Is Tesla The Next Amazon Of Auto Companies? One Investment Bank Offers Their Answer

We often rib on Morgan Stanley’s Adam Jonas for blindingly supporting Tesla with egregious price targets based on things like “Tesla Mobility”, which don’t even exist. But every once in a while Jonas produces an actual piece of analysis that can be useful.

One of two notes Jonas put out on Thursday was called “A Valuation Guide for Tech PMs” and was dedicated to trying to compare Tesla to other tech titans, now that the automaker’s stock has ascended into the stratosphere for seemingly no reason at all.

Tesla’s meteoric rise has “put it in the discussion with the most popular Teracaps, accelerating the hand-over from traditional

auto investor to tech investor,” Jonas said in his note. He says his firm is getting increasing numbers of calls from tech PMs who have picked up Tesla as a tech investment, instead of an auto investment. The market, Jonas says, is now viewing Tesla as a tech company.

It has to – how else is it going to justify a market cap of $150 billion on a company that has never turned an annual profit?

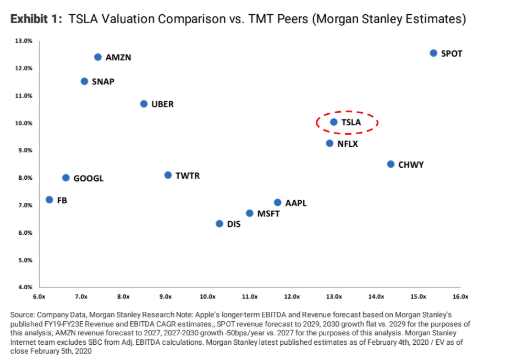

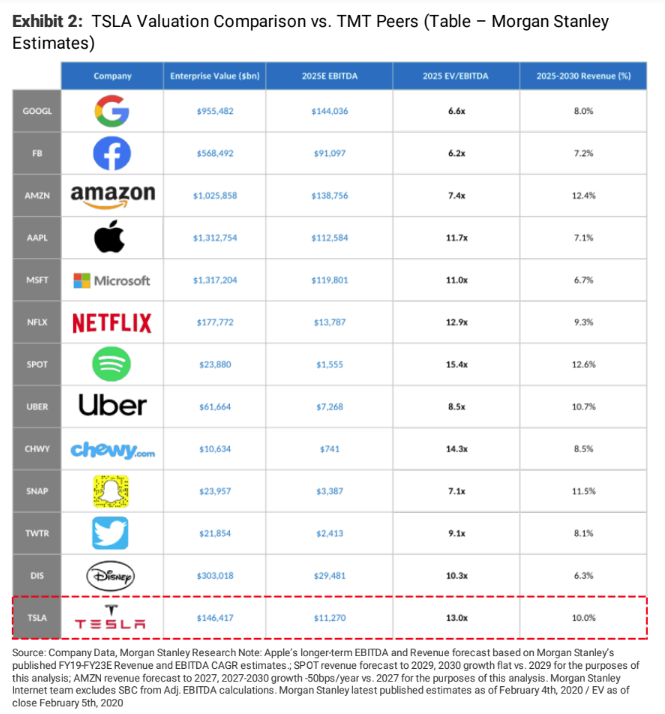

But, we digress. In his note, Jonas compares Tesla to Amazon, Apple, Netflix and Spotify. He hilariously calls it “more expensive, but higher growth” than the hyper-cash generative Apple and “cheaper than Spotify”:

- Is Tesla the next AMZN? Amazon (covered by Brian Nowak) trades at over 7x 2025 EBITDA with over 12% top line growth from 2025 through 2030. On this framework, Tesla is much more expensive and lower growth (on our forecasts)vs. AMZN.

- Is Tesla the AAPL of autos? Apple (covered by Katy Huberty) trades at under 12x 2025 EBITDA with 7% top line growth (based on Morgan Stanley’s published FY19-FY23E Revenue and EBITDA CAGR estimates) from 2025 through 2030. On this analysis, Tesla is slightly more expensive but higher growth than Apple.

- How about Tesla vs. Netflix? Netflix (covered by Ben Swinburne) trades at around 13x 2025 EBITDA with over 9% top line growth from 2025 through 2030. On this analysis, Tesla is materially more expensive and slightly higher growth.

- And vs. Spotify? Spotify (covered by Ben Swinburne) trades at around 15x 2025 EBITDA with over 12% top line growth from 2025 through 2030. On this analysis, Tesla is slightly cheaper than Spotify while materially lower growth.

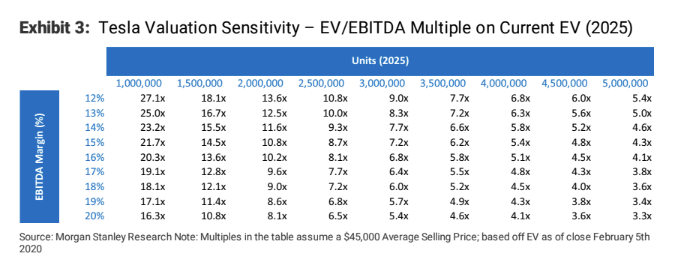

He then says that Tesla’s valuation can appear “relatively reasonable” to some investors as a technology stock. But ultimately, he concludes, “for an investor to purchase TSLA’s stock today, based upon current 2025e valuation, he or she needs either higher growth or a better business (higher ROIC, recurring revenue, lower volatility, etc.) or both.”

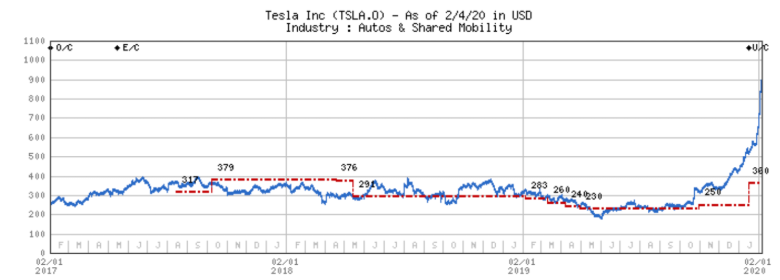

Just yesterday, we pointed out that Morgan Stanley had kept an “underweight” rating on the stock with a $360 price target, amidst the stock’s recent run up, where it had nearly tripled in the span of just weeks.

In that note, Jonas noted the astounding volume with which Tesla has traded. Jonas said that “Tesla traded over 48 million shares on Wednesday (over 25% of shares outstanding) for a value traded of approximately $36bn. For comparison, Apple, a company with roughly 10x the market cap of Tesla traded approximately $9.5bn of value yesterday. Tesla traded nearly 4x the value of the world’s most valuable public company.”

And he also was cautious about calling Tesla the winner in the EV space, given its new entrants: “Moreover, with US and global EV penetration at approximately 2% we believe it may be too early to declare the ultimate winner in the global EV market. At a minimum, there may be substantial risk to modeling the growth and market share of a market at such a low level of maturity today.”

He concluded by noting that even the bulls he was speaking sound like they are starting to change their tone to a slightly more skeptical one:

“We continue to engage with investors in high volume on Tesla, but noted a slight change in feedback where even some bulls on the name we have spoken with have expressed a degree of uncertainty, and in some cases, concern around the recent price action..”

Tyler Durden

Sun, 02/09/2020 – 21:40

via ZeroHedge News https://ift.tt/2OEnyuq Tyler Durden