See this post from two weeks ago for more on the breakdown among the states, and for an explanation of exactly what’s involved in this question (and what isn’t).

from Latest – Reason.com https://ift.tt/3pSB2CT

via IFTTT

another site

Over 432,000 Votes Removed From Trump In Pennsylvania, Data Scientists Say

Authored by Allen Zhong via The Epoch Times (emphasis ours),

Pennsylvania election data shows that over 432,000 votes were removed from President Donald Trump during the November election, data scientists say.

According to an analysis by the Data Integrity Group, obtained exclusively by The Epoch Times, votes for Trump – from both Election Day and mail-in ballots – were removed from the totals in at least 15 counties.

Time-series election data shows Trump’s votes decrementing in various counties at numerous time points instead of increasing as would be expected under normal circumstances.

The group said that Election Day vote removals happened during the vote tabulation process in at least 15 counties, including Lehigh County, Chester County, Allegheny County, Armstrong County, Westmoreland County, Northampton County, Delaware County, Montgomery County, Lackawanna County, Dauphin County, Pike County, Carbon County, Washington County, Erie County, and Luzerne County.

Meanwhile, absentee vote removals happened in Allegheny County, Chester County, and Lehigh County.

At least 432,116 votes—213,707 election day votes and 218,409 absentee votes—were removed in total.

“There were vote movements across all candidates. However, we did not see the same type of negative decrements to any of the [other] candidates that we saw with President Trump’s tallies, and they happened repeatedly with no explanation,” Lynda McLaughlin, a member of the group, told The Epoch Times.

The Pennsylvania Secretary of State’s office didn’t respond to a request for comment from The Epoch Times.

The Data Integrity Group is a group of scientists, engineers, and machine learning experts who have been working together to check whether or not there was manipulation of data in the 2020 general election.

The group’s lineup of data scientists includes Justin Mealey and Dave Lobue.

Mealey is a nine-year veteran of the U.S. Navy, where he worked as an electronic warfare technician, cryptologic technician, and Arabic linguist. He worked at the NSA as a mission manager for Levant/North Africa and later worked as a CIA contractor at the National Counter-Terrorism Center.

Lobue has 12 years of experience in data science and machine learning across financial services, telecommunications, and research consulting industries. He currently specializes in artificial intelligence applications.

Data scientists from the group have analyzed the election data for several states including Arizona and Georgia.

In their analysis of Georgia’s election data, the group said it found that more than 30,000 votes had been removed from Trump’s tally, and another 12,173 votes were switched to Biden.

The group didn’t name any state official, county official, or related voting machine manufacturers for wrongdoing.

However, the group urged the state to authorize forensic audits to uphold election integrity and said it’s irresponsible to certify the results before the alleged errors and anomalies are explained.

“The bottom line is the errors were made. Data confirms these errors and it shouldn’t matter if they were machine or human, they’re still errors and deserve a second review and thorough analysis with forensic audits to find the answers,” the group said.

Pennsylvania’s electors cast their votes for Biden and Kamala Harris as president-elect and vice president-elect on Dec. 14, 2020.

State-certified results show Biden won the Keystone State by 80,555 votes.

Edison Admits One Error in Vote Switching

During the vote tabulation process, the results, which are commonly known as tabulated results, are sent to the secretary of state’s office. The data is then also shared with the media via Edison Research.

Errors could be made in several steps in the election result reporting process.

Though it’s unclear what caused the errors that were flagged by the Data Integrity Group, Edison Research did admit a reporting error that happened separately.

In a widely-circulated video clip of CNN’s live election night broadcast, 19,958 votes were seen being switched from Trump to Biden in 30 seconds.

Rob Farman, executive vice president at Edison, admitted that the “switching” stemmed from a brief reporting error from Edison Research.

He told The Associated Press that a state feed from Armstrong, Pennsylvania, first showed the correct values of 24,233 votes for Trump and 4,275 for Biden, but a team member had mistakenly entered them backward—4,275 for Trump and 24,233 for Biden. Farman said the company’s quality control team discovered the error and corrected it that night.

