Key Events This Week: Final Presidential Debate, Earnings And PMIs

Tyler Durden

Mon, 10/19/2020 – 09:20

Looking at the busy week ahead, we get the final presidential debate of the US election on Thursday, the flash PMIs on Friday, and earnings season moving into full flow with 90 S&P 500 companies reporting. As well as this, there is an array of central bank speakers as usual.

As DB’s Jim Reid previews, in terms of the final presidential debate on Thursday, the format will feature six 15-minute segments, with the topics expected to be announced in advance. Otherwise, investors will be paying close attention to the Senate polls, since the question of whether we have united or divided government in the US next year will determine the likelihood and composition of different stimulus packages. FiveThirtyEight’s model currently puts the chance of Biden winning the presidency at 87%, though the odds of Democratic control of the Senate are at a lower 74% with a few important tight races evident.

Earnings season moves into full swing this week, with 90 of the S&P 500 companies reporting and 78 in the Stoxx 600. In terms of the highlights, we’ll hear from IBM on today, before tomorrow sees releases from Procter & Gamble, Netflix, Texas Instruments, Philip Morris International, Lockheed Martin and UBS. Then on Wednesday, there’ll be announcements from Verizon Communications, Abbott Laboratories, Thermo Fisher Scientific, NextEra Energy and Tesla. Thursday then sees releases from Intel, Coca Cola, AT&T, Danaher and Union Pacific. Finally on Friday, there’s American Express, Daimler and Barclays.

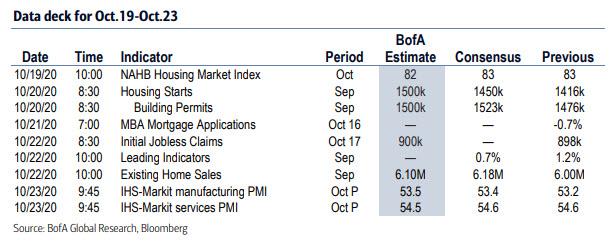

On the data front this week the October flash PMIs from around the world on Friday will be closely watched as ever especially with economic restrictions mounting again, especially in Europe. There’ll also be some attention on the weekly initial jobless claims from the US after last week’s unexpected increase to a 7-week high. Another deterioration would raise further concerns about the state of the US labor market.

The rest of the data, including Central Bank speakers can be found in the breakdown below. Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday October 19

- Data: Japan September trade balance, China Q3 GDP, September industrial production, retail sales, Canada August wholesale trade sales, US October NAHB housing market index

- Central Banks: Fed Chair Powell, ECB President Lagarde, Fed’s Clarida, Bostic, Harker and BoE’s Cunliffe speak

- Earnings: IBM

- Politics: UK House of Lords begins debate on Internal Market Bill

Tuesday October 20

- Data: China September new home prices, Germany September PPI, Japan final September machine tool orders, US September building permits, housing starts

- Central Banks: Fed’s Quarles, Williams, Evans, BoE’s Vlieghe speak

- Earnings: Procter & Gamble, Netflix, Texas Instruments, Philip Morris International, Lockheed Martin, UBS

Wednesday October 21

- Data: UK September CPI, public sector net borrowing, US weekly MBA mortgage applications, Canada August retail sales, September CPI

- Central Banks: Federal Reserve releases Beige Book, Fed’s Mester and BoE’s Ramsden speak

- Earnings: Verizon Communications, Abbott Laboratories, Thermo Fisher Scientific, NextEra Energy, Tesla

Thursday October 22

- Data: Germany November GfK consumer confidence, US weekly initial jobless claims, September leading index, existing home sales, October Kansas City Fed manufacturing activity, Euro Area advance October consumer confidence

- Central Banks: Central Bank of Turkey monetary policy decision, Bank of England Governor Bailey and BoE’s Haldane speak

- Earnings: Intel, Coca Cola, AT&T, Danaher, Union Pacific

- Politics: Final US Presidential Debate

Friday October 23

- Data: Flash October manufacturing, services and composite PMIs for Japan, France, Germany, UK and US, UK October GfK consumer confidence, September retail sales, Japan September nationwide CPI

- Central Banks: Central Bank of Russia monetary policy decision, BoE’s Ramsden speaks

- Earnings: American Express, Daimler, Barclays

Finally, looking at just the US, Goldman notes that the key economic data release this week is the jobless claims report on Thursday. There are several speaking engagements from Fed officials this week, including Chair Powell and Vice Chair Clarida on Monday.

Monday, October 19

- 08:00 AM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will participate in a moderated panel on cross border payments during the IMF annual meeting.

- 10:00 AM NAHB housing market index, October (consensus 83, last 83)

- 11:45 AM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will discuss the economic outlook at a virtual event hosted by the American Bankers Association. Prepared text and Q&A from a moderator are expected.

- 12:00 PM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will speak on transparency into the health of the nation’s largest banks at a virtual conference hosted by the Minneapolis Fed. Audience Q&A is expected.

- 02:20 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss the benefits of an inclusive and diverse economy in remarks at SIFMA’s annual meeting. Prepared text is expected.

- 03:00 PM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the post-virus recovery at a virtual event hosted by Operation HOPE. Prepared text is expected.

Tuesday, October 20

- 08:30 AM Housing starts, September (GS +3.4%, consensus +2.9%, last -5.1%); Building permits, September (consensus +1.6%, last -0.5%): We estimate housing starts rose 3.4% in September following a 5.1% decline in the prior month. Our forecast incorporates boosts from a likely catch-up of single-family starts with firmer permits, lower mortgage rates, stronger construction job growth, and likely mean reversion in the noisy multifamily category.

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give opening and closing remarks for a webinar series hosted by the New York Fed.

- 10:50 AM Fed Vice Chair for Supervision Quarles (FOMC voter) speaks: Fed Vice Chair for Supervision Randal Quarles will discuss the Financial Stability Board’s agenda at an online event hosted by SIFMA. Prepared text and Q&A from a moderator are expected.

- 01:00 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will discuss COVID-19 and the future of the economy at a virtual event hosted by the Detroit Economic Club. Audience and media Q&A are expected.

Wednesday, October 21

- 10:00 AM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss monetary policy at a virtual event hosted by the Money Macro and Finance Society. Prepared text and audience Q&A are expected.

- 12:00 PM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a discussion on a potential amendment to the Minnesota constitution. Audience Q&A is expected.

- 02:00 PM Beige Book, October/November FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the October Beige Book, we look for anecdotes related to growth, labor markets, wages, price inflation, and the economic impacts of the ongoing coronavirus outbreak.

Thursday, October 22

- 08:30 AM Initial jobless claims, week ended October 17 (GS 860k, consensus 860k, last 898k); Continuing jobless claims, week ended October 10 (last 10,018k): We estimate initial jobless claim decreased to 860k in the week ended October 17. We see two-sided risks around this week’s initial claims forecast if California revises initial claims reports after reporting estimated claims since the week ended September 26.

- 10:00 AM Existing home sales, September (GS +5.0%, consensus +4.2%, last +2.4%): After increasing by 2.4% in August, we estimate that existing home sales increased 5.0% further in September. Existing home sales are an input into the brokers’ commissions component of residential investment in the GDP report.

- 11:00 AM Kansas City Fed manufacturing index, October (last 11)

Friday, October 23

- 09:45 AM Markit Flash US manufacturing PMI, October preliminary (consensus 53.5, last 53.2)

- 09:45 AM Markit Flash US services PMI, October preliminary (consensus 54.6, last 54.6)

Source: Deutsche Bank, Goldman, BofA

via ZeroHedge News https://ift.tt/35f9Pl9 Tyler Durden