Earlier this month, I blogged about my top travel tips. I received a number of favorable comments from Volokh readers–fellow road warriors. Here are five more tips for flying. My general goal: make my time in the air as familiar and predictable as possible.

1. Always select the same seat on every plane.

Travel is difficult precisely because it is unfamiliar. You are not sleeping in your own bed, you are in a strange hotel. You are not driving your own car, you are in a rental car, a taxi, or a train. You aren’t working in your own private office, but are working in a cramped airplane seat next to strangers. And the list goes on. To reduce such unfamiliarity, I try to make travel as as familiar as possible.

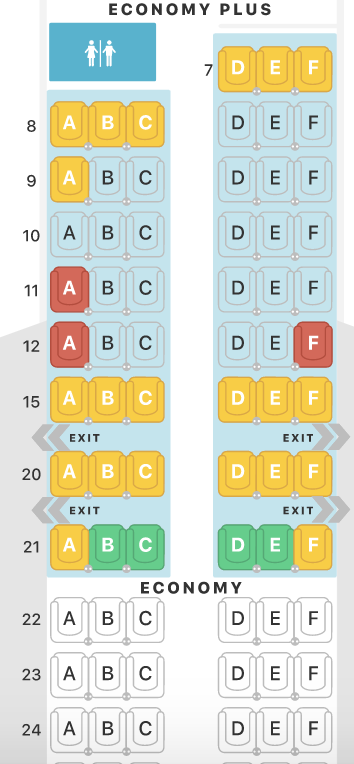

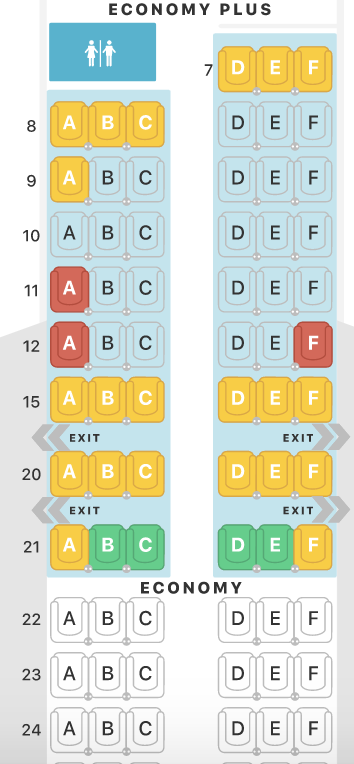

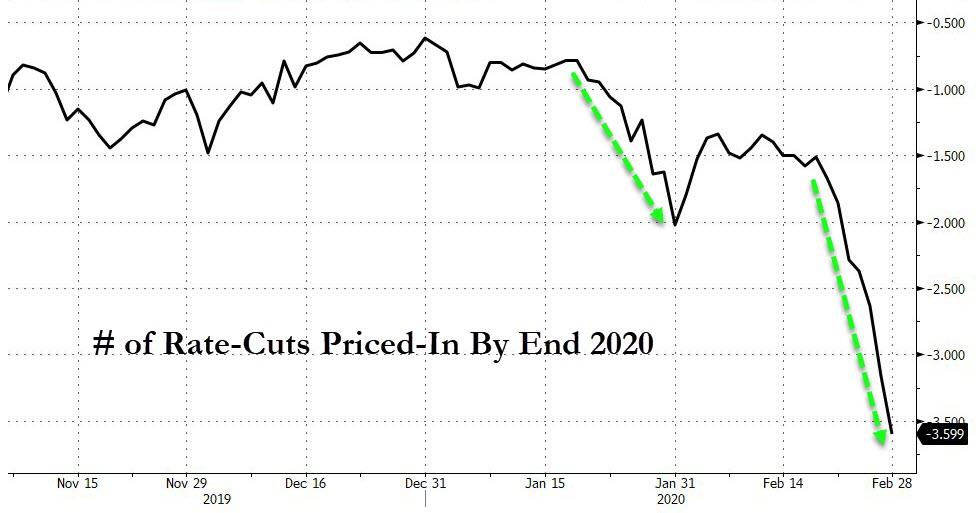

The most effective way to make your trip predictable is to establish a routine. For example, on planes, I will always select the same seat. Here, I will refer to three of the most popular planes on United’s fleet. These planes will appear in most major fleets. (Southwest, for example, only flies the Boeing 737.) These principle should extend to all fleets.

On a Boeing 737 I will always sit in Seat 11C. Why 11C? I have several reasons.

On a Boeing 737 I will always sit in Seat 11C. Why 11C? I have several reasons.

