Key Events In The Very Busy Week Ahead

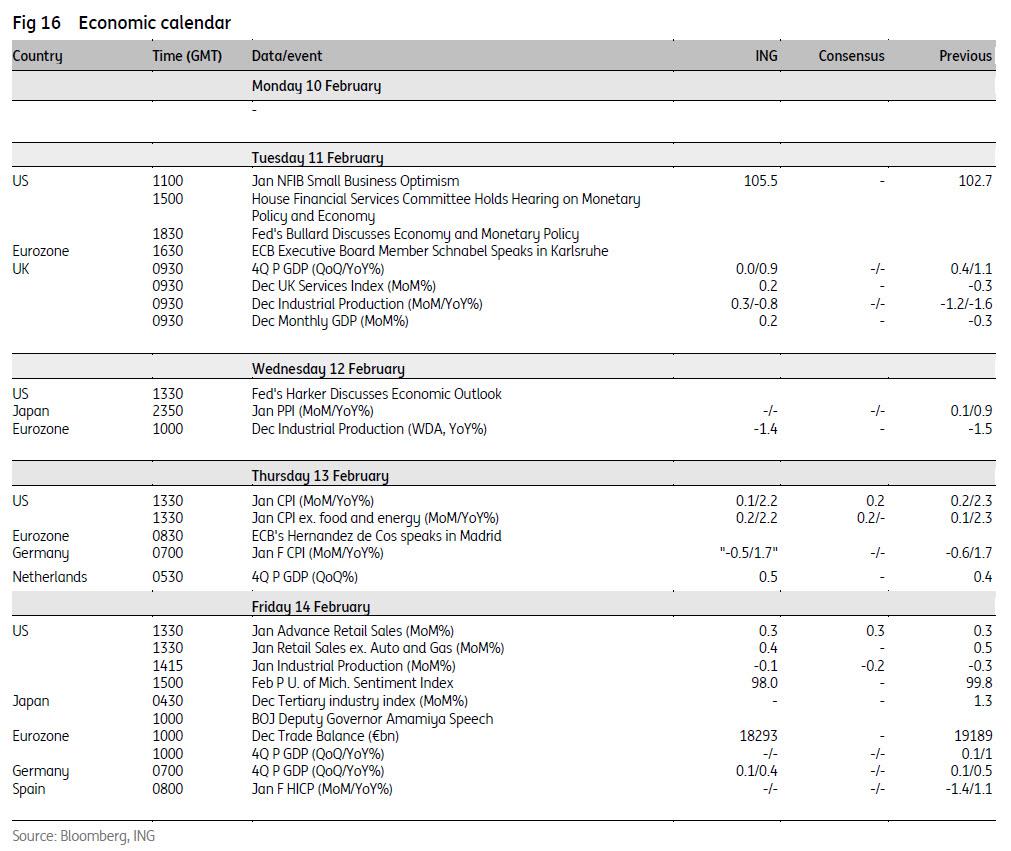

While investor attention remains fixed on the latest coronavirus developments in China, the week after payrolls is often a bit light for macro events but as DB’s Jim Reid notes, the second Democratic primary in New Hampshire tomorrow will be an additional focus. Meanwhile, attention will also be on Fed Chair Powell, who’ll be testifying before congressional committees on Tuesday and Wednesday. Data highlights include the release of US CPI (Thursday), US retail sales (Friday), and Q4 GDP readings from Germany (Friday) and the UK (tomorrow). Earnings season slows a bit but will still be important.

