S&P Futures Soar To All Time High As Traders Shrug Off Global Viral Epidemic

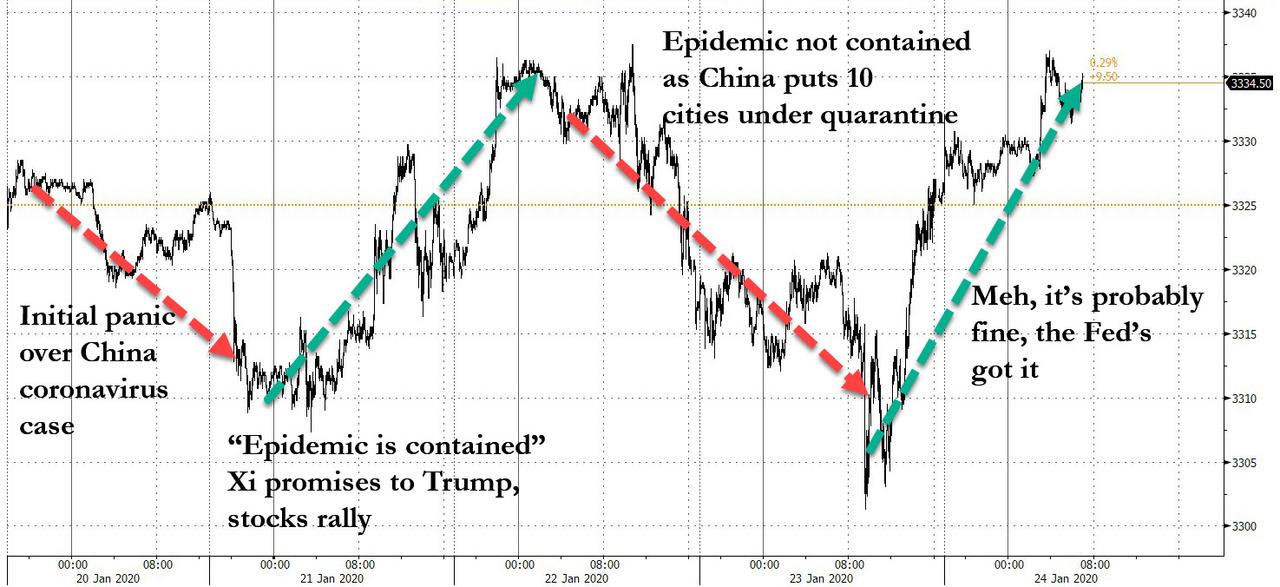

One day after global stocks slumped amid fears that China is losing the fight to contain the coronavirus epidemic, European shares and US Equity futures on Friday once again shrugged off worries over the viral outbreak after the World Health Organisation designated it an emergency for China but not yet for the rest of the world.

In retrospect, the market reaction is precisely why the WHO did what they did, although with almost a thousand people infected and dozens dead, it is now only a matter of time before the algos will no longer be ale to ignore reality. Until then..

For those who missed our latest recap, here is the latest in a nutshell: the Chinese virus, which may have escaped a top biohazard lab in Wuhan just 20 miles away from the infamous food market cited as ground zero for the breakout, has killed 25 people and infected at least 800 in China, where health authorities fear the infection rate could accelerate as hundreds of millions of people travel over the week-long Lunar New Year holiday, which began on Friday.

“Drastic steps, such as city-wide quarantine measures, can be a double-edged sword when it comes to market impact,” ING senior rates strategist Antoine Bouvet wrote in morning note. “On the one hand they signal the authorities are taking the problem seriously and help containment, on the other hand, they help paint a dramatic picture to investors unfamiliar with dealing with this sort of risk.”

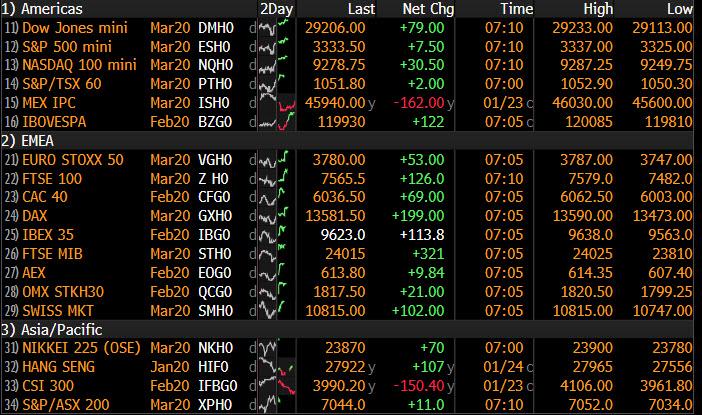

None of this was a concern to algos though, as S&P futures soared back to all time highs right around the “Hartnett” number of 3,3333 while the broad Euro STOXX 600 gained 1.1% in early trading, with indexes in Frankfurt, Paris and London all advancing similar amounts. In fact, global stocks were a sea of green even as a deadly viral pandemic is now spreading at an unknown pace.

