China Considers Dropping GDP Growth Target Range For 2020

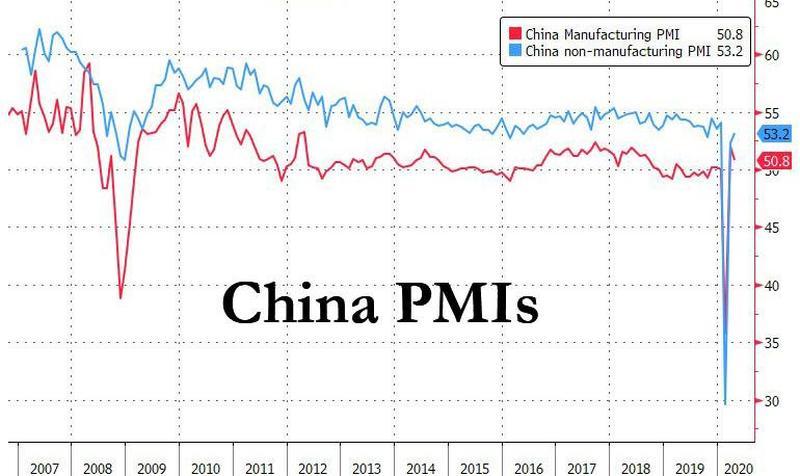

Well, it seems after China’s magical V-shaped recovery in PMIs amid the rest of the world crashing into recession, if not depression, as a result of coronavirus lockdowns, a new report via Bloomberg suggests Chinese leaders are contemplating “the option of not setting a numerical target for economic growth this year given the uncertainty caused by the global coronavirus pandemic.”

After a dramatic rebound in PMIs for the second consecutive month after the February crash, artificially engineered, of course, the fakery is not likely to hold, hence why to the prospects of not setting a growth target this year is reportedly being discussed by officials.