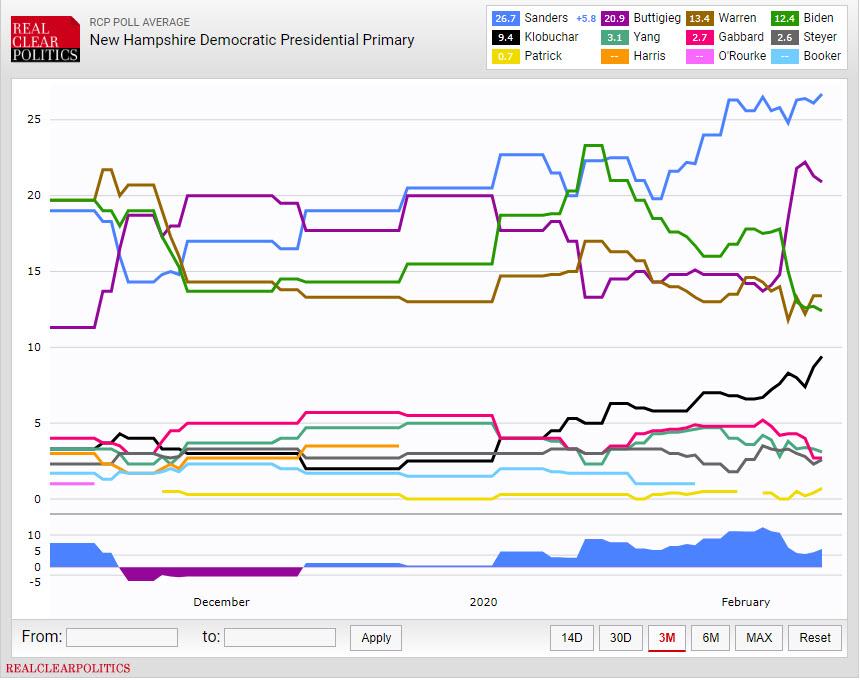

Going into the New Hampshire primary tomorrow, the RealClearPolitics polling average puts Bernie Sanders in the lead on 26.6%, ahead of Pete Buttigieg on 21.3%. It’s worth remembering that Sanders actually won the New Hampshire primary in 2016 against Hillary Clinton, and it also neighbors his home state of Vermont, which he represents in the US Senate.

