“It’s A F**king Rout” – Re-Open Rally Ruined But Bonds & Bullion Bid

Tyler Durden

Thu, 06/11/2020 – 16:01

Re-Open Rally Routed

As one newly-minted “expert” in trading expressed to us: “it’s a f**king rout! … and this after the most dovish Fed statement ever!”

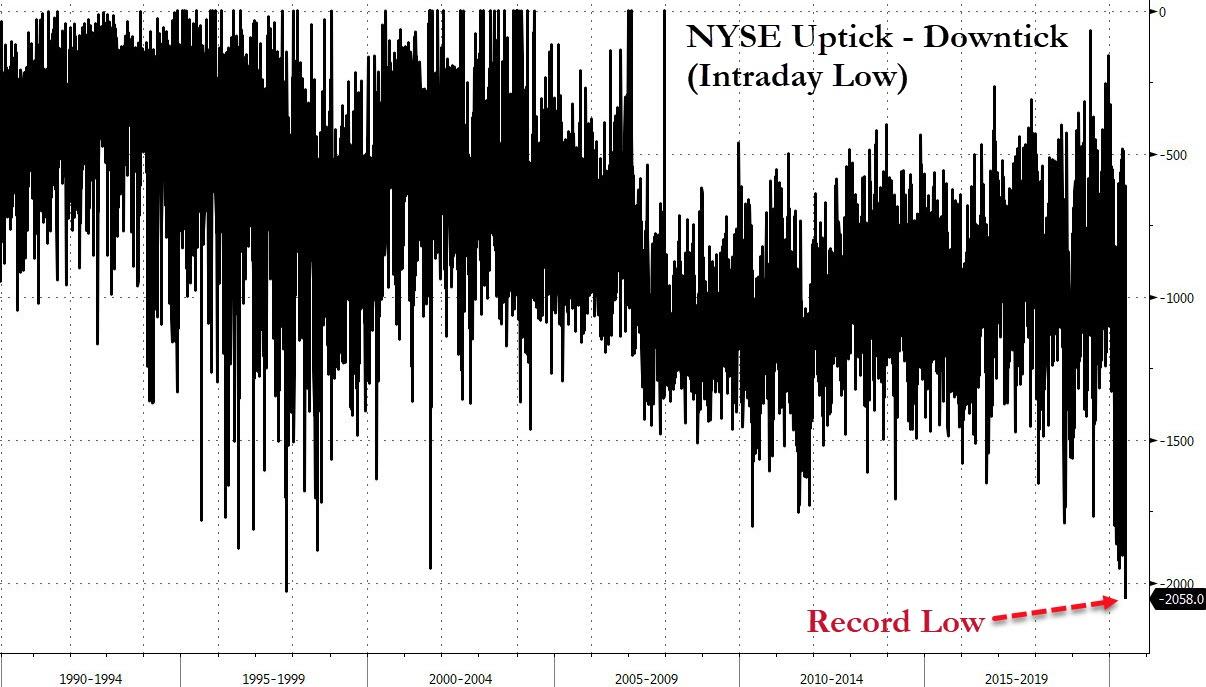

Today saw the heaviest selling-pressure in stocks since record began as TICK collapsed to -2058 intraday