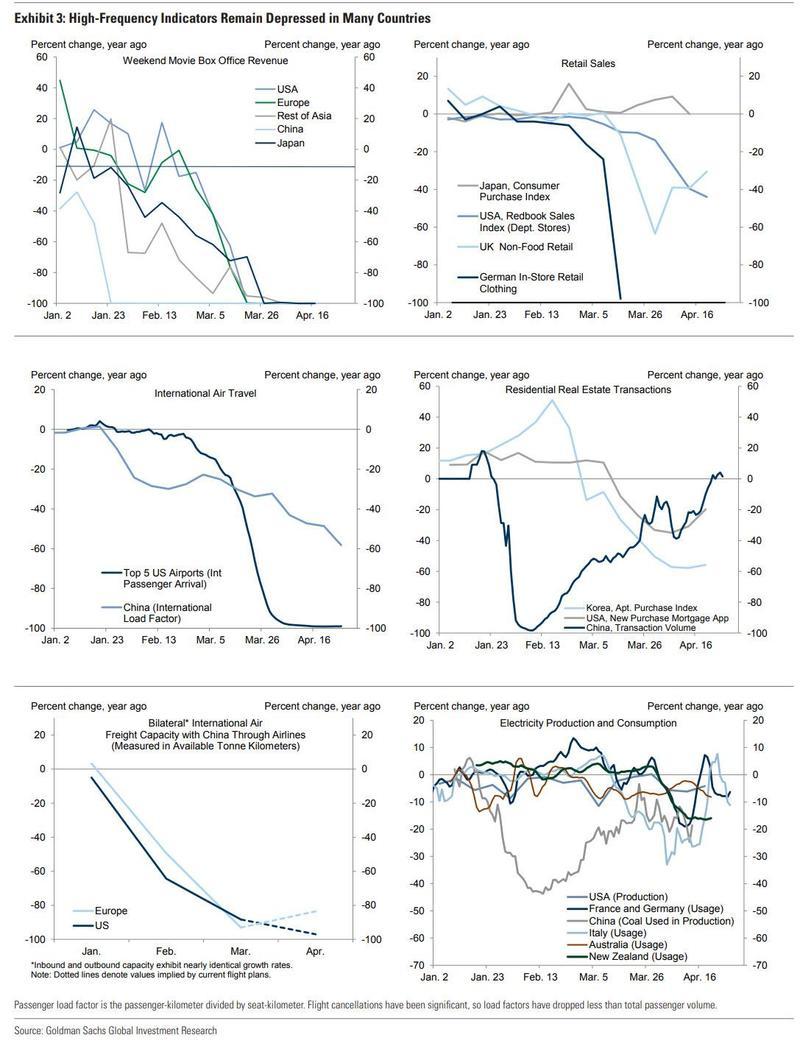

Real-time indicators tell an entirely different picture of the economy, still severely damage from lockdowns with no V-shaped recovery.

Sources said the GDP target range would likely not be set at the upcoming National People’s Congress meeting slated for May 22 in Beijing. Last year, the range was set between 6% and 6.5%. The source added that a final decision on how to characterize the target had not been made.

Under the leadership of the Communist Party of China (CPC) Central Committee President Xi Jinping, the party in the upcoming meeting is like to project how the country is attempting to normalize after virus shutdowns.

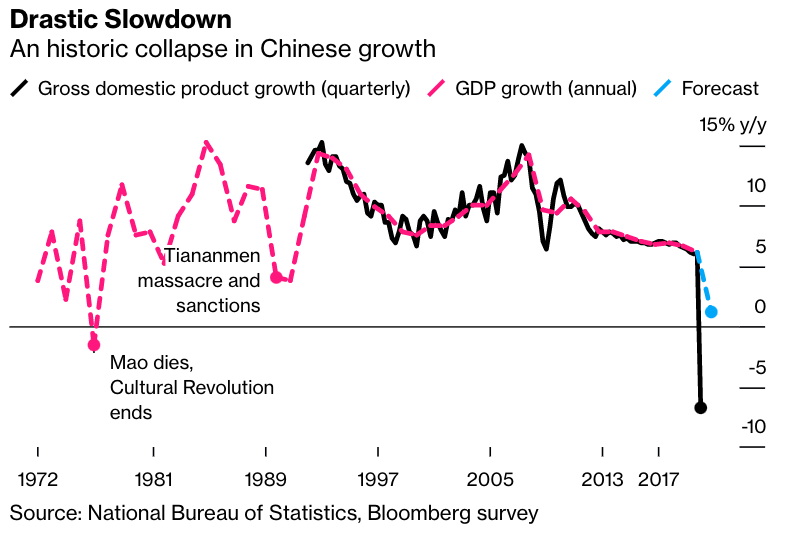

Jinping’s party is facing one of the sharpest economic declines in the post-Mao era, the impact of the pandemic, and unable to completely restart manufacturing plants because Western demand has collapsed, has constrained the economy.

However, there’s good news because CPC leadership can blame the virus for the prospectus of low growth in the quarters ahead. This would likely result in new rounds of stimulus as leadership attempts to revive the economy:

“Such a move would free up policymakers from the obligation to issue significant stimulus to meet a certain growth level as long as employment remains stable. While China has announced credit easing policies, tax breaks and additional spending plans, the efforts are still targeted and more moderate compared with other major economies. The leadership’s caution is driven by fears of another debt blowout after total borrowing ballooned after the global financial crisis,” Bloomberg noted.

We showed last month how Chinese GDP shrank by 6.8% from a year ago (considerably worse than the 6.0% drop expected) and the worst drop on record (since 1992).

China’s top leaders face unprecedented economic difficulty at the moment, and they must effectively blame everyone but themselves about lower growth while attempting to prop up the economy with stimulus. But for those expecting rounds of stimulus, like that seen in 2016, here’s Shang-Jin Wei, a China expert at Columbia Business School in New York and formerly chief economist of the Asian Development Bank, warns: “Prevention of a return or the ‘second wave’ of the virus outbreak is more important than getting a high growth rate for the remainder of the year.”

Tyler Durden

Wed, 05/06/2020 – 20:45

via ZeroHedge News https://ift.tt/2L9h9VT Tyler Durden