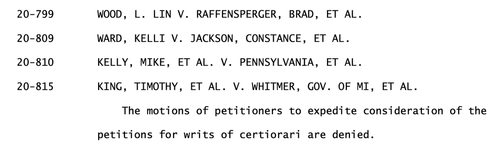

Amazon pulls plug on Parler. The relatively new social media platform Parler has—for now, at least—vanished, after Amazon canceled its web hosting contract with the company effective Sunday night. Google also banned Parler, on Friday, with Apple following suit on Saturday. The companies cite posts making threats against Mike Pence, organizing last week’s events in Washington, D.C., and making plans for further action to challenge the 2020 election results.

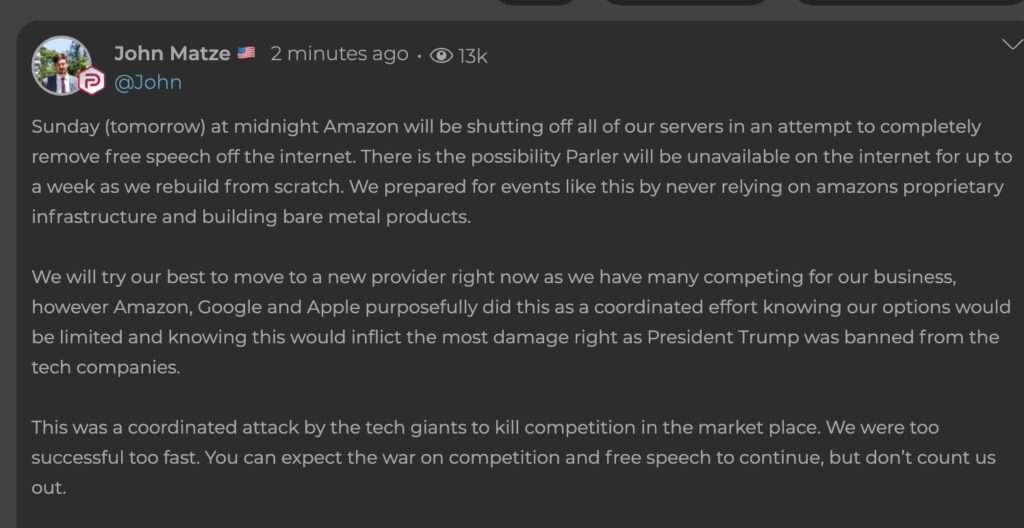

Parler may “be unavailable on the internet for up to a week as we rebuild from scratch,” wrote CEO John Matze in a statement. “We will try our best to move to a new provider right now as we have many competing for our business.”

Matze called it a coordinated attack by Apple, Amazon, and Google “to kill competition in the market place.” He added that “you can expect the war on competition and free speech to continue, but don’t count us out.”

Parler isn’t really a competitor for Apple, Amazon, or Google, and Parler’s head displays a fuzzy conception of free markets if he thinks it means big tech companies must contract with apps and businesses they don’t wish to, for whatever reason.

But Matze isn’t wrong that something here stinks.

Plenty of digital platforms—including those much bigger and more mainstream than Parler—provide a place for conspiracy theorists, MAGA riot organizers, and threats of violence, as well as the politicians who back and encourage these forces. To take action against Parler and no other social media sites or web forums—and to do it so swiftly, without providing them with a little buffer to find new options—feels like the Amazon/Apple/Google version of Twitter and Facebook suddenly banning Trump’s accounts and deleting his post history. It’s a big, high-profile move in the midst of inflamed passions and threats of legal action that feels more designed to stave off becoming a target themselves.

It’s not a First Amendment issue, of course, and it’s perfectly within Apple’s, Google’s, and Amazon’s rights as private companies to make these choices. But it also looks a lot like they’re making Parler a sacrificial lamb to political pressure to do something about people talking too uncontrollably online.

Actionable threats and harassment needn’t be ignored, but we should focus on the folks behind those threats, not aim to take down whole ancillary reams of speech and content to punish a minority of lawbreakers.

Incidentally, this provides the anti-Section 230 crowd with a better glimpse of what a world without Section 230 would look like all the time, not just in the wake of incidents that rattle us. Nobody would want to even tangentially do business with apps and other web forums that don’t aggressively police and limit user speech, for fear that liability would work its way up the food chain to them.

(One of the first civil lawsuits under the 2018 law FOSTA, which took aim at Section 230 and online ads for sex work, was against Mailchimp for letting an adult ad website sign up for an account and send emails.)

Parler was painted as a broadly conservative answer to Twitter, a place where free speech reigned. In reality, it attracted a certain strain of conservatism—that which worshiped President Donald Trump and often trafficked in wild conspiracy theories—and quickly started running into issues between its original “anything goes” ethos and the demands of moderating a major platform. But for all its flaws, it doesn’t deserve its current fate as a tech scapegoat for last week’s attack on the U.S. Capitol.

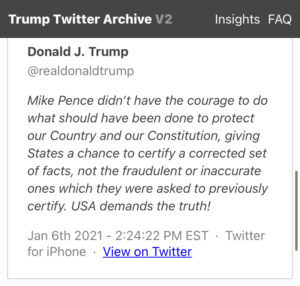

IMPEACHMENT IMMINENT?

If the vice president doesn’t invoke the 25th Amendment to get Trump out of the White House now, Nancy Pelosi will start impeachment proceedings. The House speaker plans to begin taking those steps today, attempting “to pass a resolution by unanimous consent Monday morning calling for Pence and Trump’s Cabinet to invoke the 25th Amendment and remove Trump from office,” reports CNN.

If the resolution doesn’t pass by unanimous consent — and it most assuredly won’t given likely Republican resistance — then the measure will be brought to the floor for a full vote on Tuesday.

The resolution will call on Pence to respond within 24 hours and, if not, the House would move to impeach the President.

“Next,” Pelosi said in a letter to Democratic colleagues, “we will proceed with bringing impeachment legislation to the Floor.”

[…] Senate Majority Leader Mitch McConnell previously made clear in a memo that even if the House moved in the coming days to impeach Trump, the Senate would not return to session before January 19. That would place the start of the trial on January 20 — the date of Biden’s inauguration.

QUICK HITS

Some quotes from my interview yesterday with @RepMeijer, the young anti-war vet and Republican who succeeded @JustinAmash in Congress. https://t.co/x5pQmzafIr

— Matt Welch (@MattWelch) January 8, 2021

- “More than 5,000 law school alumni and students have signed a petition calling for the disbarment of Sens. Josh Hawley (R-Mo.) and Ted Cruz (R-Tex.) over what it says were their ‘efforts to undermine the peaceful transition of power after a free and fair election,'” notes The Washington Post. You can read the full petition here.

- Asylum restrictions set to take place today have been blocked, after another federal judge ruled Acting Homeland Security Secretary Chad Wolf’s appointment to be illegitimate. “In a scathing 14-page decision, Judge James Donato of the U.S. District Court in San Francisco agreed with other federal judges who have concluded that DHS failed to follow proper legal procedures when installing Wolf as the department’s acting secretary,” reports CBS News. “He said Trump administration lawyers ‘recycled’ arguments to defend the legality of Wolf’s appointment, ‘as if they had not been soundly rejected in well-reasoned opinions by several courts.'”

from Latest – Reason.com https://ift.tt/3bu1krq

via IFTTT