Never Before Seen Market Complacency, As Everyone Goes Even More “All In”

Last weekend, we pointed out that according to the latest flow data as compiled by Deutsche Bank’s Parag Thatte, virtually every segment of the market – from institutional to retail investors, and systematics such as quants, risk-parity, vol-targeters, and CTAs – were essentially “all-in” stocks (if you missed it, please read “Institutions, Retail And Algos Are Now All-In, Just As Buybacks Tumble“).

Fast forwarding to today, when the S&P just had another impressive meltup week, sending the S&P more than 3% higher YTD and for the 11th consecutive year blowing the professional investing community out of the water (hedge funds have underperformed the S&P on every single day of 2020 so far)…

… we find that investors are, inasmuch as that is possible, even more “all in” stocks. So without boring readers with the same narrative as we laid out last weekend, for the simple reason that nothing has changed since then, here is a quick rundown the key charts showing just how vested (and invested) everyone is in stocks as of this moment.

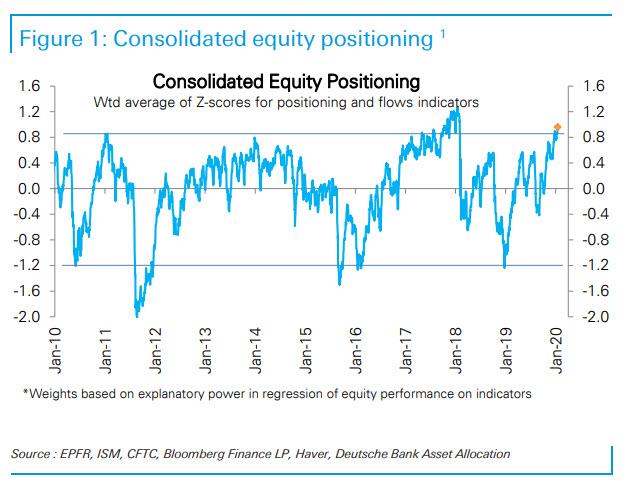

We start with consolidated equity positioning, representing a weighted average of Z-scores for positioning and flows indicators used by Deutsche Bank in tracking its entire positional universe:

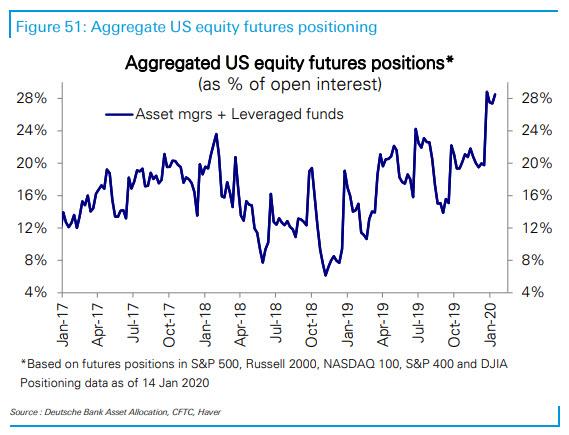

A somewhat simpler and perhaps more accurate take, one based on the aggregated equity futures positioning as a % of Open Interest, shows that asset managers and levered funds have never been longer!

A similar picture emerges when looking at just net positioning in S&P 500 futures among asset managers and leveraged funds.

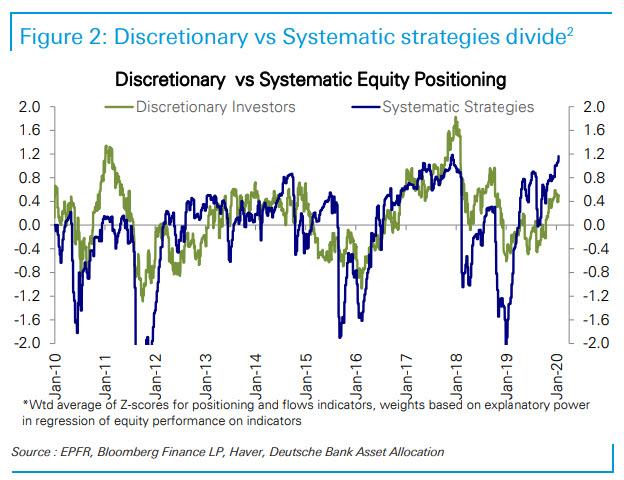

Curiously, while Discretionary investors are almost at all time highs, if not quite, Systematic investors have now thrown all caution to the wind, perhaps as a result of the sharp drop in VIX Y/Y, and have never been more invested:

