US equity futures and global stocks tried and failed to rebound from Monday’s rout which was the worst first day to a new year since 2016.

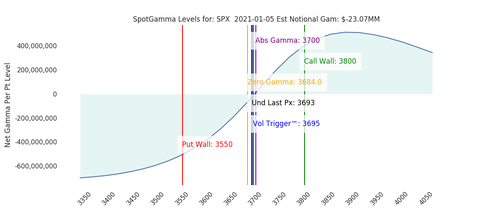

Emini futures failed to turn green and were last trading down 7 points or 0.2%, at 3,685, as investors looked to twin Senate runoff elections in Georgia that would determine the balance of power in Washington. Europe’s Stoxx 600 Index reversed earlier gains and dropped to session lows -0.5% even though Asian stocks climbed as China’s equity benchmark rose to a 13-year high; the dollar dropped, yields rose and bitcoin was flat.

In the most bizarre overnight move, the Hong Kong-traded stocks of China Mobile, China Unicom, and China Telecom rallied by more than 6% after the New York Stock Exchange suddenly and inexplicably abandoned plans to de-list the companies’ shares following a U.S. executive order. Late on Monday, the NYSE announced that it is no longer planning to delist Chinese telecom firms as it said it would do just last Thursday. The decision followed further consultation with relevant regulatory authorities in connection with a recent update of guidance from the US Treasury Department regarding Executive Order on companies with military ties to China, while the update had also stated that the E.O. does not require US persons to divest holdings in such companies. Elsewhere, Chipmaker Micron rose 4% after Citigroup raised its rating on the stock to “buy” from “neutral”. The VIX Index eased after closing at its highest level in two months in the prior session.

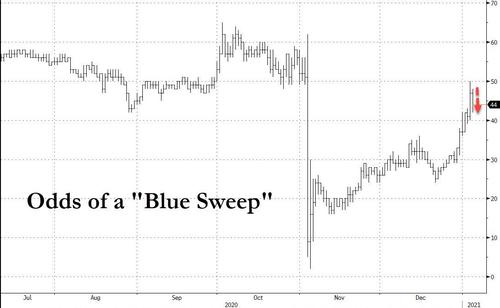

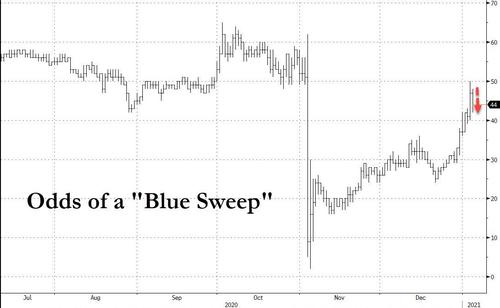

Despite occasional sparks of bullishness, overall mood remained soggy. The reason for the bearish sentiment is that a Blue Sweep in Georgia, whose odds dipped modestly from 48 yesterday to 44 today…

… is viewed as bearish for risk as a Democratic victory in both races could tip control of the Senate away from Republicans, potentially boosting the profligate spending agenda of President-elect Joe Biden, sparking greater corporate regulation, higher taxes, and a more reflationary agenda hurting some areas of the market.

“The result could be quite crucial on how much leeway Biden has to push his own agenda,” said Wells Fargo Asset Management’s global head of multi-asset solutions, Matthias Scheiber. Markets are likely to “move on” if the vote sees Republicans maintain control of the Senate, Scheiber said. A Democrat win would see additional fiscal stimulus priced in as well as potential additional regulation for the energy and tech sectors. “We could see quite a mixed market,” he said. Investors having been increasingly looking to hedge their equity positions following the recent strong rally, he said.

As Bloomberg adds, if a “blue wave” materializes in Tuesday’s Senate race, traders are weighing scenarios such as the possibility of greater U.S. fiscal stimulus, higher taxes and more regulation. If on the other hand Republicans manage to win one of the seats, they’ll have enough to block any initiative from President-Elect Joe Biden, from approving his cabinet onward.

That said, both Georgia elections are tight and the results may not be immediately known, which could lead to a repeat of the chaotic vote re-counts after the U.S. presidential election in November. Outgoing Republican President Donald Trump’s call to pressure Georgia’s top election official to “find” votes to overturn his loss to President-elect Biden in the state has also unnerved some investors.

