Futures Rebound Despite Historic Bloodbath In China Where 3,257 Stocks Hit Limit Down

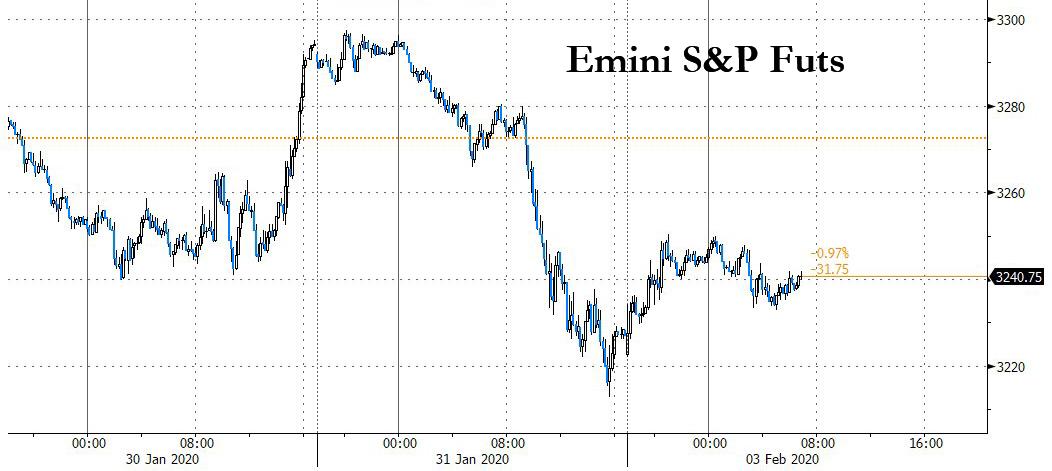

While Beijing’s emergency intervention in Chinese markets which included a short sale ban, a dramatic liquidity injection and a cut in reverse repo rates, failed to prevent a rout, it certainly helped stabilize stocks in Europe and US equity futures, which have staged a modest rebound after plunging on Friday in their worst drop since August.

First the good news: European shares opened on apparent relief that the UK had finally exited the European Union (even as cable tumbled amid renewed fears about the ongoing negotiation between Boris Johnson and Brussels), however fears about the coronavirus kept buying in check. Having risen 0.2% in early deals, the pan-European STOXX 600 index was flat by midday in London. Blue-chip British stocks added 0.35%, helped by a fall in sterling

Futures for U.S. stocks were higher by 0.4% in early trading, and contracts on the three main American equity indexes all climbed, with Gilead Sciences rising in the premarket as China prepares to test one of the company’s new anti-viral drugs.

Asian markets more broadly continued to sell off. MSCI’s broadest index of Asia-Pacific shares outside Japan was down for an eighth straight day, falling 0.85% at 527.61 points, its lowest since early December. Japan’s Nikkei dropped 1% to the lowest since November and Australia’s benchmark index ended down 1.3%. But it was China that was the highlight of the overnight session.

Aiming to prevent a market panic, China’s government took emergency steps to shore up an economy hit by travel curbs and business shut-downs, including a short sale ban. In a bid to soften the blow to China’s economy, the country’s central bank also unexpectedly cut reverse repo rates by 10 basis points and injected 1.2 trillion yuan ($173.8 billion) of liquidity into the markets on Monday, of however 1 trillion yuan was to rollover maturing liquidity.