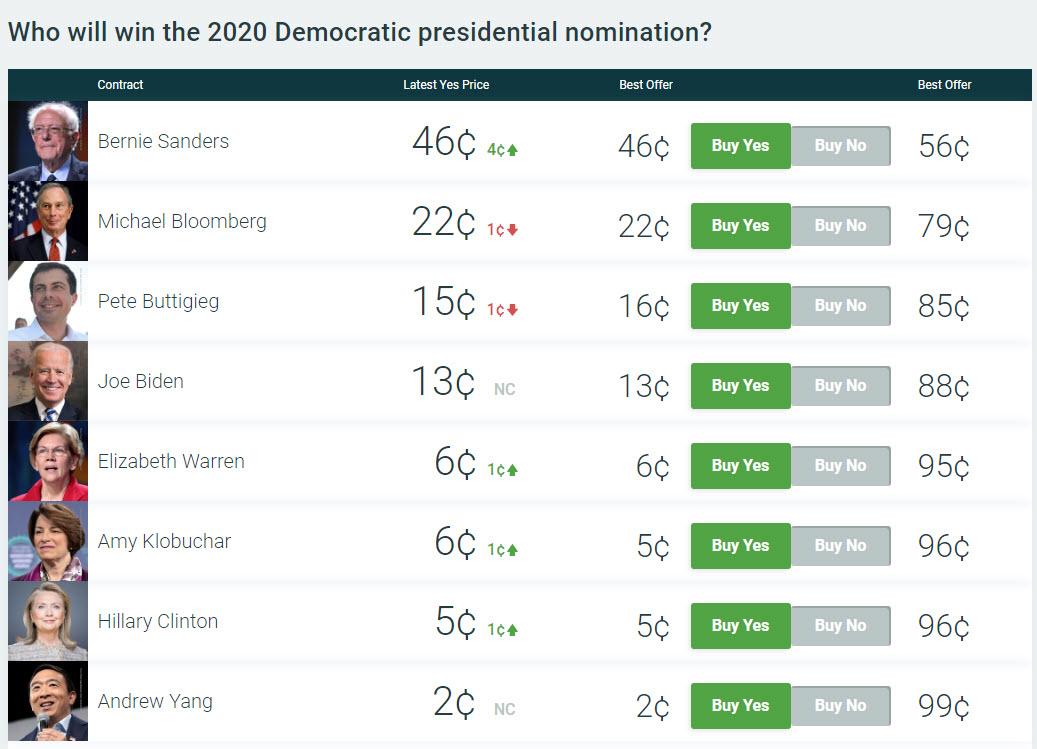

Nationally the latest poll of polls still have Biden narrowly ahead of Sanders in the race for the nomination but most of the polls are prior to the middle of last week. The last one from Wednesday had Sanders 1pp ahead. In betting markets (PredictIt) Sanders has odds of 46% against Biden who has collapsed to 13% – down over 20pp over the last week.

Staying with the US, the main central bank highlight this week will come from Federal Reserve Chair Powell, who’ll be appearing before the House Financial Services Committee tomorrow, and then the Senate Banking Committee on Wednesday. He’ll deliver the Fed’s semi-annual monetary policy report to Congress, so it’ll be interesting to hear his latest views on the outlook (and the fallout from the Coronavirus) even if they are unlikely to deviate much from the last FOMC. Another event to watch out for on Thursday will be the hearing held by the Senate Banking Committee regarding the nomination of Judy Shelton and Christopher Waller to be governors on the Federal Reserve Board.

Turning to data releases, they will all be a little backward looking given the Coronavirus but will show the direction of travel pre-outbreak. In the US a key highlight will be CPI on Thursday, which is expected to increase to +2.5%, up from +2.3% previously, to what would be its highest level since October 2018. However, the core reading is expected to fall slightly to +2.2%. Other important readings to watch out for include January’s retail sales and industrial production releases on Friday, as well as the preliminary reading of the University of Michigan consumer sentiment index, which rose to an 8-month high in January.

One of the main highlights from Europe will be the preliminary estimate of German GDP for Q4 on Friday. The consensus is expecting a +0.1% increase, following the +0.1% growth in Q3. However it comes against the backdrop of unexpectedly poor German data out this week on factory orders as well as industrial production for December, so an important release to keep an eye out for. In terms of other GDP releases from Europe, tomorrow sees the preliminary Q4 GDP reading from the UK, which is expected to show a flat reading following growth of +0.4% in Q3. Finally, there’ll be the second release of GDP for the Euro Area on Friday, though this is expected to be in line with the first estimate, which saw the region’s economy expand by +0.1%.

Earnings season slows down (148 S&P 500 and Stoxx 600 companies) but in terms of what to look out for this week, Daimler will be reporting tomorrow, then on Wednesday, we’ll hear from Cisco Systems, CVS Health and CME Group. It’s a busy day on Thursday, with companies reporting including Nestle, PepsiCo, Nvidia, Airbus, Linde, Zurich Insurance Group, AIG, Barclays, Credit Suisse and Nissan. Then on Friday, we’ll hear from AstraZeneca, Credit Agricole, Royal Bank of Scotland.

We are now 64% of the way through the S&P 500 Q4 earnings season. 71% of companies are beating estimates which is slightly below the five-year average of 75%. In aggregate, companies are currently beating by +4.6% above the estimates, above the longer-run historical average rate (+3.4%) but below the five year average (+5.4%). According to DB, the decline in margins has been led by the Energy and Materials sector. This is likely a reflection of lower commodity prices, but the trend has been broad based with margins down across all sectors.

