Meltup Accelerates Into Christmas Break As Algos Run Wild In Illiquid Markets

After the decade’s last quad-witching came and went without any adverse incidents, and instead a massive short squeeze of the December Emini contract into its 930am Friday expiration repriced the entire market about 15 points higher…

… the relentless, QE4 inspired melt-up has only accelerated in today’s low volume session, as US equity futures pushed to fresh all time highs above 3,230…

… even as world stocks took a breather near record highs while currency and bond markets were little changed on Monday as trading volumes collapsed before the Christmas holiday.

On Friday, the S&P extended its record highs to seven straight sessions, its longest streak in more than two years, as all three major U.S. indexes – the S&P 500, Nasdaq and Dow – gained.

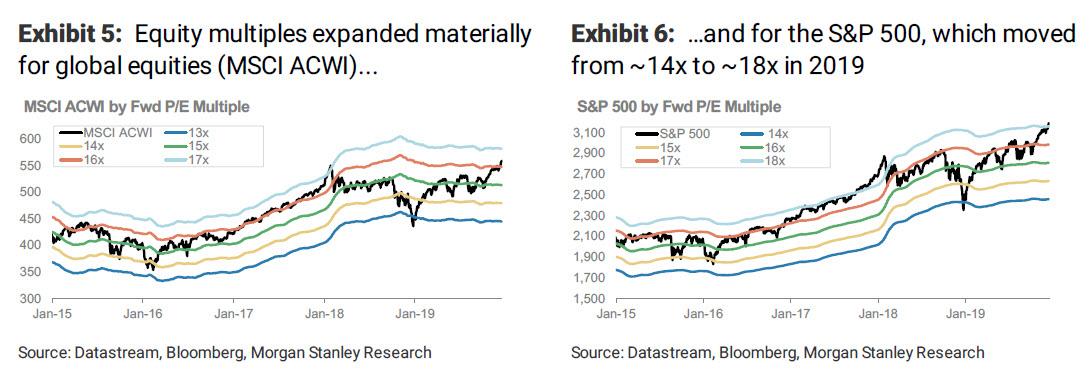

The MSCI ACWI index was flat, trading at Friday’s record high. It has risen nearly 3% this month as U.S.-China trade tensions eased and confidence grew that Britain would avoid a no deal exit from the European Union. The index is up 23% so far in 2019, set for its best year since 2009, with all of this upside thanks to multiple expansion as global earnings are down in 2019 compared to the prior year.

Trump did everything in his power to ensure a Monday spike after repeating – once again – on Saturday the United States and China would “very shortly” sign phase one a trade agreement, the same agreement he said in October would be signed in November. In response, China said on Monday it would lower tariffs on products ranging from frozen pork and avocado to some types of semiconductors next year.

“The Phase 1 (P1) agreement and UK elections have cleared up tail risks, but the market is now transcending that euphoria,” AxiTrader strategist Stephen Innes told Bloomberg. “While P1 is already reflected in stock prices, positioning is still relatively light, and with plenty of capital yet to be deployed, markets could even push significantly higher supported by the global growth rebound.”

The European Stoxx 600 index was flat, after starting off modestly lower before trading in positive territory. It hit a new record high in the Friday session.

Earlier in the session, MSCI’s broadest index of Asia-Pacific shares outside Japan was near its highest since June 2018, up 0.05%, despite an unexpected hiccup in Chinese markets, where stocks posted their worst single-day drop in six weeks, weighed down by a correction in tech shares after a state fund announced plans to cut its stakes in some chip makers.

Asian shares were mixed with subdued volume ahead of the year-end holiday season. Health care stocks rose while material companies fell. The benchmark MSCI Asia Pacific Index was little changed, as gains in New Zealand stocks offset declines in China shares. The New Zealand Exchange 50 Gross Index jumped 0.6%, extending a new high on Monday, while China’s Shanghai Composite Index slumped 1.4% due to weak performance in financial shares. India’s S&P BSE Sensex Index dropped 0.3%. As we reported, on Monday the Chinese government said it will cut import tariffs for goods including frozen pork, pharmaceuticals, paper products and some high-tech components starting from Jan. 1, according to a statement from the Ministry of Finance.

As Bloomberg notes, all asset classes are on track for the best returns in a decade in 2019 after central banks around the world eased monetary policy.

“There is justification to say that the fundamentals are turning, but we haven’t seen confirmation in prices or data yet,” Kyle Rodda, an analyst at IG Markets Ltd., said on Bloomberg TV. “The risk is skewed to the upside, but I still think it’s a tentative picture at the moment.”

In FX markets, the euro was at $1.1083, up 0.05% after slipping 0.4% last week. Sterling tumbled again, sliding as low as 1,2930, a fresh 3 week low, extending its decline after seeing its worst week in more than two years. It remains on the back foot after U.K. Prime Minister Boris Johnson renewed hard-Brexit fears with an accelerated schedule for signing a trade deal with the European Union. It slid 2.6% last week for its worst weekly showing since October 2017. The safe-haven Japanese yen was down 0.08% at 109.35. And while the dollar was initially lower against most Group-of-10 peers in light holiday trading, it has since turned positive on the back of the pound’s latest mauling.

