7 Year Auction Prices At Lowest Yield Ever Amid Blockbuster Demand

While this week’s 2Y and 5Y auctions were solid with impressive stats and indicative of solid demand for US paper, today’s 7Y auction was nothing short of stellar.

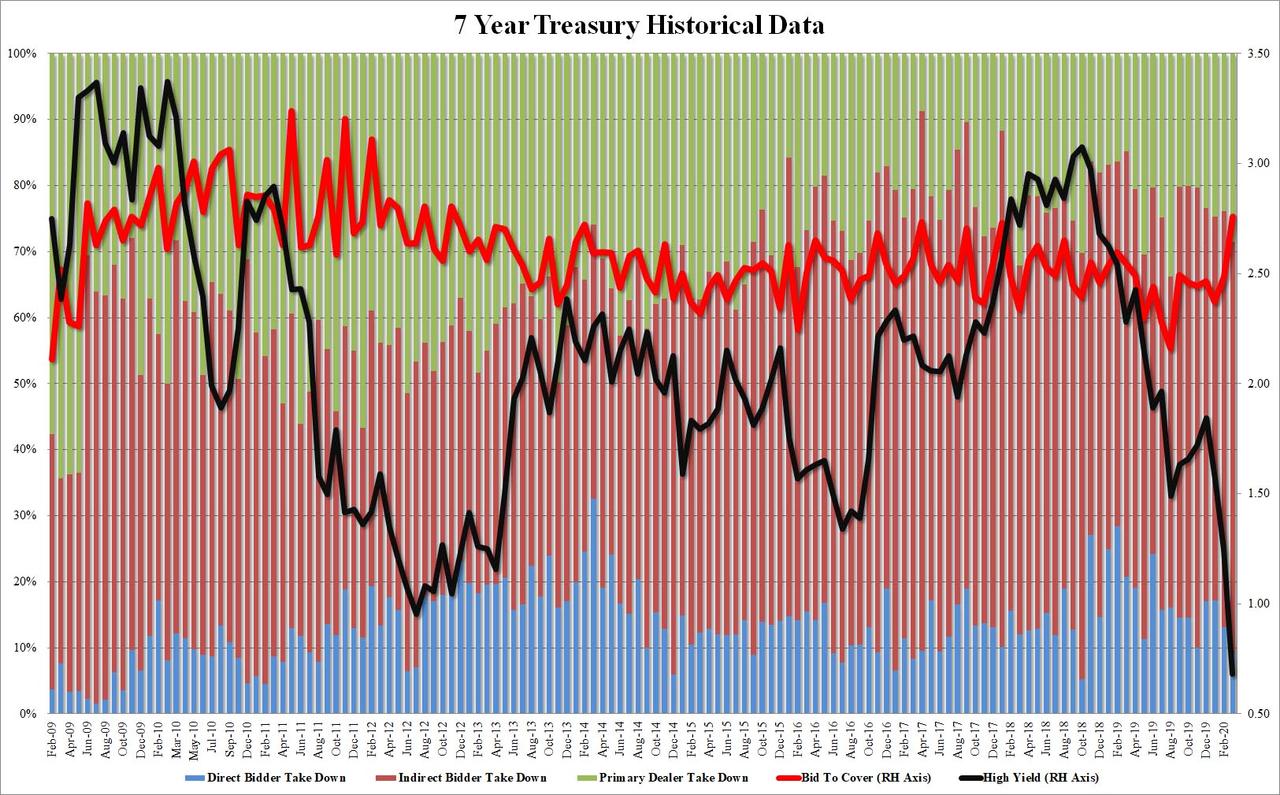

Printing at a yield of 0.68%, this was not just 57bps below February’s 1.247%, but more importantly it stopped through the When Issued 0.707% by 2.7bps and was the lowest yield for a 7Y auction on record.

But what was even more impressive was the bid to cover which soared from 2.49 last month to a whopping 2.75 in March, the highest since November 2012.

Finally the internals were in line, with Indirects taking down 62.35%, just below last month’s 63.0% and the six auction average of 63.4%, and with Directs easing a bit to 9.1% from 13.1%, Dealers were left holding 28.6%, up from 23.9% last month.

Overall, a blistering auction with spectacular buyside demand for US debt, which in light of the onslaught of new issuance coming down the pipeline to fund the $2 trillion stimulus – not to mention today’s risk-on bonanza – was just a bit surprising.

Tyler Durden

Thu, 03/26/2020 – 13:16

via ZeroHedge News https://ift.tt/3btVnHw Tyler Durden