A History Of The Biggest Bailouts In History

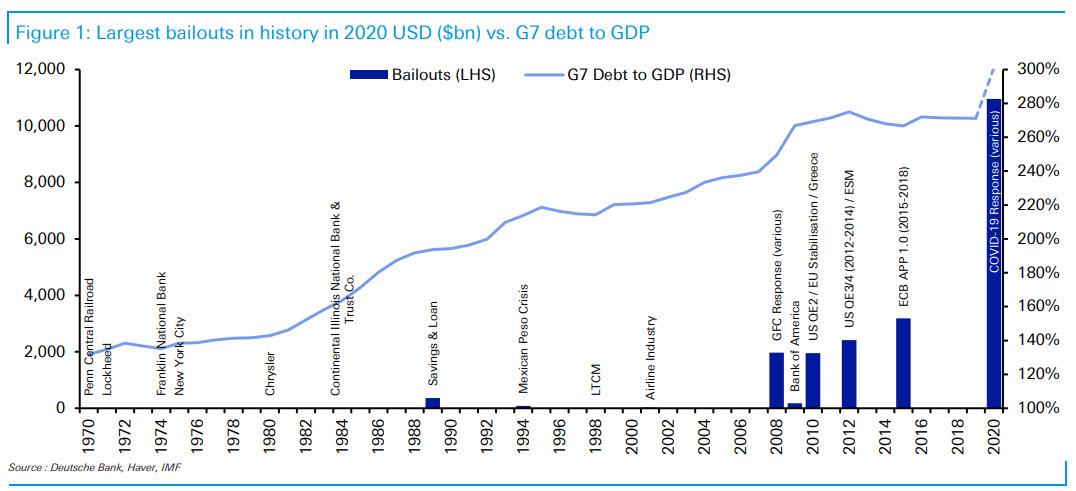

While nobody knows when the US economy will fully recover from the coronacrisis pandemic, what the economy will look like, or where the S&P will be one year from now, we do know how much money the current bailout has cost. And, at over $10 trillion to date – and counting – the Covid-19 bailout is now officially the biggest bailout in history.

Deutsche Bank’s Jim Reid has put together the following chart graphing the history of global moral hazard all large bailouts/interventions, covering both government and central bank moves, seen each year since 1970 in US inflation adjusted terms.

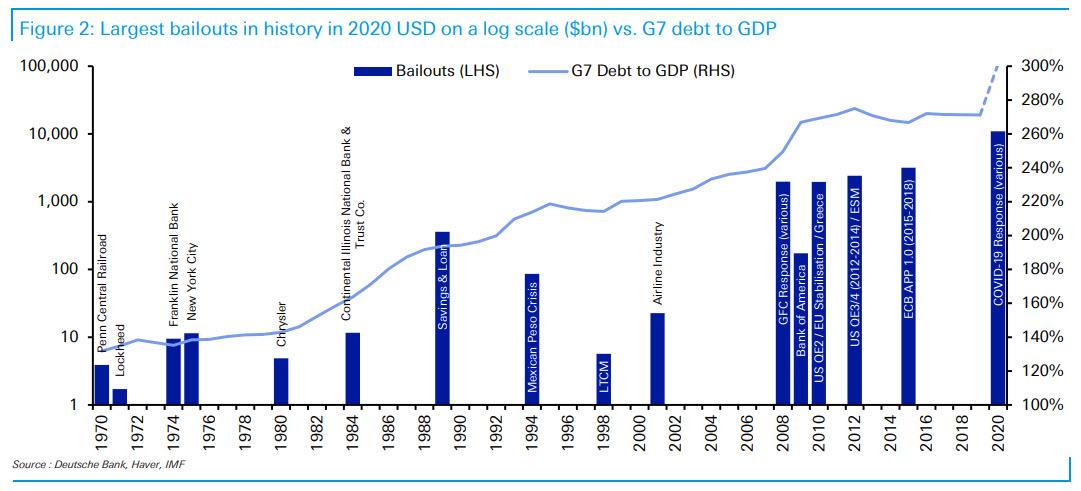

There is also a graph on a log scale so as to better identify the earlier bailouts and get a rough feel visually for the numbers.

For the 2020 bailout, DB has aggregated the fiscal and monetary support programs announced so far from the US and the largest economies in Europe, which means that the final cost of the current crisis could be substantially higher: “Obviously we won’t know how much will be used until much further down the road but these are the main commitments undertaken so far as we see them.”

Reid has also added overall G7 debt (private and public) to GDP to the charts to point out the patently obvious, namely that as global debt gets higher so does the level of bailouts/intervention needed to protect the system. The strategist also made a rough approximation for G7 debt/GDP for 2020.

Some more observations:

- Most bailouts before the GFC tended to be less than $10bn in today’s inflation adjusted terms. The S&L ($293bn in 2020 inflation adjusted terms) and Peso ($93bn) crises saw higher numbers but still relatively small for more recent times.

- The GFC moved us from ten billion being a big number to a trillion being the new bail-out currency.

- This Wu Flu crisis has moved us towards ten trillion plus being the bailout currency globally.

As Reid puts it, “the prior 20-25 year bailout culture and extremely low policy rates has left us with ever higher and higher debt requiring the bailout numbers to also go higher and higher on any outside shock.” And the punchline:

“Even without the covid-19 shock, the next recession would have likely required multiple trillion dollars of intervention to protect the current system.”

Which, of course, is correct, but why not use the “crisis” to unleash the biggest intervention in history and institutionalize helicopter money in the process, a key event that will allow the establishment to kick the can for several more years.

And while Reit would stress “the extraordinary nature of the covid-19 shock”, the point is that we are once more in too big to fail territory and the authorities are doing everything they can to minimise defaults in this crisis – defaults which somehow are nobody’s fault yet the world has never had more debt making it the most prone to even the smallest shock. As such to say that the aftermath of the coronacrisis is nobody’s fault is a borderline crime – it is the fault of everyone who believed that the Fed has made any future crashes impossible… starting with the Fed itself. After all who can forget Janet Yellen’s idiotic declaration that there will be no more crises in our lifetime. Well, why not just issue record amounts of debt in that case. Fast forward 3 years later and all that debt needs to be bailed out.

Additionally, as Reid concludes, “what the massive crisis does to productivity in the future is an open question as is whether we can ever see proper capitalism again with current levels of global debt/GDP.”

Spoiler alert: no.

Tyler Durden

Wed, 04/22/2020 – 15:50

via ZeroHedge News https://ift.tt/2VtEIPd Tyler Durden