In commodities, Brent crude was down 23 cents to $65.95 a barrel. West Texas Intermediate crude slipped 24 cents to $60.2 a barrel, while gold rose to a 7 week high.

The U.S. personal consumption expenditure deflator for November, due on Friday, is the only major economic report this week.

Market Snapshot

- S&P 500 futures little changed at 3,228.25

- STOXX Europe 600 up 0.02% to 418.49

- German 10Y yield fell 0.7 bps to -0.259%

- Euro up 0.03% to $1.1082

- Italian 10Y yield rose 2.4 bps to 1.237%

- Spanish 10Y yield fell 0.7 bps to 0.436%

- MXAP up 0.01% to 170.13

- MXAPJ up 0.06% to 550.41

- Nikkei up 0.02% to 23,821.11

- Topix down 0.2% to 1,729.42

- Hang Seng Index up 0.1% to 27,906.41

- Shanghai Composite down 1.4% to 2,962.75

- Sensex down 0.1% to 41,629.16

- Australia S&P/ASX 200 down 0.5% to 6,785.14

- Kospi down 0.02% to 2,203.71

- Brent futures down 0.3% to $65.94/bbl

- Gold spot up 0.4% to $1,484.27

- U.S. Dollar Index little changed at 97.63

Top Overnight News from Bloomberg

- China cut import tariffs on a wide range of goods including food, consumer items and parts for manufacturing smart-phones, continuing Beijing’s drive to lower trade barriers and spur domestic demand

- Oil extended losses after the biggest decline in three weeks as Kuwait signaled a deal with Saudi Arabia to renew crude output along their border and as U.S. shale explorers increased drilling

- One of Donald Trump’s top allies and his chief economic adversary are drifting closer, at least when it comes to trade

- After money-laundering scandals involving hundreds of billions of euros rocked some of Europe’s biggest banks, the Baltic region has begun a fresh clampdown. This time, the target is payment-service providers

- U.S. President Trump told Brazilian President Jair Bolsonaro he won’t reimpose tariffs on steel, aluminum from the Latin American nation, according to a person familiar

- Satellite images show North Korea has added a structure to a factory linked to the production of intercontinental ballistic missiles, reports NBC News

- Financial Times reports that traders at HSBC and JPMorgan Chase are among those who accessed a high-speed audio feed of Bank of England press conferences

- Michel Barnier, European Commission chief negotiator for Brexit, says Britain must stick closely to Brussels’ standards on tax, state aid and environment to secure a trade deal with the bloc. Warns it will be “immensely challenging” to finish a deal by end of 2020 deadline, according to the Sunday Times

Asian equity markets traded somewhat mixed as the region once again failed to fully join in on the Christmas cheer which had propelled Wall Street to fresh record highs on Friday, with volumes light heading into the holidays. ASX 200 (-0.5%) and Nikkei 225 (+0.1%) were varied with Australia dragged by commodity-related losses and due to the adverse effects of its recent currency appreciation, while the Japanese benchmark remained afloat but with upside capped by an indecisive JPY and after Japanese Chief Cabinet Suga clarified that they have not eased export controls on South Korea. Hang Seng (+0.1%) and Shanghai Comp. (-1.4%) lacked conviction despite the announcement that China is to lower import tariffs for some products beginning January 1st and after the recent Trump-Xi call in which the leaders were said to have conducted a very good talk regarding the trade deal, although reports further noted that Chinese President Xi stated US interference is harming China’s interests and there were also downward revisions to November Chinese trade data including a wider contraction in Exports. Finally, 10yr JGBs languished firmly below the 152.00 level after the recent bear-flattening in USTs and with demand also dampened by the lack of BoJ presence in the market today.

Top Asian News

- Warburg-Backed ESR Is Said to Mull REIT IPO of Korean Assets

- SoftBank, Naver Hike Line Offer as Son Takes on Google, Amazon

- Rescuers Sought for India Shadow Bank Altico as Crisis Deepens

- India BJP Trails in State Poll Signaling More Woes for Modi

Tentative and mixed trade for European bourses in the final full session before Christmas [Euro Stoxx 50 -0.1%] following on from a similar APAC handover amid a lack of conviction and participants. In terms of YTD performance in Europe – FTSE MIB stands as the winner with YTD returns of just over 30% followed by the CAC 40 (+27.3%), DAX (+26.0%) and Euro Stoxx 50 (+25.7%) whilst IBEX 35 (+13.1%) and FTSE 100 (+12.8%) reside towards the bottom end of the spectrum. State-side, Nasdaq (+34.5%) leads the YTD gains followed by S&P 500 (+28.5%) and DJIA (+22.0%). Back to today’s session, FTSE 100 (+0.4%) outpaced peers as exporters benefit from a softer Sterling. Sectors also reflect an indecisive risk tone with no major standouts. In terms of individual movers: Bayer (+3.0%) rose to the top of the German index after the US government said the USD 25mln verdict on Co’s Roundup case should be reversed. Lufthansa (-1.3%) shares are pressured after talks with the German Union UFO fell through and strikes are imminent, albeit the union will refrain from strike action during the busy Christmas period. Meanwhile, GSK (-0.4%) drifted off lows but remains subdued after the US FDA declined to approve Co’s long acting HIV injections after the regulator questioned the treatment’s chemistry, manufacturing and controls process but not its safety. Finally, NMC Health (+28.5%) spiked higher at the open, and have continued to strengthen, after the Co. stated it will be commencing an independent third-party review to provide additional reassurances to shareholders after activist short-seller Muddy Waters questioned the integrity of NMC’s reports. Note: tomorrows session sees Eurex and all its derivatives closer whilst cash DAX will be shut all day – the rest of the cash bourses will see an early finish.

