Traders Rattled After Morgan Stanley Sees 80% Odds Result Won’t Be Determined On Election Night

Tyler Durden

Thu, 10/15/2020 – 11:55

After we saw a brief surge in market expectations that the election would be resolved quickly on Nov 3 amid an avalanche of polls that predict a Biden avalanche (the same polls that predicted a Hillary avalanche 4 years ago), sentiment for a painless outcome has soured in the past few days, perhaps as doubt has crept into the “accuracy” of these same pollsters whose track record is absolutely catastrophic (as even JPMorgan reminded us).

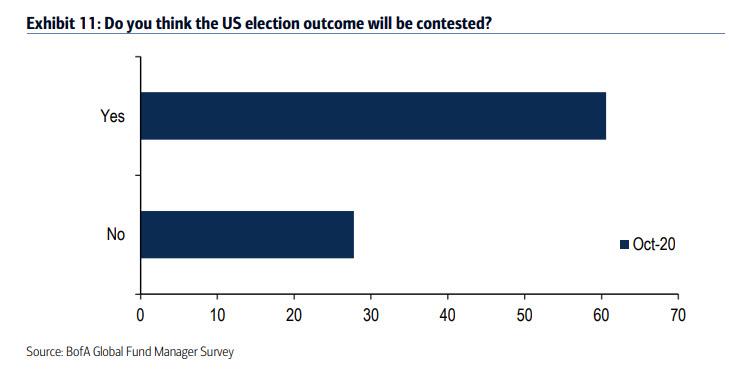

As we noted two days ago, it is the view of the vast majority of Wall Street professionals that a contested election is inevitable, a direct rebuke of all the Biden-friendly polls, with 74% expecting a long and drawn out process.