A day by day summary of the week’s key events

Monday

- Data: China January CPI, PPI, Bank of France January industry sentiment indicator, Italy December industrial production, Canada January housing starts, December building permits

- Central Banks: Fed’s Bowman, Daly and Harker speak

Tuesday

- Data: UK preliminary Q4 GDP, December industrial production, manufacturing production, trade balance, US January NFIB small business optimism index, December JOLTS job openings, Japan January M2 and M3 money stock

- Central Banks: Fed’s Powell, Quarles, Daly, Bullard and Kashkari, ECB’s Schnabel, BoE’s Haskel speak

- Earnings: Daimler

- Politics: New Hampshire primary in US

Wednesday

- Data: Japan preliminary January machine tool orders, Euro Area December industrial production, US weekly MBA mortgage applications, January monthly budget statement, Japan January PPI

- Central Banks: Fed’s Powell and Harker speak, monetary policy decisions from the Reserve Bank of New Zealand and the Riskbank

- Earnings: Cisco Systems, CVS Health, CME Group

Thursday

- Data: France Q4 unemployment rate, Germany final January CPI, US January CPI, core CPI, weekly initial jobless claims

- Central Banks: ECB’s Hernandez de Cos speaks, Senate Banking Committee holds hearing on the nomination of Judy Shelton and Christopher Waller to the Federal Reserve Board of Governors, Banco de Mexico policy decision

- Earnings: Nestle, PepsiCo, Nvidia, Airbus, Linde, Zurich Insurance Group, AIG, Barclays, Credit Suisse, Nissan

Friday

- Data: Japan December tertiary industry index, Germany preliminary Q4 GDP, Italy December trade balance, Euro Area December trade balance, preliminary Q4 GDP and employment, US January retail sales, industrial production, capacity utilisation, December business inventories, preliminary February University of Michigan sentiment, Canada January existing home sales

- Central Banks: BoJ’s Amamiya and Fed’s Mester speak

Finally, here is Goldman previewing the of key US economic data releases this week which are the CPI report on Thursday and retail sales on Friday. There are several speaking engagements from Fed officials this week. Chair Powell will deliver his semiannual monetary policy report to Congress this week, with the first testimony occurring Tuesday and the second testimony Wednesday. Fed Board nominees Shelton and Waller will have their nomination hearings on Thursday.

Monday, February 10

- 08:15 AM Federal Reserve Governor Bowman (FOMC voter) speaks: Federal Reserve Governor Michelle Bowman will speak on community banking at an event in Orlando. Prepared text and audience Q&A are expected.

- 01:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will give a speech in Dublin. Prepared text and audience Q&A are expected.

- 03:15 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will speak on the economic outlook at an event at the University of Delaware. Prepared text and audience Q&A are expected.

Tuesday, February 11

- 06:00 AM NFIB small business optimism, January (last 102.7);

- 06:00 AM San Francisco Fed President Daly (FOMC voter) speaks; San Francisco Fed President Mary Daly will participate in a moderated discussion at Trinity College, Dublin. Prepared text is not expected. Audience Q&A is expected.

- 10:00 AM JOLTS Job Openings, December (last 6,800k)

- 10:00 AM Federal Reserve Chairman Powell (FOMC voter) speaks; Federal Reserve Chairman Powell will give his semiannual monetary policy report to Congress in front of the House Financial Services Committee. Prepared text and questions from committee members are expected.

- 12:15 PM Federal Reserve Vice Chair for Supervision Quarles (FOMC voter) speaks; Federal Reserve Vice Chair for Supervision Quarles will give a speech on bank regulation at an event at Yale University. Prepared text and audience Q&A are expected.

- 01:30 PM St. Louis Fed President Bullard (FOMC non-voter) speaks; St. Louis Fed President James Bullard will speak on the economic and monetary policy outlook at an event in St. Louis. Prepared text and audience Q&A are expected.

- 02:15 PM Minneapolis Fed President Kashkari (FOMC voter) speaks; Minneapolis Fed President Neel Kashkari will participate in a town hall event in Kalispell, Montana. Audience Q&A is expected.