Ironically, shares of German drugmaking giant Bayer gained 2.5%, driven by a report on a possible out-of-court settlement at a U.S. jury trial over allegations that its weed-killer Roundup causes cancer.

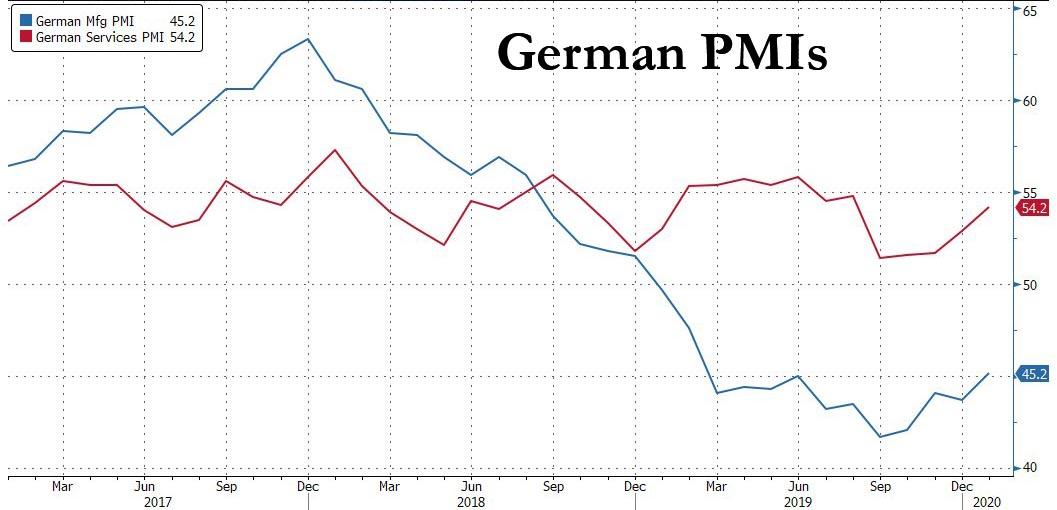

There was some more good news out of Europe, where the economy appears to have turned the corner for now with PMIs in Germany rising once again in January, beating expectations for both manufacturing and services…

… resulting in the strongest Mfg PMI for Europe since 2018, even as service PMIs continue to be depressed largely due to France.

Friday’s euphoric start supported MSCI’s world equity index, which gained 0.2%, with resilience among markets in Asia also helping. There, MSCI’s broadest index of Asia-Pacific shares ex Japan was little changed, rising 0.12% amid slow trade for the Chinese holiday with health care and industrials rising, after falling in the last session. Financial markets in mainland China, Taiwan and South Korea were closed on Friday. Markets in the region were mixed, with India’s S&P BSE Sensex Index, Singapore’s Straits Times Index rising and Thailand’s SET and Japan’s Topix Index falling. Nidec contributed most to the decline in the Topix Index.

As the scramble for risk assets returned, safe havens such as the Japanese yen and gold stepped back: the yen fell a touch to 109.57 yen against the dollar, off two-week highs of 109.26 touched on Thursday. Gold fell 0.3% to $1,558.

“Markets are waiting to see whether or not it has a material impact on growth, and that’s hard to judge at the moment,” said Neil Wilson, chief analyst at Market.com. Markets have reacted more calmly to the outbreak than was the case during the SARS epidemic in 2003, Wilson said, possibly because of greater information about its spread.

Still, underscoring the grave economic risks posed by any deepening of the crisis, the National Australia Bank estimated China’s GDP growth for the first quarter could be hit by around 1 percentage point by the outbreak of the virus. The Lunar New Year is a time of heavy consumption on travel, gifts and entertainment. “The impact on Chinese growth could be significant given the outbreak coincides with the Chinese New Year,” said Tapas Strickland, NAB’s director of economics in Sydney.