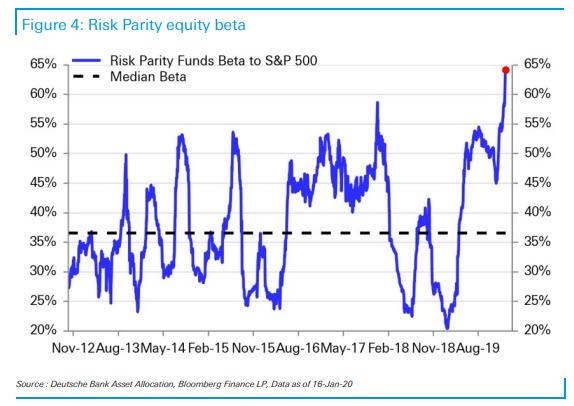

Among the systematics, the bullishness of risk parity is now almost literally off the charts.

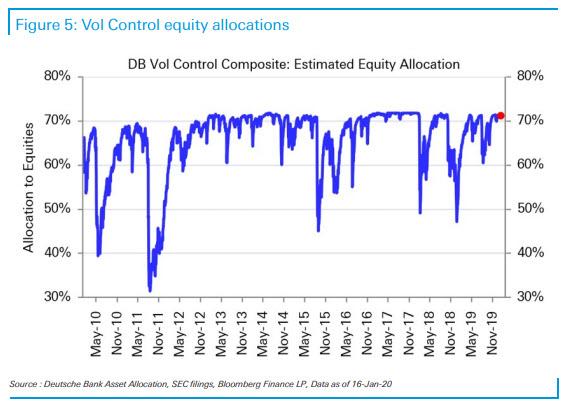

Likewise for vol-control funds, these are at the maximum of their theoretical maximum equity allocation.

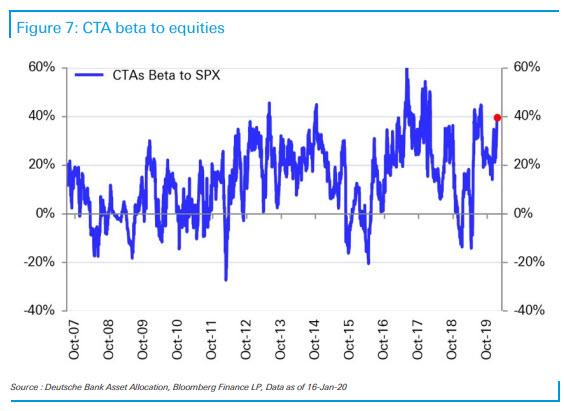

And while CTAs have had a higher beta to equities in the past, this too is rising fast and approaching the all time high.

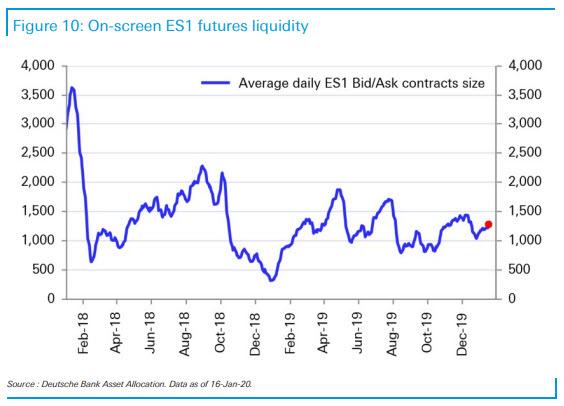

In one ominous sign that we are taking the stairs higher and will take the parachute on the way down, the higher we get, the lower overall market liquidity gets.