As a general matter, I prefer aisle seats. I do not want to have to ask permission of my seat mate if I need to use the bathroom. Also, after the plane arrives at the gate, the person in the aisle seat can quickly get up and retrieve his or her bag before he queue forms down the aisle.

Aisle seats have another perk: you can lift up the arm rest. Under most seats is a little button–push it, and you can pull up the arm rest. Removing the arm rest gives you a few more inches to spread out. This extra space is especially helpful if the person in the middle seat is crowding you. (It happens.)

In particular, I prefer the aisle on the left side of the plane, over the right side of the plane. That is seat C rather than seat D. Why? I am a righty. When I use the trackpad on my laptop, my right elbow naturally sticks out to the right. It is possible to use a trackpad with a straight arm, but the motion is unnatural. (Try it.) When I sit in seat C, my elbow juts out into the aisle. It doesn’t bother anyone. (When the drink cart comes down the aisle, I have some temporary restraints). When I sit in seat D, my elbow juts out into the person sitting in seat E. As a result, I much prefer Seat C. Indeed, if there are no seat Cs available, I will sometimes prefer a Seat F (window on the right side). That way, my elbow juts into the window, rather than the person next to me.

Of all the C seats, why 11C? First, the 8C and 20/21C are out. (I explain below why the bulkhead and exit row seats are overrated). 15C, the row immediately before the exit row, is also out. That seat cannot recline. (I am on the pro-side of the recline debate; it’s my seat, I can use it as I choose.) That leaves us with 9C, 10C, 11C, and 12C. If I am in a pinch, I will select any of these four seats, but I prefer 11C the most. I consider three factors.

- Proximity to the front of the plane: Flights board by status (Zone 1 before Zone 5) but deplane by row (Row 1 before Row 11). The closer you are to the front of the plane, the closer you get off the plane. A person in Zone 5, who sits in 10A will usually get off the plane before a Zone 1 passenger in 11C. Based on my rough timing, it takes a row (6 passengers abreast) about 30 seconds to a minute to get out of their seats, retrieve their overhead bags, and move forward. Passengers in every row, further back, will have to wait more time to get off the plane.

- Availability of overheard space: Generally when I board early, I don’t have to worry about overhead space above my seat. But if I am running late, or if the gate agent boards early (I really wish they wouldn’t), I sometimes have a tougher time locating overhead space. I find that among rows 9-12, the overhead space fills up the quickest towards the front. Sometimes the airline will store some type of emergency equipment by the bulkhead–fixed space you cannot move. Also, pilots and other crew will put their bags up there. I rarely have problems with bag space in row 11 or 12.

- Likelihood that the middle seat remains empty: On a less-than-sold out flight, middle seats are often open. I will usually prefer an aisle seat with an empty middle seat to a business class seat. (On shorter flights, I’ve declined last-minute upgrades to avoid the hassle of moving from a spacey position.) Sometimes the airline will “upgrade” someone from a regular economy seat to a middle seat in economy plus. (I am not sure that is an upgrade; I would rather have a cramped aisle seat than a roomy middle seat.) In my experiences, the middle seat in Rows 11 and 12 fill up after the middle seats in Rows 9 and 10. No science here. My anecdotal observations.

Given these three considerations. I have made 11C my default choice. It is my mobile office. Wherever available, I take it. Indeed, I am comfortable with it. When I have to use 10C, I feel too close to the front. 12C feels too far from the front. If you ever see me on a plane, and I am not in 11C (or in business class), you can assume that I didn’t buy the ticket early enough.

All of the C seats I mentioned are in the Economy Plus section of the plane. United (and most carriers) designate the first few rows of the plane as “premium.” You have more space between seats. Specifically, there are more inches from the end of one seat to the beginning of another. This unit is known in the industry as “pitch.” (I will explain later why “pitch” is not a useful measurement.) With premium seats, you can also board earlier (with Zone 1 or 2). All passengers can choose to pay extra for these seats (between $50 and $75). Passengers can also buy an annual subscription and receive unlimited economy plus seats (about $600 a year). And members with gold status or higher receive complimentary economy plus seating. (Traditionally gold status was awarded to passengers with 50,000 miles flown a year, but now status is primarily based on spending money.)

