Bond ETFs, Retail Bagholders, & “Shame On The FT”

Authored by Bill Blain via MorningPorridge.com,

Another interesting’s day play in prospect as markets digest the ongoing oil-shock, BoA predicting $3000 Gold price, and stocks taking a bit of tiny tumble. I detect something of a new reality setting in among clients – many never expected markets to rally so hard after March’s fall. Now there is an increasing sense the market got ahead of itself, boosted by all the central bank and government promises. Now the market is settling in for the “Long Run” – fundamentally reassessing where the global economy is headed. Lets see where it takes us.

Yoorp

If I get a chance, I am going to put out a Porridge Extra on Yoorp this afternoon. I’ve been thinking a lot about Europe – readers will be surprised to learn I’m somewhat optimistic (but only because I suspect they will successfully mumbleswerve and avoid an Italy bust-up by kicking the proverbial can further down the road)! I haven’t had a chance to put it all together yet, but I suppose I really ought to try before tomorrow’s big Zoom Call between Europe’s leaders..

Fixed Income ETFs

I must congratulate the ETF industry for a superb piece of counterfactual post-crisis agenda setting in the FT this morning! I am wondering if the ETF lobby has contracted the Chinese State Propaganda Ministry to run their media campaigns?

“All that Drama about fixed income ETFs was overplayed” says the FT. The article’s narrative is how Fixed Income ETFs eased market tensions through March’s turbulent markets by acting as a “safety valve” for the corporate bond market. It cites a recent BIS report about how ETFs are a suitable input for risk management and reg cap calculations, boosting by association the credentials of these market hero products.

Really?