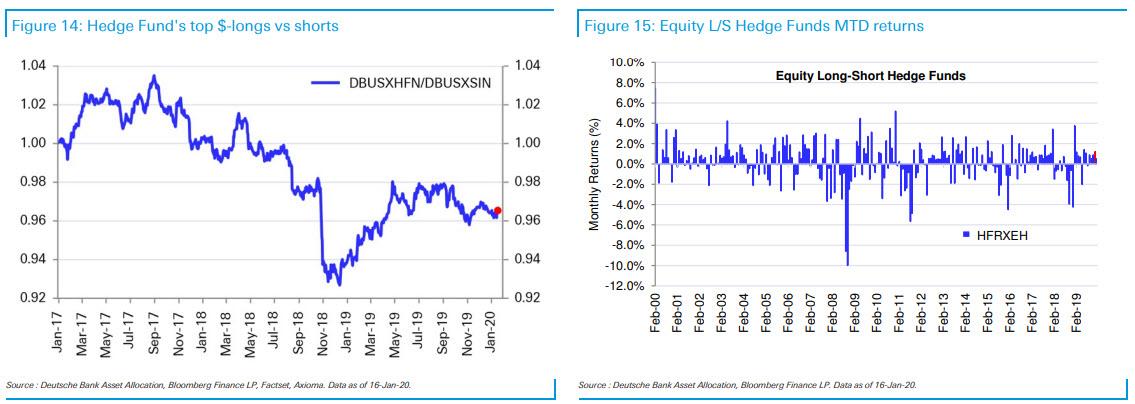

Another ominous signal: hedge funds are unable to keep up with the meltup in the broader market, with hegde fund shorts dominating performance ever since the summer of 2018, and preventing the 2 and 20 community to keep up with the S&P500.

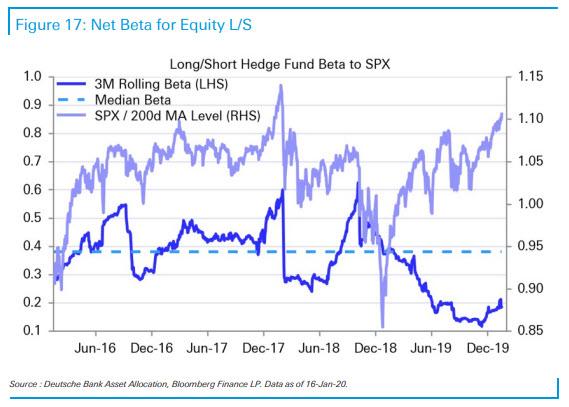

And as a result of the negative contribution from shorts which are once again outperforming the broader market, hedge fund beta is near the lowest in the four years.

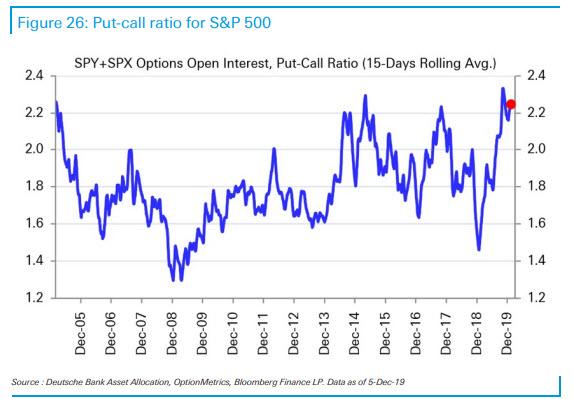

As a result of aggressive central bank intervention which has effectively wiped out risk, extreme put-to-call ratios indicate near record complacency…

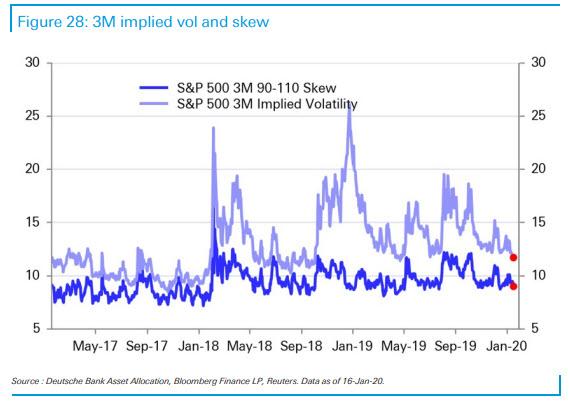

… as does collapsing implied vol and skew.