Source: Bloomberg

Cramer called it…

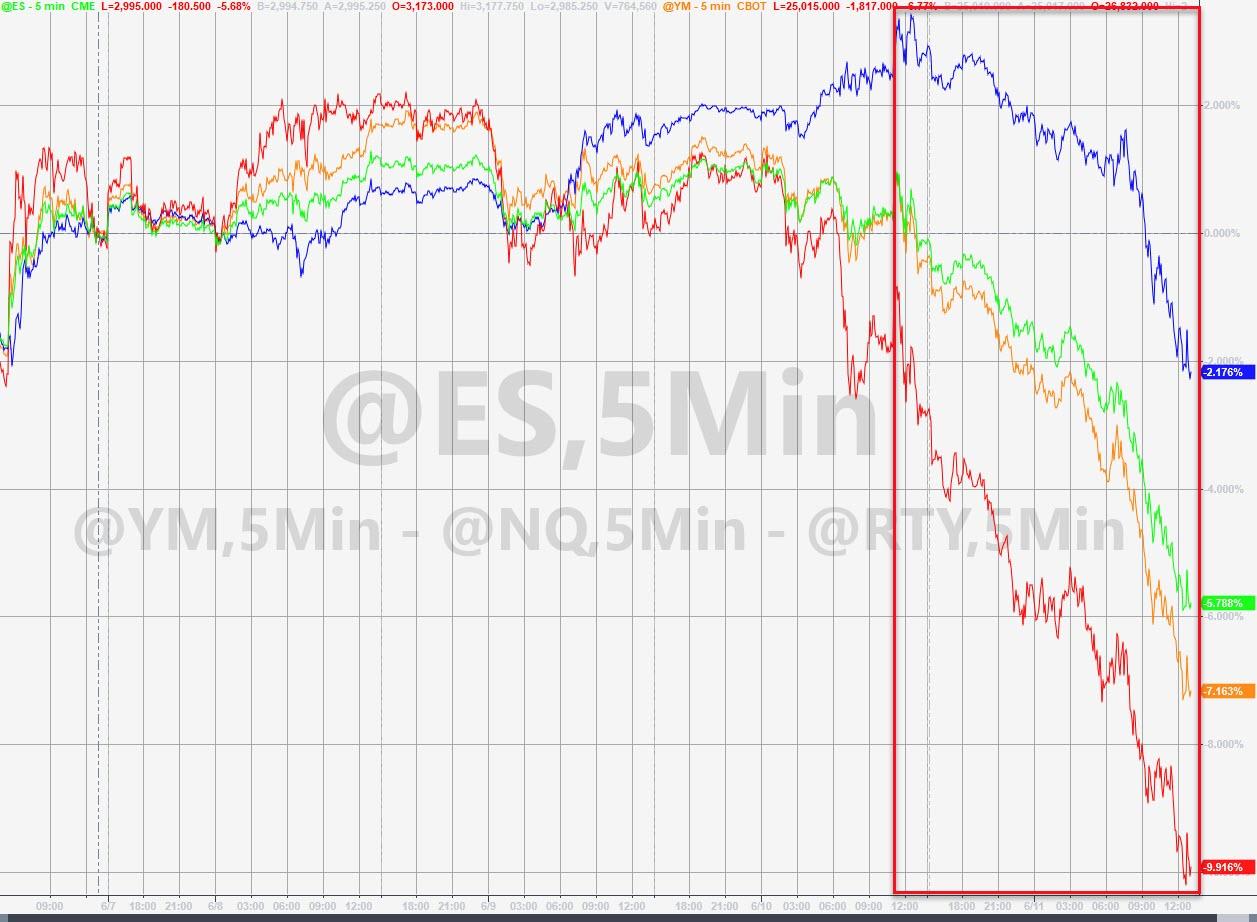

Too much transparency from Powell (on the economic shitshow) perhaps, COVID-19 second-wave concerns maybe, or just too far, too fast, and quant models reversing (more likely), but one thing is sure… Robinhood’rs were routed amid a big-tech bloodbath but Small Caps were the worst – down 10% this week!…

This is the biggest daily drop in stocks since mid-March at the height of the collapse.