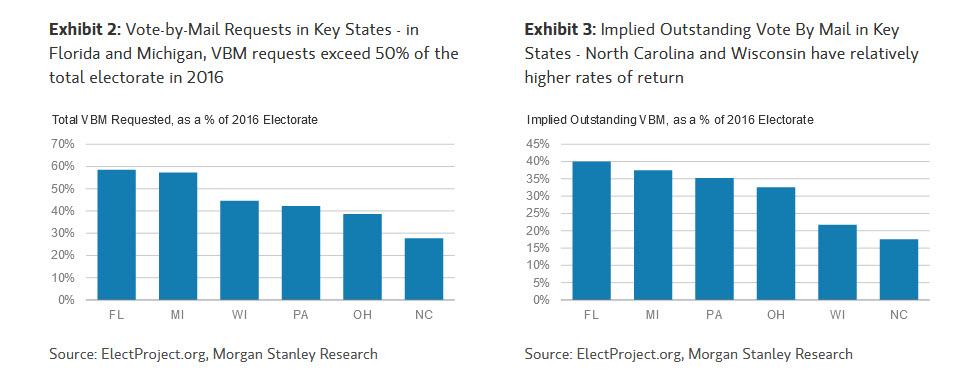

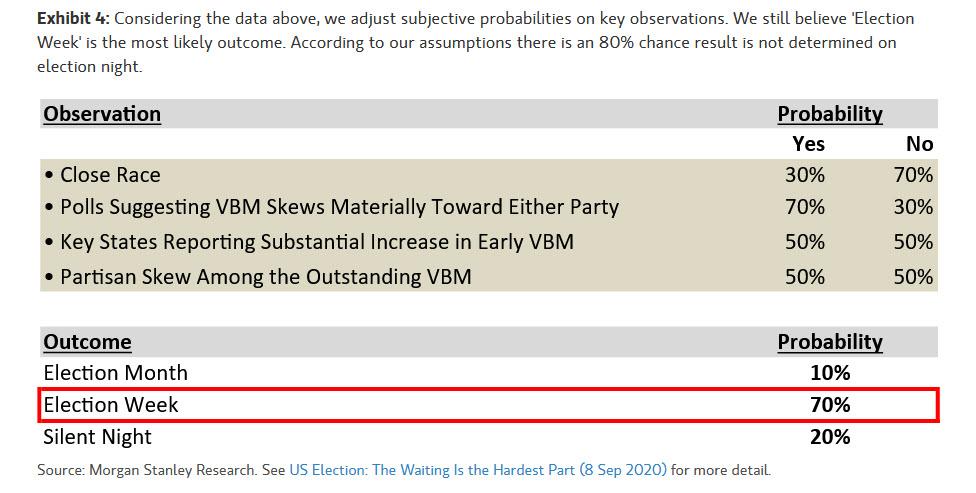

However, there is some good: contrary to some expectations that the election outcome could take as much as a month to be decided – a la Gore vs Bush – new data cited by Morgan Stanley suggests “the worst-case outcome is the least likely.” And while vote-by-mail (VBM) requests are breaking records, a concern given the slower process for counting those ballots, voters appear to be returning those ballots at a rapid pace in key battleground states according to Morgan Stanley’s Michael Zezas.

This reduces the risk of sufficient vote counts to reliably know the election result dragging out for weeks, according to the MS strategist who nonetheless predicts that a reliable result may take some time (i.e., a “Election Week”) given key swing states like WI, where VBM totals are high and ballots can’t be processed or counted before Election Day. In short, Morgan Stanley says that “there is an 80% chance the result is not determined on election night.”

On the other hand, there is an upside surprise is possible if VBM returns accelerate in FL and NC over the next two weeks. These are key tipping point states that can tabulate VBMs early.

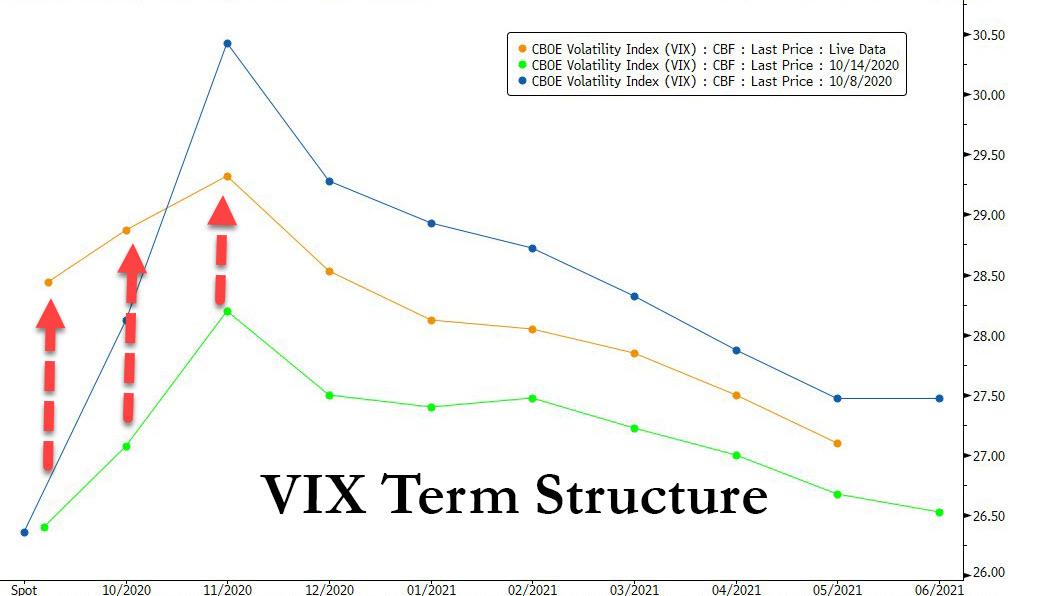

Finally, judging by the VIX term structure where the November “kink” just spiked in the curve, the market is also far less sanguine, with both Oct and and Nov expiries which capture the period around the election, seeing a sizable move higher today (or “kinking”) compared to yesterday, and are almost in line with a week ago.

via ZeroHedge News https://ift.tt/31arEAZ Tyler Durden