Tyler Durden

Mon, 01/04/2021 – 17:40

via ZeroHedge News https://ift.tt/2Li04g2 Tyler Durden

Trump ‘Abruptly’ Overruled Pentagon Chief On Carrier Pullout From Middle East

Late last week we noted there was a hopeful sign of potential US de-escalation in the Persian Gulf given the Pentagon announced it was bringing its only supercarrier for the Mideast and Persian Gulf region home.

Acting Secretary of Defense Christopher Miller ordered the USS Nimitz to return to its US West Coast base at the time, but we also noted there was a split within Trump administration and Pentagon ranks over whether Iran constitutes a severe threat to US troops and interests in the region, particularly neighboring Iraq.

But as of late Sunday the Pentagon reversed course, with Miller issuing a new directive: “Due to the recent threats issued by Iranian leaders against President Trump and other U.S. government officials, I have ordered the USS Nimitz to halt its routine redeployment,” he said. A new report in Politico says that President Trump personally intervened in the decision, with the commander-in-chief ordering the Pentagon the reposition the Nimitz in its Middle East zone of operation.

According to the bombshell Politico report published Monday afternoon:

President Donald Trump was behind the abrupt decision announced on Sunday night to reverse course and keep the aircraft carrier USS Nimitz in the Middle East due to Iranian threats against top U.S. officials, according to two people familiar with conversations.

The move was the latest in a string of reversals that befuddled observers and sent mixed signals to Iran.

A number of things have happened since all of this: Iran has begun enriching uranium to 20%, Israel has threatened to act in preventing the achievement of nuclear weapons capability, the IRGC Navy has seized a South Korean-flagged tanker in the gulf, and Iran’s military announced plans to conduct a “major drone exercise” in the region scheduled for Tuesday.

It appears Trump wants to keep a close eye on things, with the Nimitz supercarrier nearby just in case. It’s also emerging that pulling the carrier out was a deeply controversial move objected to by many top commanders in the first place. Politico explains:

Miller made the move over the objections of top commanders, a development first reported by The New York Times and confirmed by a defense official.

Officials said Miller made the decision to send the carrier home as a “de-escalation” tactic as tensions with Tehran continued to simmer. But the ship was also scheduled to return around that time for routine maintenance anyway, and the Navy had pushed for the departure, officials said.

After public threats from Iranian leaders over the weekend, Trump abruptly ordered Miller to turn the carrier around and keep it in the Middle East, according to two U.S. officials, who spoke on condition of anonymity to discuss internal deliberations.

We described over the weekend that a Soleimani commemoration speech given earlier by President Hassan Rouhani was taken as a direct threat against Trump by some US media.

Particularly The Washington Times in a headline claimed it constituted a direct assassination or death threat against the US president.

Cowardice in assassinating foreign leaders is a US-Israeli trademark; NOT Iranian.@WashTimes should know better than to publish #FakeNews & spread anti-Iran bigotry -even though it has featured PAID content by the outlaw MeK terrorist cult.

Your readers deserve better! https://t.co/f8OrGEu4cm pic.twitter.com/FxuYqbp2IE— Saeed Khatibzadeh (@SKhatibzadeh) January 1, 2021

Iran’s leaders and media subsequently called it out as a complete mistranslation which seemed intentioned to mislead.

Rouhani’s words wherein he described of Trump and the presidential transition, “…he will be overthrown in the next few weeks, not just from office but from [political] life” (according to Iranian official media’s translation of the controversial words) — seem to be the “threats” Miller is referencing the latest statement reversing the Nimitz decision.

Tyler Durden

Mon, 01/04/2021 – 17:20

via ZeroHedge News https://ift.tt/38ZNtGf Tyler Durden

Saudi Arabia Lifts Its 3.5 Year Economic Blockade Of Qatar In US-Brokered Deal

Within the Gulf Cooperation Council (GCC) a more than three-year diplomatic and economic war has raged between Saudi Arabia and Qatar, which has even involved the closing of borders and airspace between the two (with UAE firmly in the Saudi camp), hardening into a total economic blockade of Qatar by other members (also including Bahrain and Egypt) but the deep rift looks to have been healed this week.