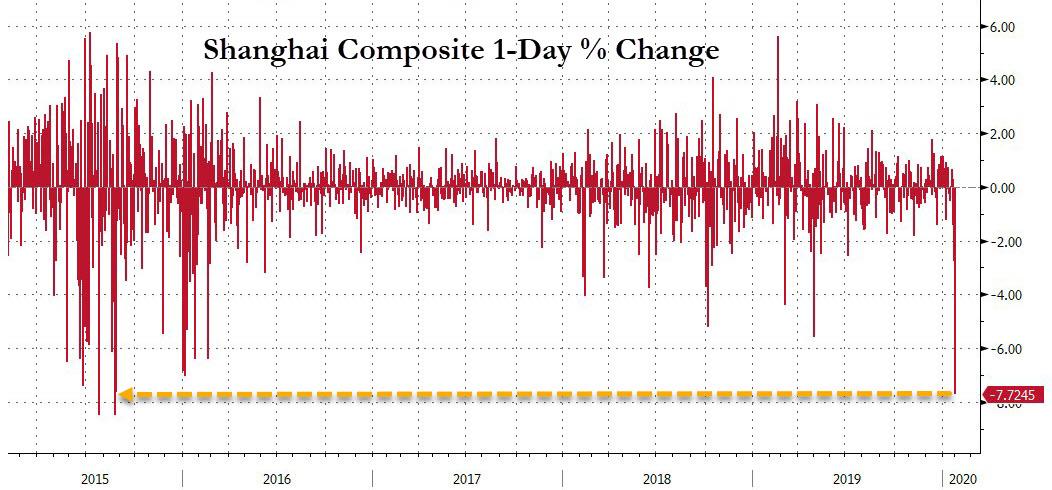

It wasn’t enough, however, and Chinese shares closed deep in the red, with the blue-chip index down 7.8% – the worst return from a Chinese lunar new year for the index in 13 years and the biggest one day drop since the 2015 market rash – to a 4-1/2 month low, wiping out 12 months worth of gains!

Monday’s declines were particularly severe. The CSI 300 Index sank as much as 9.1% – a slump rarely seen in its almost 15-year history.

It was even uglier at the single-stock level, because even though investors tried to log their sell orders order, many of them couldn’t exit the market fast enough, as all but 162 of the almost 4,000 stocks in Shanghai and Shenzhen recorded losses, with about 90% dropping the maximum allowed by the country’s exchanges, and a whopping 3,257 Chinese stocks were closed limit down. Health-care shares comprised most of Monday’s gainers on speculation they will benefit from the virus outbreak. The huge number of stocks trading limit down means it could take days for investors to execute their orders, prolonging the sell-off.

“The sell-off was so quick and intense,” said Li Changmin, managing director at Snowball Wealth in Guangzhou. “We’ll be busy dealing with risk controls and even liquidation pressure if stocks keep falling.”

“I was anxious before the market opened, and had made plans on what to sell and by how much last Friday,” said Bruce Yu, a fund manager with Franklin Templeton SinoAm Securities Investment Management Inc. in Taipei. “Some of my trades weren’t made today — we’ll see if we can sell them tomorrow.”

Fund managers hit the phones to calm investors, seeking to avoid the kind of redemptions and forced selling seen as recently as 2018. China’s securities regulator took steps to support the stock market, telling some brokerages that their proprietary traders aren’t allowed to be net sellers of equities this week, according to people familiar with the matter.

“My biggest concern was that investors would rush to redeem their holdings in private and mutual funds,” said Jiang Liangqing, a money manager at Ruisen Capital Management in Beijing whose team is working from home across China. “A key task for us is to reassure our fund holders and ask them to stay calm.”

The benchmark $7.5 trillion Shanghai Composite index lost $420 billion in value and the yuan opened at its weakest level of 2020, tumbling past 7 per dollar, a level which may spark fresh accusations by the US Treasury that Beijing is manipulating its currency lower.

The sell-off was widespread on Monday: in addition to thousands of stocks, commodity futures from iron ore to crude also sank by the daily limit. That said, while China’s losses were heavy, they were mostly a product of selling pressure that had built up over the Lunar New Year break, not a reflection of new fears among investors.

“The market seems to have reacted quite reasonably,” said David Nietlispach, PM at Pala Asset Management. “There is no panic and no selloff of securities that are unrelated to the coronavirus. The government interventions have been so heavy, though, that you will see an impact on the global economy.”

“The impact in Chinese equity markets has been in line with what futures were suggesting, so the market has taken the slump in its stride,” said Rodrigo Catril, Sydney-based strategist at National Australia Bank. “There was also some cushion from the new measures.”

