The Fed’s Dollar Debasement Will Trigger An Unprecedented Structural Shift

Tyler Durden

Fri, 07/31/2020 – 15:45

Whether it is merely the continued debasement of the dollar by a Fed that has gone full-tilt on money printing, or a historic transition away from the current global reserve currency, the recent sharp drop in the US currency is all Wall Street is talking about, with some such as Goldman going so far as to warn that “real concerns are emerging” about the US Dollar as global reserve currency (and is a reason why the bank is buying gold instead).

BofA’s CIO Michael Hartnett also could not resist the temptation of commenting on the dollar, and in his latest weekly Flow Show note, discussed what is rapidly emerging as the biggest story of 2020.

But before we get there, here is Hartnett on 2020, first looking at the year in numbers:

- Covid-19 deaths >670k

- Global GDP loss $10tn

- US claims >50mn

- US budget deficit >40% of Q2 GDP

- MOVE index all-time low

- Cash on sidelines $5tn,

- US corporates raise $2.7tn,

- Global stock market cap crashes $30tn, then $25tn rally.

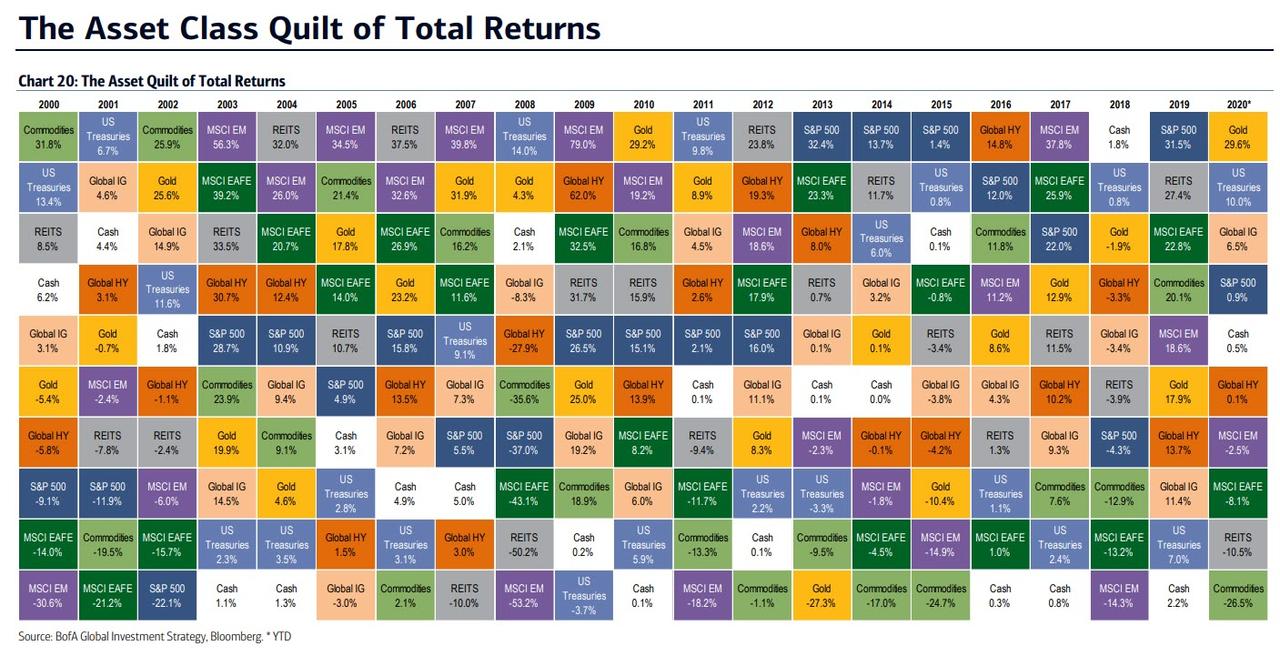

… then in terms of returns, where gold not surprisingly is the best performing asset:

… and then, tying it all together, showing why $20 trillion is the most important number for 2020: that, as the BofA strategist explains, is the total in global policy stimulus unleashed so far in 2020 and consisting of $8.5TN in monetary and $11.4TN Fiscal stimulus (it does not include any of the Phase IV US fiscal stimulus which Congress is fighting over now).

