Walmart Misses Across The Board As Guidance Disappoints, Online Sales Slow

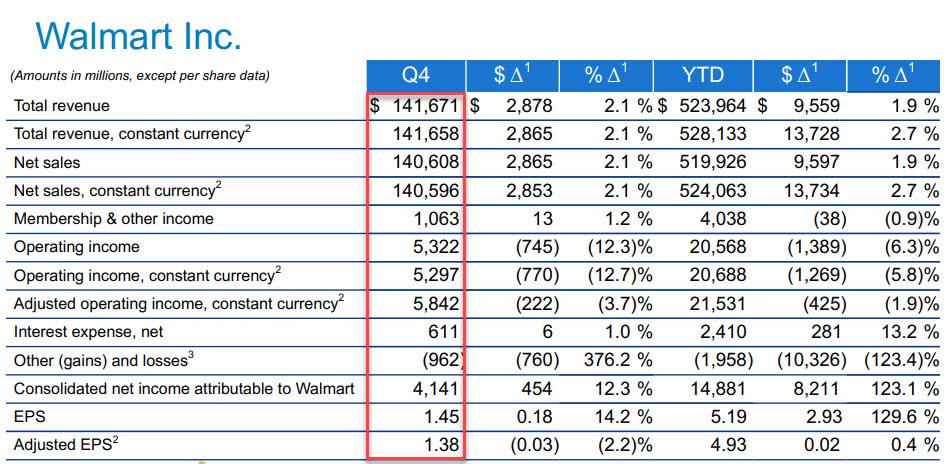

One quarter after after Walmart shares jumped when the company reported a solid beat in its Q3 earnings report and boosted the full year outlook, it’s a complete mirror image, as Walmart not only couldn’t deliver on its guidance boost from just three months ago, but also delivered 2021 EPS guidance that was well below Wall Street expectations.

“We started and finished the quarter with momentum, while sales leading up to Christmas in our U.S. stores were a little softer than expected,” Chief Executive Officer Doug McMillon said in a (under)statement. He’s right: this is just how ugly the company’s current quarter was:

- Q4 revenue $141.61 billion, missing the consensus estimate of $142.55 billion

- Q4 EPS $1.38, missing estimates of $1.44

- Q4 Walmart-only U.S. stores comparable sales ex-gas +1.9%, missing estimates +2.4%

- Q4 Sam’s Club U.S. comparable sales ex-gas +0.8%, missing estimates +1.2%

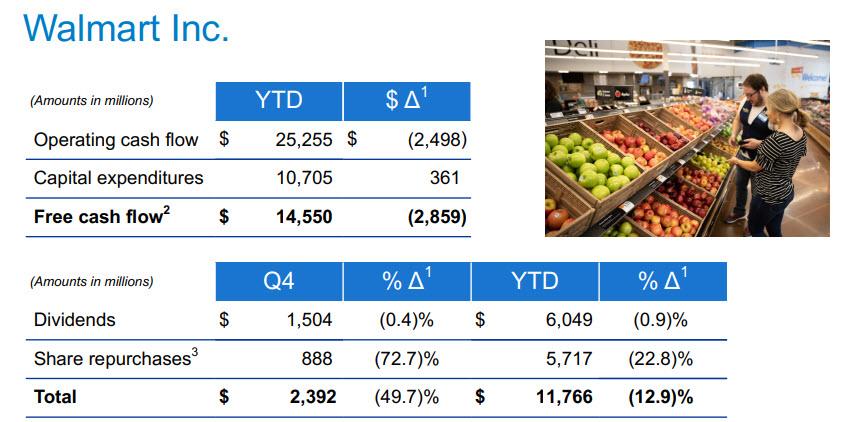

The company also reported that free cash flow for 2020 was $14.55BN, down from $17.4BN a year earlier; most of this cash was sent back to shareholders in the form of dividends ($6BN) and repurchases ($5.7BN):

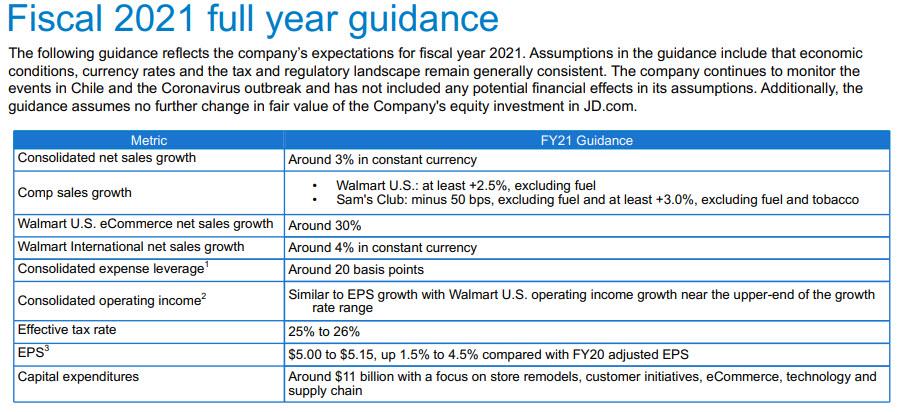

More ominous was Walmart’s far gloomier outlook for the coming year (at least compared to the jolly outlook published just 3 months ago):

