Galloway: “Seeing The Mother Of All Shifts From Focusing On Growth To Margin”

Authored by Scott Galloway via ProfGalloway.com,

I’m sick and depressed. Why? Lederhosen. Oktoberfest in Munich brought with it jet lag and 18 hours in a tube with recirculated air. Crossing 6+ time zones seriously messes with my amygdala, making me depressed. On top of that, I caught a chest cold. At home, in exchange for chicken soup and care, I will reward those around me with a short temper and constant complaining.

I went to the doctor three times before the age of 18 and was never exposed to antibiotics, so I’ve been sick only a handful of times in adulthood. (To be clear, I am pro-vaccination, as I’ve embraced the whole “science” thing.) Anyway, when I get sick I take (even) more than I give. I cost more than I’m worth. I have negative margins.

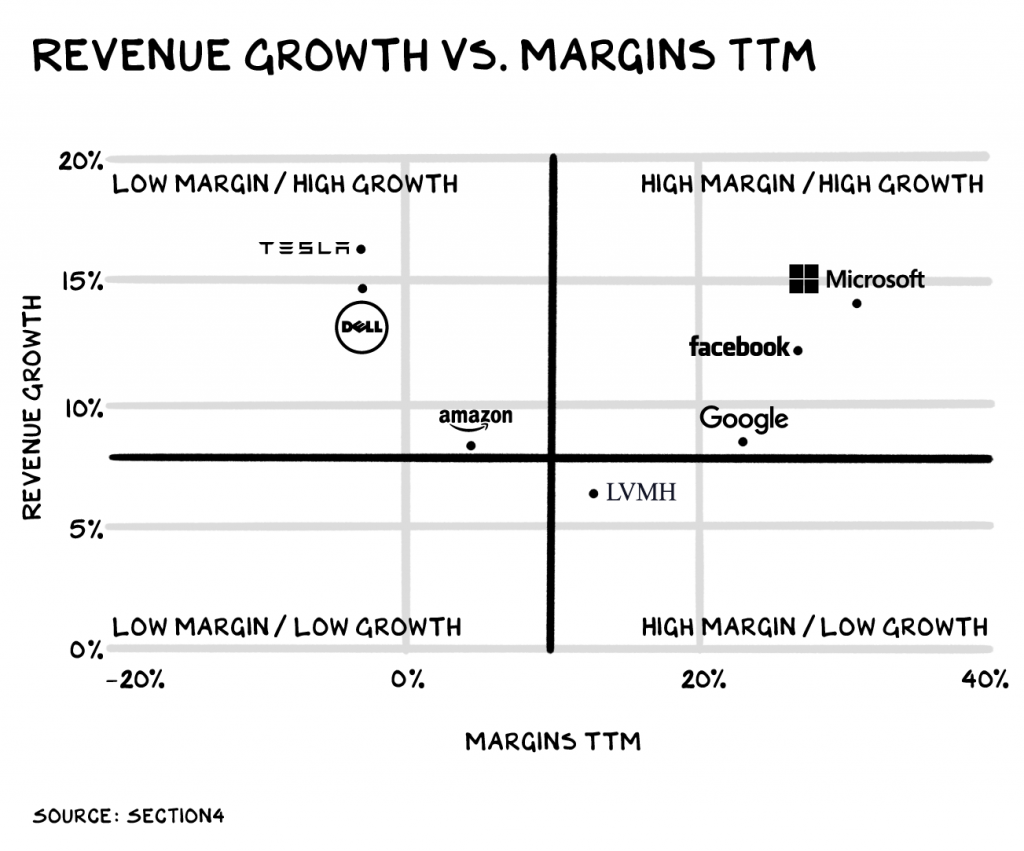

Margins are the value add of the business world — what you do with a set of assets/resources that commands more value to the next stop in the supply chain. The collision of growth and margin is the gangster cocktail of value creation. Most businesses have a little of one and (hopefully) a bunch of the other. The two exist mostly in opposition to each other. High-margin activity almost always involves friction. The artisans and alligator farms required to create an Hermès Birkin bag are difficult to scale. Services businesses (high margin) usually involve the most unpredictable and messy of inputs — people — and are dependent on relationships (also not scalable). Other high-margin businesses (technology, media, pharma) require a staggering up-front capital investment and are fraught with risk.

Companies that scale fast typically have low margins, and their primary feature is (wait for it) their low margins. Walmart, Amazon, and Dell pass along the savings to their consumers and, at critical mass, become difficult to compete with, as to achieve a similar scale requires exceptionally cheap capital.

Enter Microsoft, Google, and Facebook, which defied gravity and brought to the markets the chocolate and peanut butter combination of margin and growth. IP, network effects, brilliant execution, flaccid regulation, and deft acquisitions resulted in firms that grew shareholder value faster than many in history. However, this is hard (really hard) to mimic.

I believe we are seeing the mother of all shifts from a focus on growth to margin. Value stocks, as of late, have outperformed growth stocks as investors return to margins and the markets reel from the scars of peak growth. Uber and WeWork reflect the high watermark of an infatuation with growth at the expense of margin. How did we get here?

The Original Gangster

The original gangster of growth is Amazon, who replaced profits with vision and growth. However scant, though, Amazon did have positive gross margins. It eventually began registering a profit. In addition, Amazon was able to demonstrate a massive flywheel effect. The firm used their runway to find margin with AWS and Amazon Media Group.