With this fiscal and monetary tsunami it is hardly a surprise that investors are flocking to the deflationary safety of gold and bonds, and dumping the currency in which all this new liquidity is being created out of thin air, the dollar.

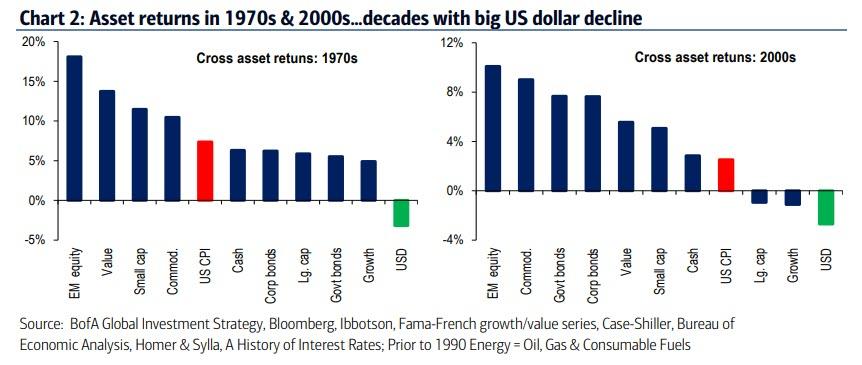

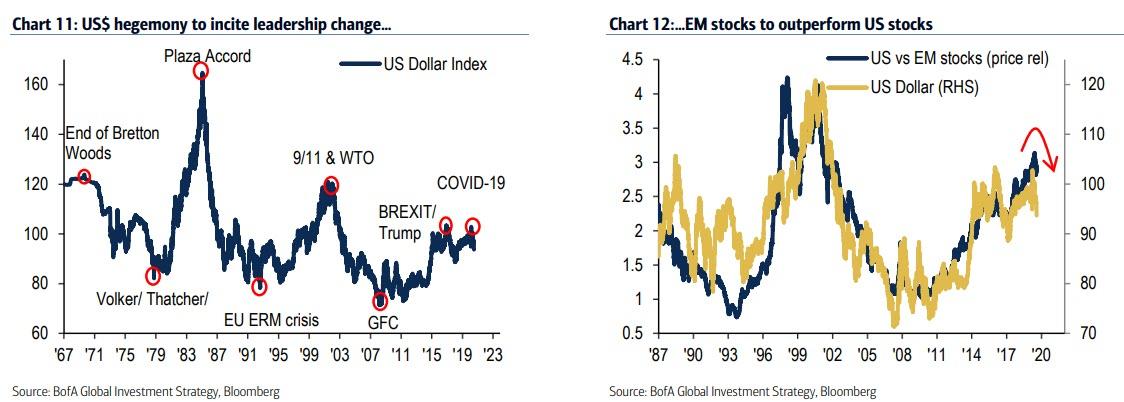

As Hartnett puts it, when looking at dollar bear markets, new highs in gold tends to emerge on “dollar debasement” themes, and notes the two great dollar bear markets were in 1970s & 2000s, with outperforming assets those decades were EM equities, commodities, small cap, and value stocks.

