Oil Soars 20%, Hits Goldman’s Q3 Target 4 Months Early, But Here Comes June Maturity

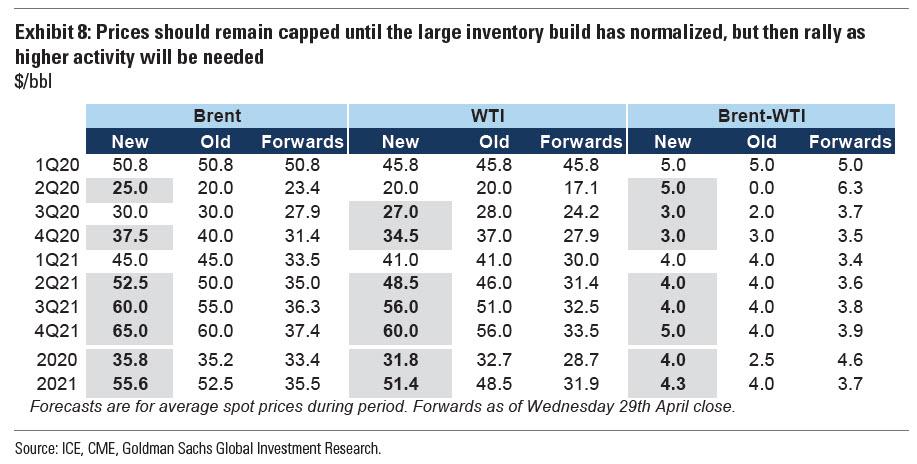

Just two trading days after Goldman flipped bullish on oil, saying that “it now appears likely that the market is passing its test on storage capacity” and hiking its oil price forecasts to $25/$30 for Q2/Q3 Brent, and sees WTI at $20/$28 for Q2/Q3, respectively…

… Brent has already hit Goldman’s Sept 30 price target, and on Tuesday afternoon Brent was trading above $31, thanks to a torrid rally that saw a barrel of the black stuff trading at $25 just yesterday.

Meanwhile, in a market that goes all in from one extreme to the other, WTI is also surging, and was up 20% at last check, trading as high as $24.85 for the June contract before settling at 230pm …

… which is remarkable because just two weeks ago it was trading at MINUS $40.

The last time WTI was here, traders realized that with Cushing effectively full, and with demand still dismal, oil prices cratered as there was no space for the physical deliverable. And while there has been a modest improvement in global demand, the surging oil price means that supply that was put on pause in recent weeks will once again start pumping aggressively, and the global supply/demand imbalance will once again shift aggressively toward supply, and result in sharply lower oil prices.

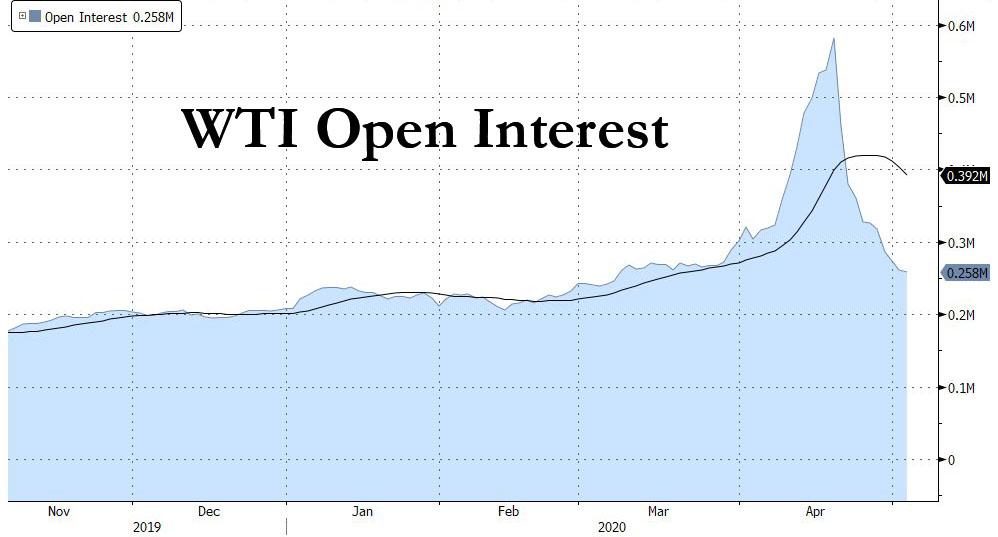

When? Look for another round of “April 20” fireworks on May 19 when the June WTI contract matures and becomes deliverable. And while this time there will be far less supply from the USO, the open interest is still around 258K, or the equivalent of 258 million barrels…

… which in the next few days will need some place to be stored. And something tells us it won’t find it, meaning we are about to go through the oil rollercoaster all over again…

Tyler Durden

Tue, 05/05/2020 – 15:12

via ZeroHedge News https://ift.tt/2L32ADp Tyler Durden