- Sees 2021 EPS $5.00 to $5.15, missing the estimate $5.22 (range $5.10 to $5.34) (Bloomberg Consensus)

- Sees 2021 comp sales of 2.5%, missing the estimate 2.7%

- Sees 2021 Sam’s Club U.S. stores comparable sales ex-gas at least +3%

So what happened? First, looking at the current quarter, Walmart’s holiday sales suffered the same fate as other retailers who were hurt by a shorter selling season, warmer weather in some regions and a lack of must-have items in key categories like toys and electronics. This prompted many analysts to ratchet down their expectations for Walmart in recent weeks.

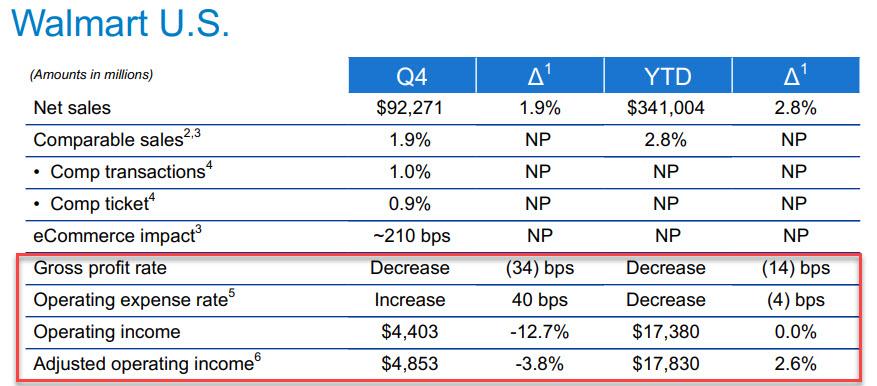

“In the few weeks before Christmas, we experienced some softness in a few general merchandise categories in our U.S. stores,” Chief Financial Officer Brett Biggs said in the statement. Sales volumes were lower than expected and the company said it experienced margin pressure because of higher employee wages; and to think how eager WMT and its shareholders were to virtue signal by raising minimum wages ahead of time; we wonder if they feel the same way now.

Walmart’s lackluster results, following a similarly dour performance from Target Corp., heap more gloom on a U.S. retail sector that’s already grappling with store closures, bankruptcies and increasing uncertainty from China’s coronavirus. In its home market, where Walmart generates the lion’s share of its sales and profits, Walmart’s subpar holiday was due to softness in apparel, toys and gaming, Biggs told Bloomberg, echoing the reasons also cited by Target. In apparel, it carried too much seasonal merchandise, he said. Gross profit margins also declined in the quarter due in part to changes in employee pay incentives that were a bigger factor than anticipated as fewer workers skipped shifts during the season.

“There were a number of things that were market-related but some of it was on us,” Biggs said, adding that there was “not a lot of newness” in departments like toys and video games.

Additionally, as Bloomberg notes, 2020 is a key year for the world’s largest retailer, which has made massive investments in recent years to lower prices, expand its e-commerce operations and enhance employee wages and benefits. Now, shareholders want to see a return from all that spending, particularly at its U.S. online division, which needs to find a path to profitability as it battles Amazon.com Inc.

Well, that may be a major problem as Walmart forecast slowing online sales growth for the year (in addition to missing Wall Street expectations for quarterly sales and profit) hurt by a shorter holiday season and lower demand for apparel, toys and electronics. Specifically, Walmart said it expects online sales to grow about 30% for fiscal 2021, down from last year’s growth of 37%. For the holiday quarter, the company reported a 35% rise, its slowest in nearly two years. Biggs said domestic e-commerce losses were “higher than expected” last year, but will level off or decline in 2020, with details coming during presentationsto investors in New York.

Walmart’s curbside grocery pickup service has fueled most of the gains, but the company now needs to find a new pillar of growth online as the click-and-collect service is now available at 3,200 stores, more than half of its U.S. locations.

And the big wildcard: the full-year forecast excludes any potential financial effect from the coronavirus outbreak in China, the company said; that will prove problematic because as AAPL demonstrate, it is only a matter of time before the coronavirus impacts virtually every supply chain, including those of Walmart. The outbreak’s impact hasn’t been included the retailer’s full-year guidance but could lower first-quarter earnings by a couple of cents per share, Walmart Chief Financial Officer Brett Biggs said.

What may be the biggest surprise is that the market’s unprecedented complacency and kneejerk response to BTFD no matter what, saw WMT stock dip initially, only to rebound back in the green… perhaps because algos are convinced that even dumber algos will buy tomorrow.

Tyler Durden

Tue, 02/18/2020 – 08:28

via ZeroHedge News https://ift.tt/2vI4vcc Tyler Durden