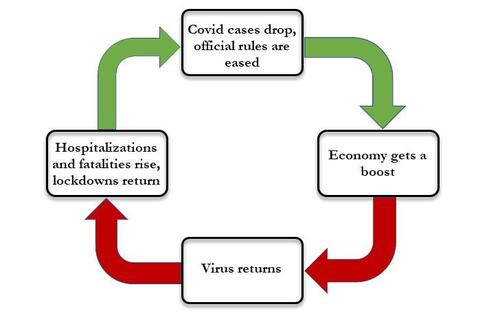

Then there is also the virus: while the start of vaccine rollouts and massive monetary support powered the major U.S. stock indexes to record levels, the discovery of a more contagious strain of the coronavirus and the latest virus-related curbs have muddied the economic outlook.

In Europe, stocks dropped after the U.K. imposed its third national lockdown to prevent hospitals being overwhelmed. Clothing chain Next Plc surged as much as 9.5% after holiday sales beat the company’s October guidance.

Asian stocks climbed in afternoon trading as China’s equity benchmark rallied to the highest level since 2008. Equities in Hong Kong reversed earlier losses following the New York Stock Exchange’s unexpected scrapping of plans to delist China’s three biggest telecommunication companies, a decision described by a Jefferies analyst as “bizarre.” China’s CSI 300 Index jumped 1.9% to a 13-year high, surpassing its 2015 bubble high, and marking a recovery from one of the country’s worst equity crashes.

The MSCI Asia Pacific Index hit a record high, overcoming early weakness on concerns over the continuing surge in coronavirus cases and the U.S. Senate runoffs in Georgia. Outside of Greater China, shares also mounted late rallies in South Korea and Thailand. New Zealand’s benchmark gauge was the region’s biggest gainer, climbing more than 2%, boosted by utilities in its first trading session of 2021. Stocks were also strong in Vietnam and Taiwan. Philippine shares underperformed as inflation accelerated to the fastest pace in almost two years, exceeding economists’ forecasts

In FX, the Dollar Spot Index fell 0.3% after the New York Stock Exchange dropped a plan to de-list China’s three biggest state-owned telecommunications companies; the dollar’s slide also continued as China raised its official yuan exchange rate by the biggest margin since abandoning its peg in 2005, which helped support demand for other currencies and kept MSCI’s emerging-market currency index near the record high it had set on Monday. The offshore yuan also strengthened as far as 6.4419 for the first time since June 2018, after the New York Stock Exchange scrapped a plan to delist China’s three biggest state-owned telecommunications firms. Other emerging Asian currencies were mixed ahead of Georgia’s Senate runoff elections.

“If the Chinese currency is going up, it’s providing a degree of support for Asian currencies in general, and I suspect that’s why the U.S. dollar is partially reversing the gains that we saw from Wall Street time,” said Ray Attrill, head of FX strategy at National Australia Bank in Sydney. “It’s a very big move by any historical yardstick, and I don’t think you can ignore that.”

In rates, treasury yields rose across the curve led by long end, off session lows reached amid gains for stock futures after NYSE scrapped plans to delist China telecom names. Yields beyond the 5-year are higher by 1bp-2bp, steepening 2s10s by 1.5bp; 10-year around 0.93% underperforms bunds, gilts, where U.K. Prime Minister Boris Johnson’s imposition of an anti-virus lockdown in England has spurred gains for bonds. Another heavy slate of IG credit offerings is expected to follow Monday’s $23.5b haul. Results of Georgia Senate runoffs under way may not be clear for a few days.

The dollar index weakened 0.2% to 89.731. It dropped as low as 89.415 on Monday for the first time since April 2018, but ended the day with a 0.1% gain after U.S. stocks slid. The euro rose 0.2% to $1.22765 after reaching $1.231 on Monday. The British pound regained 0.2% to $1.3573 having tumbled the previous day after the UK’s COVID surge had forced another nationwide lockdown.

In commodity markets, oil futures were steady as traders awaited a meeting later on Tuesday where major crude producers are set to decide output levels for February. WTI was higher at $47.96 a barrel; Brent futures edged up 0.7% to $51.47 per barrel. Gold also gained, inching up 0.2% to $1,946 per ounce . Bitcoin steadied at 31,500 after a sharp drop on Monday.

