Junk Bond Leverage Hits Record High As “Fed Rewards The Worst Abusers”

A quarter of issuers in the broad Russell 3000 index have reported their Q1 results so far, with an average Y/Y EPS drop of 12% (this figure is not materially different between large and small caps, with the former segment at -11% and the latter at -16%). In sectors, earnings were hit hard in energy, capital goods, autos, travel, financials, and healthcare providers. On the other side, earnings held in relatively well in staples, utilities, and real estate. Looking ahead, BofA expects earnings to contract 30% on the Y/Y scale in Q2, before beginning to recover gradually from there.

That’s about as far as any forecasts will go, as visibility for earnings growth a year from now is virtually nonexistent, however for some bizarre reason, bottom-up consensus numbers are showing a +15% growth for Q1 2021 Y/Y, and it’s unclear where this growth will come from. Like this website, BofA says that it “would take the other side of that view and assume a -15% drop in earnings in our models and base-case scenarios.”

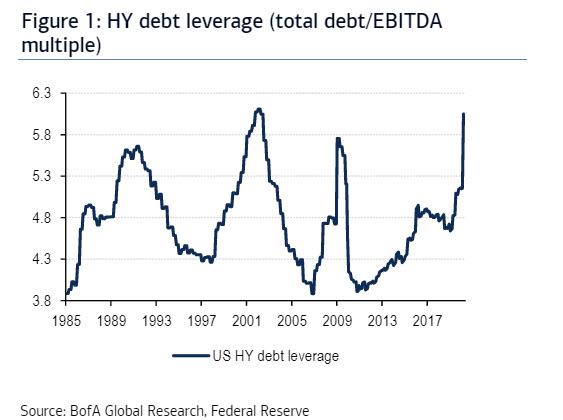

Under such an assumption, US high yield total debt leverage is likely to reach 6.0x in a year from now, matching its 20-year highs last seen in early 2000s, and a 99th percentile on historical range.

In fact leverage would temporarily set a new all-time high based on Q2 numbers, before potentially recovering somewhat if there is some recovery in Q3 and onward. Unless, of course, instead of a V-shaped recovery in GDP we get an I-shaped surge in corporate bankruptcies.

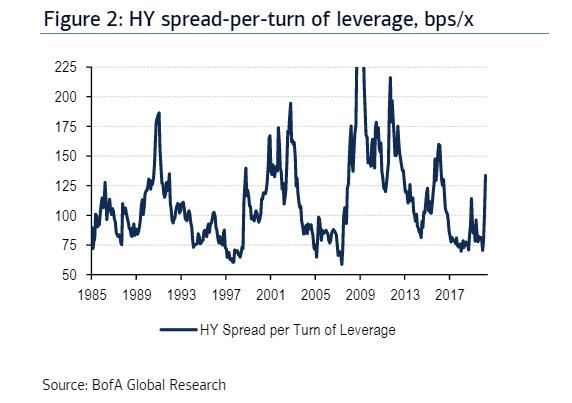

From a technical standpoint, given current spreads of 790bps, investors are looking at 130bps per turn of next-12mo leverage, which is somewhat cheaper compared to the historical average of 110bps/turn and a 75th percentile on the historical range.

As BofA notes, both previous credit cycles have seen this measure averaging 150bps/turn through the cycle, implying 900bps OAS at 6.0x leverage. Worse, at peak levels this measure has reached 200bps/turn in both cycles, implying a 1,200bps OAS, which explains why the Fed intervened directly in the bond market to limit the blow out in spreads.

Of course, the one and only reason for this massive buildup of leverage is the Fed, which for years allowed companies to issue super cheap “junk” debt, and then when everything crashed, the Fed stepped in and said it would buy IG and fallen angel high yield bonds, ensuring that the debt bubble it had blown would get even bigger.

We discussed this dynamic in “Unprecedented Pace Of Corporate Debt Issuance Has Crippled Corporate Fundamentals” and today Bloomberg agrees, writing that “for years, the Federal Reserve warned that too many highly risky companies were engaging in fuzzy accounting that bumped up their earnings – making it easier for them to obtain loans. The practice was driving up corporate debt to excessive and worrisome levels, regulators chastised. But now, in its latest effort to keep credit flowing, the Fed has done a remarkable about-face. It essentially endorsed the dubious practice with a program that may serve to bail out some of America’s most leveraged companies.”

The Fed move “rewards the worst abusers,” said Mark Carey, a former Fed official and co-president of GARP Risk Institute, the research arm of an association of risk managers. “People will see this as a backstop and in the future they will be encouraged to take on really high leverage.”

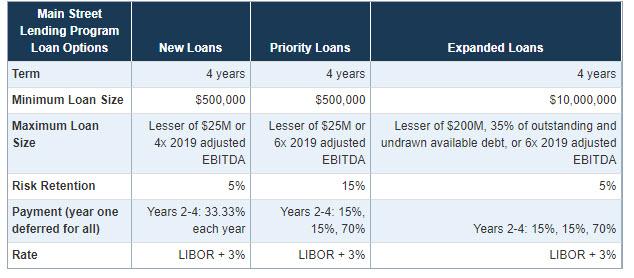

The reversal came in the Fed’s announcement last week to expand its Main Street Lending Program to allow more small and medium-sized businesses to qualify for as much as $600 billion in loans. That was widely applauded. But less noticed was a provision that allows companies that had used the widely-abused accounting techniques in the past to seek the loans.

Well, no: last week when discussing the expanded Main Street lending program, we explicitly pointed out that “the Fed also added a third loan option for companies with higher debt.“

… Adding that “the launch of this new option will ensure that the already record debt bubble gets even bigger, this time with the explicit blessing of the Fed.”

It wasn’t just us however, because increasingly more “establishment” figures are lashing out at the central bank for now openly inviting not only moral hazard but also so much debt that not even the Fed will be able to bail out the next debt-driven crisis:

The Fed move “rewards the worst abusers,” said Mark Carey, a former Fed official and co-president of GARP Risk Institute, the research arm of an association of risk managers. “People will see this as a backstop and in the future they will be encouraged to take on really high leverage.”

Which is funny since leverage is, a shown above, already at all time highs, and just to make sure it is even higher, the Fed will accept adjusted EBITDA as its cash flow benchmark, a number that is literally whatever the company and/or underwriters want it to be.

The new Fed lending facility says debt can be no more than 6 times earnings to be eligible for two of the programs.

But for companies that have played the adjustment game, that leverage cap becomes less relevant, said Scott Macklin, director of leveraged loan strategies at asset manager AllianceBernstein.

“We foresee the ability for companies which are far more levered than 6 times to take advantage of the program given the creative adjustments to Ebitda often marketed,” he said.

Ironically, while the Fed is now accepting 6x “adjusted EBITDA”, just a few years ago the Fed was warning about the dangers of using adjusted EBITDA as a metric. A Fed official in 2018 noted “material loosening of terms and weaknesses in risk management,” particularly in adjustments to Ebitda. Just two years later we find that when one – i.e, a price indiscriminate central bank – is “investing” with recently printed “money” there are no concerns about a “material loosening of terms” and certainly no concerns about “weaknesses in risk management.”

Tyler Durden

Tue, 05/05/2020 – 15:15

via ZeroHedge News https://ift.tt/2WvXapJ Tyler Durden