The Trump administration announced an agreement is to be signed between the two former GCC allies on Tuesday, according to Reuters, which reports further that “As part of the deal, Saudi Arabia will reopen its airspace and land and sea border to Qatar as of Monday, Kuwaiti Foreign Minister Ahmad Nasser al-Sabah said on Kuwait TV ahead of a Gulf Arab summit in Saudi Arabia on Tuesday.” Both the United States and Kuwait have long worked to bring both sides to the table to heal the breach, which previously put the US awkwardly in the middle of two warring gulf allies.

The airspace has been closed for 3.5 years. Qatar stood accused by other members of the gulf alliance of “supporting terrorism” given its warming relations with Iran. Both the Saudis and Qataris were also eventually at odds in Syria. Both were behind the covert war to oust Assad, while eventually supporting rival jihadist factions. There were additionally severe disputes over gulf economic policy as well.

Reuters continues to detail:

Saudi state agency SPA quoted Saudi Arabia’s de facto ruler Crown Prince Mohammed bin Salman as saying the annual gathering of Gulf leaders would unite Gulf ranks “in the face of challenges facing the region.”

Qatar’s ruler, Emir Sheikh Tamim bin Hamad al-Thani, will attend, the royal court said. The U.S. official said the Saudi crown prince and Qatari emir would sign the deal.

The Gulf crisis ends:

* Saudi Arabia and Qatar will open their borders and air spaces

* The UAE, Bahrain and Egypt will lift the embargo on Qatar.

* Qatar will abandon all the lawsuits

* Kushner will attend the signing of the Gulf deal

— Amichai Stein (@AmichaiStein1) January 4, 2021

The crisis which had been raging since mid-2017 effectively unraveled the GCC with many also saying Saudi Arabia’s leadership within the regional economic and political union took a deep hit.

Crown Prince Mohammed bin Salman (MbS) hailed the breakthrough of the impasse on Monday and underscored it is in “the ultimate interests of the Gulf Cooperation Council (GCC) member states and the Arab countries.”

State news agency SPA said “[The] Crown Prince reasserted that the upcoming GCC summit shall be a summit to close the ranks and unify the stance and to enhance the march of the good and prosperity.”

Jared Kushner ‘left Washington en route to Saudi Arabia early Monday morning’ to participate in the signing of the agreement to end the blockade of Qatar.https://t.co/iYqE8vs9lV

— Kristian Ulrichsen (@Dr_Ulrichsen) January 4, 2021

However, Bahrain, the UAE and Egypt have yet to agree to lift the blockade, but are eventually expected to follow, especially given the closeness between UAE and Saudi Arabia on foreign policy matters impacting the region.

Jared Kushner is reportedly now en route to the Saudi city of al-Ula where the formal agreement to heal the dispute will be signed. It comes on the heels of a number of historic ‘normalized’ ties agreements in the region overseen by the Trump White House, most notably involving Arab countries and Israel.

Tyler Durden

Mon, 01/04/2021 – 17:00

via ZeroHedge News https://ift.tt/2KRp2mB Tyler Durden

National Guard Activated to Help Support Police During Pro-Trump Protests

Authored by Zachary Stieber via The Epoch Times (emphasis ours)

Some 100 National Guardsmen will be in Washington this week to help support police officers patrolling protests planned by President Donald Trump supporters this week.

“We have received confirmation that the D.C. National Guard will be assisting the Metropolitan Police Department, beginning tomorrow through the life cycle of this event,” Metropolitan Police Chief Robert Contee III told reporters at a press conference on Monday.

National Guard personnel will be assisting police officers with crowd management and traffic control, freeing officers “to focus on anyone who’s intent on instigating, agitating, or participating in violence in our city,” he added.