And so, even with the rebound in US futures, an index of global stocks hovered near seven-week lows on Monday as Asian stocks plunged on their first trading day after a long break, amid growing fears the coronavirus epidemic would hit China’s economy and cripple Chinese supply-chains and demand. MSCI’s All Country World Index, which tracks shares in 47 countries, was down 0.2% on the day, touching its lowest since Dec. 16. The index is down 1.3% this year.

Meanwhile, as we noted yesterday, all attention remains on China, and overnight a raft of banks, including Citigroup, Nomura and JPMorgan, downgraded their forecasts for China’s economic growth.

“Given that we’re 10 years into a global equity bull market, the potential for the virus to trigger a significant market correction is much greater now than it has been during previous epidemics,” said Neil Shearing, chief economist at Capital Economics in a note to clients.

As Chinese markets opened after the 10-day break, Shanghai copper hit its daily selling limit as did Shanghai crude oil while yields on the country’s 30-year government bonds traded in the interbank market were down 18.5 basis points.

In commodities, oil pared early losses after Brent slumped into a bear market since hitting a high in early January following a Bloomberg report Chinese oil demand is down by 20%, while the safe-haven Japanese yen and gold stepped back from recent highs. Chinese commodities were especially hard hit: Shanghai copper hit its daily selling limit as did Shanghai crude oil while yields on the country’s 30-year government bonds traded in the interbank market were down 18.5 basis points. Dalian soymeal plunged 4.1% while Dalian iron ore hit limit down as steel prices fell.

Gold, which posted its best month in five in January, slipped as much as 1% to $1,574.5 an ounce. Yields on U.S. debt came off lows.

In currencies, the yen fell but remained near a 3-1/2 week high against the dollar at 108.50. The euro was 0.25% lower at $1.1066. The dollar gained as the market unwound some of the month-end trades from last week. Norway’s krone fell to a three-month low versus the euro after Norway’s manufacturing PMI data came in weaker than expected and on news that Chinese oil demand has dropped by about three million barrels a day, or 20% of total consumption, amid the coronavirus crisis. The pound slipped by more than 1% against the dollar on fears of a new cliff edge in trading arrangements between Britain and the European Union, as the two sides prepare to negotiate their future relationship.

While Brexit is now in the history books, remarks from UK PM Johnson on post-Brexit talks have been largely in-line with reports via UK press over the weekend; with Johnson saying there is no need to accept various EU rules in a trade deal. In related news, UK will begin free trade negotiations immediately after Brexit and is reportedly aiming to have 80% of trade covered by FTA’s within 3 years, while there were separate comments from DUP’s Foster that it is difficult to see how there will not be new checks between Britain and Northern Ireland.

On the calendar today, expected data include PMIs. Sysco and Alphabet are reporting earnings