Wednesday, February 12

- 08:30 AM Philadelphia Fed President Harker (FOMC voter) speaks; Philadelphia Fed President Patrick Harker will speak on the economic outlook at an event in Malvern, Pennsylvania. Prepared text and audience Q&A are expected.

- 10:00 AM Federal Reserve Chairman Powell (FOMC voter) speaks; Federal Reserve Chairman Powell will give his semiannual monetary policy report to Congress in front of the Senate Banking Committee. Prepared text is expected.

Thursday, February 13

- 08:30 AM CPI (mom), January (GS +0.20%, consensus +0.2%, last +0.2%); Core CPI (mom), January (GS +0.24%, consensus +0.2%, last +0.1%); CPI (yoy), January (GS +2.50%, consensus +2.5%, last +2.3%); Core CPI (yoy), January (GS +2.26%, consensus +2.2%, last +2.3%): We estimate a 0.24% increase in January core CPI (mom sa), which would leave the year-on-year rate unchanged at 2.3%. Our monthly core inflation forecast reflects a post-holiday rebound in the household goods and personal care categories, a stabilization in used car prices, and a modest rebound in airfares and hotel lodging costs. We also expect a rebound in apparel prices reflecting residual seasonality. On the negative side, we look for softness in education inflation. We estimate a 0.20% increase in headline CPI (mom sa), reflecting lower energy prices but higher food prices.

- 08:30 AM Initial jobless claims, week ended February 8 (GS 210k, consensus 210k, last 202k); Continuing jobless claims, week ended February 1 (consensus 1,748k, last 1,751k): We estimate jobless claims rebounded to 210k in the week that ended February 8. We expect a persistent winter seasonal bias to continue to exert upward pressure on the continuing claims measure through February.

- 10:00 AM Federal Reserve Board nominees Shelton and Waller nomination hearings: Federal Reserve Board nominees Judy Shelton and Christopher Waller will give prepared testimony and answer questions from senators in a joint nomination hearing.

- 05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will participate in a moderated discussion at an event hosted by the New York Bankers Association. Prepared text is not expected.

Friday, February 14

- 08:30 AM Retail sales, January (GS +0.3%, consensus +0.3%, last +0.3%); Retail sales ex-auto, January (GS +0.1%, consensus +0.3%, last +0.7%); Retail sales ex-auto & gas, January (GS +0.2%, consensus +0.3%, last +0.5%); Core retail sales, January (GS +0.1%, consensus +0.3%, last +0.1%): We estimate that core retail sales (ex-autos, gasoline, and building materials) edged higher by 0.1% in January (mom sa), reflecting softness in chain store sales and scope for normalization in eComerce sales following the holiday season. We also see a potential boost to food services from below-average snowfall. We estimate a 0.3% increase in the headline measure in this week’s report, reflecting a pullback in gas prices and a rebound in auto sales.

- 08:30 AM Import price index, January (consensus -0.2%, last +0.3%)

- 09:15 AM Industrial production, January (GS +0.1%, consensus -0.2%, last -0.3%); Manufacturing production, January (GS +0.3%, consensus flat, last +0.2%); Capacity utilization, January (GS 77.0%, consensus 76.8%, last 77.0%): We estimate industrial production rose modestly in January, reflecting a rebound in auto manufacturing but weakness in the utilities category. We estimate capacity utilization was flat in January at 77.0%.

- 10:00 AM University of Michigan consumer sentiment, February preliminary (GS 100.0, consensus 99.2, last 99.8): We expect University of Michigan consumer sentiment increased to 100.0 in the preliminary February reading, reflecting increases in other confidence measures.

- 10:00 AM Business inventories, December (consensus +0.1%, last -0.2%)

- 11:45 AM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will speak at a financial literacy event in Sarasota, Florida. Prepared text and audience Q&A are expected.

Source: DB, Goldman

Tyler Durden

Mon, 02/10/2020 – 09:14

via ZeroHedge News https://ift.tt/2HcVWIE Tyler Durden