‘Father Of Credit Risk Modeling’ Has Ominous Warning Over “Insolvent” Companies Piling Up Debt

Tyler Durden

Wed, 07/15/2020 – 18:10

“When there is an increase in insolvency risk, what you do not need is more debt. You need less debt.”

That is the common-sense warning from Ed Altman that every talking head in the world seems incapable of understanding or admitting.

Altman, who, along with Oldrich Vasicek, is often described as the father of credit risk modeling, warns that this year’s spate of “mega” insolvencies is just getting started.

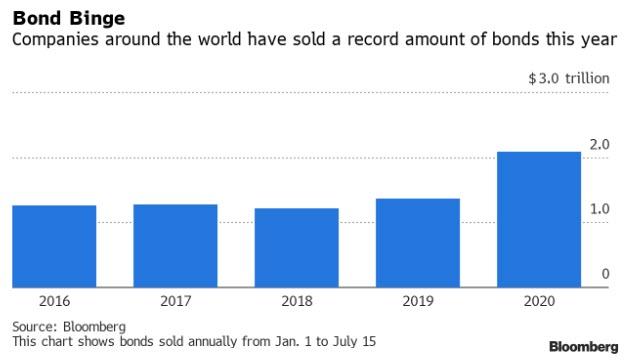

On the back of Fed guarantees, global firms have sold a record $2.1 trillion of bonds this year, with nearly half coming from U.S. issuers, according to data compiled by Bloomberg.

“The speed and magnitude of the increase in corporate debt this year poses various risks to an already fragile global economic outlook,” said Ayhan Kose, director of the World Bank Group’s Prospects Group.

While the stimulus-fueled rally in credit markets since March has helped borrowers stay afloat during the coronavirus crisis, Bloomberg’s Denis Wee reports that Altman and others have warned that many companies are just delaying an inevitable reckoning.

“There was a huge buildup in corporate debt by the end of 2019 and I thought the market would gain some much needed de-leveraging with the Covid-19 crisis,” said Altman, who is also director of credit and debt market research at the NYU Salomon Center.

“Now, seems like companies again are exploiting what seems to be a crazy rebound.”

For Altman, some of the debt sold “kicks the can down the road” for firms that don’t deserve support.

Altman is most famous for his “Z Score”, which is used to predict the likelihood that a business will go bankrupt within the next two years.

The formula is based on information found in the income statement and balance sheet of an organization; as such, it can be readily derived from commonly-available information. The Z score is based on the liquidity, profitability, solvency, sales activity, and leverage of the targeted business. Given the ease with which the required information can be found, the Z Score is a useful metric for an outsider who has access to a company’s financial statements. In its original form, the Z score formula is as follows:

Z = 1.2A x 1.4B x 3.3C x 0.6D x 0.99E

The letters in the formula designate the following measures:

A = Working capital / Total assets [ Measures the relative amount of liquid assets]

B = Retained earnings / Total assets [Determines cumulative profitability]

C = Earnings before interest and taxes / Total assets [measures earnings away from the effects of taxes and leverage]

D = Market value of equity / Book value of total liabilities [incorporates the effects of a decline in market value of a company’s shares]

E = Sales / Total assets [measures asset turnover]

A Z score of greater than 2.99 means that the entity being measured is safe from bankruptcy. A score of less than 1.81 means that a business is at considerable risk of going into bankruptcy, while scores in between should be considered a red flag for possible problems. The model has proven to be reasonably accurate in predicting the future bankruptcy of entities under analysis.

This scoring system was originally designed for manufacturing firms having assets of $1 million or more. Given the targeted nature of the model, it has since been modified to be applicable to other types of organizations.

This approach to evaluating organizations is better than using just a single ratio, since it brings together the effects of multiple items – assets, profits, and market value. As such, it is most commonly used by creditors and lenders to determine the risk associated with extending funds to customers and borrowers.

And judging by the weakness he is seeing in his Z-Scores, for instance, here is UAL (note this is even before Q2’s massive collapse)…

Altman warns, companies are doing the opposite of what they should be doing, which is to de-leverage as the banks did after the global financial crisis of 2008.

via ZeroHedge News https://ift.tt/2Wm1I2G Tyler Durden