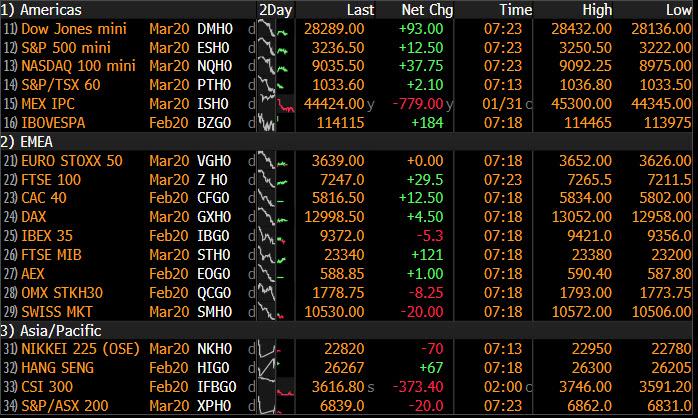

Market Snapshot

- S&P 500 futures up 0.4% to 3,237.75

- STOXX Europe 600 up 0.1% to 411.21

- MXAP down 0.9% to 164.32

- MXAPJ down 0.9% to 527.16

- Nikkei down 1% to 22,971.94

- Topix down 0.7% to 1,672.66

- Hang Seng Index up 0.2% to 26,356.98

- Shanghai Composite down 7.7% to 2,746.61

- Sensex up 0.4% to 39,905.62

- Australia S&P/ASX 200 down 1.3% to 6,923.25

- Kospi down 0.01% to 2,118.88

- German 10Y yield rose 0.4 bps to -0.43%

- Euro down 0.3% to $1.1063

- Italian 10Y yield fell 0.7 bps to 0.769%

- Spanish 10Y yield rose 0.4 bps to 0.239%

- Brent futures down 3.1% to $56.37/bbl

- Gold spot down 0.6% to $1,579.13

- U.S. Dollar Index up 0.3% to 97.66

Top Overnight News from Bloomberg

- China cut some borrowing costs and injected cash into the financial system to ensure ample liquidity as the nation’s stocks tumbled 9%. The central bank set its daily yuan reference rate stronger than the key 7-per-dollar level as onshore markets resumed trading for the first time since Jan. 23

- The dollar advanced and Japan’s currency snapped a three-day winning run as markets took some comfort in the measures the Chinese government were taking, while the 10-year Treasury yield climbed as much as three basis points from an almost five-month low reached on Friday

- Norway’s krone fell to a three-month low versus the euro after Norway’s manufacturing PMI data came in weaker than expected and on news that Chinese oil demand has dropped by about three million barrels a day, or 20% of total consumption, amid the coronavirus crisis

- The pound slipped by more than 1% against the dollar on fears of a new cliff edge in trading arrangements between Britain and the European Union, as the two sides prepare to negotiate their future relationship

- Chinese stocks plummeted by the most since an equity bubble burst in 2015 as they resumed trading to the worsening virus outbreak. The CSI 300 Index dropped 9.1%. China’s benchmark iron ore contract fell by its daily limit of 8%, while copper, crude and palm oil also sank by the maximum allowed

- OPEC and its allies considered how to respond to a plunge in oil prices, with Russia signaling for the first time it was open to Saudi Arabia’s push for an emergency meeting. Potential dates being discussed are Feb. 8-9 and Feb. 14-15, though for now the next regular meeting on March 5-6 remains on the schedule, a delegate said

- Chinese oil demand has dropped by about three million barrels a day, or 20% of total consumption, as the coronavirus squeezes the economy, according to people with inside knowledge of the country’s energy industry. Fatalities top 360 as China returns from holiday: virus update

- The U.K. and the European Union begin their battle over a future trade deal on Monday. In a major speech in London, Prime Minister Boris Johnson will threaten to walk away from talks with the EU rather than accept demands from Brussels to sign up to the bloc’s single market regulations and the rulings of its court

- New Zealand Treasury expects economic growth to ease through 2020. Domestic data over December and January showed tentative signs of an improving economy with measures of business sentiment improving but still in negative territory

Asian equity markets mostly traded with heavy losses as markets braced themselves for China’s return from the Lunar New Year holiday in which mainland bourses opened with losses of nearly 9% and several Shanghai commodity prices hit limit down, despite efforts by China to cushion the blow. ASX 200 (-1.3%) was lower in which energy and mining sectors underperformed the broad weakness across Australia sectors aside from the gold miners due to recent safe-haven plays, while Nikkei 225 (-1.0%) traded subdued but off its lows after finding mild relief from currency flows. Elsewhere, a blood bath was seen at the reopen in mainland China as the Shanghai Comp. (-7.7%) played catch up to the global market rout brought on by the coronavirus and with sentiment not helped by a contraction in Industrial Profits, although mainland bourses were slightly off their worst levels and the Hang Seng (+0.2%) recovered into positive territory after several supportive measures including efforts to restrict short selling and the PBoC’s CNY 1.2tln reverse repo operation in which the central bank also lowered repo rates by 10bps. Finally, 10yr JGBs consolidated overnight and although prices eventually retreated back below the 153.00 level, they still held on to the majority of last week’s advances amid the rout in stocks and after the BoJ kept February purchase intentions mostly in line with the previous month.

