Mission Accomplished: Fed Officially Blows The Biggest Ever Bubble

Tyler Durden

Fri, 07/31/2020 – 16:00

Mission Accomplished:

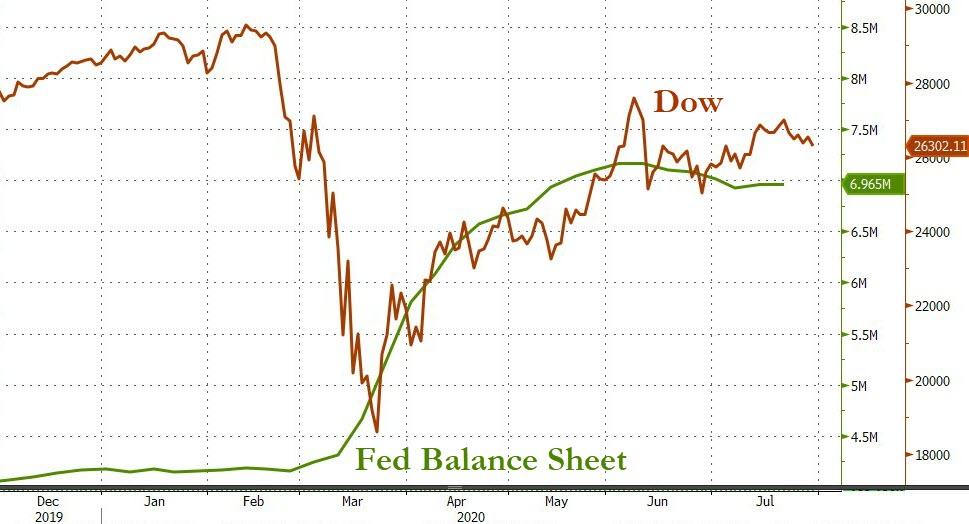

Hey @federalreserve you did it, you officially blew the biggest bubble ever:

All-time high monthly close in S&P 500

All-time low 10Y yield close

All-time high in gold pic.twitter.com/zjC7wd5o8J— zerohedge (@zerohedge) July 31, 2020