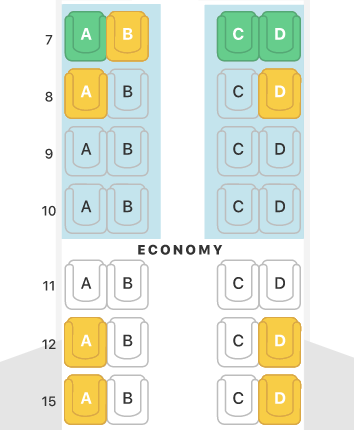

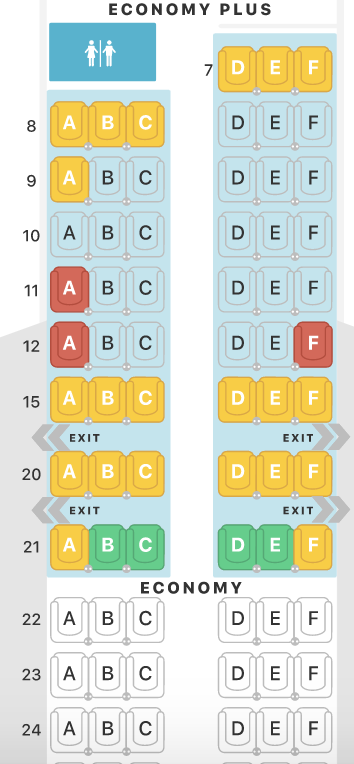

The seating configuration is different on the Embraer Regional Jet (ERJ) 175. Instead of two rows of three, the smaller plane has two rows of two. In other words, no middle seat. The seats themselves are also much thinner, and less comfortable. For a short flight, the seats are fine. But United treats some three-hour flights (Houston to DC) as “regional.”

The seating configuration is different on the Embraer Regional Jet (ERJ) 175. Instead of two rows of three, the smaller plane has two rows of two. In other words, no middle seat. The seats themselves are also much thinner, and less comfortable. For a short flight, the seats are fine. But United treats some three-hour flights (Houston to DC) as “regional.”

The first four rows of the ERJ 175 are Economy Plus. I usually prefer 9B. (The aisle side on the left side). I avoid the bulkhead (7B). I also avoid 10B. This row is immediately in front of the regular Economy Section. It is harder to recline onto someone who has space. I prefer to recline onto people who have the added space of an economy plus seat. 8B also works in a pinch. As a general matter, I will take a D window seat in Economy Plus over a C aisle seat, to avoid having my elbow jut into the seat mate.

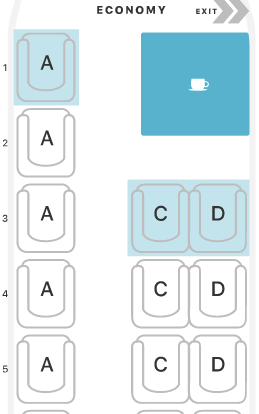

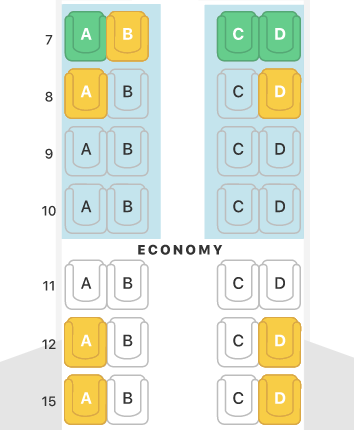

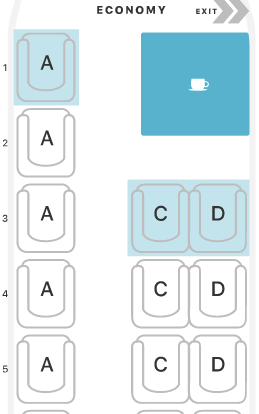

Finally, we have the ERJ 145, the tiny regional jet with a 2-1 configuration. This plane is (thankfully) being phased out. It is very cramped and uncomfortable. Some smaller airports can only be reached by these tiny planes. Here, the A seats are preferred. You sit by yourself, in your own row. But there is very little leg room. My knees always touch the seat in front of me. If the person in front of me reclines, I have to lift the tray table up, and put my laptop on my lap. Here I actually prefer the exit row (Row 18A). There is more leg room, and I can comfortably work. Also, the tray table is not in the arm rest, so there is more lateral space.

Finally, we have the ERJ 145, the tiny regional jet with a 2-1 configuration. This plane is (thankfully) being phased out. It is very cramped and uncomfortable. Some smaller airports can only be reached by these tiny planes. Here, the A seats are preferred. You sit by yourself, in your own row. But there is very little leg room. My knees always touch the seat in front of me. If the person in front of me reclines, I have to lift the tray table up, and put my laptop on my lap. Here I actually prefer the exit row (Row 18A). There is more leg room, and I can comfortably work. Also, the tray table is not in the arm rest, so there is more lateral space.

