Bloomberg Qualifies For Nevada Democratic Debate, Releases ‘AOC-Lite’ Tax Plan

Former New York Mayor Michael Bloomberg qualified on Tuesday to participate in this week’s Democratic presidential debate in Nevada, which will take place in Las Vegas Wednesday night.

Bloomberg has vowed to leverage his fortune to defeat President Donald Trump, who has already raised a campaign war chest that dwarfs the money raised by the other Democratic rivals.

As Tom Steyer demonstrated during the pre-Iowa debate, it seems that money can buy you anything in America: even a spot on the debate stage.

It also rendered this SNL sketch eerily prophetic:

The media mogul has a net worth of $64 billion, and has openly said he will spend $1 billion or more to defeat President Trump.

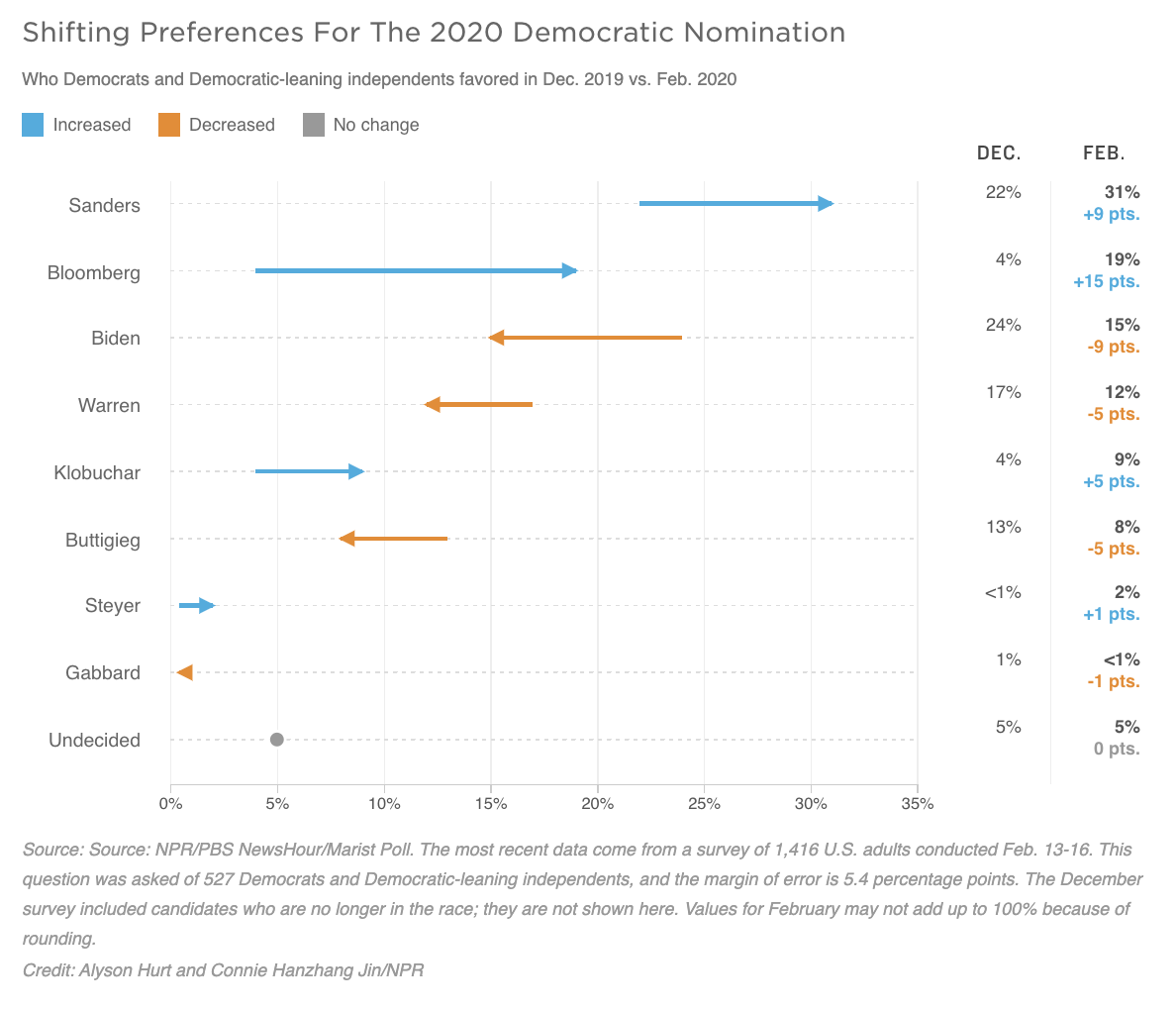

Bloomberg received 19% of the support from an NPR/PBS NewsHour/Marist poll, which guaranteed him a spot on the debate stage in Las Vegas on Wednesday.

His campaign said he’s ‘looking forward’ to joining the other Democrats on stage.