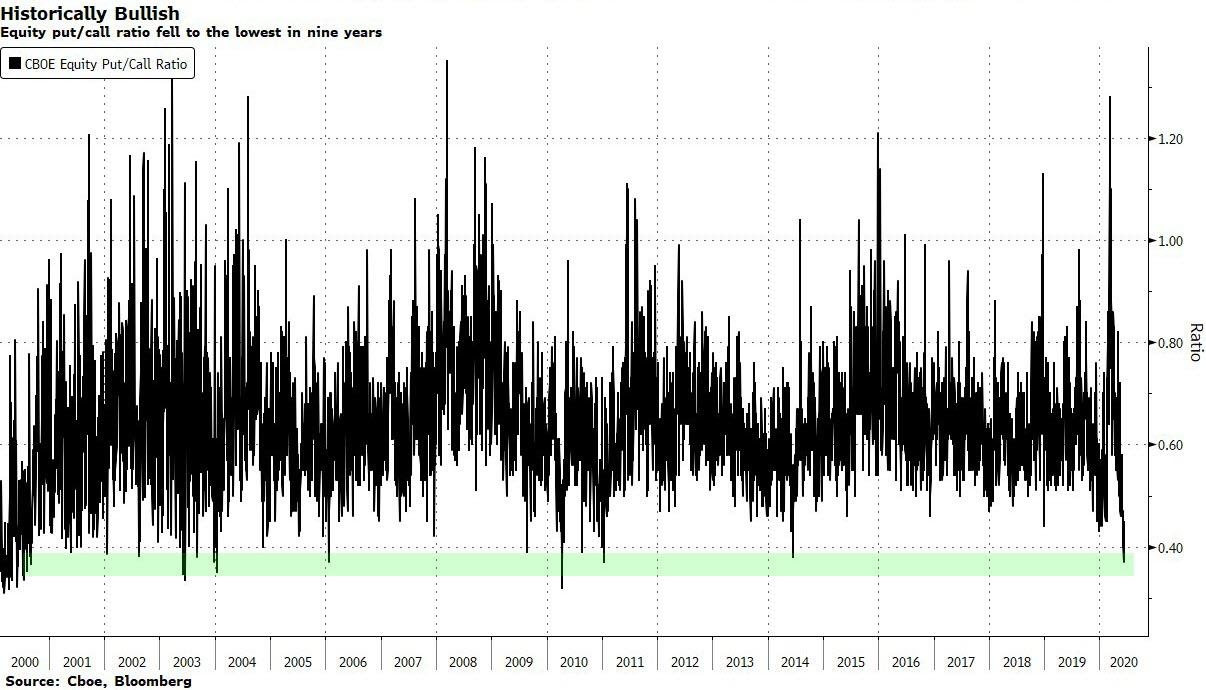

And this collapse comes as the market has abandoned hedges…

Source: Bloomberg

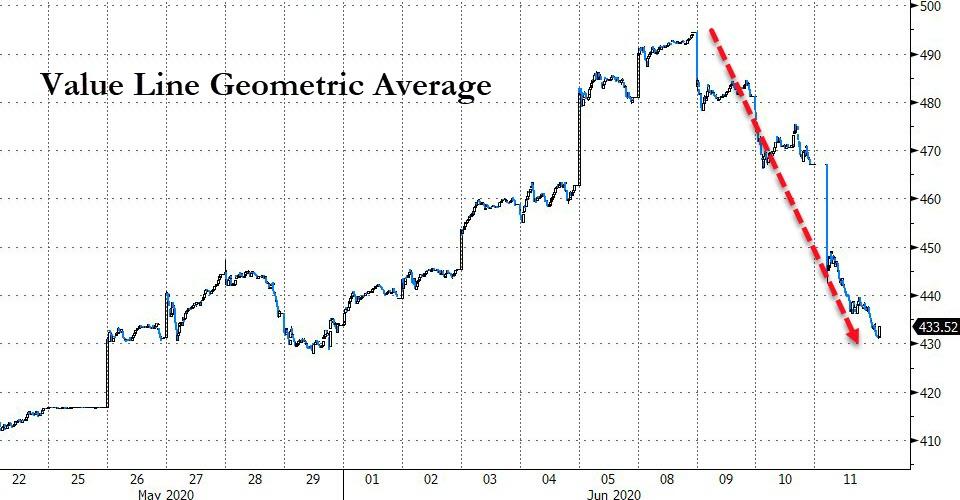

The median price of US stocks is down 12.5% in the last few days…

Source: Bloomberg

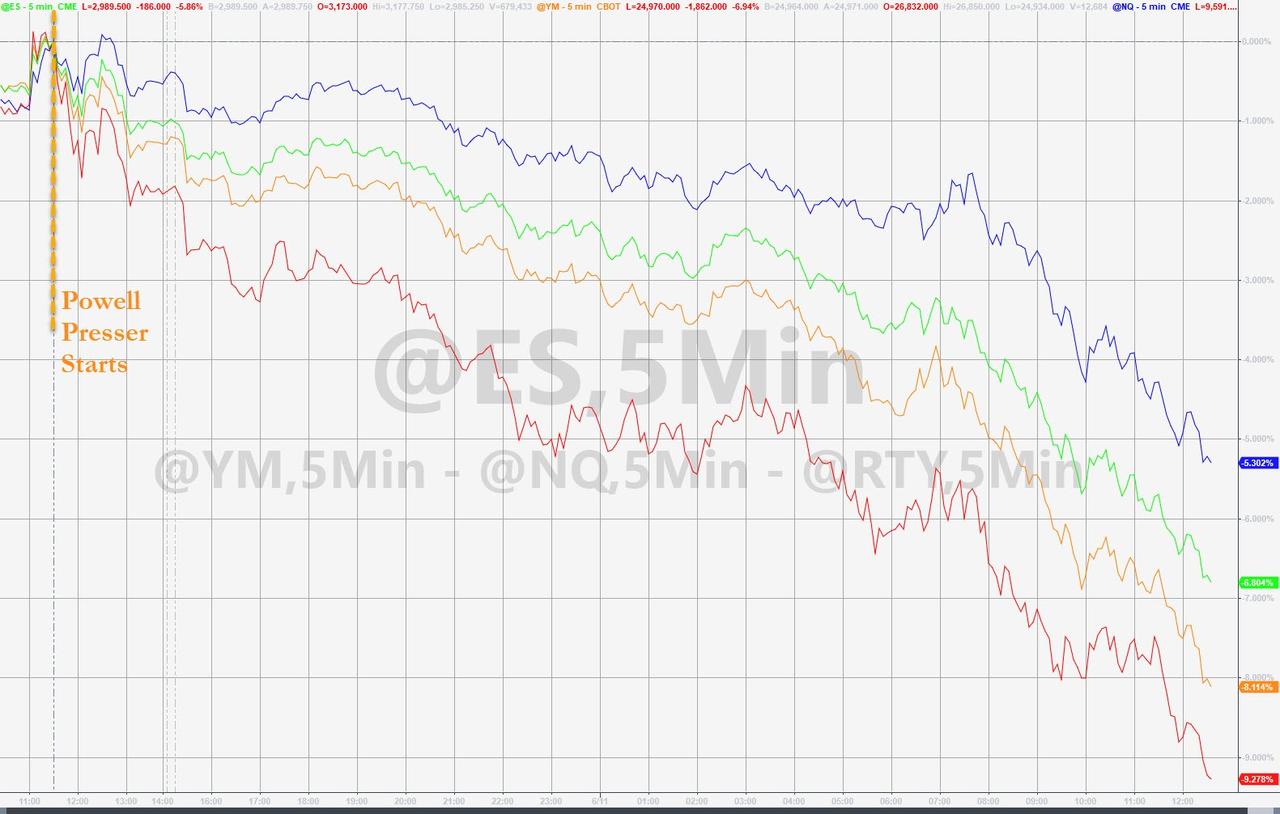

Since The Fed statement and Powell presser, bonds & bullion are bid as stocks sink…

