USO Oil ETF To Execute 1-For-8 Reverse Stock Split

With chaos in the crude space getting worse by the day, and with some predicting that oil could plunge as low as negative $100 per barrel, every day is now a scramble for survival for the largest oil ETF, the USO, which is desperate to avoid the liquidation that its smaller peer, the OIL ETN which was fully redeemed, succumbed to yesterday. And to survive, it will succumb to the lowest tricks in the book including puffing up its stock price using such cheap gimmicks as reverse stock splits.

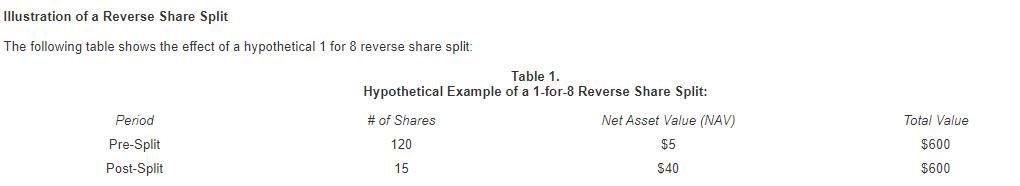

On Wednesday morning, USO manager USCF said in an 8K filing that “it will execute a one-for-eight reverse share split that will be effective for shareholders of the United States Oil Fund.”

Some more details from the 8K:

The reverse share split will reduce the number of USO’s shares outstanding and will result in a proportionate increase in the net asset value per share (“NAV”) of USO. As a result of the reverse share split, USO shareholders on April 28, 2020 will receive one post-split share of USO for every eight pre-split shares of USO they hold. Immediately after the reverse share split is effective, USO’s post-split shares will have an NAV that is eight times higher than that of pre-split shares.

The reverse share split will affect all of USO’s shareholders. The reverse share split will not affect any shareholder’s percentage interest in USO, except to the extent that the reverse share split results in a shareholder receiving cash in the transaction. The NYSE Arca does not permit the trading of fractional shares. As described below, shareholders otherwise entitled to receive fractional shares as a result of the reverse share split will thus receive cash in lieu of such fractional shares.

Considering that the biggest holder of the US are very unsophisticated retail investors, the 8x “jump” in the price of every USO share just may fool the majority of shareholders that the ETF won’t go “….. and it’s gone” next month, should oil really hit -$100.

Tyler Durden

Wed, 04/22/2020 – 07:44

via ZeroHedge News https://ift.tt/2RYZfsL Tyler Durden