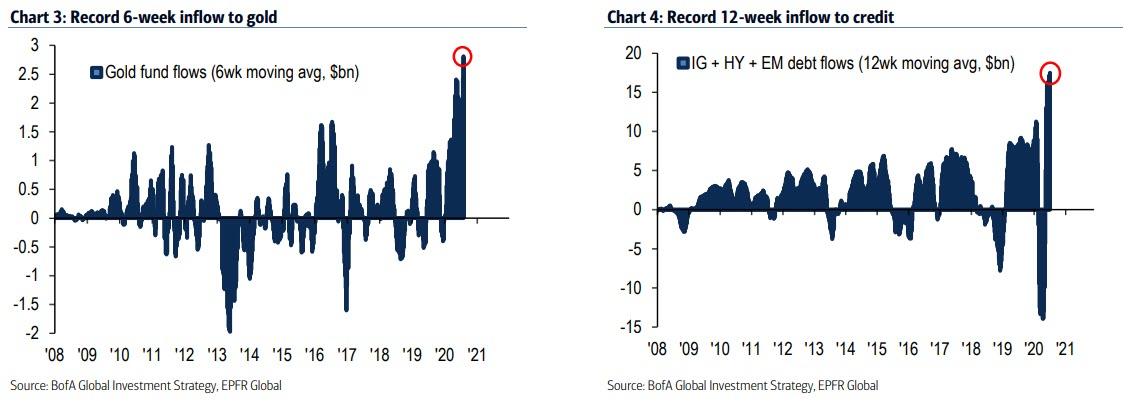

Of course, gold – as a “hard” currency – is expected to outperform everything, and sure enough recent inflows into gold funds are off the charts, with $16.7BN allocated over the past 6 weeks, with other notable fund flows include a credit surge: $210bn with a record 12-week inflow to IG, HY and EM bonds), $75.9BN out of money-market funds in the past 11 weeks after $1.2tn inflow.

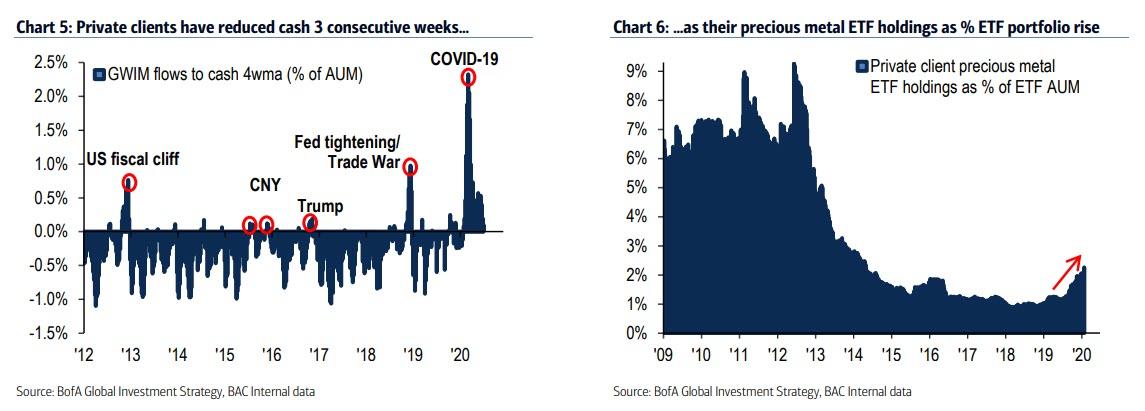

Meanwhile, as Hartnett explains looking at BofA private clients, there is a lot more gold buying on deck: the current asset allocation is 58.7% equities, 22.0% debt, 13.0% cash, reducing cash holdings for 3 consecutive weeks (first time in 2020 – Chart 5); At the same time, their precious metal ETF holdings % ETF portfolio on rise (2.3%) but well below 9.3% peak of 2012. So they can and will buy a whole lot more.

Fund flows aside and gold surge aside, Hartnett takes a step back to observe the bigger stories of the year unleashed by dollar debasement, which include:

- the coming era of bigger government, smaller world,

- unconventional fiscal policy accelerated by pandemic, heralded by higher gold & weaker US dollar, best positioned for via commodities, HY bonds, and long RoW stocks vs US stocks;