Looking to the day ahead now, and the main highlight will be the aforementioned Georgia senate races. Elsewhere, data releases include the US December ISM manufacturing reading. Central bank speakers include the Fed’s Evans and Williams.

Market Snapshot

- S&P 500 futures up 0.2% to 3,699.25

- MXAP up 0.6% to 202.36

- MXAPJ up 0.8% to 675.02

- Nikkei down 0.4% to 27,158.63

- Topix down 0.2% to 1,791.22

- Hang Seng Index up 0.6% to 27,649.86

- STOXX Europe 600 down 0.1% to 401.26

- German 10Y yield rose 1.1 bps to -0.593%

- Euro up 0.2% to $1.2277

- Italian 10Y yield rose 0.4 bps to 0.437%

- Spanish 10Y yield rose 1.0 bps to 0.033%

- Shanghai Composite up 0.7% to 3,528.68

- Sensex up 0.5% to 48,408.02

- Australia S&P/ASX 200 down 0.04% to 6,681.86

- Kospi up 1.6% to 2,990.57

- Brent futures up 0.4% to $51.31/bbl

- Gold spot up 0.1% to $1,945.68

- U.S. Dollar Index down 0.2% to 89.68

Top Overnight News from Bloomberg

- The New York Stock Exchange said it will no longer delist China’s three biggest state-owned telecommunications companies, backtracking on a plan that had threatened to escalate tensions between the world’s largest economies

- Central banks are set to spend 2021 maintaining their ultra-easy monetary policies even with the global economy expected to accelerate away from last year’s coronavirus-inflicted recession

- Gold climbed to a eight- week high, topping $1,900 an ounce, as lower U.S. real yields and a weaker dollar helped the metal build on the biggest annual advance in a decade. Silver jumped, while platinum was little changed after touching the highest since 2016

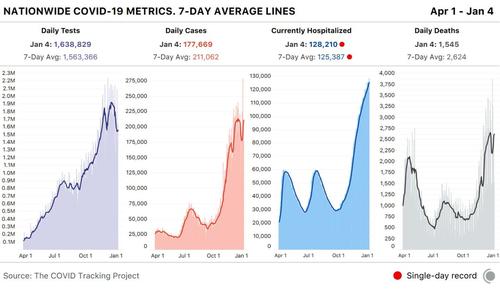

- The variant strain of the coronavirus first identified in the U.K. has been found in New York State. Global coronavirus infections climbed above 85 million, after daily cases in the U.S. soared to a record of nearly 300,000 following the New Year holiday

- Italy and Ireland are tapping buoyant investor appetite for government debt in the euro-area with the bloc’s first major bond sales of the year

- U.K. businesses are calling for more support and relief measures after U.K. Prime Minister Boris Johnson plunged England back into full lockdown in a bid to stem the surge of rising Covid-19 infections

- The variant strain of the coronavirus first identified in the U.K. has been found in New York State. Global coronavirus infections climbed above 85 million, after daily cases in the U.S. soared to a record of nearly 300,000 following the New Year holiday

- Federal Reserve Bank of Cleveland President Loretta Mester said the U.S. economy will require steady, continued support from monetary and fiscal policy throughout 2021 as it faces a bleak winter before reaching a vaccine-driven, mid-year rebound

- Oil edged higher in Asia after dropping the most in almost two weeks as OPEC+ talks were unexpectedly suspended due to a disagreement over whether to raise output in February

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously following on from the uninspiring performance on Wall St where the major indices declined from record levels and the DJIA briefly slipped beneath 30k as sentiment was hampered by surging COVID-19 infections and upcoming risk events. ASX 200 (Unch.) and Nikkei 225 (-0.4%) were pressured in which cyclicals underperformed in Australia but with losses in the index stemmed by continued strength in the mining sectors, while Tokyo sentiment remained hampered by the prospects of a state of emergency declaration which PM Suga will make a decision on this Thursday. Hang Seng (+0.6%) and Shanghai Comp. (+0.7%) were indecisive after another liquidity drain by the PBoC and with FTSE Russell announcing to delete China United Network Communications, SMIC and Nanjing Panda Electronics from the Global Equity Series due to President Trump’s executive order. Furthermore, the China State Council passed the draft stamp tax law to bring stamp duty on securities trading into its legal framework and Hong Kong extended the work from home policy for civil servants through to January 20th with social distancing restrictions likely to remain in place until the Lunar New Year. However, losses were eventually pared after NYSE backtracked on plans to delist the Chinese telecom giants which boosted China Mobile, China Telecom and China Unicom shares. Finally, 10yr JGBs were higher with prices lifted amid the cautious mood in stocks but with further upside capped by resistance at the psychological 152.00 level and after the BoJ’s Rinban announcement to purchase a total of nearly JPY 1.3tln of 1yr-10yr JGBs but lowered the purchase amounts in 1yr-3yr maturities from prior.