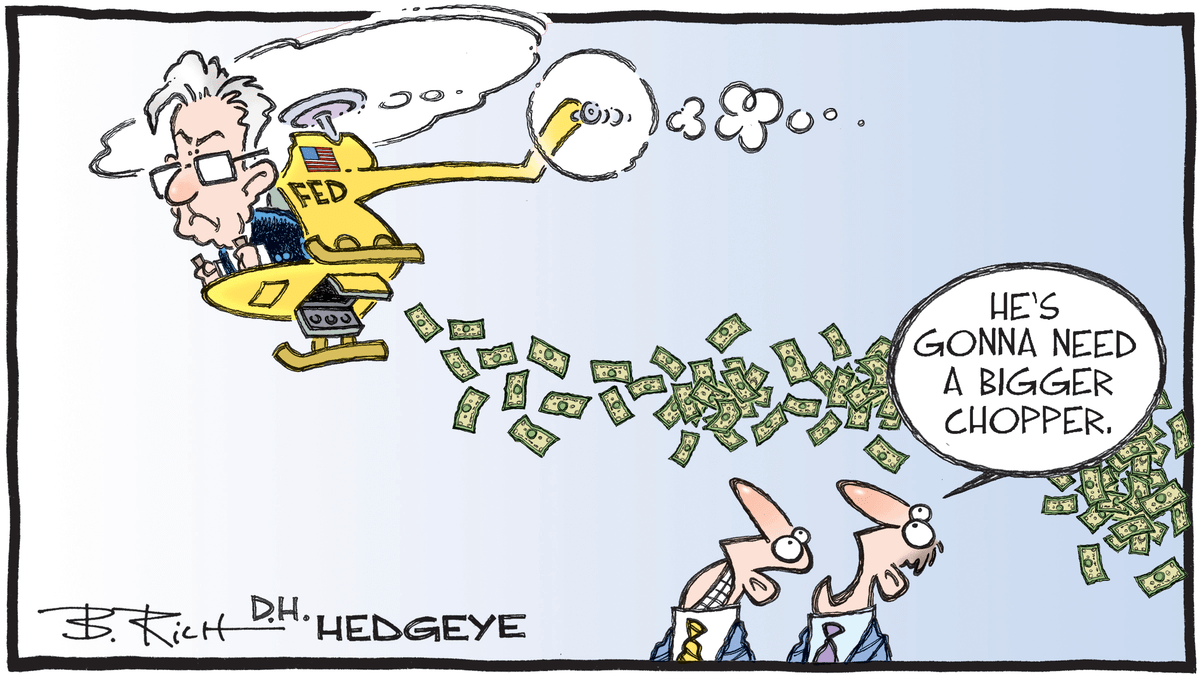

Silly me. Here was me thinking it was the BoE, ECB and Fed coming in with QE Infinity packages, and finding ways to buy Junk and Junk ETF onto Central Bank balance sheets that saved the corporate bond markets? (The ECB is debating junk purchases today.)

How wrong was I? Apparently, the recovery in Corporate Bonds is nothing to do with Central Bank distortions. It was ETFs that saved us! All these years (35 and counting) in Fixed Income and I never knew. (US Readers: Sarcasm Alert.)

The article is all puff. And that worries me.

Retail investors read the FT – they think it is credible and a journal of record.

I’m agnostic on ETFs – many times over the past 10 years I’ve proposed them as potential portfolio solutions to clients. However, a large portion of the fund managers I work with, especially those grey-hairs who traded through the last crisis, are sceptical and suspicious of them. I share some of their concerns that any instrument based on wholly on a fairly non-discrete pool of illiquid underlying components, (ie the corporate bonds that comprise Fixed Income ETFs), is potentially also vulnerable to illiquidity events.

Generally, I would give support to ETFs as useful portfolio tools and an effective way for informed retail investor to address bond markets. Buyer beware: in crisis markets – stormy waves can swamp all assets. Understand their risks and why not use them?

However, when you start to ascribe superhero powers to a financial instrument, there is a risk that investors start to believe. And when that belief is based on nonsense and marketing puff, it gets dangerous.

The gist of the FT article this morning is the Net Asset Value (NAV) of an ETF – which is effectively just a basket of corporate bonds mimicking an bond index – will lag any wild price movements of the individual bonds (which are wholly illiquid), therefore acting as a “dampner” on chronic price over-reaction: a “safety valve” which mitigates the wild swings in prices of wholly illiquid bonds.

I would agree, and that’s fair enough in “normal” markets. For investors playing trends and following bond indexes, EFTs have greater liquidity than the component bonds. In many cases they are apt investment choices. I have ETFs in my PA accounts. I could not get bids on some last month.

In a market where most fund managers and portfolio traders have less than 10-years experience and tenure, most haven’t seen market crisis. Lacking crisis experience, they will tend to believe what the ETF experts, sponsors and promoters tell them about liquidity. From this morning’s FT article its clear the journalist also believes. I suspect he’s regurgitated what ETF promoters have fed him.

That’s not journalism – that’s one step up from a precis of a press release.

What happens to ETFs in time of chronic crisis could have been very different. In the pre Fixed-Income days of 2008 we saw the bond markets set like concrete. It happened again last month. In times of crisis illiquid bonds prices crash precipitously when there are no buyers. Successful brokers know who the bottom fishers are – the accounts who look for chronic illiquidity to cause prices to massively over-react. But otherwise, markets become offered-only. Your price is where they will trade.

In March ETFs looked caught in exactly the same negative feedback loop as the underlying bonds. There were no bids for many Fixed Income ETFs.

The only thing that reversed the chronic decline was the prospect of unlimited QE creating liquidity – if liquidity can be defined as Central Banks promising to buy whatever junk (literally) the investment banks and dealers want to flog them.

The ETF industry is trying to write the history books. The truth should out. It is disingenuous for the ETF industry to suggest EFTs saved the fixed income markets and performed well through the March selloff. Let’s be blunt about it, some very large firms are very all-in as ETF promoters. They have an agenda to push.

ETFs – like everything else – were bailed out by Central Banks.

Shame on the FT.

Tyler Durden

Wed, 04/22/2020 – 07:30

via ZeroHedge News https://ift.tt/2VUux5w Tyler Durden