From the moment Jay Powell began his press conference, things “escalated very quickly”…

For many freshly minted day-traders, this is inconceivable… but to veterans, we’ve seen this malarkey before…

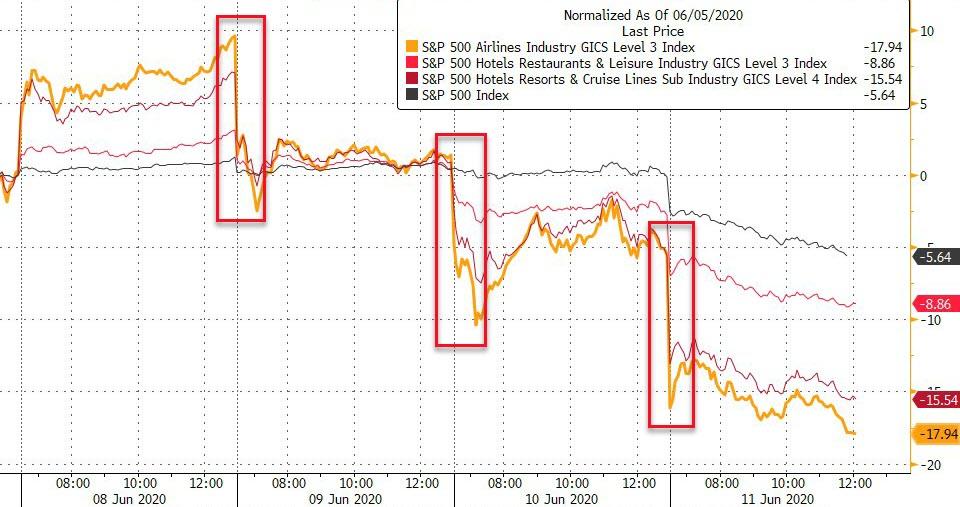

Looks like those rampant “Re-Open Rally” runs into value were entirely wrong…

Source: Bloomberg

Virus-impacted sectors are reversing all their insane gains…

Source: Bloomberg

Boeing, Boeing, Gone!