Washington Mayor Muriel Bowser, a Democrat, revealed she’d asked for National Guard personnel in a Dec. 31 letter to District of Columbia National Guard Commanding General William Walker.

Bowser said guardsmen would not be armed and would not be engaged in domestic surveillance, searches, or seizures of Americans.

Pro-Trump ralliers plan on gathering in D.C. this week to protest during the counting of electoral votes.

Bowser noted that two pro-Trump protests late last year devolved into violence. In both instances, most violence appeared to be perpetrated by left-wing agitators, but pro-Trump ralliers, including members of the Proud Boys, were filmed brawling as well.

Enrique Tarrio, the chairman of the right-wing group, said on Parler recently that members would be in D.C. on Jan. 6 but would not be wearing their traditional black and yellow outfits. “We will be incognito and we will spread across downtown DC in smaller teams,” he wrote.

The Harrington Hotel, where Proud Boys members often stayed and congregated, announced last month that it was closing Jan. 4 to Jan. 6.

Other groups linked to violence at previous protests, including Black Lives Matter, plan on turning out this week.

Refuse Fascism called on people to go to the city, saying the protests “must not go unopposed.”

Bowser on Sunday asked Washingtonians and those who live in the region to avoid the downtown area on both Tuesday and Wednesday.

People should not “engage with demonstrators who come to our city seeking confrontation, and we will do what we must to ensure all who attend remain peaceful,” she said.

People are allowed to protest in Washington but authorities won’t allow them “to incite violence,” Bowser said Monday.

Contee said signs have been posted around the city emphasizing it is illegal to possess firearms on the U.S. Capitol grounds and on National Park Service areas, and that the District of Columbia does not recognize concealed carry permits issued by other jurisdictions.

The U.S. Capitol Police said in a statement that it “has comprehensive security plans in place and we continuously monitor and assess new and emerging threats, with the overall goal of keeping those within the Capitol Complex safe and secure.”

Tyler Durden

Mon, 01/04/2021 – 16:20

via ZeroHedge News https://ift.tt/3rWa7Ic Tyler Durden

Stocks Suffer Worst Start To A Year Since The Dot-Com Crash

The re-awakening of “Blue Wave” risk…

Source: Bloomberg

…along with escalating pandemic-related lockdowns/restrictions (worse than expected vaccination roll-out and hospitalization panic-mongering like we saw in 2018 due to the flu) sparked the worst start to a year for the S&P since 2001…

The entire market was hit with a selling wave at the cash open after some hopeful buying overnight. NOTE, the markets all moved together largely…

All sectors were lower led by Utilities (oddly) and Energy stocks led (lost the least)…

Source: Bloomberg

But, don’t panic… as the Robinhood’rs will be back tomorrow…

As @dougboneparth noted, summing up the markets perfectly:

“After watching a teenager on TikTok call their $600 stimulus check a ‘stimmy’ and recommend three stocks that will turn it into $13,000, I’ve decided to go deaf and blind.”

VIX surged higher today…

… with the short-end now inverted as expectations around tomorrow’s GA Runoff vote leave traders looking to hedge uncertainty…

Source: Bloomberg

Treasury yields were wildly unchanged today…

Source: Bloomberg

But real yields collapsed to record lows (suggesting support for higher gold)…

Source: Bloomberg

As Breakevens surged (10Y above 2%)…

Source: Bloomberg

The dollar managed to scramble modestly higher today, bouncing off the 2018 lows critical support…

Source: Bloomberg

While the dollar ended flat, it was the Chinese Yuan that made headlines overnight, surging to its strongest against the dollar since June 2018 and at a critical level that has prompted volatility-inducing devaluations in the past…

Source: Bloomberg

Cryptos are up huge since the pre-new-year close – even with the overnight crash – with Ethereum leading…

Source: Bloomberg

With Bitcoin surging back from a $27k handle to back above $31k…

Source: Bloomberg

#Bitcoin went straight from $9,600 to $29,600 after this moment pic.twitter.com/bkI0KitKKA