Top European News

- Consilium Soars More than 200% on Unit Sale to Nordic Capital

- Germany Expects Gas Pipeline Delay Before Completion in 2020

- Neste Jumps on Reinstatement of U.S. Blender’s Tax Credit

- Benettons’ Atlantia to Confront Italy Government on Road Reform

In FX, AUD/NZD – The Aussie and Kiwi are still outpacing their G10 rivals and jostling for top spot in the major stakes having made firmer breaches of big figures against their US counterpart, with Aud/Usd up to 0.6920 and Nzd/Usd reaching 0.6625. Both have benefited from a mixture of short covering and technical buying after recent relatively upbeat data that has reduced or rolled back RBA/RBNZ rate cut expectations. In terms of next bullish chart targets, 0.6939 looms as long as the pair holds/closes above the 200 DMA (circa 0.6905) and 0.6636 respectively.

- CHF/GBP – The Franc is in bronze position and eyeing 0.9800 vs the Buck as latest weekly Swiss sight deposits suggest less active currency intervention and the Greenback drifts down from best levels generally (DXY dipping within a narrow 97.708-578 range) amidst even thinner seasonal volumes and a softer/flatter Treasury yield curve. Similarly, Sterling is trying to take advantage of the Dollar’s dip and attempting to keep hold or sight of the 1.3000 level even though no deal Brexit risks have risen with the passing of the 1st parliament vote on PM Johnson’s WAB that includes a no transition delay clause.

- EUR//JPY/CAD – All more narrowly mixed against the Usd, with the single currency mired between 1.1074-88 parameters, Yen meandering from 109.35-53 and Loonie pivoting 1.3150 ahead of Canadian GDP for the month of October that is forecast to be flat, but could disappoint given a string of bleak data since this month’s BoC meeting. Back to Eur/Usd, some option expiry interest could impact in the absence of anything else and the aforementioned quiet pre-Xmas trade, as almost 1 bn rolls off at 1.1070 and from 1.1100-10.

- SCANDI/EM – The Swedish Crown has slipped after another test of resistance near 10.4150 against the Euro failed to propel the Sek higher, but its Norwegian peer is extending gains through 10.0000 towards 9.9150 on the back of the Norges Bank’s gently inclined depo rate path. Elsewhere, EMs are largely going through the motions in tight bands vs the Dollar.

In commodities, the energy complex remains flat/subdued amid holiday-thinned conditions after a lacklustre Asia session in light of a number of bearish supply-side factors including Friday’s increase in active rigs reported via the Baker Hughes rig count coupled with reports of a Saudi-Kuwaiti agreement to renew oil output in the shared neutral zone by year-end. WTI futures hover just above the USD 60/bbl mark whilst its Brent counterpart retains USD 66/bbl+ status at time of writing. Russian Energy Minister Novak failed to provide the complex with much impetus in early EU trade despite noting that the OPEC+ could discuss deeper oil output cut quotas at its March meeting (5th/6th) in 2020. This follows this month’s policy revision in which the cartel agreed to deeper cuts of 496k BPD starting from Q1 2020, with an extraordinary meeting in March for a review. Elsewhere, gold trades on a firmer footing with the yellow metal hovering around current session highs of ~USD 1485/oz ahead of reported trend-line resistance at ~USD 1487/oz. Copper also garnered some support from the initially softer Dollar with prices re-eying USD 2.80/lb to the upside, although the red metal’s 100 WMA rests just below the round figure at USD 2.7988/lb. Finally, Dalian iron ore rose in excess of 1.0% after key steelmaking cities in Northern China issued pollution alerts as air quality in the region deteriorates.

UIS Event Calendar

- 8:30am: Durable Goods Orders, est. 1.5%, prior 0.5%; Durables Ex Transportation, est. 0.2%, prior 0.5%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.2%, prior 1.1%; Cap Goods Ship Nondef Ex Air, est. 0.0%, prior 0.8%

- 8:30am: Chicago Fed Nat Activity Index, est. -0.3, prior -0.7

- 10am: New Home Sales, est. 730,000, prior 733,000; New Home Sales MoM, est. -0.41%, prior -0.7%

Tyler Durden

Mon, 12/23/2019 – 08:08

via ZeroHedge News https://ift.tt/2rk8cCU Tyler Durden