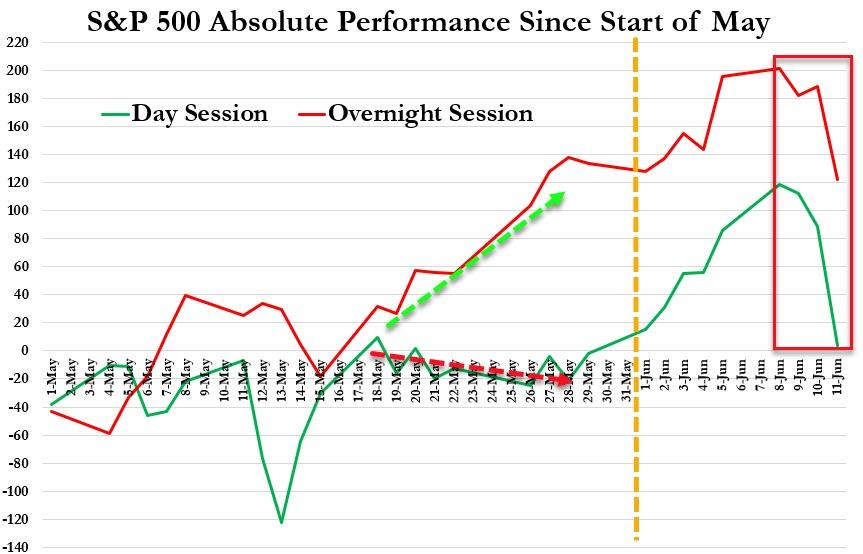

The overnight session remains a big winner but June has seen day session and overnight session syncing up…

Small Caps tumbled back to their 100DMA…

S&P dumped back to its 200DMA…

Dow dumped back to its 100DMA…

The S&P 500 appears to have tagged unchanged on the year (3230.78) and given up…

Banks bloodbath’d further today…

Source: Bloomberg

…extending the reversal from the perfect tag of the 200DAM…

Source: Bloomberg

VIX soared back above 35 today (not call-buying this time) as its curve inverted once again for the first time since April….