In geopolitics, President Trump said he plans to release the Middle East Peace Plan before Israel PM Netanyahu’s visit on January 28th, while he suggested Palestinians may react negatively at first to the plan but there is a lot of incentive for them to do it and noted that it is a great plan. Additionally, the US sanctioned four companies related to Iranian petroleum and petrochemical trading in an attempt to further tighten Iranian revenue sources.

Elsewhere in FX, the Bloomberg Dollar Spot Index held on to modest weekly gains and the pound touched session high after better-than- forecast U.K. PMIs kept traders on edge as they were weighing the probability of Bank of England rate cut next week; the pound move subsequently faded and gilts reversed an earlier slump as money market pricing held around 60%. The Swiss franc and the yen eased while antipodean currencies advanced as China took further measures to limit the spread of the coronavirus.

Market Snapshot

- S&P 500 futures up 0.2% to 3,334.00

- STOXX Europe 600 up 1.2% to 425.17

- German 10Y yield rose 1.5 bps to -0.293%

- Euro down 0.08% to $1.1046

- Spanish 10Y yield rose 1.8 bps to 0.376%

- MXAP up 0.05% to 172.31

- MXAPJ up 0.2% to 560.94

- Nikkei up 0.1% to 23,827.18

- Topix unchanged at 1,730.44

- Hang Seng Index up 0.2% to 27,949.64

- Shanghai Composite down 2.8% to 2,976.53

- Sensex up 0.6% to 41,630.35

- Australia S&P/ASX 200 up 0.04% to 7,090.54

- Kospi down 0.9% to 2,246.13

- Brent futures down 0.4% to $61.78/bbl

- Gold spot down 0.1% to $1,561.26

- U.S. Dollar Index up 0.1% to 97.83

Top Overnight News

- China is struggling to contain rising public anger over its response to a spreading coronavirus even as it took unprecedented steps to slow the outbreak, restricting travel for 40 million people on the eve of Lunar New Year; the outbreak of the SARS-like virus has killed 25 people, all in China, while new cases have emerged in Singapore, Vietnam, Japan and South Korea

- The euro-area economy continued to trundle along at the beginning of 2020, despite signs of a pickup in Germany. IHS Markit’s composite Purchasing Managers’ Index for the region stayed at 50.9 in January, falling short of the 51.2 median forecast of economists. There was a drag from France, where strikes hit the services sector, which offset an improvement in Germany

- European Central Bank President Christine Lagarde said investors shouldn’t assume that current monetary policy is locked in for the foreseeable future just because officials are focused on reviewing their strategy

- ECB Governing Council Klaas Knot says the ECB hasn’t technically hit effective lower bound on rates

- Italian Regional elections on Sunday could weaken the government, especially after the leader of the Five Star Movement, the biggest party in the ruling coalition, quit earlier this week. A win by the populist Matteo Salvini’s League in one of the Democratic Party’s historical strongholds would raise the prospect of an early election and a potential comeback for a euroskeptic agenda

- Concerns about the coronavirus in China has taken some steam out of Asia’s dollar bond market, which had been on a tear in recent months.

- The European Union and a group of 16 nations that includes China and Brazil are forming an alliance to settle their trade disputes using an appeals and arbitration system at the World Trade Organization to replace temporarily a process stymied by the U.S.

Asian equity markets traded cautiously but eventually edged mild gains following the slight reprieve on Wall St where most major indices rebounded after the World Health Organization refrained from declaring the coronavirus as a Public Health Emergency of International Concern, while Nasdaq futures were also boosted after-hours due to Intel earnings which beat on top and bottom lines. Nonetheless, price action for Asia was restricted amid widespread closures for Lunar New Year’s Eve and with the number of infected and deaths from the coronavirus continuing to rise. ASX 200 (Unch.) remained afloat with outperformance in Healthcare spurred by outbreak fears after further virus cases were reported in both mainland China and abroad, while the largest weighted financials sector benefitted amid the recent pushback in rate cut forecasts and with Macquarie underpinned by reports it is nearing a deal with Bell Financial to outsource the back office of its private wealth management business. Elsewhere, Nikkei 225 (+0.1%) largely reflected the indecision of its currency and the Hang Seng (+0.2%) was contained in today’s shortened trading session as stocks remained dampened by the coronavirus fears including gambling names after Macau Chief Executive Ho said they may close all casinos and have cancelled the Lunar New Year parade after a second case of the virus was recently confirmed in the special administrative region. Finally, 10yr JGBs were subdued following yesterday’s pullback and after the BoJ minutes from the December meeting provided very little to spur demand, while the knee-jerk reaction to stronger demand at the enhanced liquidity auction was only brief.

