As Central Banks Spark Trading Floor Chaos, Women Are Placing The Blame On Gender Discrimination

As Central Banks have made a mockery out of trading floors worldwide, the blame of course winds up squarely on…

…gender discrimination?

That’s right: women are starting to desert the trading floor at banks, blaming “bias” and “microaggressions” as reasons for leaving their jobs as traders, according to Bloomberg. The outlet recently profiled women like Camilla Sutton, who left her job because she was often the only woman at top level meetings. She left her job as a trader to work for a company that aims to improve gender diversity.

Sutton said:

“Very senior women in the industry are going to be the only woman at the table at every table they’re sitting at. It becomes very tiring and exhausting for women who are at senior levels within the industry to continually be faced with the everyday microaggressions.”

Perhaps someone should tell her that women can’t break through the glass ceiling if they keep resigning after making it to higher level jobs – but, we digress…

Other woman have complaints, too. Chau Pham, a former Morgan Stanley vice president in foreign-exchange sales, said she was fired without explanation 22 days after coming back from maternity leave. Stacey Macken, a broker, recently won a lawsuit against BNP Paribas after claiming she was paid less than male colleagues. On one occasion, she found a witch’s hat on her desk.

Was it halloween?

But, according to the article, current and former traders still say it is a tough industry for women due to the “daily grind” that wears them down – this includes being “interrupted constantly in meetings, getting short shrift in pay or working without female role models.”

Banks, meanwhile, continue to say that they are striving to hire and promote women. None of the 10 investment banks has a woman running currencies trading currently.

Meg Browne is another defector, having previously worked in foreign exchange for 30 years. She began her career as a trader for the New York Fed and then went on to HSBC and Brown Brothers Harriman & Co. She said she once went with her colleagues to a strip club in the 1990’s because “because I didn’t know how else to network with my bosses.”

“My worry is that things have not changed. It’s just more hidden,” she commented.

Other women in the industry say they were pushed toward sales, instead of trading, when they started. A fourth woman said she left forex traduing after taking a new role and being “bullied and undermined” by her boss.

She said: “I had a very hard experience. I never quite recovered from it.”

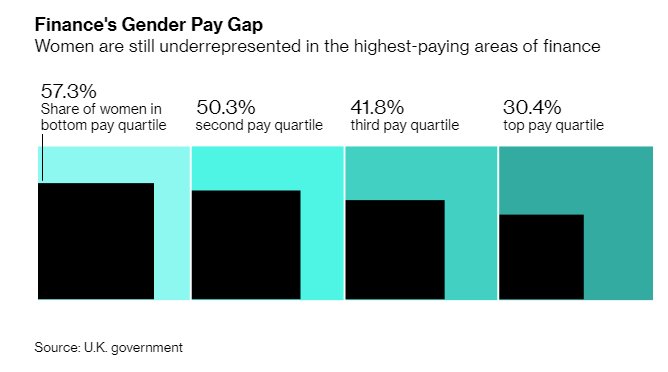

In the U.K., women make up more than 57% of the bottom pay quartile in finance and insurance and just over 30% of the top pay quartile. HSBC’s gap widened the second year it was required to report these numbers.

Sutton now works for “Women in Capital Markets”, which is a group aiming to accelerate gender diversity in the Canadian finance industry. She said that when she started in currencies, there were many women at junior levels of companies, all of whom disappeared.

Sutton said: “All of a sudden you put your head up and look around and go ‘Oh my gosh, where did all the women go? The days of a stripper walking onto a trade floor are completely behind us. There isn’t anything as obvious as that. What we face now are these somewhat subtle biases that are built into every single day.”

Catherine Flax was featured in a Bloomberg story three years ago about the rise of female currency traders. Now, she works as a management consultant, board member and adviser for “various organizations”. She wants banks to offer more “flexible ways of working” when it comes to hours.

We wonder if anyone ever told her that if you’re going to be a trader, you’re likely going to be at the behest of what time the markets are open…

Still, banks like JP Morgan say they are doing more to attract women, including setting up internal programs aimed at attracting female talent. JP Morgan had a female co-head of currency trading until March.

Goldman Sachs says it aims to make women 50% of its incoming analysts and has set up onsite childcare centers around the world that open at the start of the trading day.

Bank of America has a female head of global G10 FX options trading and a spokesman for the woman said that the company’s management team is more than 54% women and/or people of color.

In fact, females are in such demand that recruitment specialist Richard Hoar says they put headcount aside just to snap up any and all senior women as soon as they become available.

Tyler Durden

Sun, 11/24/2019 – 09:55

via ZeroHedge News https://ift.tt/37zJCOT Tyler Durden