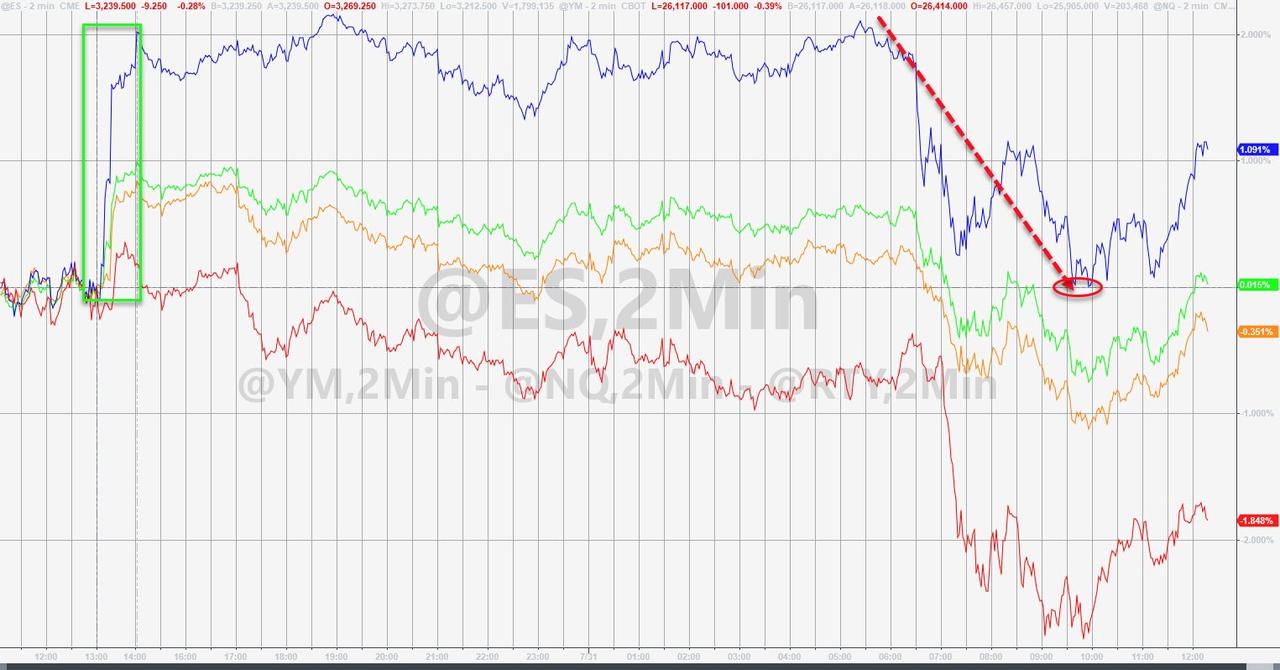

Stocks managed gains on the month (4th month in a row) – Nasdaq best, Dow worst…

Source: Bloomberg

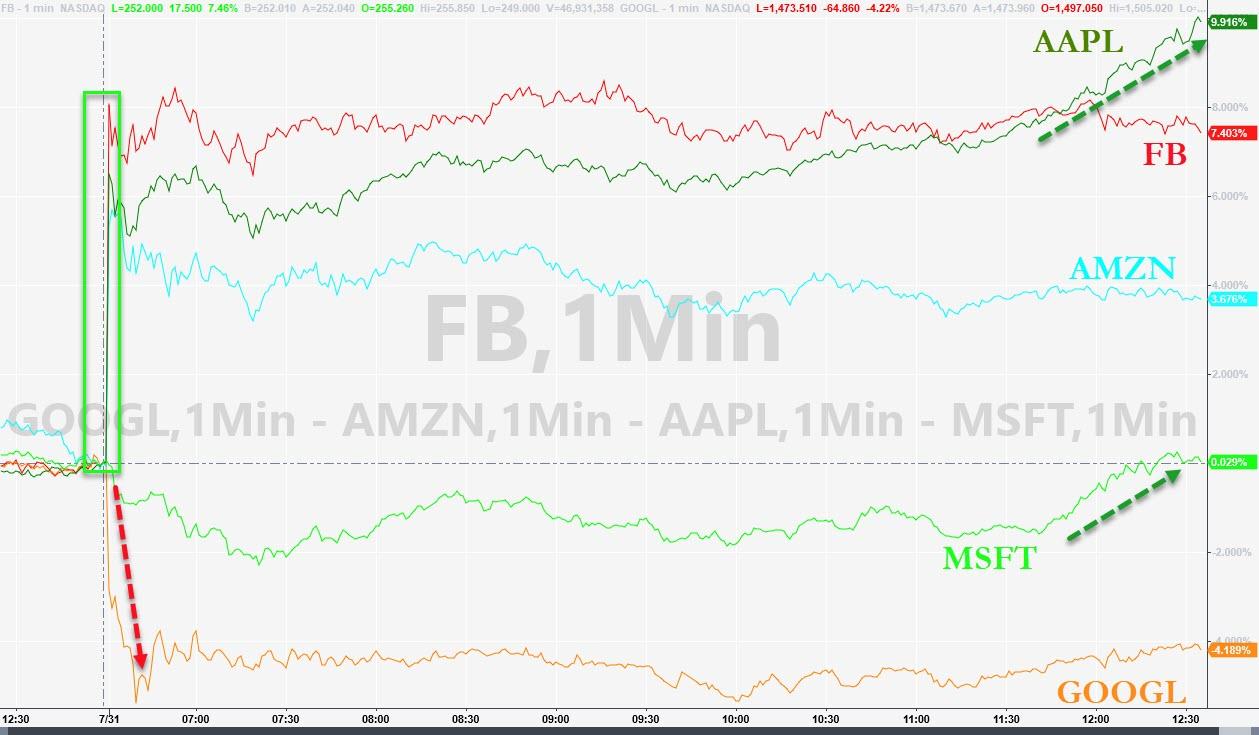

And note that despite the epic surge in the mega tech stocks overnight… Yes, that is AAPL up 10%!! (GOOGL -4%)…MSFT managed to rally back to unch after rumors of it buying TikTok…

Apple is up $170BN today, more than the market cap of Oracle, more than the GDP of Hungary; Apple’s value increase today would be the 33rd biggest company in the S&P500.

Nasdaq was not a one-way street today as CNBC stunningly remarked “nasdaq has now gone negative which is quite interesting…”