Top Asian News

- Risks Mount for Hong Kong After Economy Shrank in 2019

- Billionaire Razon Buys 25% Stake in Ayala’s Manila Water

- Turkey’s Real Rates as Low as in Japan After Inflation Surprises

A relatively tame session for European equities thus far [Eurostoxx 50 +0.2%], following on from the frantic Chinese sell-off in which its markets wiped some USD 420bln in its catch-up play, with Shanghai Comp closing with losses of almost 8%. Sectors are mixed with no clear reflection of the current risk tone as defensives and cyclicals remain varied, albeit energy is underperforming amid losses in the complex. In terms of individual stocks Ingenico (+11.4%) shares spiked higher to the top of the Stoxx 600 at the open amid M&A induced moves with Wordline set to acquire the company in a deal value at EUR 7.8bln. Ryanair (+4.6%) shares follow closely behind amid earnings in which the group announced an extension to its share buyback programme. On the flip side, Siemens Heathineers (-4.6%) shares fell to the foot of the pan-European index following double-digit YY declines in adj. EBIT and net income.

Top European News

- U.K. Manufacturing Avoids Contraction in Post-Election Bounce

- Avast Roller Coaster Exposes Frailty of Sleepy Czech Bourse

- Euro-Area Manufacturing Sees Green Shoots at Start of 2020

- Macron Seeks Poland Reset as Warsaw Tightens Grip on Courts

In FX, the Yuan suffered from revived angst/catch-up play upon Mainland’s return following its extended Lunar New Year holiday and having had its first opportunity to react to the escalating threats from the outbreak. Moreover, China took a barrage of measures, including lowering rates on its 7- and 14-day reverse repos by 10bps each, in an attempt to cushion losses in the markets amid expectations for a tumultuous session. USD/CNY was propelled at the onshore open as the pair breached 7.00 to the upside (vs. 6.9364 close on Jan 23rd) and eclipsed its 100 DMA at 7.0223 before closing around 7.0250 – the weakest close since December 12th, USD/CNH remains comfortably above 7.00. Subsequently, DXY gained and resides above 97.500 (vs. 97.429 open and low) with the index supported amid weakness in some peers. DXY sees its 200 DMA around 97.720 and 100 DMA at 97.832 ahead of the psychological 98.000 – with traders eyeing the ISM Manufacturing release for influence, whilst the Iowa caucus will also be followed to give a lens into the Democratic presidential candidate.

- GBP – The marked G10 underperformer heading into PM Johnson’s speech, the content of this was predominantly flagged by UK press over the weekend; taking a hard stance regarding post-Brexit trade negotiations with the EU – with one of the pledges being to not align the UK with the EU alongside a willingness to leave on WTO terms if necessary. Meanwhile, EU’s Chief Brexit Negotiator was expected to warn that a FTA is unlikely should the UK misalign itself with EU standards. Barnier noted that the EU is not seeking UK regulatory alignment, but “we do want consistency”, which is similar in essence. GBP/USD saw some support around 1.3100, having retreated from Friday’s 1.3200 close and with limited reaction seen by the UK manufacturing PMI being revised higher to neutral from a mild contraction. Thereafter, GBP/USD breached 1.3100 to the downside, breaching Friday’s low (1.3080) and its 50 DMA (1.3075) to a low of 1.3055 ahead of the psychological 1.3050.

- AUD, NZD, JPY, EUR – All softer vs. the Buck as DXY gains traction. Antipodeans were supported in overnight trade but have since trimmed gains and reside around flat territory – AUD/USD briefly topped 0.6700 before reversing and finding mild support around 0.6680, whilst its Kiwi counterpart fell back below its 100 DMA (0.6466) having reached an overnight high of 0.6476 and with 0.6450 seen as psychological support. Similarly, the safe-haven currencies succumb to the firmer Dollar, with USD/JPY meandering around 108.50 ahead of its 100 DMA at 108.75. EUR/USD was largely unreactive to a modest revision higher in the EZ manufacturing PMI, which also came with an optimistic accompanying statement from the IHS, noting that economy could see growth strengthen in the period ahead. EUR/USD trades just above the 1.1050 mark (vs. high 1.1095) with the pair eyeing EUR 927mln of options expiring around 1.1075 at today’s NY cut.

