Rabobank: Facebook And Twitter Are Suppressing The Biden News While Allowing A “Slew” Of Other Unconfirmed Stories

Tyler Durden

Thu, 10/15/2020 – 11:35

By Michael Every of Rabobank

Barbara Streisand in Split-screen

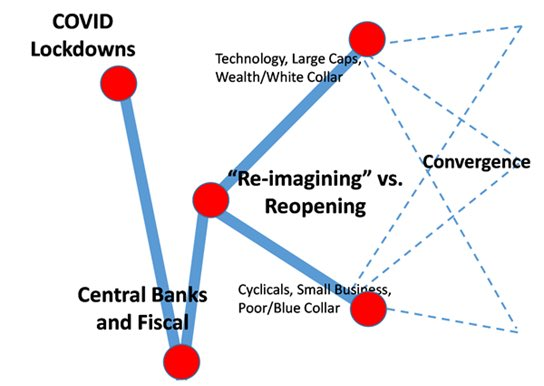

Life is very much split-screen at the moment. We obviously have the whole K-shaped recovery thing: depending on which screen you are watching, life is either great or terrible.

We also have the deep political dichotomy around the US election, which is taken up another notch today with the alleged scandal surrounding Hunter Biden: you are either reading all about this, or you aren’t aware of it, depending on which media you follow – and which stories they follow.

Notably, Facebook made clear it would be suppressing this particular unconfirmed story, unlike a slew of others, some of which have subsequently proved to be wrong. So did Twitter. The editor of the New York Post –running the Hunter story, and which can be sued for defamation and libel– claims he was blocked from tweeting it by Twitter, which can’t be. Other users trying to do the same saw the message: “We can’t complete this request because this link has been identified by Twitter or our partners as being potentially harmful. Visit our Help Center to learn more.” Those trying to share the story got a message saying the link was “unsafe”, “potentially spammy”, “malicious”, “violent”, or “misleading”. The original tweet from the New York Post was also deleted by Twitter, and the accounts of some people trying to retweet it were suspended.

This is all as the role of social media firms and censorship is already a hot political issue, with a Congressional report calling for them to be broken up: well, things just got even hotter. Expect to hear much more about the First Amendment, Section 230,…and the ‘Streisand Effect’.

On the same day in the US, the Miriam-Webster dictionary also redefined a commonly-used word to a completely new meaning to follow its use in the contentious confirmation hearing for judge Amy Coney Barret – and one in complete opposition to how the same word was used officially by Justice Ruth Bader Ginsburg, whom ACB might replace, as recently as 2017.

Turning the heat up even more, Germany’s ambassador to the US tweeted out (with no problems): “Hannah Arendt, a German Jew, political theorist and philosopher, was born on this day in 1906. One of her many legacies: Totalitarianism can flourish where people systematically refuse to engage with reality, and are ready to replace reason with ideology and outright fiction.” Whom was that directed at? Or was it just random European intellectual musing? Of course, the White House already accuses Germany of just that kind of fiction in its mercantilism-over-values foreign policy; and a German official was recently alleged to have covered up Chinese influence operations in the country so as not to provoke a response that could damage business ties. That tweet won’t help German-US business ties much though.

Similarly hot, then not on more than one level, and on two screens, a museum in France was displaying an exhibition about Genghis Khan and the Mongols and their Empire; and now isn’t, because China insisted it had to remove the words “Genghis Khan” and “Mongols” and “Empire”, and wanted a say over all legends, maps, and brochures; in response, the museum closed it all down so nobody gets to see anything at all.

Markets will probably remain sanguine about these kind of trends **in the West** right up until it’s something they care about –or themselves– in the cross-hairs. On which note, the US might be seeking to blacklist Ant Group, so we can add another Chinese firm to the list of market entities being blocked in some places.

Back to the US election, we can take two-screen-ery to extremes tonight as Democrat Biden holds a town-hall event live on ABC TV to replace the presidential debate we were supposed to have before President Trump caught Covid – which he looks to be over as he dances his way through YMCA. Meanwhile, Trump will be holding a rival town-hall event live on NBC TV at the same time. Joe Rogan is presumably not involved. Hopefully neither is YMCA.

For those who remember the good old days when there used to be live sport with actual people watching, this is like the World Cup football games that were big enough to be broadcasted live by both major TV networks. You were always tempted to keep flicking back and forwards between the two to see if you were missing an angle, replay, or sarcastic comment, or sometimes even in the forlorn hope the score was different (You weren’t; it wasn’t.) Let’s see what the scores are, and if there are any red cards. However, markets, as in 2016, aren’t even glancing at the other screen. As the media quotes an analyst today, a Trump win over Biden would be the ‘biggest error’ in ‘modern era of mass polling’. True: but then again, polling response rates didn’t used to be as low as 5-6%, which always distorts the sample group. This is the stuff fat tail risks are made of!

Meanwhile, we are far from guaranteed to get any fiscal stimulus pre-election given Republicans and Democrats are still only talking, with Mnuchin admitting a deal is “unlikely” – although there was pressure on Nancy Pelosi to compromise in an interview on CNN(!) yesterday, as the political screens somehow got crossed over briefly. Risk is not going to be on like that.

Very firmly on two very different screens is another ‘lower forever’ issue: the ineffectiveness of fiscal stimulus anyway. As a pithy example, wage inflation is still largely absent in the UK, and we can see why. However, Sky News reports one of the reasons the UK has managed to spend GBP12bn on a track and trace system that doesn’t work is that they have been paying management consultants up to GBP7,000 a day (equivalent to an annual salary of over GBP1,500,000). That’s almost like a day’s work for Mrs Streisand. Once again, we see the Cantillon effect in effect: it’s good to be close to the king. Or Babs. We also see why there is no real inflation despite huge fiscal expenditure. Or rather very localized inflation. The consultant paid GBP7,000 a day isn’t going to be too price sensitive or consumption averse at the moment; but is this really how the IMF recommends using fiscal stimulus, which it now recommends for once?

BoJo is meanwhile pleasing markets, as well as management consultants, by showing his 15 October deadline for walking away from Brexit talks is not a hard one. Issues like fishing may be flexible after all (as Bloomberg implies with its brilliant headline: ‘Fish as Chips’). Apparently now the real deadline is the end of the month, or even early November, which is starting to get last-minute enough to be genuinely European. Germany is allegedly pursuing its usual mercantilist policy, and telling France to be more flexible over the fishing issue that doesn’t matter to it at all compared to continued manufactured goods access to the UK market. One sees why markets like that kind of German stance, even as it takes the moral high ground.

via ZeroHedge News https://ift.tt/2SYRKlG Tyler Durden