Source: Bloomberg

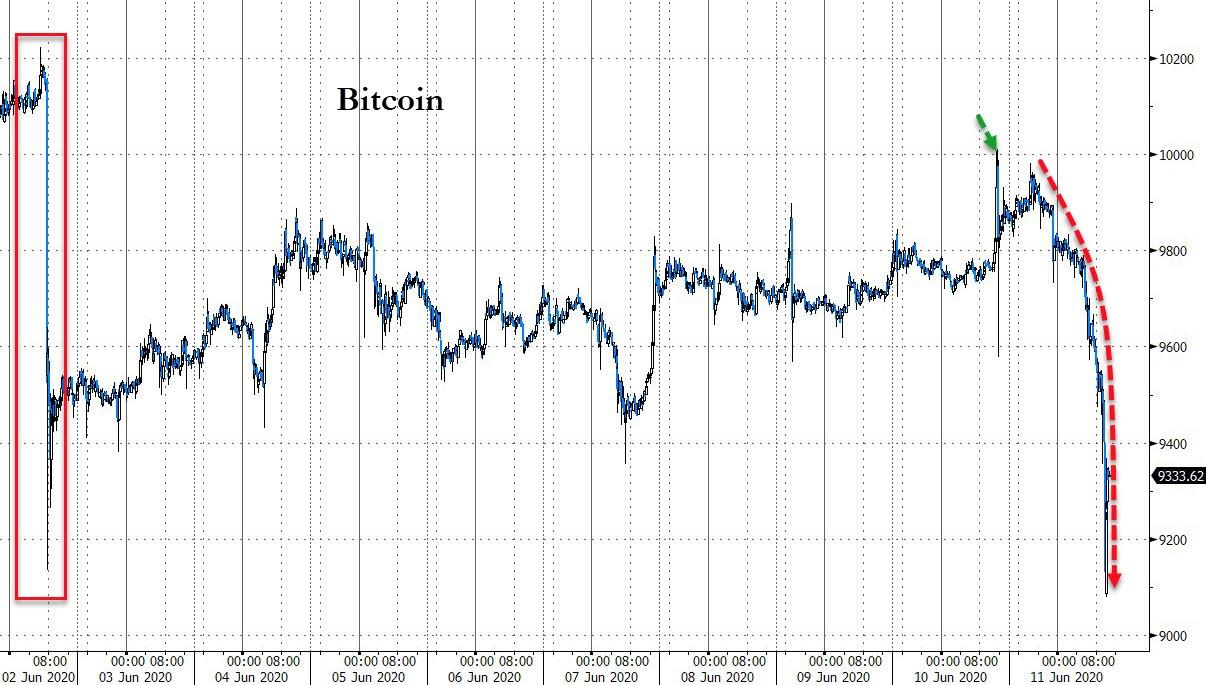

Bitcoin was also battered today (after tagging $10k yesterday)…

Source: Bloomberg

But, on the positive side, bonds were bid…

Source: Bloomberg

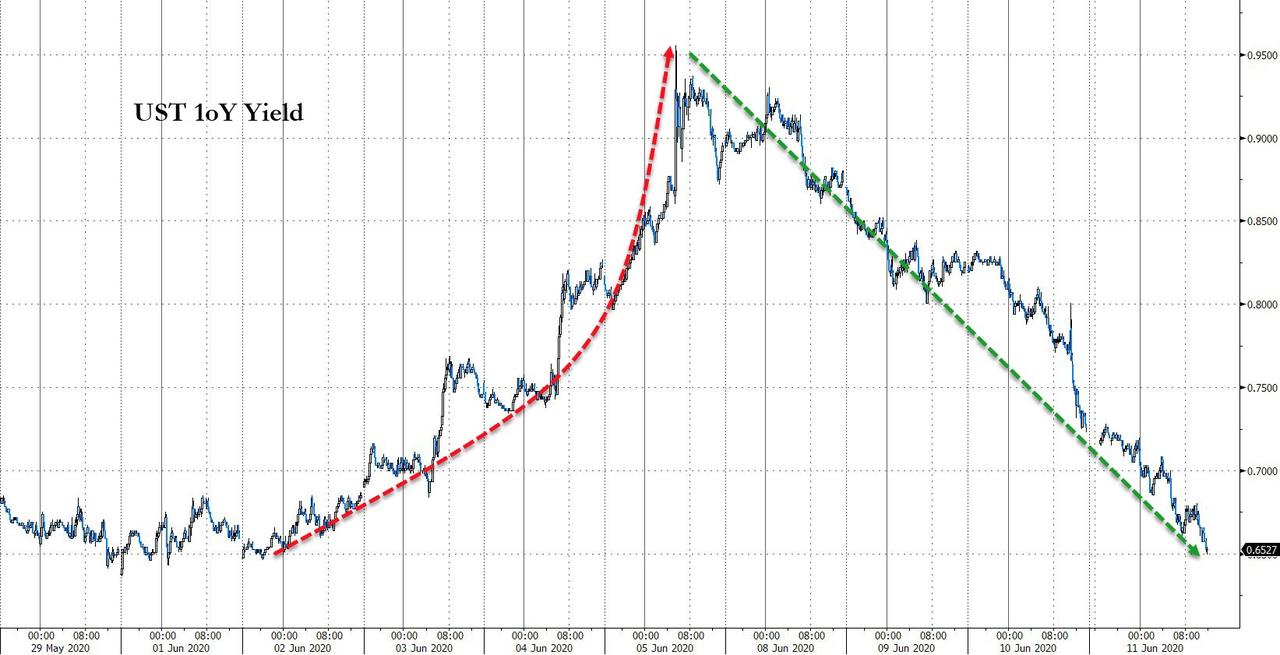

As the coiling yield dismisses the false upside breakout of the reopen rally…

Source: Bloomberg

Treasuries have erased all their losses for June with the long-end yields actually now lower this month…