Top Asian News

- EU Widens Tariff Threat on Steel From China, Taiwan, Indonesia

- India Doubles Cap for Some Foreign Debt Investment Before Budget

- Deutsche Bank Doubles Down on Indian Shadow Lender’s Debt

- Strikes Take a Toll on French Economy at Start of 2020

European bourses are firmer across the board [Eurostoxx 50 +1.3%] as bourses in the region welcomed the World Health Organisation’s current assessment of the virus, in which it refrained from labelling it a PHEIC. Further, bourses react to a number of earnings – with the IT sectors outperforming and bolstered by Intel’s stellar earnings after the bell, with shares seen higher by 6% pre-market. Other sectors are experiencing broad-based gains with no clear reflection of the current risk sentiment. In terms of individual movers: Bayer (+3.0%) extended on its opening gains amid reports that the Co. is edging towards a possible settlement regarding the glyphosate scandal. Carrefour (+4.3%) sits at the top of the Stoxx 600 after reporting a 3.1% YY rise in group sales in Q4. On the flip side, Ipsen (-24%) plumbed the depths after it paused dosing in Palovarotene drug trials. Meanwhile, Nokian Tyres (-8.7%) rests near the foot of the pan-European index amid a guidance downgrade, with Pirelli (-3.9%) and Continental (-2.3%) lower in sympathy

Top European News

- Swiss Watchdog Seizes Insider Trading Profit From Ex-Bank CEO

- Czechs Pushing Ahead With Tax on Google After France Backs Down

- Takeaway Falls After CMA Plans Review of Just Eat Purchase

- KKR Bids for Rest of Axel Springer, Says Co. Applies to Delist

In FX, the price action post-UK PMIs could be construed as a classic case of ‘buy the rumour/sell the fact’, but the sheer scale of Sterling’s fall from grace smacks of something else, or coincidental. Indeed, Cable collapsed from 1.3170+ to 1.3085 having rallied ahead of the IHS surveys to circa 1.3155 even though the headline reads for manufacturing, services and composite all beat consensus comfortably and the compiler contended that this this would likely keep the BoE on hold next week. However, market pricing is still close to 50-50 and the Pound’s sharp reversal came alongside a broader Dollar buying spree amidst reports that China’s coronavirus has now spread to all but just 2 of the country’s 31 regions. Usd/CNH rebounded towards weekly peaks in response and the DXY extended gains beyond 97.800.

- EUR – The Euro has also felt the weight general Greenback demand having derived scant bullish momentum from preliminary Eurozone PMIs that were better than expected on balance, and not really reacting to more ECB rhetoric from President Lagarde plus GC members that were largely reiterations of yesterday’s post-policy meeting statements and the official strategic review launch text. Eur/Usd is now just off a marginal new sub-1.1035 low, but Eur/Gbp has rebounded through 0.8400 on the back of Sterling’s much deeper pull-back.

- NZD/AUD/JPY/CAD/CHF – The Kiwi remains relatively firm/resilient in wake of NZ CPI data overnight that marginally surpassed forecasts, and the Aussie is also benefiting to a degree from another bank rolling back its RBA easing call to April from next month previously. Nzd/Usd is holding above 0.6600, while Aud/Usd keeps tabs on 0.6850 and the Yen pivots 109.50 after easing back from Thursday’s peaks near 109.25 and the 50 DMA. Elsewhere, the Loonie continues to regain composure after the BoC’s shift towards a looser policy stance, with Usd/Cad back down below 1.3150 and now looking towards Canadian retail sales data as the first release post-Wednesday’s meeting. Conversely, Usd/Chf has bounced further post-SNB verbal intervention to 0.9700+, but the Franc is still outperforming the Euro as the cross meanders between 1.0709-23.