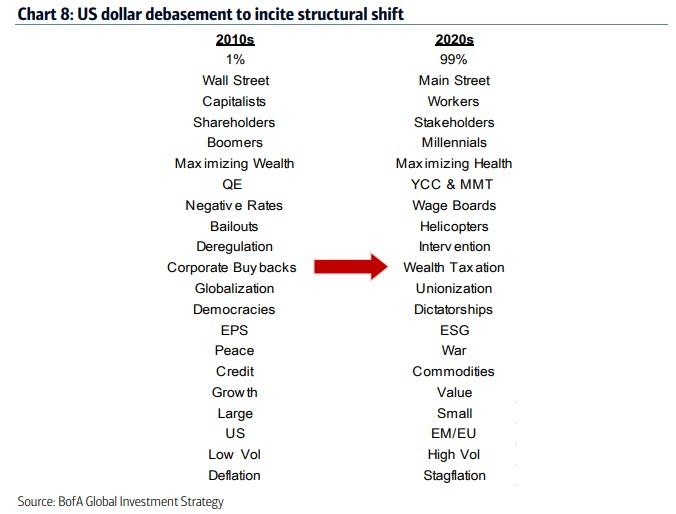

- 2010s were decade of liquidity, globalization, profits;

- 2020s to be decade of deficits, localization, redistribution;

- War on Inequality means unconventional monetary policy of 2010s to be replaced by unconventional fiscal policies of 2020s…MMT, UBI, debt forgiveness, unionization (Chart 8).

While not central to Hartnett’s thesis, he sees two outcomes for markets: a big top in the S&P preceded by a “summer dip.”

Big top: 2020 risk asset peak most likely at time of vaccine, full capitulation by bears, higher interest rates (lower US $ + higher yields = risk-off); note history of great bear market rallies predicts SPX 3300-3600 top between Aug-Jan.

Summer dip: summer dip in SPX to 3050 plausible given cross-asset price action on universal belief in interest rate suppression & US$ debasement of US$ (lower $ + lower yields = risk-on); summer trading positives of Fed, tech & credit are peaking

And, as usual, the US dollar is the lead indicator of all major changes because:

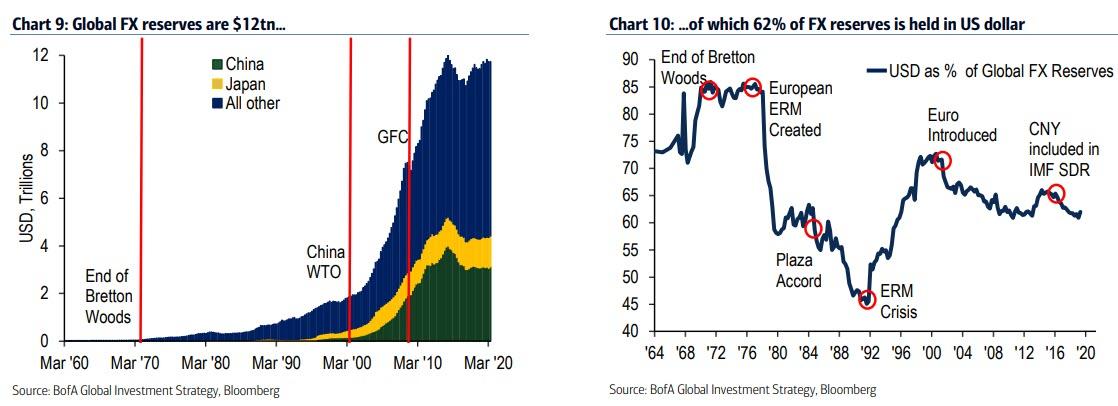

- US$ = 62% of global FX reserves (Euro = 20%, JPY = 6%, GBP = 4%, CNY = 2% – Chart 10);

- US$ = 45% of global FX reserves in 1992; global FX reserves are $12tn (up $10tn since 2001 – 9/11 & China/WTO – Chart 9);

- FX reserve shares of Euro (with EU fiscal union) & China (in Tech War with US) likely to rise vs US.

Meanwhile, the most important asset over the short-term is neither gold, nor dollar, nor risk assets, but oil which is “now key for autumn rotation” as consensus remains stubbornly entrenched in deflationary portfolio: “if higher gold, weaker US dollar (Chart 11) followed by oil >$50/b deflationary positions likely to crack (Chart 12)…

… especially if Fed YCC means bond yields stop undershooting expectations (on average by 100bps since 2008).”

via ZeroHedge News https://ift.tt/30ibYeA Tyler Durden