Top Asian News

- China Stock Index Tops 2015 Bubble Peak, Closes at 13-Year High

- China Sentences Former Huarong Chairman to Death Over Bribery

- Vietnam Convicts 3 Bloggers for Anti-State Propaganda: VnExpress

- China Sentences Ex-Huarong Chairman Lai Xiaomin to Death

European cash bourses see more of a mixed picture in choppy morning trade after a broadly lower open (Euro Stoxx 50 Unch) and following a similarly varied APAC performance, as investors remain cautious over the implications of the more transmittable COVID-19 variant ahead of key risk events including the Georgia Senate run-offs, FOMC minutes and the US labour market report – with US equity futures treading water in early European hours. In terms of the more immediate Senate run-off races, if Democrats manage to clench both seats (not expected), some desks believe that stocks might see a knee-jerk move lower as markets begin pricing in the prospects of higher corporation tax, and a potentially more activist regulatory approach – particularly against some of the concentrated large-cap names in tech (full primer available in the Research Suite and on the headline feed). Back to Europe, UK’s FTSE 100 (+0.4%) outperforms despite UK PM Johnson yesterday announcing a full lockdown for England, as heavyweights Shell (+3%) and BP (+2%) keep the index propped up amid firmer oil prices heading into the extended OPEC+ meeting, whilst the former is also to sell its Queensland Curtis LNG stake for USD 2.5bln to Global Infrastructure Partner. Sectors are also mixed with no risk profile to be derived. Oil & gas are among the top performers alongside Retail outpacing as Next (+9%) shares jump on a positive trading update. The IT sector also mildly benefits from a revenue guidance upgrade by Dialog Semiconductor (+3.5%) amid firmer-than-expected 5G phone and tablet demand, with this positive momentum is expected to continue into Q1 2021 – in turn, providing some impetus to the likes of Infineon (+0.8%) and STMicroelectronics (+1.7%). In terms of individual movers, Tui (+2%) is supported after Co. said Germany’s BaFin has exempted a consortium backed by Russian billionaire Alexey Mordashov from making a compulsory takeover offer for the Co. Meanwhile, easyJet (-1.1%) and Ryanair (-0.9%) bear the brunt of more stringent lockdown measures and higher fuel prices.

Top European News

- U.K. Bets 2 Million Vaccine Shots a Week Will End Lockdown

- Sunak Boosts Grants to Tide U.K. Businesses Through New Lockdown

- Global Switch’s Chinese Owners Said to Explore $11 Billion Sale

- Italy Boosts Covid Lockdown Measures to Avoid Deadly Resurgence

In FX, although the Greenback has regained some poise and safe-haven premium, its Antipodean rivals are outperforming and both are back on, or near round number levels that proved too tough to maintain on Monday. Aud/Usd has been boosted by a combination of factors including ongoing appreciation in the YUAN, a rise in iron ore prices, another jump in ANZ job vacancies and PM Morrison expressing hope that border restrictions between Victoria and NSW may be relaxed in the not too distant future. However, gains above 0.7700 are still relatively light and 1.0700 is capping the Aud/Nzd cross to keep Nzd/Usd afloat above 0.7200. Back to China, the PBoC gave the Cny and Cnh a further lift via a sub-6.5000 midpoint fix for the strongest onshore setting since June 2018, but additional strength towards 6.4300 and 6.4100 for the offshore unit stalled amidst reports of major state banks buying Usd/Cnh in pm trade.