— Documenting Bitcoin 📄 (@DocumentBitcoin) January 1, 2021

Source: Bloomberg

And Ethereum holding above $1000 after crashing back below $900 overnight…

Source: Bloomberg

ETH’s recent surge has erased all of BTC’s relative outperformance since Thanksgiving…

Source: Bloomberg

As Morgan Stanley noted, with The Fed clearly depressing yields, Bitcoin is the only remaining true indicator of future inflation… and in fact, the move in Bitcoin suggests markets are starting to think this adjustment may not be so gradual or orderly.

Gold also surged higher today, back above $1900 to its highest since the vaccine-headline collapse day in November (this is the biggest daily gains for gold since the election/Fed in November)…

Oil took out Mid0-December high stops overnight then was pummeled lower amid Russia/OPEC+ comments…

Finally, with gold up and oil down, the signal was not a good one for global growth/recovery…

Source: Bloomberg

We give the last word to Carl Icahn:

“In my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction. Nobody can predict when it will happen, but when that does happen, look out below,” ominously adding that “another thing they have in common is it’s always said, it’s different this time. But it never turns out to be the truth.“

Tyler Durden

Mon, 01/04/2021 – 16:00

via ZeroHedge News https://ift.tt/35bv6NH Tyler Durden

Why There Is Literally No “Cash On The Sidelines”

Authored by Lance Roberts via RealInvestmentAdvice.com,

In the later stages of a bull market advance, the financial media and Wall Street analysts start seeking out rationalizations to support their bullish views. One common refrain is “there are trillions of dollars in cash sitting on the sidelines just waiting to come into the market.”

For example, Barron’s recently penned the following:

“There is record amounts of cash sitting in checking accounts of American households—and for optimistic investors, it’s just one more reason the stock market should keep pushing higher.

Yahoo! Finance also jumped on the claim:

“It should also come as no surprise that there’s never been so much cash sitting on the sidelines — nearly $5 trillion, as a matter of fact. This is significantly above the record $3.8 trillion in cash set back in January 2009 during the financial crisis!”

McKinsey & Co also published the following graphic.

See. There are just tons of “cash on the sidelines” waiting to flow into the market.

Except there isn’t.

Despite 10-years of a bull market advance, one of the prevailing myths that seemingly will not die is that of “cash on the sidelines.” To wit:

“A growth bomb”: 3.5$ trillion of excess cash on the sidelines” – Forbes

Please stop it.

Such is the age-old excuse why the current “bull market” rally is set to continue into the indefinite future. The ongoing belief is that at any moment, investors are suddenly going to empty bank accounts and pour them into the markets. However, the reality is if they haven’t done it by now, following 4-consecutive rounds of Q.E. in the U.S., a 400% advance in the markets, and ongoing global Q.E., precisely what is it going to take?

But here is the other problem.

For every buyer, there MUST be someone willing to sell. As noted by Clifford Asness:

“There are no sidelines. Those saying this seem to envision a seller of stocks moving money to cash and awaiting a chance to return. But they always ignore that this seller sold to somebody, who presumably moved a precisely equal amount of cash off the sidelines.”

Every transaction in the market requires both a buyer and a seller, with the only differentiating factor being at what PRICE the transaction occurs. Since this is necessary for there to be equilibrium in the markets, there can be no “sidelines.”

Think of this dynamic like a football game. Each team must field 11 players despite having over 50 players on the team. If a player comes off the sidelines to replace a player on the field, the substituted player will join the other sidelined players’ ranks. Notably, at all times, there will only be 11 players per team on the field. Such holds equally true if teams expand to 100 or even 1000 players.

Furthermore, despite this very salient point, a look at the stock-to-cash ratios (cash as a percentage of investment portfolios) also suggests there is very little available buying power for investors currently. As we noted just recently with charts from Sentiment Trader:

As asset prices have escalated, so has an individual’s appetite to chase risk. The herding into equities suggests that investors have thrown caution to the wind. Such also means they have deployed most of their investible cash.