Source: Bloomberg

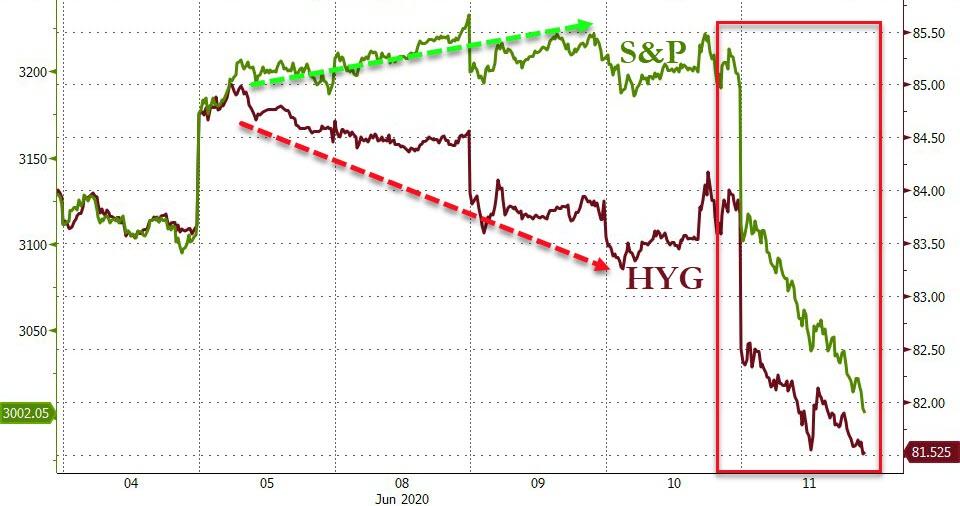

Despite everyone’s excitement about The Fed’s apparent HY backstop, it led the drop…

Source: Bloomberg

And precious metals surged (though we did see some liquidation that was reminiscent of the ‘sell everything’ trend we saw in March)…

Source: Bloomberg

As black gold was battered (WTI was down over 10% at its worst, back to a $35 handle, but bounced)…

Source: Bloomberg

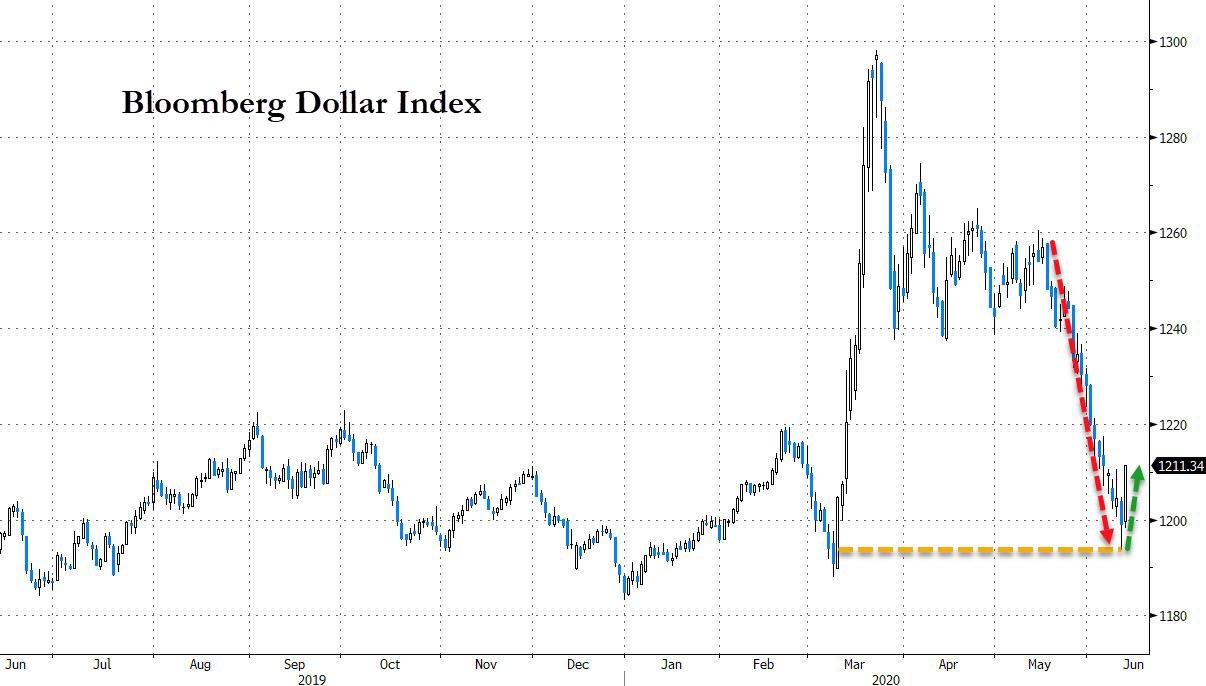

The dollar screamed higher today (biggest jump in 3 months), bucking its recent trend dramatically…

Source: Bloomberg

Notice where the dollar bounced…

Source: Bloomberg

Finally, is it catch-down time?

