China Suddenly Has Another Major “Virus” Problem, As Soaring Food Prices Put A Lid On Central Bank Intervention

Soon the only food that will be affordable in China, is coronabat stew.

With over 400 million people across dozens of Chinese cities living in lock down as a result of the Coronavirus pandemic, crippling global supply chains and grinding China’s economy to a halt, it is easy to forget that China has been battling another major viral epidemic for the past two years: namely the African Swing Fever virus, aka “pig ebola” which killed off over half of China’s pig population in the past year, sending pork prices soaring, and unleashing a tidal wave of inflation.

Well, moments ago, the world got a stark reminder of this when China reported that in January, its CPI jumped by whopping 5.4% Y/Y, the highest print in nine years…

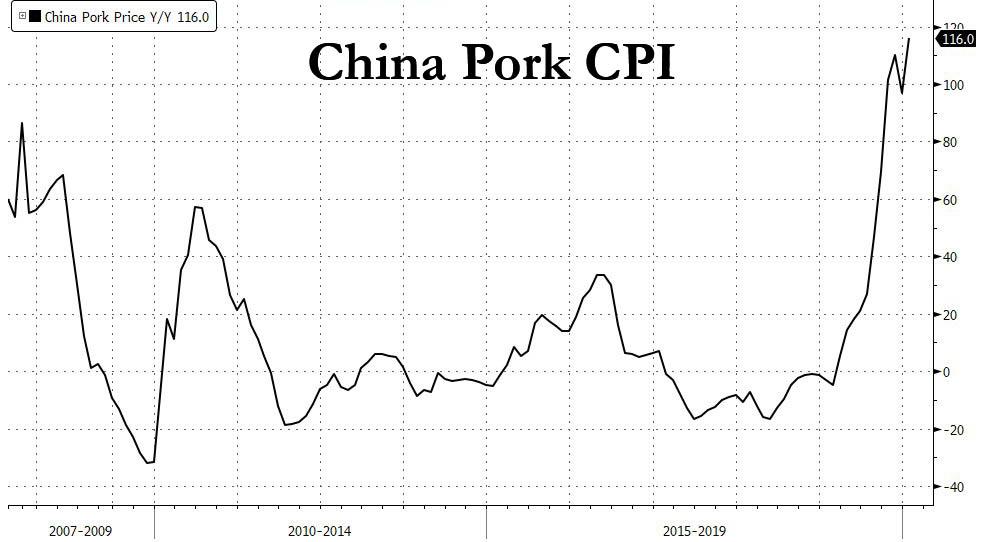

… driven by a surge in pork prices, which reversed a rare drop in December when the slid by 5.6%, rising 8.5% in just ont month, and a record 116% compared to a year ago.

This unprecedented surge in pork CPI meant that China’s food CPI rose a record 20.6% in January, also the highest on record, as China’s population, now ordered to live under self-imposed quarantine, suddenly finds it can no longer afford to buy food .

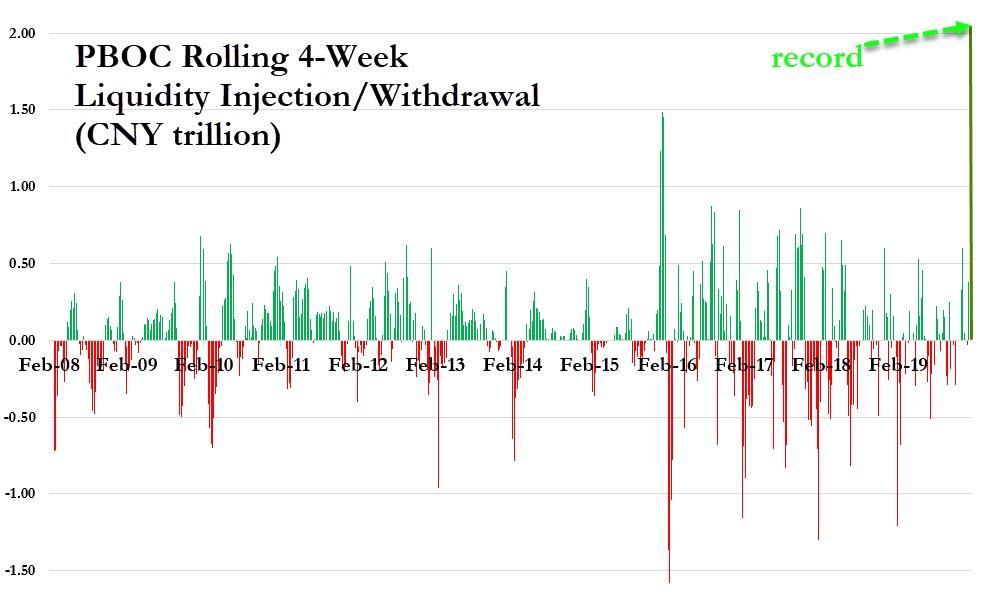

Needless to say, this is suddenly a major problem for China, whose central bank has in the past two weeks unleashed an unprecedented liquidity tsunami, including the biggest ever reverse repo injection…

… in hopes of stabilizing the stock market. Well, oops, because some of this liquidity now appears to be making its way into the broader economy, and is making already scarce food (aside from bat stew of course) even more unaffordable, and the already depressed and dejected Chinese population even more hungry, and angry.

There was one silver lining in today’s data: after spending half a year in deflation, China’s Production Prices, a proxy for industrial profits and overall price leverage, finally printed in the positive, rising 0.1% Y/Y, and better than the expected 0.0%

So far so good, however, with China’s economy now on indefinite lock down, expect the correlation shown in the chart above to break any moment now, with industrial profits crashing as a result of the coronavirus putting countless Chinese factories on lock down at least until the coronavirus is contained. When that happens is anyone’s guess, but one thing is certain: at the rate food prices are exploding, soon the only food China’s population will be able to afford will be the experimental bats used by the Wuhan Institute of Virology, one of which may or may not have been accidentally sold to the local fish market last December triggering what is now the worst viral pandemic in decades.

Just as concerning, if only for Beijing, is that if the surge in food prices isn’t “contained” very soon the arms of the PBOC will be tied and any hopes that China will reflate its economy – and the world – to offset the economic crunch resulting from the coronavirus, will be weaponized and vaporize right through the HVAC, just like any number of manmade viruses currently being developed in Wuhan, as pretty soon China’s population – starving and quarantined – will have no choice but take matters into its own hands.

Tyler Durden

Sun, 02/09/2020 – 22:03

via ZeroHedge News https://ift.tt/2w789wx Tyler Durden