Of course, once you run out of cash to invest, the next step is to “borrow cash” to increase equity allocations. With professional investors leveraging their bets, there isn’t much excess cash sitting around.

Mutual fund managers are also holding record low levels of cash.

With net exposure to equity risk by individuals at historically high levels, it suggests two things:

There is little buying left from individuals to push markets marginally higher, and;

The stock/cash ratio, shown below, is at levels ordinarily coincident with more important market peaks.

The reality is investors are holding very little ‘cash’ as they have gone “all-in” to chase the market higher.

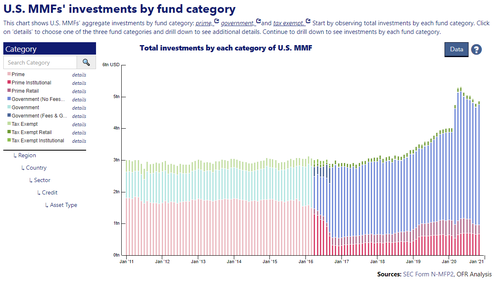

The statement is correct in that money market cash levels have indeed been climbing. The chart from the Office Of Financial Research shows this:

There are a few things we need to consider concerning money market funds.

Just because I have money in a money market account doesn’t mean I am saving it for investing purposes. It could be an emergency savings account, a down payment for a house, or a vacation fund on which I want to earn a higher rate of interest.

Also, corporations use money markets to store cash for payroll, capital expenditures, operations, and various other uses not related to investing in the stock market.

Foreign entities also store cash in the U.S. for transactions processed in the United States, which they may not want to repatriate back into their country of origin immediately.

The list goes on, but you get the idea.

If you look at the chart above, you will notice that the bulk of the money is in Government Money Market funds. These particular types of money market funds generally have much higher account minimums (from $100,000 to $1 million), suggesting these funds are not retail investors. (Those would be the smaller balances of prime retail funds.)

As noted, much of the “cash on the sidelines” is held by corporations. As we said in “A Major Support For Assets Has Reversed,” such isn’t a surprise:

CEO’s make decisions on how they use their cash. If concerns of a recession persist, companies will become more conservative on the use of their cash, rather than continuing to repurchase shares.” – September 2019

As we also stated in that article:

“When stock prices do eventually fall, companies that performed un-economic buybacks would find themselves with financial losses on their hands, more debt on their balance sheets, and fewer opportunities to grow in the future. Equally disturbing, the many CEO’s who sanctioned buybacks, are much wealthier and unaccountable for their actions.”

As we saw, the same companies which have spent billions on “share buybacks” over the last decade were the first ones in line for a Government bailout earlier this year. Now, companies are hoarding cash as we approach the end of the year to ensure their survival against a weaker economic environment in 2021.

The other problem is that record debt issuance by corporations was the driver of record-cash levels. As per the WSJ:

“Cash hoards swelled this year after companies issued record-breaking amounts of debt to bolster their balance sheets against the Covid-19 pandemic’s disruptions. As of Nov. 30, U.S. companies had sold more than $2 trillion of investment-grade and high-yield bonds—the most on record in data going back to 2006—according to LCD, a unit of S&P Global Market Intelligence.

At the same time, many cut share repurchases, dividends or capital expenditures.”

Of course, the problem with debt is that it is not “free” money even at low-interest rates. The interest on the debt diverts capital from productive investments. Companies must use their cash to make “productive” investments that will generate a return higher than the debt cost or pay down debt. Given that economic growth will likely remain weak, along with revenue growth, the former will be difficult. If inflationary pressures and interest rates rise, as many expect, cash will get used to pay off debt rather than invest.

While the bulls are certainly hoping the “cash hoard” will flow into U.S. equities, the reality may be quite different.

As noted above, the stock market is always a function of buyers and sellers, each negotiating to make a transaction. While there is a buyer for every seller, but the question is always at “what price?”