I have given seating a lot of thought.

2. Bulkhead seats and Exit Row seats are overrated

Bulkhead seats refer to the first row on a plane. On the Boeing 737, for example. There are two bulkheads. First, Row 1 in business class. Second, Row 7 in economy class. Generally, there is a wall in front of the first row to separate the seats.

Also, every plane has at least one or more exit rows. These are the rows that align with the plane’s wings. In the event of the emergency, people may need to evacuate through the exit rows, onto the wing. Some travelers prefer the bulkhead and exit rows. I think these seats are overrated.

One law professor described me as “tall and muscular.” I agree with the first half of that statement. I am about 6’2″, with long legs. I’m also wide. The bulkhead seats, located in the first row of the plane, don’t work for me for three reasons. First, there is actually less room for my legs. In seat 11C, I can stretch my legs all the way out under the seat in front of me (10C). But for the bulkhead, there is a partition in front of the seats. The bulkhead offers more knee room–that is, no one will recline a seat into my knees. (This measurement is referred to as “pitch.”) But there is less leg room–I have less space to stretch out. Indeed, with most economy plus seats, I seldom have problems with knee room. Even if the person in front of me reclines, I still have plenty of room. (Though I have to reposition my laptop on the tray table slightly).

Second, in the bulkhead, I cannot keep my laptop under my seat during taxi, takeoff, and landing. The path in front of the bulkhead must be clear. This FAA rule never made much sense to me. There is no quick escape by the bulkhead seat. I’m not sure why this path must remain free, but other rows can be cluttered. This rule is enforced unevenly. Some flight attendants will let me keep the laptop under my seat. Others will let me put it in the seat pocket (which hangs off the partition). But some flight attendants make me put my computer in the overhead bin. That change deprives me of about 20-30 minutes of working time per flight. Why? You can’t get the computer from the overhead until you reach cruising altitude (double chimes). And you have to stow your computer during the descent. Depending on weather, that could be as much as a 20-minute. No thanks.

Third, in the bulkhead the tray tables are stored in the arm rest. As a result, there are fixed boundaries on both the right and left side of the seat. I feel cramped inside that unit. Unlike with my beloved 11C, the exit rows do not allow me to lift up the arm rest, and extend into the aisle. Also, the tray tables that fold of the arm rests are far more flimsy. They are likely to sit on top of my knees, creating undue pressure throughout the entire flight.

The exit row seats will also place the tray table in the arm rest. You have more knee, and leg room, but there is less lateral space. But the exit row has plenty of knee room and even more leg room. I can’t even reach the seat in front of me. On some planes, the exit row is colder because of the proximity to the window. The temperature doesn’t bother me, but it could be a factor for other passengers.

I think the exit row and the bulkhead seats are overrated. They provide some benefits, but also add costs for taller, and wider passengers.

3. Tips for trading seats

This tip will be unpopular among unfrequent flyers, but will resonate with frequent flyers. I will generally switch seats switch to allow a parent to sit next to his or her child–the younger the child, the more likely I will make the switch. As a general matter, there are inconveniences to sitting next to a young child: they can make a lot of noise, can jump and kick around, and there are frequent bathroom breaks. Sometimes moving away from a child on a plane is win-win. Also in rarer cases, a person will want to sit next to an elderly parent with some health conditions. That switch will also usually work for me.

But I won’t entertain a switch for a husband, wife, boyfriend, girlfriend, etc. Seat 11C is very important to me. (See #1 above.) If I have to sit in a window seat, or an aisle seat, I will not be able to get work done that I had planned to finish. And I will likely have to sit in a cramped position, leading to discomfort for the rest of the day. Indeed, I won’t switch from seat 11C to 11D. Recently, someone asked to switch an “aisle for an aisle.” I declined. I’ve tried to explain in the past the difference between 11C and 11D while someone is asking me to switch, but it is too complicated. Now I just say no, without an explanation. (That incident, in part, spurred this lengthy post.)

Refusing to switch in such cases generates a lot of glares and dirty looks. And I have to sit next to the person who wanted to switch for 2+ hours. There are costs. But I am efficient at looking ahead and focusing on my work. I usually forget about the issue by the time we reach cruising altitude.

Indeed, my general tactic when my seat mate is unpleasant is to simply look forward and ignore them. Responding or engaging in any way simply escalates the issue. There are no rational conversations when a passenger is irate. On rare occasion, if the situation escalates, I press the call button and let the flight attendant deal with it. In some cases, reaching up to press the button could escalate the situation further–especially if the seat mate perceives the sudden motion as an act of aggression. In such cases, I get up “to go to the bathroom” and mention something to the flight attendant.