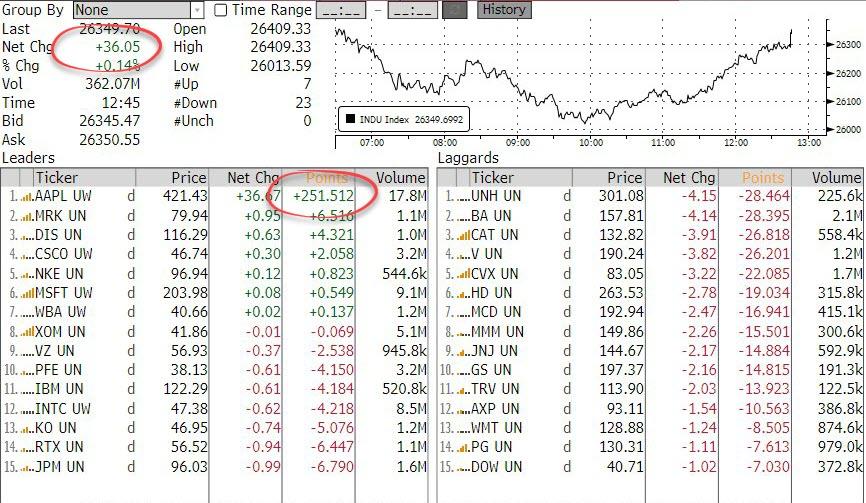

And you have to laugh at this – The Dow scraped by today… as AAPL’s insane squeeze higher dominated the rest of the entire index…

Source: Bloomberg

but that will change when AAPL splits.

BUT, it was in currency, commodity, credit, and crypto land that the real fun and games took place.

Bonds were bid pretty much all month with the long-end notably outperforming…

Source: Bloomberg

… and pushing to new record low yields…

Source: Bloomberg

Some highlights:

-

2Y Treasury yields fell for the 8th month in a row

-

30Y Treasury yields fell for the 5th month this year

-

2s30s Curve flattened by the most since August 2019

Source: Bloomberg

Still a long way down for stocks if bonds are right…

Source: Bloomberg

Gold and silver screamed higher on the month.

-

Silver’s best month since 1979 (when the Hunt Brothers tried to corner the market)

-

Gold’s best month since 2011

Spot Gold reached a new record above Sept 2011 and Futures topped $2000…

Source: Bloomberg

Silver’s at its highest since June 2013…

Source: Bloomberg

Oil’s up for the 3rd month in a row, but has largely trod water all month…

Source: Bloomberg

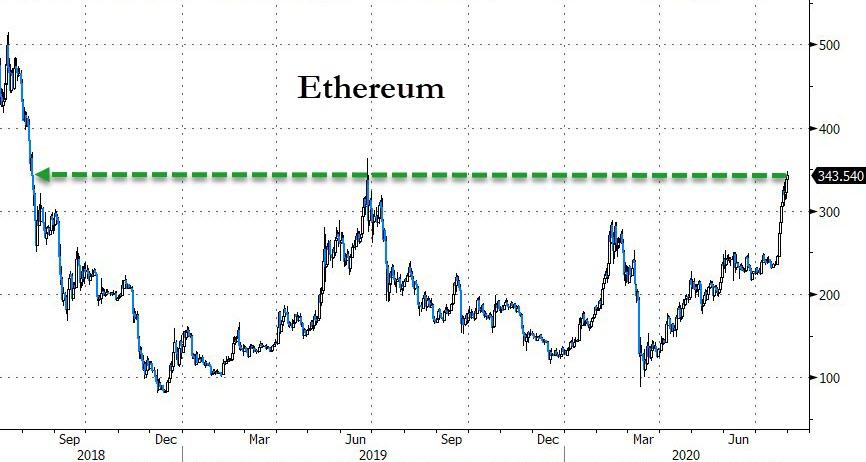

Cryptos soared in July with Ethereum best (up over 50%, its 4th monthly rise in a row) and Bitcoin up 22%…

Source: Bloomberg

Ethereum closed at its highest since August 2018…

Source: Bloomberg

And helping all these assets rise in value, DXY Dollar Index suffered its biggest monthly drop since 2010…

Source: Bloomberg

Breaking a key up-trend line…

Source: Bloomberg

Did Washington mess with the ‘money’ one too many times?

Gold seems to think so…

Source: Bloomberg

Finally, we note that ‘soft’ survey macro data has surged full of hope to a region that has not ended well in the recent past