- USD – Off recovery highs, but back in a degree of demand as risk sentiment stalls and the DXY holds above 89.500 within a 89.917-637 range ahead of the US manufacturing ISM, more from Fed’s Evans and the eagerly-awaited Georgia state run-off results. However, Dollar/major and a few EM pairings remain skewed to the downside (or upside if quoted inversely of course), with ongoing pressure from commodities, like precious metals and crude to a lesser pre-OPEC+ extent.

- EUR/CAD/JPY/CHF/GBP – The Euro is hovering below 1.2300 with external support from the aforementioned Yuan rally and strength in German data to compensate for the pandemic resurgence, while the Loonie has recovered some losses alongside oil in advance of Canadian PPI to trade back above 1.2750 compared to almost 1.2800 and Yen has rebounded through 103.00 in the run up to Japan’s services PMI and consumer confidence tomorrow. Elsewhere, the Franc is retesting 0.8800 in wake of slightly softer than expected Swiss CPI and the Pound is trying to keep sight of 1.3600 after confirmation that the UK will enter its 3rd lockdown and more business support measures from Chancellor Sunak.

- SCANDI/EM – A change of fortunes for the Sek and Nok as the former derives technical/psychological support following a bounce from under 10.1000 vs the Eur, but the latter loses oil-induced impetus after failing to breach 10.4000 yesterday. Meanwhile, the Zar is underperforming amidst the fight to contain SA’s COVID-19 variant, but the Rub is also lagging on diplomatic strains in contrast to the Try that has sustained frothy Turkish inflation momentum with extra assistance from an increase in exports according to the Trade Ministry.

In commodities, WTI and Brent front-month futures trade with mild gains as participants prepare to monitor the extended OPEC+ meeting after producers failed to reach an accord during yesterday’s session. The meeting is slated to commence around 14:30-15:00GMT with some speculation doing the rounds that the alliance will attempt a compromise of around 250k BPD output hike given the varying positions on February output. Headlines early in the session highlighted one scenario proposed by the JMMC which includes an output reduction of 500k BPD, although it is hard to see this gaining traction as both Russia and Kazakhstan are advocating for a 500k bpd increase to quotas – with unanimous consent needed on the decision. Reminder: the exclusive Newsquawk OPEC Twitter dashboard is available on the website. On that note, the backdrop of the spreading COVID-variants remain, with England announcing a full lockdown yesterday and other European countries tightening measures – while scientists have also warned the South African COVID-19 variant may evade vaccines and testing, according to the Telegraph. WTI trades on either side of USD 48/bbl (vs low 47.27/bbl) while its Brent counterpart trades just north of USD 51/bbl (vs. low 50.60/bbl). Elsewhere, precious metals eke mild gains amid the modestly softer Buck, with spot gold eyeing 1950/oz to the upside (vs. low ~1935/oz) and spot silver just shy of 27.50/oz (vs. low 27/oz). Over to base metals, LME copper prices creeps towards the USD 8,000/t psychological mark amid a recovery in stocks coupled with a softer Dollar. Dalian iron ore futures meanwhile advanced for a third consecutive session amid tight supply concerns after iron ore volumes dispatched from 19 ports and 16 mining companies in Australia and Brazil fell by 4.3% WW over Dec 28th to Jan 3rd, Mysteel consultancy reported.

US Event Calendar

- 10am: ISM Manufacturing, est. 56.7, prior 57.5;

- 10am: ISM New Orders, prior 65.1;

- 10am: ISM Prices Paid, est. 65, prior 65.4

- 10am: ISM Employment, prior 48.4

- Wards Total Vehicle Sales, est. 15.8m, prior 15.6m

DB’s Jim Reid concludes the overnight wrap

Happy New Year to you all. Before I had kids, coming back to work after two plus weeks off would have been a miserable experience. So it’s a measure of how life and expectations change that shutting my door on my study this morning, locking the door from inside and throwing the key out the window, and knowing I was leaving the chaos behind me was a wonderful thing. However the strangest thing that happened to me over Xmas was not to do with the kids, instead it was that I had a severe allergic reaction to washing up. It’s fair to say that I did a lot more of it during the holidays than I do when I’m working and after a mammoth clear up of dishes post Xmas day both hand swelled up and were red, burning and raw. So having to stop this chore for a few days eliminated the good will from the surprise present I gave the family on Xmas Day. I wrote and recorded a song about the twins. For those who want to see the world premiere outside my household see the link to the video clip on my Bloomberg header or email me. If Pixar ever write a film about identical twins who fight all the time but deep down love each other I hope I get the call for the soundtrack.

