Market To World: “Be Happy Or Get Punished!”

Authored by Richard Breslow via Bloomberg,

It’s never in good taste to gloat. Although there is a powerful attraction to do so in a competitive environment. Similarly, no one wants to constantly hear grumbling about how wrong things are and how they have personally been mistreated. But that tendency has virtually become a national pastime. Those are the emotions once again being vented by one group or the other while watching the equity markets perform.

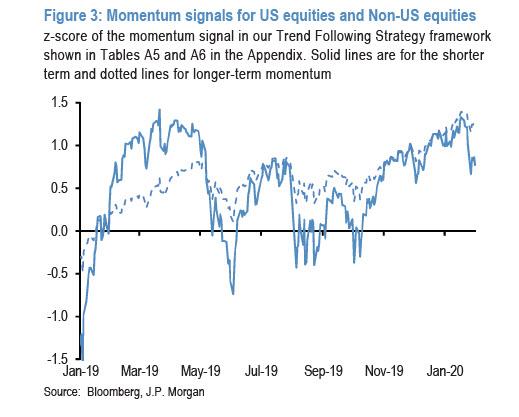

I did hear a very smart guy yesterday sum it all up by saying that it doesn’t matter why, this is a market that just refuses to go down, and we are meant to simply go along. And, for once, it was hard to argue with that sort of flippancy. Especially because it is so easy to argue, and believe, both sides of the debate. With the end result deciding the matter for all practical purposes.

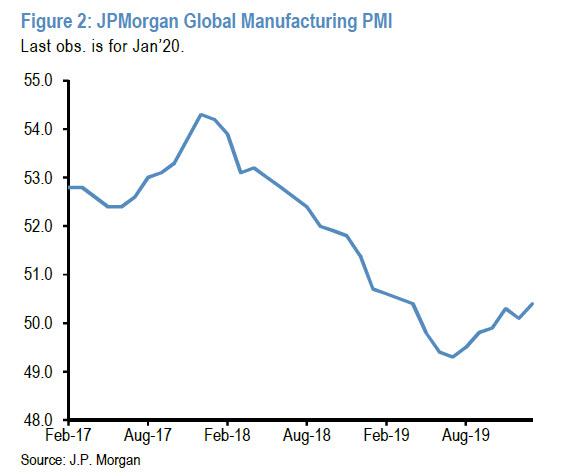

As a case in point, the market was up big overnight, with China’s announcement of a cut in certain tariffs on U.S. imports being cited as the main reason. That was questionably, even laughably, taken as a sign to be optimistic about the global economy and an easing of trade tensions.

No matter that phase one being implemented in full is unlikely to happen. Much more importantly, it came two days after the U.S. Commerce Department published new rules making it far easier to impose countervailing duties on product imports that are deemed to have benefited from “unfair currency subsidies.” The new regulations set a far lower bar than the traditional currency manipulator process used by the Treasury Department to lead to the imposition of consequences.

And it doesn’t require an entire country to be cited. Rather, it can target specific products and industries. Do you believe in coincidences? We also learned yesterday that the U.S. started an anti-dumping probe on imports of Chinese-made vertical shaft engines. I didn’t know what they are either. But if you mow a lawn or drive a go-cart you use one. How do you spell “swing state employers?”

Eliminating unfair trade practices or the next phase of the trade war? The market is in the mood to vote for the former. And so it did. Which is the only thing that matters if you have a position. But this isn’t just a Sino-American issue. The rest of the world might be well-served by reading the press release carefully.

Especially as they will also have learned this week that the U.S. is considering withdrawal from the WTO’s Government Procurement Agreement. The cost of poker may be going up for Europe, Japan, Canada and others as they negotiate their ongoing trade relationships with the U.S..

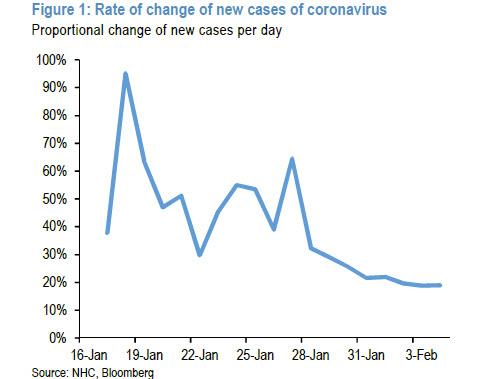

Traders are watching the market go up and have rushed to conclude that it must mean the economic impact of the virus outbreak will be short-lived. Anyone claiming to be able to handicap that is being presumptuous in the real world, but bang-on in the the current trading environment. Scientists don’t claim to know the answer. Market commentators are much more sanguine.

But as I was assured by someone yesterday, “We’re looking for good news.”

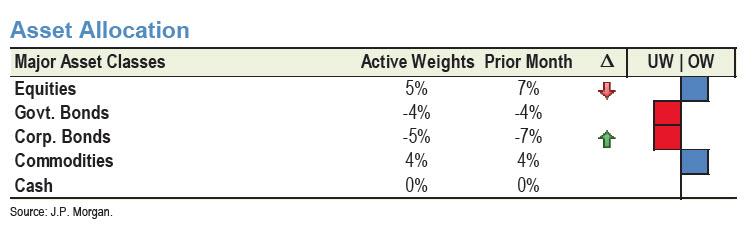

Stocks keep going up. Commodities want to follow their lead, but are having trouble suspending their disbelief. The foreign exchange market has concluded it makes sense to cover dollar shorts and otherwise lay low. Fixed income may be the most interesting story today and through tomorrow’s non-farm payrolls. Ten-year yields tried to move higher overnight but have so far failed right at their resistance zone. There are multiple technical reasons to watch whether they can get through 1.67% to 1.70% and stick. Or if we are watching a dead cat bounce.

Tyler Durden

Thu, 02/06/2020 – 12:10

via ZeroHedge News https://ift.tt/2Uw7EWE Tyler Durden