging 1.3000 intraday (despite today’s proceedings going against Johnson) – up 8 handles in 8 days

Source: Bloomberg

Silver and Gold were lower on the day (after decent gains overnight) and oil was also lower…

Source: Bloomberg

Gold futures pushed up towards $1500 itraday before falling back…

And silver popped and dropped…

WTI chopped around intraday (between $53 and $54) but ended lower…

Copper/Gold continues to track 10Y TSY yields (or vice versa) almost perfectly..

Source: Bloomberg

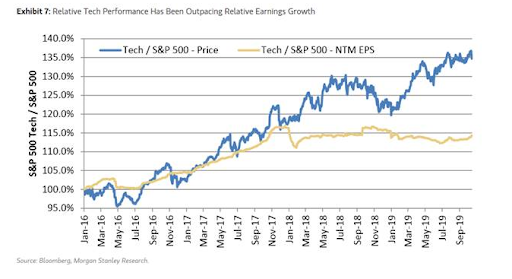

Finally, we note that tech stocks continue to outperform, despite flat to falling earnings expectations…

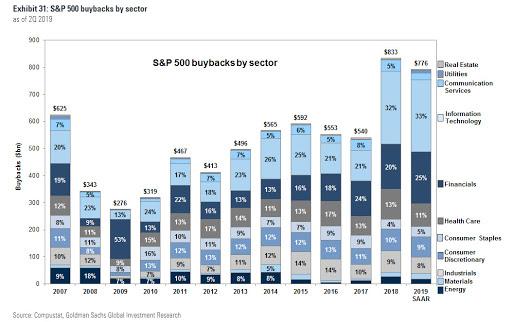

And this is why…

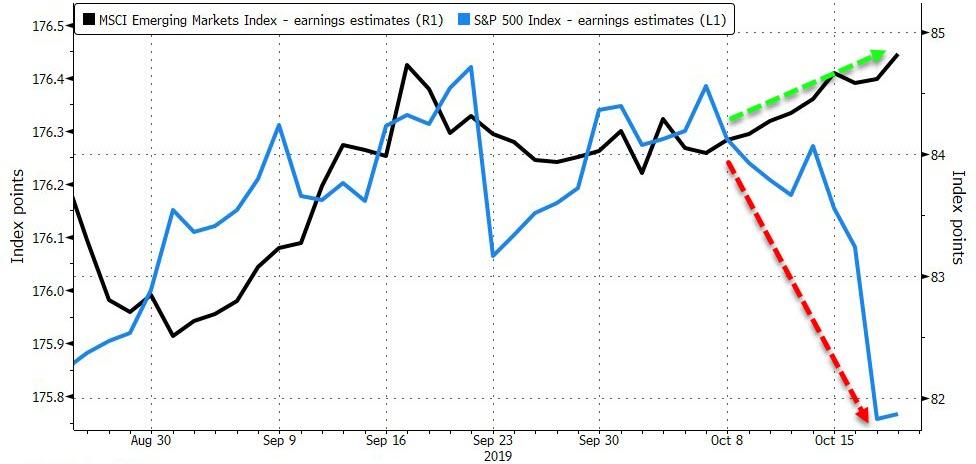

But it may not be enough as Bloomberg points out that as the U.S. dollar heads for the biggest monthly decline since the trade war began, the outlook for corporate profits has started to deteriorate in America and improve in emerging markets.

Source: Bloomberg

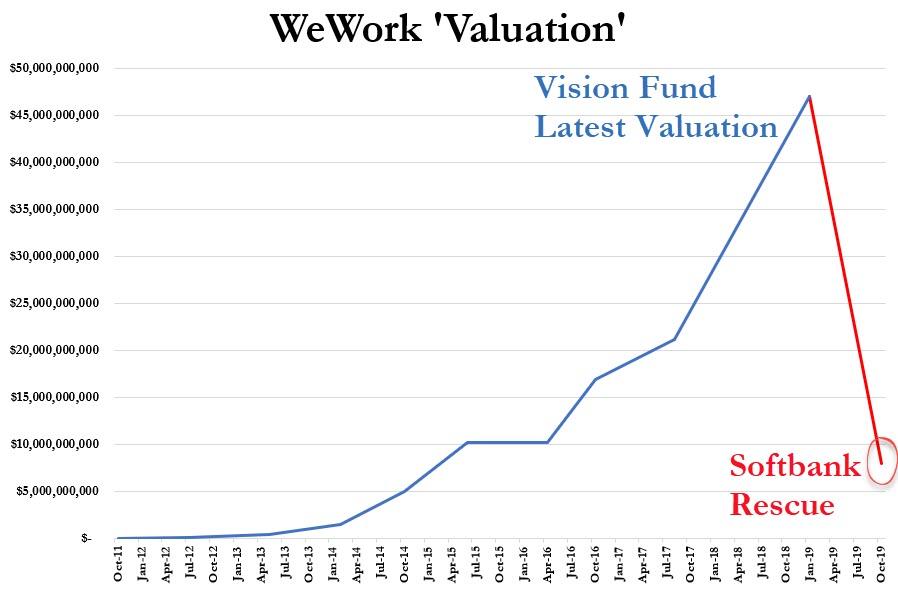

Late breaking news was that Softback will bailout WeWork at a valuation around $7.5-8 billion…

Neumann’s wealth went full Keyser Söze.

Tyler Durden

Mon, 10/21/2019 – 16:02

via ZeroHedge News https://ift.tt/2Mz3VTV Tyler Durden