Anyway if you turned the story of our global life at the moment into a movie hopefully we’d be at the bit where the darkest hours are just before the dawn. Indeed life in the U.K. got ever darker last night with an evening address to the nation from the Prime Minister placing us back in the fullest lockdown since the Spring. PM Johnson said the lockdown would remain in effect until at least February 15, with the government aiming to vaccinate the majority of vulnerable residents by then and thereby ease the strain on the NHS. This will require around 2 million vaccinations a week to get to this point. The U.K. is currently at just shy of 1 million in total and is one of the world leaders so a big ramp up needed to hit this aspiration. We’ll show where we are with vaccines numbers around the world below.

Meanwhile in Germany, the Bild newspaper reported that the country’s lockdown would be extended until January 31, which comes ahead of today’s meeting between Chancellor Merkel and the state premiers to discuss whether to extend the lockdown beyond January 10. In the US, four states – New York, Colorado, California and Florida – have now announced cases in the last week of the mutated coronavirus strain that has been seen as more virulent and has been transmitting aggressively through the UK of late. This comes as the US saw a record number of new cases, nearly 300,000, but which will likely include some catchup from the holiday period.

Even before we get to today’s pivotal Georgia Senate run-off, the aforementioned covid headlines and nervousness ahead of the election seemed to be enough to create one of the worst first days for the year for the S&P 500 since daily data started 90 years ago. The index fell as much as -2.5% at the day’s lows, even after opening slightly higher, before closing down -1.48%, in a broad-based decline that saw 424 companies in the index move lower, while the VIX index of volatility surged +4.2pts to its highest level in two months. That makes yesterday the worst first day of the year for the S&P 500 since 2016 (-1.53%) and the seventh worst first day overall since 1928. At its lows for the session, the index was on course to be the 3rd worst start to the year in the 90 year period.

Elsewhere, the NASDAQ (-1.47%) and the Dow Jones (-1.25%) lost significant ground too, and European equities also pared back gains following a strong start, with the STOXX 600 closing up just +0.67% as it fell back from its intraday high of +1.69%. It was a similar story for other risk-sensitive assets, with both Brent crude (-1.37%) and WTI (-1.85%) oil prices falling back from their post-pandemic highs in the morning to close lower. This move was also driven by a failure of OPEC+ to agree on a new production schedule, which is more uncertain in the light of renewed lockdowns. The classic safe haven of gold rose +2.33% to near a two-month high. Markets also got a reminder that bitcoin can actually fall as well, with the cryptocurrency down -7.6% as it headed for its first daily loss of the year. However it’s still trading at $30,998 versus the $19,378 at the start of December and the $22,901 before I left for holiday. 10yr USTs were unchanged yesterday even as 10yr breakevens climbed +2.3bps.

Though Covid will continue to dominate attention, today’s main story is the two Georgia Senate races that will have a major bearing on President-elect Biden’s ability to enact his agenda and get his cabinet nominees appointed. In terms of the state of play, the latest polling averages continue to give the Democrats the lead, albeit ever so slightly narrower than they were 24 hours ago, with an advantage of +1.8pts and +2.0pts in the 2 races according to FiveThirtyEight. For reference, Joe Biden had a +1.2pt lead over Donald Trump in the FiveThirtyEight average of Georgia state polls just prior to the general election – Biden eventually won by around 12,000 votes or 0.2%. These races will be watched closely by markets since if the Democrats win both seats, and hence take control of the Senate, that will mean another large fiscal stimulus package becomes likely, along with a number of other Biden priorities such as tax increases, since this would mean that we finally get the so-called ‘Blue Wave’ scenario where the Democrats have control of the presidency and both houses of congress. However, if the Republicans can hang on to the Senate by winning just one of the races, then any fiscal stimulus or tax increases will look a lot less likely, and Biden will also have to get any cabinet appointments past a Republican Senate, along with any ambassadors, judges and Federal Reserve Board nominees.