Source: Bloomberg

Robinhood’rs favorite stock routed…

And yesterday’s big winner…

“These are the days I live for… it was too easy”…

You wanna get nuts? Let’s get FUCKING NUTS. How low can we go? Do the suits think I’m gonna flinch? #DDTG pic.twitter.com/3vsBWvMpCO

— Dave Portnoy (@stoolpresidente) June 11, 2020

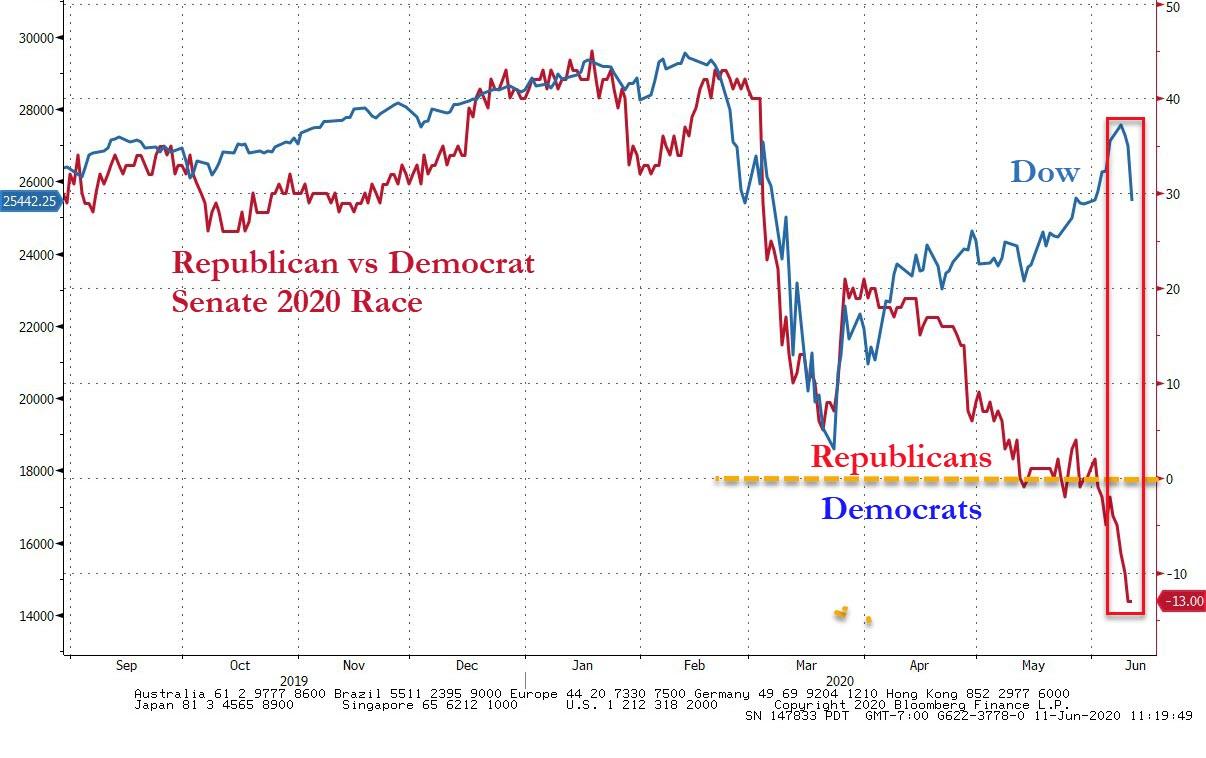

And one wonders if this is the real reason why stocks suddenly puked the last two days…

Source: Bloomberg

via ZeroHedge News https://ift.tt/3cQIYxH Tyler Durden