In commodities, WTI and Brent futures continue to retrace some of yesterday’s losses, albeit upside in the complex remains capped by the implications of the coronavirus outbreak – which could dampen global growth and further weaken the demand side of the equation. The contracts have faded about half the upside seen from yesterday’s more constructive DoE report, albeit the data remains overshadowed by the epidemic woes. WTI front month futures meander around 55.50/bbl ahead of mild support seen at 55/bbl, whilst Brent Mar’20 futures dipped below the USD 62/bbl mark, with mild support seenat 61.50/bbl. Energy prices saw fleeting gains amid source reports that OPEC+ have reportedly discussed an output cut extension until the end of 2020, may review quotas in June, according to Tass, adding that they are unlikely to ease cuts in March as markets are still bearish. Elsewhere, spot gold has remained relatively sideways ~1560/oz and largely in tandem with the Buck, whilst copper continues its downwards trajectory as is poised for its sharpest weekly drop, with global growth concerns cited as a factor. Copper eyes 2.7/lb to the downside having tested the level during the prior session.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 52.4, prior 52.4

- 9:45am: Markit US Services PMI, est. 53, prior 52.8

- 9:45am: Markit US Composite PMI, prior 52.7

DB’s Jim Reid concludes the overnight wrap

So today the World Economic Forum’s annual meeting at Davos finally wraps up. I saw my kids for the first time this week last night and was a bit mortified to find that in my absence “In The Night Garden” is back on heavy rotation at home after a 2-year sabbatical at the point my daughter finally grew out of it. The twins are absolutely transfixed and apparently don’t want anything else on now. So it looks like I have another year of Igglepiggle, Makka Pakka and Upsy Daisy amongst others. For those who have no idea what I’m talking about…. I envy you.

Anyway following an eventful week in the Swiss mountains this year that saw a heavy focus on environmental issues, the joke on the fringes of Davos is that the event is a reverse indicator of what actually becomes important to financial markets and the world. However as we said in both our September climate change report ( link here) and in our one on sustainable growth last week (link here) we think a tipping point has been reached in terms of the public awareness and on its potential impact on financial markets. This issue will continue to dominate in the years ahead and this year won’t be “peak environment” at Davos.

Before the limos and private jets roll out of town from lunchtime onwards, one of the main remaining panels is taking place at at 11:30 CET on the Global Economic Outlook. A number of key speakers will feature, with the panel including ECB President Lagarde, Bank of Japan Governor Kuroda, IMF Manging Director Georgieva, US Treasury Secretary Mnuchin, German finance minister Scholz, and Zhu Min, the Chair of the National Institute of Financial Research at Tsinghua University, Beijing. So definitely one to look out for in terms of comments on central bank policy in an era of low inflation, as well as any possible comments from Mnuchin in terms of next steps for US trade policy. The US have on balance been hawkish on trade this week at Davos – perhaps putting pressure on the EU to come to their side of the table in ongoing negotiations.

Before then however, investor attention will turn this morning to the flash PMI releases, which are some of the first indicators we have of how the global economy has fared moving into the start of 2020. In terms of what to expect, the consensus is generally looking for the recent uptick in the PMIs over the last few months to continue. For Germany, where the composite PMI rose for a 3rd consecutive month in December, back into expansionary territory, the consensus is looking for another slight increase up to 50.5. Similarly for the Euro Area as a whole, the consensus is looking for another increase to 51.2 in the composite PMI, up from the trough in September where it was at 50.1. A data point that will take on added significance though is the UK, where investors have ratcheted up the chances of a rate cut next week. The PMIs are the last big UK release before that decision, so it’ll definitely be one to watch. Overnight we’ve seen Japan’s January preliminary PMIs with manufacturing printing at 49.3 (vs. 48.4 last month) and services standing at 52.1 (vs. 49.4 last month) bringing the composite to 51.1 (vs. 48.6 last month). So a good start to today’s line up of releases.

Markets have been cautious over the last 24 hours as concerns over the coronavirus grew. However we’re notably off the lows from yesterday perhaps due to news from the World Health Organization yesterday that they were not yet declaring a PHEIC (public health emergency of international concern). Nevertheless the US State Department issued a new travel advisory for China, calling for visitors to exercise increased caution in the country. As per latest reports, 25 people have now died due to the virus, up from 17 yesterday while the number of confirmed cases has risen to 835 (from 571 two days ago) with additional cases being reported in Beijing, Shanghai and Shenzhen – China’s three largest cities. Hong Kong and Beijing became the latest new cities to cancel large public gatherings and holiday activities while the Chinese government has already locked down public transport in the cities of Huanggang and Ezhou along with Wuhan, collectively home to around 20 million people. South Korea, Japan, Hong Kong, Taiwan, Singapore and Vietnam have confirmed at least one case of the new virus while Thailand has confirmed 4 cases. Elsewhere, S&P said in a report that Chinese GDP growth could fall by 1.2pp if spending on things including discretionary transport and entertainment dropped by 10% on account of people staying at home due to fear of contracting the virus, according to back of the envelope calculations. It will clearly have to get much worst first but expect these sorts of calculations to arrive if it does. As we discussed earlier in the week, the main positive is the speed of the reaction from the Chinese authorities relative to say the SARS outbreak in 2003.