- EM – Mild reprieve across the EM-sphere, but potentially more-so consolidation following last-week’s hefty losses. TRY saw little reaction as the country’s real rates were dragged further into negative territory amid the uptick in January YY inflation – with participants noting that this may prompt a pause in the CBRT’s easing cycle, although not a cessation given the Turkish President’s pledge to bring rates back to single digits this year. USD/TRY remains flat intraday around 5.9850. Meanwhile, USD/ZAR has retreated back below 15.000 with some noting a correction from last week’s losses alongside profit taking.

In commodities, overall mixed with WTI front month futures firmer but Brent subdued on the demand implications of the cornonavirus outbreak. Furthermore, reports noted that Chinese oil demand is seen falling some 20% on the coronavirus lockdown, which does not bode well for its largest suppliers Saudi and Russia. On the OPEC front, sources noted that OPEC and allies are mulling further output reductions of ~500k BPD, with a meeting reportedly scheduled for February 14th/15th. Note: some desks highlight that a bulk of the “new cuts” could factor in the disruptions in Libya, which net-net may end up in a lower aggregate output reduction. The Joint Technical Committee will be convening on February 4th/5th to assess impacts of the virus and are likely to make a recommendation around any further action to support the market, according to sources. Further sources via journalist Summer Said noted that Saudi Arabia are reportedly considering a drastic temporary cut of up to 1mln BPD in response to the coronavirus. WTI and Brent futures reside under USD 52/bbl and just north of USD 56/bbl with fleeting support seen from the OPEC sources. Elsewhere, spot gold saw early losses amid a firming USD in which prices briefly dipped below 1575/oz. Meanwhile, panic selling seen at the resumption of Chinese commodities trading saw Shanghai copper, crude oil and Dalian iron ore futures all hit limit down in catch-up action from the Lunar New Year holiday.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 51.7, prior 51.7

- 10am: Construction Spending MoM, est. 0.5%, prior 0.6%

- 10am: ISM Manufacturing, est. 48.5, prior 47.2

- 10am: ISM New Orders, est. 47.7, prior 46.8

- 10am: ISM Prices Paid, est. 51.5, prior 51.7

- 10am: ISM Employment, prior 45.1

- Wards Total Vehicle Sales, est. 16.8m, prior 16.7m

DB’s Jim Reid concludes the overnight wrap

Before we get to a busy week ahead, including the start of US primaries in Iowa today, all eyes on this morning’s first Chinese market opening since the extended holiday ended. The CSI 300 (-7.50%), Shanghai Comp (-7.63%) and Shenzhen Comp (7.84%) are all down heavily but are off their earlier deeper loses. Meanwhile, the Nikkei (-0.98%) is also trading down while the Hang Seng (+0.53%) and Kospi (+0.11%) are up. As for fx, the onshore Chinese yuan is down -1.49% to 7.0157, the weakest since December 12, as it also reopened post the holiday. Elsewhere, futures on the S&P 500 are up +0.75% while 10yr USTs yields are +1.7bps higher this morning which shows that the sell-off hasn’t accelerated with the China re-opening. In commodities, Shanghai Iron ore futures are down c. -7.50% today while those on copper are -6.60% with brent oil prices -0.23%. As for overnight data releases, China’s January Caixin manufacturing PMI came in at 51.1 (vs. 51.0 expected) but the survey covers the period before the virus concerns mounted. Japan’s final manufacturing PMI came in at 48.8 vs. 49.3 in the initial release.

The latest on the virus is that there are now 17,205 confirmed cases (up from 9,692 on Friday) and the death toll now stands at 361 (up from 170). Philippines reported the first Coronavirus death outside of China and more cases have been confirmed globally including in the US. Lots more travel restrictions to and from China have been put into place.

