Traders Betting That “$850BN Buyer” Is In The Market

On Tuesday, just as stocks posted what was the biggest dead-cat bounce (and short squeeze) since 1933, we cautioned bears that another “$850 Billion In Stock Buying Is About To Be Unleashed” when brought attention to the month- and quarter-end rebalancing, when some $850 billion in mandated stock buying would take place.

Specifically, according to JPMorgan estimates, balanced or 60:40 mutual funds, a $1.5tr universe in the US and $4.5tr universe globally, need to buy around $300 billion of equities to fully rebalance to 60% equity allocation. At the same time the $7.5 trillion universe of US defined benefit plans, would need to buy $400 billion to fully rebalance and revert to pre-virus equity allocations.

Finally, there are the “balanced” sovereign pension funds such as Norges bank and GPIF, which before the correction had assets of around $1.1tr and $1.5tr, respectively, and which according to JPM would need to buy around $150 billion equities to fully revert to their target equity allocations of 70% and 50%, respectively.

That firepower was only extended today when following news that the Norwegian sovereign wealth fund, the world’s biggest and (formerly) at $1.1 trillion had lost $124 billion as markets crashed, we learned that the fund was doubling down, and according to outgoing Chief Executive Yngve Slyngstad, it would raise its stock market investments back to 70% of its portfolio from the current 65.3%.

And while declined to say when stocks would be back at 70%, or to comment on whether any stock purchases had taken place during the recent market crash, judging by today’s action traders are convinced that much if not all of this repricing will take place today.

Certainly, there is anecdotal evidence of a ‘forced’ buyer coming in at the cash-market open each of the last three days.

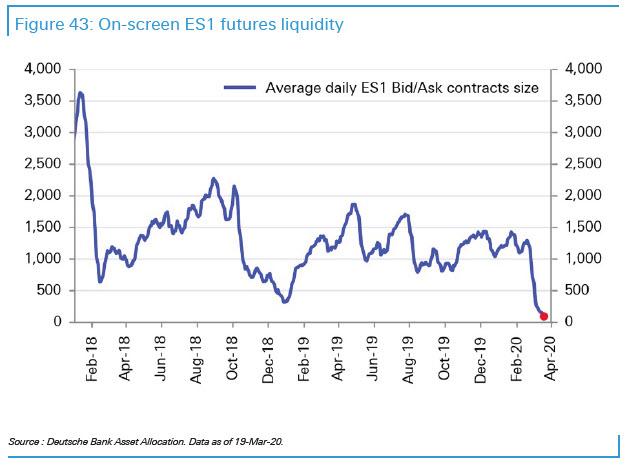

Of course, whether or not today’s action is the result of a giant pension/sovereign wealth fund whale lifting all offers in what has been the most illiquid market in history…

… and thus resulting in overly pronounced moves, won’t be known until the end of the month.

Tyler Durden

Thu, 03/26/2020 – 13:10

via ZeroHedge News https://ift.tt/2wt5WMp Tyler Durden