“Mike is looking forward to joining the other Democratic candidates on stage and making a case for why he’s the best candidate to defeat Donald Trump and unite the country,” a statement read, published by campaign manager Kevin Sheekey.

And based on the latest PredictIt odds, it looks like Bloomberg could be the new Democratic frontrunner after Joe Biden’s odds have plunged.

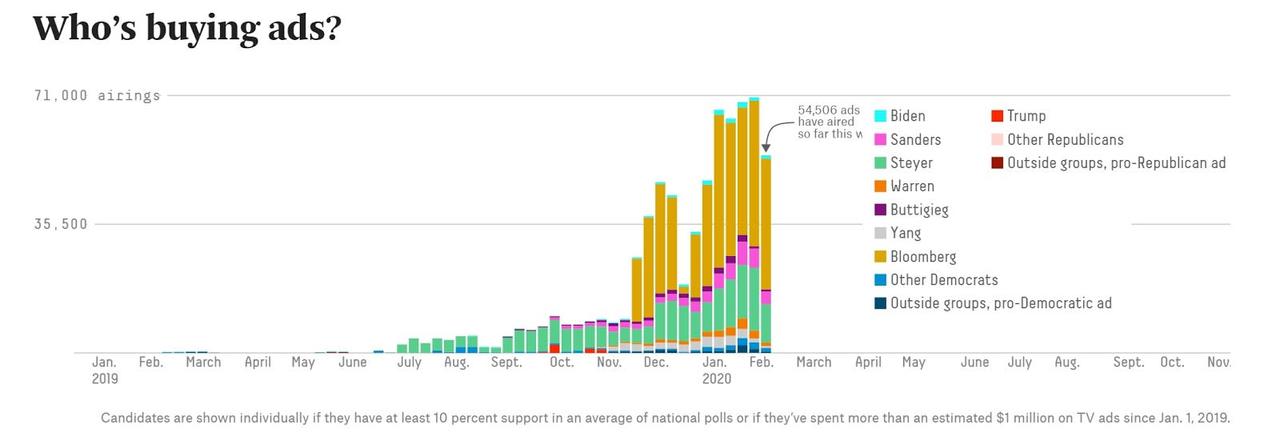

How did Bloomberg, with his cardboard charisma and ‘Mr. Burns’ mannerisms, stage such a sudden and meteoric rise in the polls? Well, he’s definitely been helped by Biden’s implosion. But the difference-maker was definitely the $386 million+ he’s plowed into advertising and hiring massive, well-paid campaign operations, with campaign workers expecting to be employed into the fall.

In a shocking sign of just how far left Democratic candidates feel they need to go to succeed in the primary, the Bloomberg campaign leaked the candidate’s new ‘progressive’ tax plan to the New York Times: Highlights include a 0.1% transaction tax that many have warned would upend traditional Wall Street business models, tightening Volcker rule regulations (i.e. making it even more difficult for banks to hold large stockpiles of securities on their books), reviving the CFPB and expanding its jurisdiction, while requiring ‘too-big-to-fail’ banks to hold even more capital in reserve.

Instead of forgiving student loans, Bloomberg promises to enroll borrowers automatically in income-based repayment schemes that would cap payments at manageable levels, effectively promising to create a raft of student-loan ‘century bonds’ which we suspect will be very popular among yield-starved investors.

As the NYT points out, Bloomberg’s proposed Wall Street transaction tax is eerily similar to a proposal embraced by AOC.

Bloomberg is expected to officially announce the plan on Tuesday. Here’s a quick breakdown courtesy of the NYT:

- A financial transactions tax of 0.1 percent

- Toughening banking regulations like the Volcker Rule and forcing lenders to hold more in reserve against losses

- Having the Justice Department create a dedicated team to fight corporate crime and “encouraging prosecutors to pursue individuals, not only corporations, for infractions”

- Merging Fannie Mae and Freddie Mac

- Strengthening the Consumer Financial Protection Bureau and “expanding its jurisdiction to include auto lending and credit reporting”

- Automatically enrolling borrowers of student loans into income-based repayment schemes and capping payments

Apparently, even a billionaire can’t win the Democratic Primary without pandering to the left.

Bloomberg entered the presidential race two months ago, and has surged in the polls after skipping the first few contests (of course, he didn’t miss much in Iowa).

So will the 2020 race become a ‘battle of the billionaires’?

In the 2020 race, Billionaire Michael Bloomberg is duking it out with Billionaire Donald Trump, often on Billionaire Jack Dorsey’s Twitter and in ads on Billionaire Mark Zuckerberg’s Facebook, all chronicled in Billionaire Jeff Bezos’ Washington Post. https://t.co/FmXK5kAmrA

— Axios (@axios) February 18, 2020

Tyler Durden

Tue, 02/18/2020 – 08:06

via ZeroHedge News https://ift.tt/37J3Rsk Tyler Durden