This is after the PBoC and other Chinese bodies announced numerous measures over the weekend to try to keep markets orderly at the re-open including a 10bps cut for both the 7- and 14-day repo rates overnight. Yesterday, the central bank had announced the injection of a net 150 billion yuan ($21.7 billion) into money markets this morning with an additional trillion yuan netting off money market redemptions today. Meanwhile, the securities regulator also said yesterday that it would halt night sessions for futures trading from today until further notice, and will allow some share pledge contracts to be extended by as long as 6 months as part of measures to improve market expectations and prevent irrational behaviour. It’s likely more intervention will come if required in the days ahead.

Back here in the UK, Bloomberg reported overnight that the UK PM Boris Johnson will say in a speech today that he wants a comprehensive trade agreement at least as good as the one the EU has reached with Canada but is likely to insist that “Britain will prosper” even without such a deal. He is also likely to say that the UK is not willing to accept demands from the EU to sign up to the bloc’s single market regulations and the rulings of its court. His speech will be followed by a speech from the EU chief Brexit negotiator Michel Barnier in Brussels, where he is due to set out his planned negotiating position with the UK. Sterling is trading down -0.31% at 1.3166 this morning on the news. Expect lots of headlines today.

Overnight we also heard from the ECB Chief Economist Philip Lane and he said that rising labour costs will eventually reignite inflation in the euro zone and that the ECB is on track toward its goal. On the strategic review he said that suggestions so far have included making the target more specific at precisely 2% – instead of the current “below, but close to, 2%” – and possibly adding a band of tolerance around it. He also acknowledged that the ECB will consider whether its measures of inflation should take better account of housing costs, which are currently severely under-weighted.

So a busy start to the week as we kick off a potentially turbulent February. In terms of the rest of this week the highlight could be today’s first US democratic primary in Iowa – the first of four this month. There’ll also be a number of data releases, including PMIs from around the world (today and Wednesday), before the US jobs report comes out on Friday. Earnings season will also continue to be in full flow.

While Iowa only makes up c.1% of nationwide delegates, we will start to see some sign as to momentum of the various candidates. Technically there will also be Republican primaries, but these are widely considered a foregone conclusion in favour of President Trump. In terms of what to expect, the national polling average from RealClearPolitics shows former Vice President Joe Biden still in the lead at the moment, with 27.2%, followed by Senator Bernie Sanders on 23.5% and Senator Elizabeth Warren on 15.0%. However, in Iowa, the polling average shows Sanders in the lead, with 24.7%, and Biden in second on 21.0%. Furthermore, both former Mayor Pete Buttigieg (16.3%) and Warren (15.2%) are around the crucial 15% mark that is important when it comes to accumulating the delegates required to win the nomination.

In terms of what will happen, the race remains competitive, with FiveThirtyEight’s model at time of writing giving Sanders a 40% chance of winning the most votes in Iowa, followed by Biden on 34%, with Buttigieg on 18% and Warren on a 16% chance. It’s true that often the winner of the Iowa caucuses don’t actually go on to be the nominee – indeed on the Republican side the winners in 2008, 2012 and 2016 all lost out to someone else. Nevertheless, it’s the first indicator of real votes we have, and very important in terms of momentum for each of the candidates, as it’s only 8 days later that the next primary takes place in New Hampshire, and between the two votes there’ll be another TV debate between the candidates on the Friday.

The week ahead also has a number of data highlights, with the main ones likely to be the release of manufacturing (today), services and composite (Wednesday) PMIs from around the world. We have already had the preliminary PMIs from a number of countries, so those countries such as Italy where we haven’t had the preliminary numbers will take on added interest. Also of note will be the ISM manufacturing and nonmanufacturing indices from the US, out today and Wednesday respectively. Back in December, the ISM manufacturing reading fell to 47.2, its lowest level since June 2009, though the consensus is expecting an uptick for January to 48.4, so that’s one to keep an eye out for.

