Bonds Dumped As Gold, Stocks, Crude, Crypto, & The Dollar Jump

After two days of carnagery, everything (almost) was up today…

Oil futures rallied across the complex led by the June contract that ripped higher across the US cash equity market open…

June WTI managed to squeeze up to $14…

But, in another lesson for the retail bagholder, as they ate the contango losses, USO (the Oil ETF), plunged 9% today…

Gold futures surged 3% higher – tagging $1740…

Silver also soared…

US equities managed gains on the day – after two ugly down days – with Nasdaq (again) squeezed over 3% higher as Trannies were unable to hold green… (weak close, perhaps after an unexpected jump in California COVID deaths)

But none of it was enough to get green on the week…

The Dow bounced 500 points hihger but was unable to get back to its critical 50% retrace levels…

The S&P 500 was unable to reach its 50DMA once again…

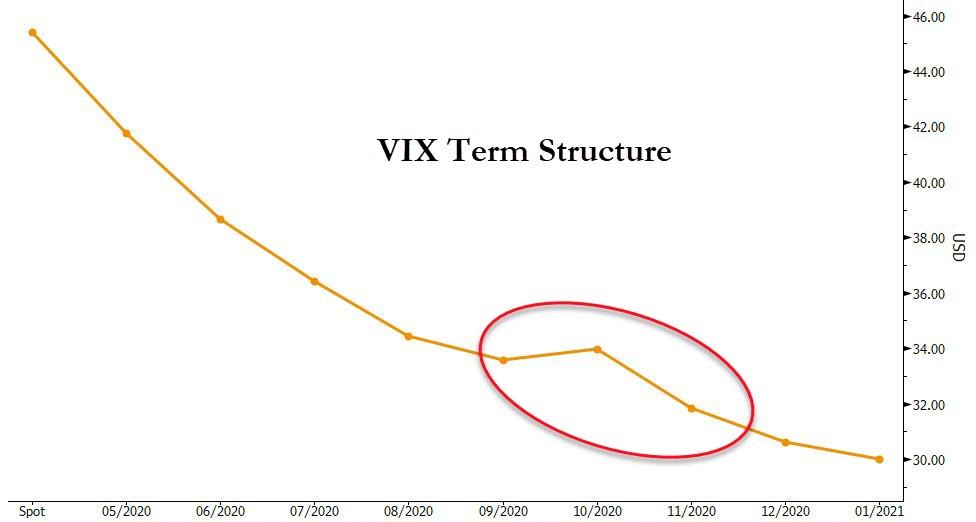

VIX was down on the day but held above 40 and remains in backwardation with a kink in the curve around the election…

Source: Bloomberg

Traders were very excited at NFLX streaming subs last night but as they realized the malarkey that saw subs double expectations but revenues only meet, they sold… (as someone said this morning, forgive us for not remembering – “if they only got an extra7MM subs during the biggest pandemic of all time, their growth is over…”

The Dollar rebounded notably intraday, higher for the 3rd days in a row…

Source: Bloomberg

Cryptos all rallied strongly on the day…

Source: Bloomberg

But…

Bonds were lower (in price) with 2Y, 5Y, and 7Y yields now flat on the week (30Y was worst performer on the day, up 6bps)…

Source: Bloomberg

10Y bounced off recent lows again…

Source: Bloomberg

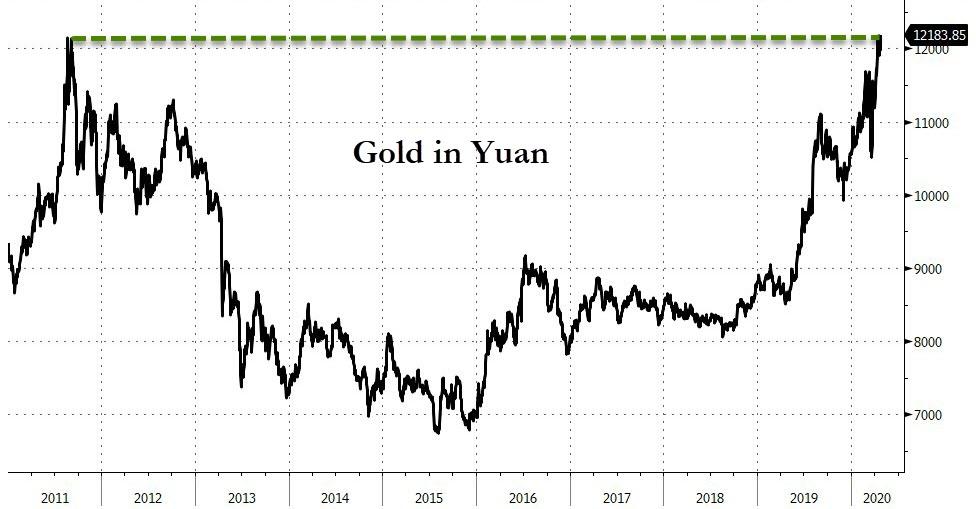

Gold is at a record high against the yuan…

Source: Bloomberg

And extends its record run against the euro…

Source: Bloomberg

Finally, we note that the S&P 500’s dividend yield has never been so high relative to 10Y TSY Yields…

Source: Bloomberg

Are dividends all about to be slashed? Or are yields just too damn low?

And while stocks may have bounced recently, implied correlations suggest systemic risks remain extremely high…

Source: Bloomberg

Tyler Durden

Wed, 04/22/2020 – 16:01

via ZeroHedge News https://ift.tt/2XWGo5x Tyler Durden