“Financialization”: A New Feature And Risk Of Monetary Policy

Submitted by Joseph G. Carson, Former Director of Global Economic Research, Alliance Bernstein

Financialization has become a new feature and risk of monetary policy as decisions on policy rates and the balance sheet operate mainly through the portfolio channel.

At the center of financialization are actual and perceived changes in monetary policy interacting with equity prices. Investors see easy policy as cumulative and mutual reinforcing, but so too at some point could their reversals.

Financialization is to financial stability what inflation is to price stability. Both, financial and price stability are under the mandates of the Federal Reserve. Yet, policymakers have specific targets or objectives for inflation, but no such goal or gauge has been established for financial stability.

What constitutes the relevant metrics for financialization?

The concept of financialization is not new, and it has be defined in variety of ways and seen through different lenses. It is being used in this context to assess the changing and expanding tools of monetary policy working through the portfolio channel and its impact on finance (equity) in relation to economic fundamentals.

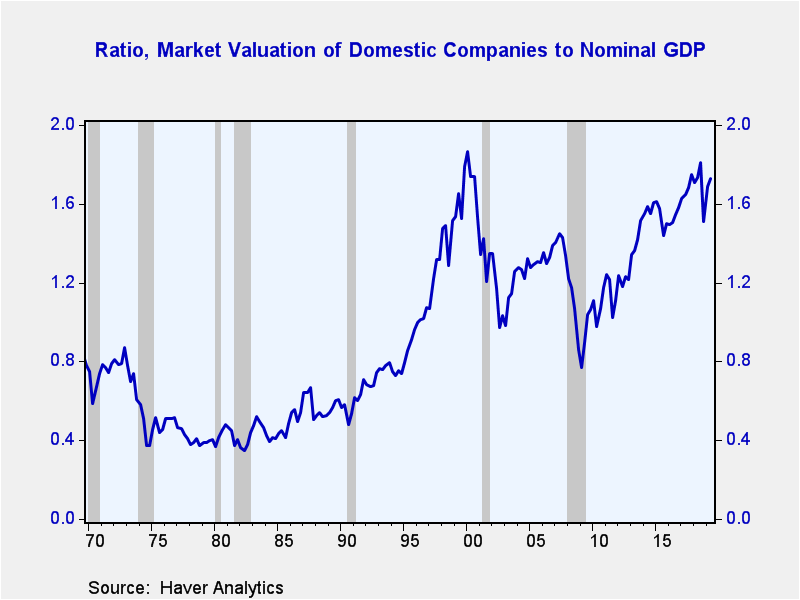

For example, the market valuation of domestic companies has skyrocketed in relation to Nominal GDP…

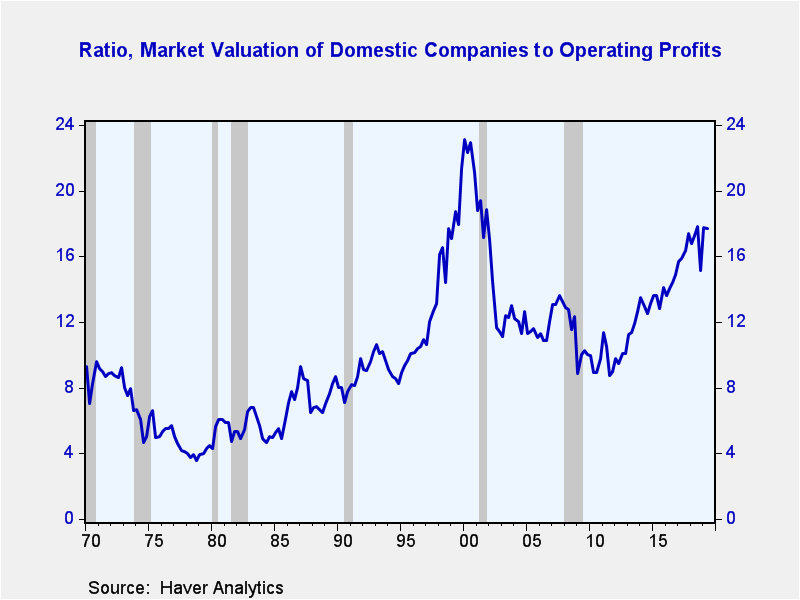

…. and aggregate operating profits (GDP basis) during the current economic cycle as policymakers have used the portfolio channel – with their new tools of forward guidance and asset purchases – to help achieve their mandated objectives on maximum employment and price stability.

Even with market valuations at lofty levels policymakers still decided to lower official rates three times over the past several months in order to show a commitment to achieving its price stability target. And the reduction in official rates also came with a commitment by the Fed chair not to reverse course and raise rates until inflation turns higher on a sustained basis.

Policymakers are effectively making investing and risk-taking far too easy since the most important item over time in the valuation of the equity market is the current and prospective level of interest rates.

It is far too soon to judge the economic and inflation effects from recent policy decisions, but the impact on finance has been swift and substantial. Updating for the gains in equity prices since June 30th the market valuation of domestic companies jumps to approximately 1.8X to GDP and near 20X to operating profits, close to levels reached during the dot.com speculative boom.

(Note: the ratio of market valuation of domestic companies to operating profits is not comparable to the P/E ratio used by analysts for individual companies or groups of stocks, like the S&P 500 index. Operating profits in the GDP framework differ from the reported profits of companies and companies also report their earnings on a per share basis.)

Financialization is an unfamiliar outcome of monetary policy. Asset price increases due to fundamental causes are desirable and pose no significant risk to economic or financial stability. Yet, gains that become unhinged from economic growth and operating profits and are based on speculation of any type – even ones tied to monetary policy – do pose a huge risk.

The transmission of monetary policy has fundamentally changed as it now operate mainly through the portfolio channel and with that comes new trade-offs. The new trade-off is easy money risks an increase in “financialization” and not general inflation. As such, policy decisions made solely to achieve the price stability mandate will eventually clash with financial stability, raising the risk of a bad outcome.

Tyler Durden

Mon, 11/25/2019 – 13:20

via ZeroHedge News https://ift.tt/2QQZyGy Tyler Durden