Inspired by the Seattle giant, and presented with a market that offered billions to “disruptors,” firms saw a shortcut: paint a compelling vision and offer $10 worth of service for $5—negative margins. There are few products that scale like a dollar offered for 50c. If it feels like 1999 again, with Pets.com and Urbanfetch recast as innovators, trust your instincts. But this time, the Series C and D rounds were not tens or even hundreds of millions, but billions. WeWork has raised more money from one fund ($11 billion) than the sum total of venture investments in 1996.

This trope funding offered negative margin firms more runway to spin up other concepts (WeGrow, WeLive, Uber Eats, Uber Freight). However, these concepts were no AWS or AMG, and WeWork has run out of tarmac. Uber extended the runway 12-24 months via additional capital secured in an IPO. Uber management is doing the right thing and acquiring firms with overvalued stock in a desperate attempt to find lift, like Cornershop.

If in the next 12 months Uber fails to get the wheel flying, they will be forced to move to a margin story. This is doable for Uber, but it will involve raising prices and exiting unprofitable markets. This will be a tacit acknowledgement that Uber is a big, low-margin consumer brand, not a growth tech firm. It’s a global brand and great product that will trade at one-third its current value. Lyft sees the end of the runway, and the correct emotion should be panic.

WeWork has run out of tarmac and will have to restructure. Any subsequent equity investment is expensive face-saving for SoftBank that will just kick the restructuring can 6-12 months down the road. The JPM debt package floated by WeWork was nothing but a lame stalking horse. SoftBank is the only source of capital, and they will be throwing good money after bad. It’s likely SoftBank will sober up, acknowledge the laws of physics, and confirm some type of pre-pack restructuring/bankruptcy before Thanksgiving. How do I know this? My Kabbalah spiritual advisor told me so in the hot tub last night.

Note: I have, no joke, been approached by three credible media firms about being the executive producer of the WeWork story. I told them I’m in on one condition: I get to play Rebekah Neumann in the series. That’s right, the big dawg on the big screen in a black wig, Pucci dress, and more legs than a bucket of chicken. It. Could. Happen.

The Shift

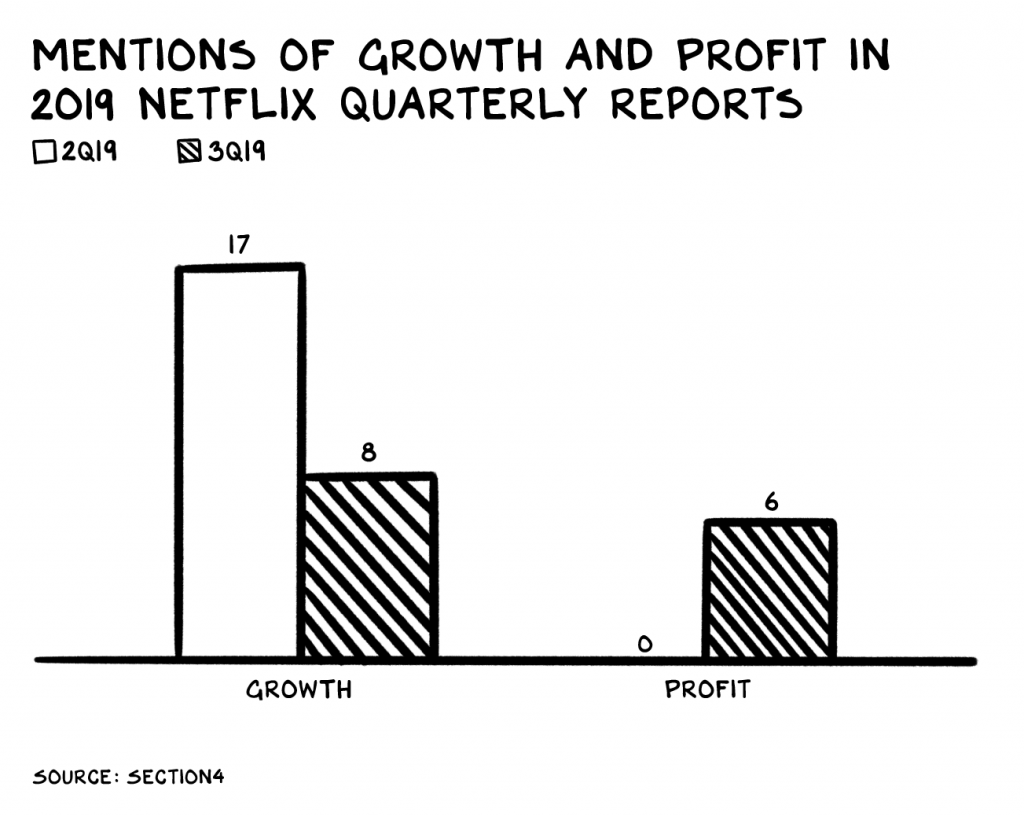

Netflix’s earnings call on Wednesday reflects the market’s shifting appetite from growth to margin. The streaming platform has morphed its nomenclature, emphasizing profits over growth.

Despite anemic subscriber growth, the firm’s bottom-line beat resulted in the stock moving higher. In the earnings call, the firm replaced the term growth with profitability as their go-to word for the call.

Tyler Durden

Mon, 10/21/2019 – 15:45

via ZeroHedge News https://ift.tt/35TRl9t Tyler Durden