SoftBank To Take Control Of WeWork With $5 Billion Bailout

Less than a week we reported that according to the Nikkei, Softbank was set to provide WeWork with a $5 billion bailout loan, one which we dubbed tongue in cheek a pre-petition DIP loan.

SOFTBANK PLANS TO FINANCE WEWORK WITH ABOUT $5B: NIKKEI

DIP Loan Secured

— zerohedge (@zerohedge) October 16, 2019

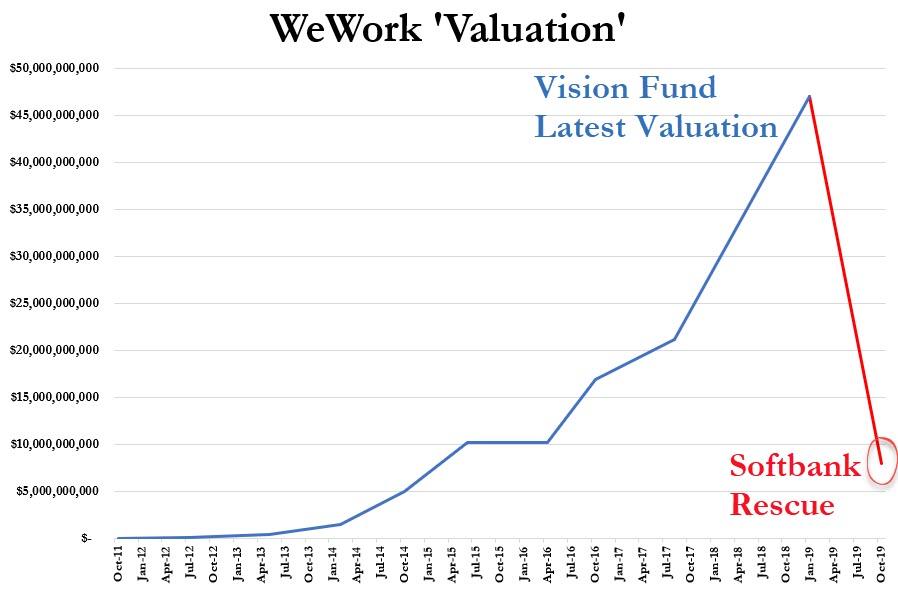

It now appears our assessment was accurate, because moments ago CNBC’s David Faber confirmed that WeWork appears to have snubbed a debt deal being arranged by JPM (arguably due to its exorbitant interest rate which was rumored to be between 8% and 15%), and was instead set to hand over control to Japan’s venture capital debacle, SoftBank, which is set to spend $4-5 billion on new WeWork equity, in a deal which values WeWork around $8 billion (we suppose this is premoney valuation), and which together with WeWork’s existing ownership, would grant SoftBank full control over the flaming fiasco that is WeWork, whose valuation has crashed from $47BN a few months ago to less than $8BN.

In other words, SoftBank is throwing even more good money after a vanity investment whose value is arguably zero, but because SoftBank wants to be able to still show idiotic slides such as this one…

How do you know it’s the biggest bubble in history? This slide from Softbank pic.twitter.com/065dyDrwZW

— zerohedge (@zerohedge) September 8, 2019

… without inspiring riotous laughter, it has no choice but to buy WeWork a few more quarters of breathing room, just so SoftBank isn’t forced to mark its investment at zero. And speaking of the $5BN in new capital, which the company desperately needed as it would have run out of cash as soon as next month, it will be WeWork – which currently burns through $3 billion per year -roughly 18 months of time unless somehow the company manages to slash its cash burn… which it can of course do, but it will also cripple its revenue, as its entire “scalable” business model is premised upon selling one dollar for 50 cents.

Take that model away, and SoftBank just threw away another $5 billion.

Tyler Durden

Mon, 10/21/2019 – 15:54

via ZeroHedge News https://ift.tt/2J9ULey Tyler Durden