Asian markets are making modest gains overnight with the Nikkei (+0.22%), Hang Seng (+0.15%) and Australia’s ASX 200 (+0.04%) all up in thin trading. Markets in China and South Korea are closed while the Hang Seng closed early on account of the Lunar New Year holidays. Elsewhere, futures on the S&P 500 are up +0.11%, the yield on 10y UST is +0.9bps and crude oil prices are c.+0.45%. As for other overnight data releases, Japan’s Dec CPI came in at +0.8% yoy (vs. +0.7% yoy expected) with core CPI and core-core CPI printing in line with consensus at +0.7% yoy and +0.9% yoy.

As discussed earlier, fears over the spread of the virus encouraged a risk-off theme for markets yesterday, though by the US close investor fears had dissipated somewhat, with the S&P 500 recovering from an intraday low of -0.60% to actually close up +0.11%. The NASDAQ recovered enough to close up +0.20% at a record high, though the Dow Jones did end the session -0.09% lower. This followed a poor session in Europe, which saw the STOXX 600 decline -0.73%, and the DAX down -0.94%. Amidst the risk-off narrative, oil’s decline continued, with Brent crude and WTI down -1.85% and -2.03% respectively. The declines mean that Brent is now down over 13% since its intra day peak at the start of the month when geo-political risk dominated.

The flight to safety supported sovereign debt, with yields declining across the US and Europe. 10yr Treasuries fell -3.7bps to 1.733%, their lowest level since early December, while the 2s10s curve flattened -2.3bps. It was a similar story in Europe, with bunds, (-4.8bps), OATs (-5.5bps) and gilts (-4.4bps) all seeing yields fall. Interestingly, the spread of Italian 10yr debt over bunds actually narrowed by -4.6bps, in spite of the political risk associated with this Sunday’s regional election in Emilia-Romagna, where Matteo Salvini’s right-wing Lega are seeking to win in what has long been a left-wing bastion. A win for Lega would likely be short-term bearish for BTPs but without a national election that could propel Salvini to the premiership it’s not clear that the bearish move could be sustained on such a result alone. Indeed, the stronger Salvini is performing nationally, the more the governing parties have an incentive to avoid triggering an early election, which could be behind some of the recent declines in the spread.

Elsewhere yesterday, the ECB meeting was pretty dull. In fact one journalist asked why they need to do press conference which sums up the immediate period of inactivity from the ECB. The main news was that they launched the review of their monetary policy strategy, with the announcement that they expect it to conclude by the end of the year. If you really want to find out more read DB’s Mark Wall’s interpretation of the meeting here but with all due respect to my good friend Mark, I suspect that this won’t be his most read ECB review piece ever. The euro was trading lower following the press conference, down -0.34% against the US dollar.

There wasn’t much in the way of data releases either yesterday, though the weekly initial jobless claims from the US came in at 211k (vs. 214k expected), up from a revised 205k the previous week. The release meant that the 4-week moving average continued to fall, down to 213.25k, its lowest level since late-September. Meanwhile, the Kansas City Fed manufacturing activity index for January also surprised to the upside, coming in at -1 (vs. -6 expected).

Turning to the day ahead now, the highlight is likely to be the aforementioned PMI releases. There’s not much data otherwise, but there will be Canada’s November retail sales numbers. From central banks, we’ll hear from a number of speakers, including ECB President Lagarde and BoJ Governor Kuroda on the Davos panel as discussed earlier. There’ll also be appearances there from the BoE’s Haskel, along with the ECB’s Villeroy and Knot. Finally, in terms of earnings, we’ll hear from American Express and NextEra Energy.

Tyler Durden

Fri, 01/24/2020 – 07:42

via ZeroHedge News https://ift.tt/2Gl15hq Tyler Durden