For example, on a recent flight, the passenger next to me was really, really drunk. (By my count, he had four vodka drinks, and probably started drinking before the flight.) He kept asking me bizarre questions and saying obnoxious things. I looked forward and ignored him. Alas the behavior did not stop. I got up and told the flight attendant to cut him off. And the flight attendant did so, and brought him coffee.

Back to switching for parents and children. The mechanics of the switch are complicated. And parents are seldom thinking about what they are asking. Their sole concern is to sit next to their kid. I can truly relate. Here I offer some general tips to make the process smooth.

As a threshold matter, parents who buy tickets well in advance would not knowingly seat their child apart. Parents and children are generally are assigned separate seats because they missed a connection, and were automatically rebooked. It happens. On most flights, stand-by passengers are assigned to the middle-seats (the most unpopular seats). As a result, a child may be assigned to 11B (an economy plus middle seat on the left side of the plane) while the parent may be assigned to 22E (an economy middle seat on the right side of the plane).

As a threshold matter, parents who buy tickets well in advance would not knowingly seat their child apart. Parents and children are generally are assigned separate seats because they missed a connection, and were automatically rebooked. It happens. On most flights, stand-by passengers are assigned to the middle-seats (the most unpopular seats). As a result, a child may be assigned to 11B (an economy plus middle seat on the left side of the plane) while the parent may be assigned to 22E (an economy middle seat on the right side of the plane).

Usually, the parent will ask me (in 11C) to move back to 22E. That certainly seems like the easiest swap. I am in the aisle, and easy to talk to. The person in the window is further away. This is probably the worst trade. The parent is asking someone seated in a premium, aisle seat to go back to a non-premium middle seat. I addressed above how that seat would affect my trip.

Rather than swapping 11C for 22E, the parent should consider two other options.

First, send the child back to row 22. The parent should ask the person in 22D or 22F to move up to 11B This person did not purchase a premium seat, but would be getting that benefit. True enough, they would be giving up a window or aisle for a middle seat. But the added legroom may make it worth it. Also, I’ve found that people in row 22+ aren’t as persnickety about their seats. If they were, they wouldn’t be sitting in row 22+.

Second, ask the person in 11A to go back to 22E. This swap also represents a downgrade (window seat to a middle seat). But if 11C (me) declines, 11A should be the next bet.

I’ve been on some flights where parents try to organize three-way trades, so that mom, dad, and kid can sit in the same row. I won’t participate. These switches are too complicated and seldom pan out. The boarding process is fairly short, and everyone must be seated by the time the door closes. Waiting around for these trades to materialize is a waste of time. Sometimes people try to organize a trade while in the air. At that point, people are seated, and are less likely to move.

On rare, rare occasion, a parent and child will be seated in my seat before I board. (Parents with children 2 and under board before members with “1K” status). Their hope is that if they are seated in my seat, I would be happy to move. I’ve acquiesced to this plan a few times. It is gutsy, but works. I would not recommend it. It could backfire, and create a scene at boarding.

4. Always use a neck pillow on planes, Ubers, and everywhere else

I have a neck pillow clipped to my bag. I bring it everywhere I go. I wear it all the time on planes, in Ubers, and everywhere else. Indeed, I usually put it on during the boarding process. It looks ridiculous. I’ll admit. But it prevent neck strain and cramping. Moreover, the neck pillow allows me to easily sleep for two hours at a time. (Something usually wakes me up during longer naps).

Not all neck pillows are created equal. I’ve tried them all. The best model I’ve seen is the Cabeau Evolution Memory Foam Travel Neck Pillow. It is perfect. The grooves on the slide let me rest my neck. And the memory foam material is quite comfortable. And the strap easily clips onto any bag handle. I have 2 or 3 extra ones at home, in the event I ever lose it.

5. To create extra leg room, remove the literature from the seat pocket

Most airplanes load lots of literature in the seat pocket: a magazine no one reads, safety cards no one reads, applications to sign up for credits cards, wifi instructions, etc. Those pages take up precious inches. Remove them. Put them on the floor. You will buy yourself a few inches of free room. Flight attendants will sometimes rebuke you for moving the safety card. (I once got yelled at while flying a 747 from Hong Kong to San Francisco–it was a tight ship.)

Some of the newer models place the literature pouch higher up, so there are no problems with knee room.

from Latest – Reason.com https://ift.tt/2vlJS5T

via IFTTT

On a

On a  The seating configuration is different on the

The seating configuration is different on the  Finally, we have the

Finally, we have the