On Friday, we’ll also get the US jobs report for January. The current consensus expectation is for a +160k increase in nonfarm payrolls in January, up from the +145k increase in December, with the unemployment rate remaining at 3.5%, and average hourly earnings growth ticking up a tenth to +3.0% year-on-year. Other key data out this week will come with the Euro Area’s retail sales for December on Wednesday, while in Germany, there’ll be the release of December’s factory orders on Thursday and industrial production on Friday.

Earnings season continues next week, with another raft of companies reporting. Looking at things so far, of the 225 S&P 500 companies that have reported, 74.4% have reported a positive surprise on earnings and 64.1% have reported a positive surprise on sales. Looking to the week ahead, today sees Alphabet report. Then tomorrow we’ll hear from Walt Disney, BP and Sony. On Wednesday, there’s Merck, Novo Nordisk, GlaxoSmithKline, Siemens, Qualcomm, BNP Paribas and General Motors. Thursday sees reports from L’Oréal, Bristol-Myers Squibb, Philip Morris International, Total, Sanofi, Enel, Nordea Bank, UniCredit, Société Générale, Twitter and Toyota. And finally on Friday, we’ll hear from AbbVie.

Finally on US politics, tomorrow sees President Trump give his State of the Union address to Congress. The full day by day calendar is published at the end.

Recapping last week now, and global equities continued to fall thanks to the impact from the coronavirus. The S&P 500 ended the week down -2.12% (-1.77% Friday) in its worst weekly performance since early August, and moving the index into negative YTD territory. It came as industrial bellwether Caterpillar fell -2.97% on Friday after it reported a worse-than-expected outlook, with 2020 EPS at $8.50-$10.00, which was below the Bloomberg consensus for $10.55. Furthermore, the VIX climbed +4.3pts to its highest level since October. It was a similar story in Europe, where the STOXX 600 fell -3.05% (-1.07% Friday), while in Asia, Hong Kong’s Hang Seng was down -5.86% (-0.52% Friday), its worst weekly performance since February 2018. The move away from risk assets was also reflected in commodity markets, where Brent crude fell -4.17% (-0.22% Friday), its 4th consecutive weekly move lower. Meanwhile copper fell for a 12th consecutive day, ending the week down -6.22% (-0.28% Friday), its worst weekly performance since December 2011. On the other hand, gold rose +1.12% (+0.95% Friday) to a fresh 6-year high.

Sovereign debt continued its advance last week, with 10yr Treasury yields down -17.7bps (-7.9bps Friday) to 1.507%, their lowest since early September, and 30yr Treasury yields closed below 2% for the first time since early September too. A notable development on Friday came from the yield curve, where the 3m10y curve saw an inverted close for the first time since October, having flattened by -20.3bps over the course of the week (-6.8bps Friday). Over in Germany, 10yr bund yields closed down -9.9bps (-2.8bps Friday), while the spread of Italian ten-year yields over bunds fell by -19.8bps (+2.1bps Friday) as investors reacted to the previous weekend’s regional election results.

Poor European data on Friday really didn’t help the mood for markets, with the flash GDP estimate for the Euro Area showing that the economy grew by just +0.1% qoq in Q4 (vs. +0.2% expected). This was the weakest quarterly growth since Q1 2013, and brings year-on-year growth down to +1.0% (vs. +1.1% expected), the lowest since Q4 2013. We also got the flash inflation estimate, which rose to +1.4% as expected, though the core reading fell to +1.1% (vs. +1.2% expected). In terms of the country-specific data, the French economy unexpected contracted by -0.1% (vs. +0.2% expected), the first quarterly contraction since Q2 2016 and the first of President Macron’s term of office. Meanwhile in Italy, the economy contracted by -0.3% (vs. +0.1% expected), the worst quarter since Q1 2013.

Elsewhere, German retail sales surprised to the downside, with a -3.3% mom decline in December (vs -0.5% expected), which was the biggest monthly decline since May 2007. In the UK however, mortgage approvals surprised to the upside in December, coming in at 67.2k (vs. 65.6k expected), which was the most since July 2017.

Tyler Durden

Mon, 02/03/2020 – 08:04

via ZeroHedge News https://ift.tt/2ShfVuO Tyler Durden