Source: Bloomberg

Better keep pumping…

Source: Bloomberg

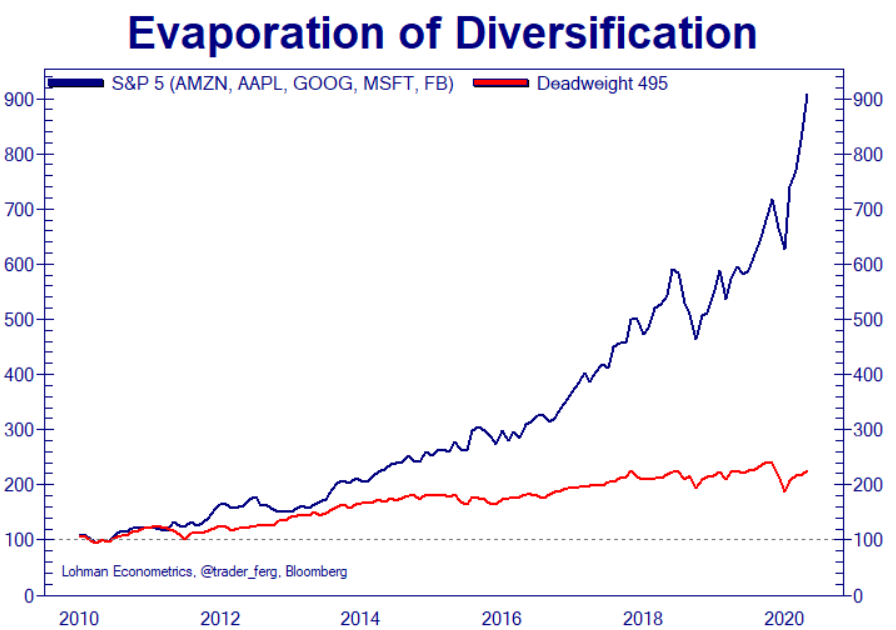

Remember, Diversify, Diversify, Diversify… oh wait!

h/t @Not_Jim_Cramer

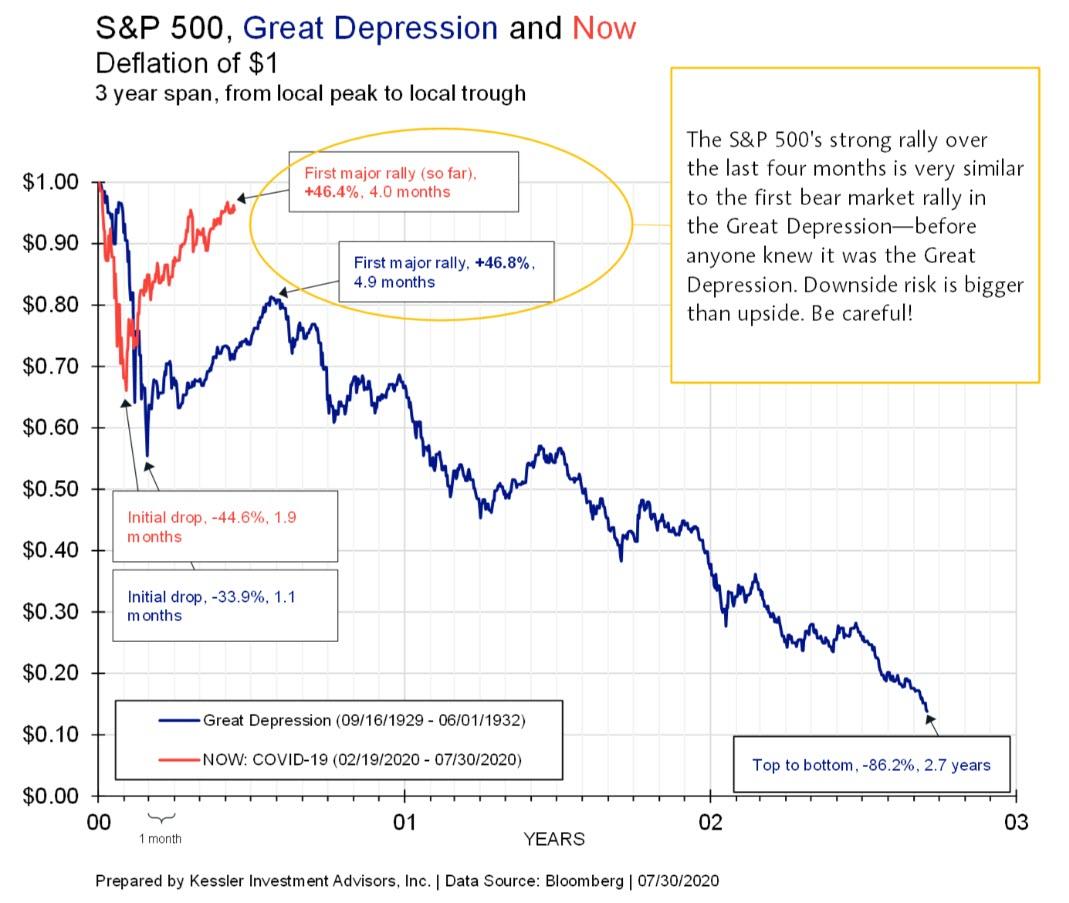

We’ve seen this before…

Trade accordingly.

So – summing up July – Stocks up, Bonds up, Gold up, Silver up, Oil up, Crypto up, Dollar Down (along with Fed credibility.)

via ZeroHedge News https://ift.tt/2XdaosQ Tyler Durden