Strong 2Y Auction As Direct Bidders Surge To 6 Year High

As a result of the holiday-shortened week and the truncated Treasury auction schedule, moments ago the US sold 2Y paper in what was a very solid auction.

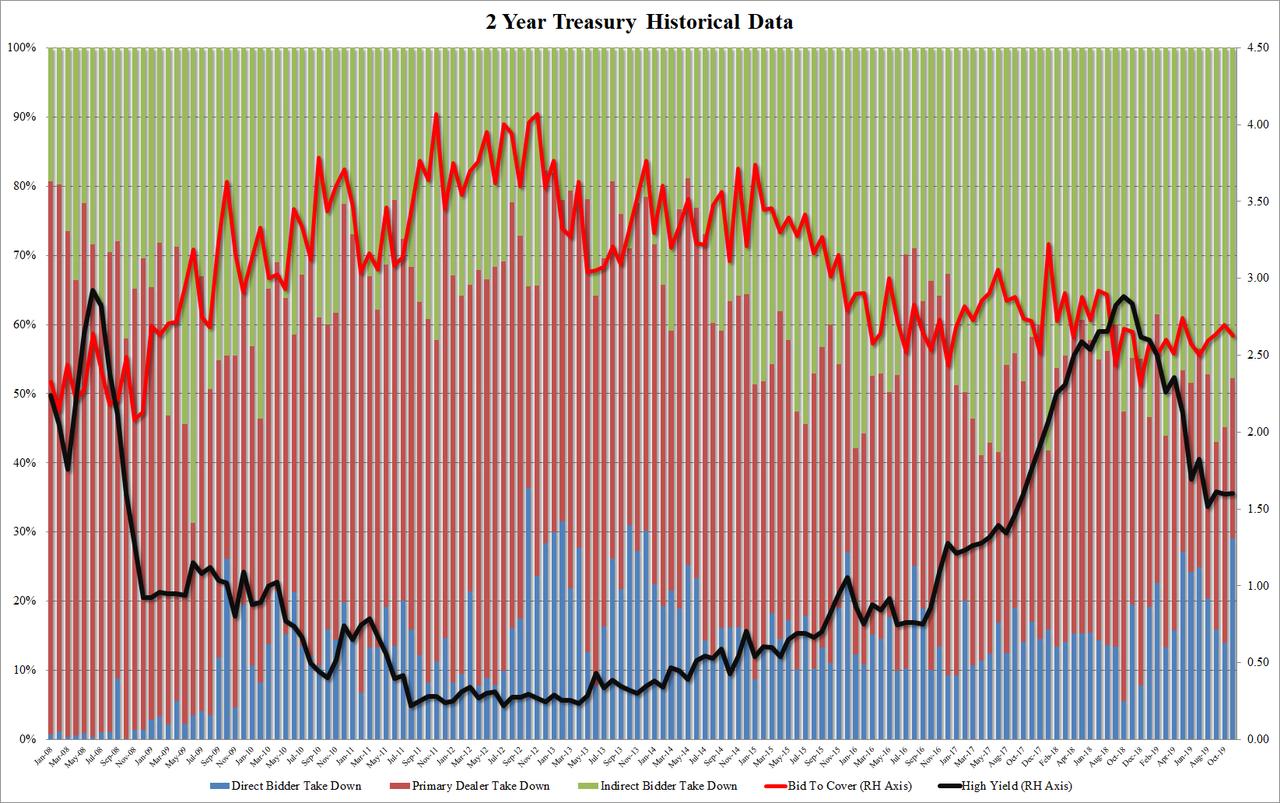

The high yield of 1.601% was just fractionally higher than last month’s 1.594%, and stropped through the 1.605% When Issued, the 3rd consecutive stopping through auction. The Bid to Cover was also in line with recent auction, dipping modestly from 2.695 to 2.626, right on top of the 6 auction average.

However, while the headline numbers were solid, there was a notable change in the internals, where the near-record Direct takedown soared from 14% to 29.1%, the highest in nearly six years going back to December 2013. The offset was a drop in both Indirects, which dropped from 54.8% to 47.8%, the lowest since August, and below the 49.6% recent average, as well as Dealers, whose allotment declined from 31.22% to 23.11%, also below the 29.3% six auction average.

While there was no immediate explanation for the dramatic surge in Direct bidding, the stronger than expected auction did not spook markets, and the 10Y yield has continued to trade near session lows, at just below 1.76%, as stocks bond yields diverge for another day.

Tyler Durden

Mon, 11/25/2019 – 13:16

via ZeroHedge News https://ift.tt/35EoW6B Tyler Durden