In terms of market reaction it makes sense for yields to rise if the Dems win both seats but how much is already priced in? 10 year breakevens rose above 2% intra-day to their highest level since November 2018 yesterday (closed at 2.0%). However for equities it’s unclear what the result should mean. More fiscal stimulus will mean higher growth but possibly less monetary stimulus. Higher yields would also be a headwind. A Democrat victory could also mean higher regulation and possibly higher taxes for the biggest US companies (especially tech) so it’s complicated.

It’s still an open question as to whether we’ll have a clear picture of the results this time tomorrow, since the state can’t start counting the mail-in ballots until Election Day and the results are expected to be very close. Ballots will only start being counted at 7pm EST, although election officials can process absentee ballots (verifying signatures, opening and scanning ballots, etc.) ahead of time. However absentee ballots that are dropped off at elections sites today may mean the process takes longer. Additionally, military/oversea ballots can still arrive by Friday to be counted, and given how close the election is expected to be, the final call may take some time. There is also the distinct possibility of a recount in the races as under Georgia law, if the margin between candidates’ vote totals is within 0.5%, the losing candidate has the right to ask for a recount. Indeed, Georgia was one of the last states to be called after November’s presidential election, and the one with the closest margin between the two candidates, with President-elect Biden having won with just a +0.2% lead over President Trump after a full hand recount. So a big day/big few days to come.

Ahead of this, Asian markets are trading mixed this morning with the Nikkei (-0.38%) and Hang Seng (-0.11%) down while the Shanghai Comp (+0.12%) and Kospi (+0.15%) are up. Meanwhile, S&P 500 futures are trading flat and the US dollar index is down -0.15% this morning after yesterday -0.08% move lower.

In other overnight news, the NYSE has said that it no longer plans to delist China’s three biggest state-owned telecommunications companies – China Mobile Ltd., China Telecom Corp. and China Unicom Hong Kong Ltd. – thereby backtracking from plan announced just 4 days ago. We also heard from Atlanta Fed President Raphael Bostic (a voter in 2021) overnight and he said that the Fed might taper its bond purchases later this year if the distribution of vaccines boosts the US economic outlook while adding that “I am hopeful that in fairly short order we can start to recalibrate”.

In today’s EMR we are adding a third daily covid table looking at global vaccination rates per 1000 people in the 37 countries we currently have data for. We’ve copied the table below in the body of the text. The most worrying larger country at the moment seems to be France where only 516 jabs were administered up to Jan 1st relative to 266k in Germany (up to Jan 3rd) and 945k in UK (up to Dec 27th) which also started on the Oxford/AZN roll out yesterday. France has a history of vaccine scepticism so this will be a country to watch in the coming weeks. This table won’t update as regularly as the cases/fatality tables in the pdf as data isn’t available daily but we’ll see how much it changes before we decide on the frequency of inserting it.

Back to markets yesterday and sovereign bonds rallied for the most part yesterday, particularly in Europe as the risk-off accelerated after the US opened. Yields on 10yr bunds (-3.5bps), OATs (-2.7bps) and gilts (-2.4bps) all fell, and there was a notable flattening of the curves, with both the French and German 2s10s curve reaching their flattest level since 2008 yesterday, at just 29.2bps and 11.4bps respectively. There was a widening in sovereign bond spreads though, with those on both Italian (+4.0bps) and Greek (+3.4bps) debt over bunds moving higher.

On yesterday’s data, there wasn’t a great deal to discern from the final December manufacturing PMIs, with the major countries having already released their flash readings in December. In Italy, where we hadn’t had a flash reading, the PMI rose to 52.8 in December (vs. 53.5 expected), but both the Euro Area and German numbers were revised down three-tenths from the flash reading to 55.2 and 58.3 respectively. Otherwise, the number of UK mortgage approvals rose to a much stronger-than-expected 105.0k in November (vs. 83.5k expected) as pent-up demand from the lockdown and a cut in the home-purchase tax boosted approvals to their highest since 2007.

Looking to the day ahead now, and the main highlight will be the aforementioned Georgia senate races. Elsewhere, data releases include the US December ISM manufacturing reading, while from Europe there’s France’s preliminary CPI reading for December, along with German retail sales for November and the unemployment change for December. Finally, central bank speakers include the Fed’s Evans and Williams.