This has also led to near all time low short interest across single stocks and ETFs:

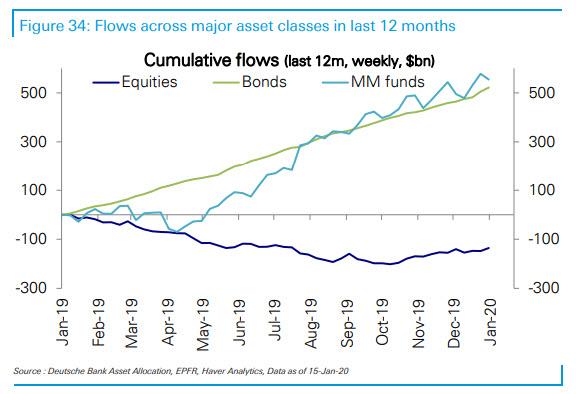

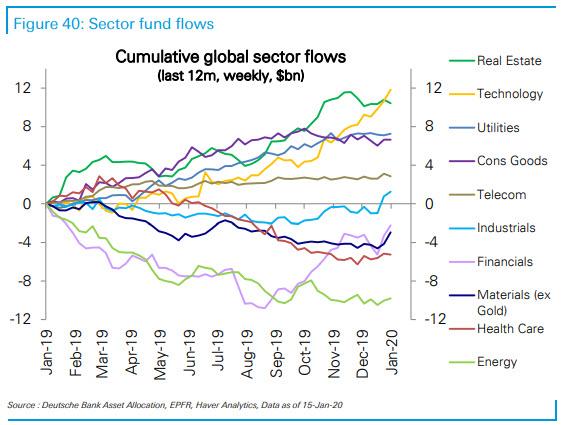

Meanwhile, the biggest conundrum of 2019 has carried over into 2020, as massive equity outflows persist and offset tremendous inflows in bonds as well as money market funds, suggesting the primary buyer remains stock buybacks…

… despite stable inflows into tech, real estate and utilities.

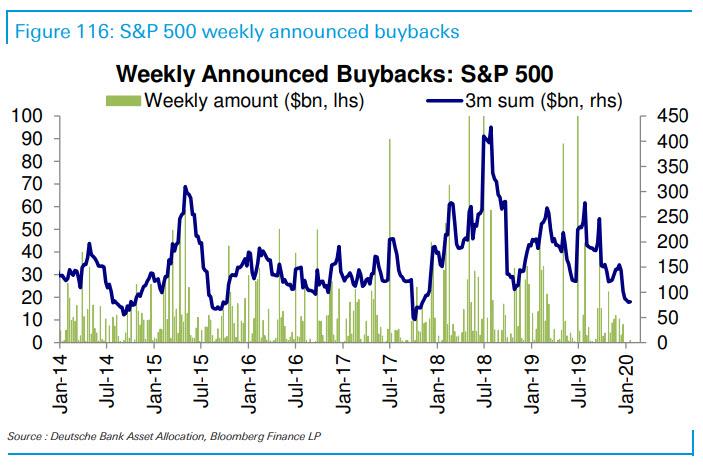

Last but certainly not least, the biggest concern for stocks is the precipitous decline in announced buybacks: without this single biggest buyer of stocks over the past 10 years, just who will propell stocks to new all time highs once sentiment reverse and marginal traders start dumping?

Tyler Durden

Sun, 01/19/2020 – 16:00

via ZeroHedge News https://ift.tt/30IAIeU Tyler Durden