In the current bull market advance, few people are willing to sell, so buyers must keep bidding up prices to attract a seller to make a transaction. As long as this remains the case, and exuberance exceeds logic, buyers will continue to pay higher prices to get into the positions they want to own.

Such is the very definition of the “greater fool” theory.

However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, there will be a rush to sell to a diminishing pool of buyers. Eventually, sellers begin to “panic sell” as buyers evaporate and prices plunge.

Sellers live higher. Buyers live lower.

What causes that change? No one knows.

But that is how bear markets begin.

Slowly at first. Then all of a sudden.

Tyler Durden

Mon, 01/04/2021 – 15:48

via ZeroHedge News https://ift.tt/3o9vELn Tyler Durden

“Look Out Below”: Carl Icahn Issues Major Warning On Markets, Warns Rally Will End In “Painful Correction”

It has been a difficult year – and decade – for billionaire investor Carl Icahn, who despite making $1.3 billion by shorting malls via CMBX 6, a trade we first pitched several years ago as the Big Short 2.0, failed to make waves with any other prominent investments and in fact has been anecdotally net short during the market’s historic surge in the past two years.

Yet despite a spotty recent investing track record, the 84-year-old legendary corporate raider remains bearish on the fence about the market’s ludicrous ascent, as he made clear in an interview with CNBC’s Scott Wapner in which Icahn warned of the possibility of a significant decline for stocks, and predicted that “wild rallies” in the market always meet a dramatic end.

“In my day I’ve seen a lot of wild rallies with a lot of mispriced stocks, but there is one thing they all have in common. Eventually they hit a wall and go into a major painful correction. Nobody can predict when it will happen, but when that does happen, look out below,” Icahn warned ominously adding that “another thing they have in common is it’s always said, it’s different this time. But it never turns out to be the truth.”

While Icahn refused to go into the specifics of his positions, he said that he was well hedged, although it is certainly that case that he has been well-hedged for the better part of the past decade. After all, who can possibly forget that at in mid-2016, just before stocks erupted higher following Trump’s election, Icahn had a record -150% net short for his Icahn Enterprises LP, one which led to lots of pain in the ensuing years.

Icahn’s cautionary statement came on a very ugly day, with U.S. stocks plunging sharply and on pace for the worst opening to a new year in decades. The three major were indexes were all down more than 3% near midday, with the Dow falling as much as 700 points before recovering some losses. Of course, the rough start to 2021 follows a stellar year for the markets, which saw the S&P 500 rise 16% after having lost a third of its value in March, with tech stocks enjoying dramatic gains even as the Covid-19 pandemic upended the world economy.

The relentless gains prompted some less bullish Wall Street strategists to warn of imminent turbulence: as we reported earlier, Morgan Stanley chief equity strategist Mike Wilson repeated his earnings from late last year, and said in his first note of the year on Monday that the market was “ripe for a drawdown” as the “risk/reward has deteriorated materially.”

We got another indication of Icahn’s challenges earlier on Monday, when Herbalife announced that it was buying back $600 million worth of shares from Icahn and that the activist’s representatives would exit the board. Icahn said in a statement that the time for activism at Herbalife, which he invested in more than eight years ago, had passed but he planned to remain a shareholder at a smaller level.

Tyler Durden

Mon, 01/04/2021 – 15:30

via ZeroHedge News https://ift.tt/2LeRKgV Tyler Durden

From Jeff Bewkes, “former chairman and CEO of Time Warner,” and Jeffrey Sonnenfeld, “senior associate dean and professor of management practice at the Yale School of Management, where he is president of the Chief Executive Leadership Institute,” writing in Fortune:

[M]ore closely regulating social media companies is a good idea…. The regulation of technology is considered by many on the left and on the right to be a taboo, a bureaucratic assault on entrepreneurship, and a neo-Luddite undermining of U.S. competitiveness. However, screening of Internet communications is common around the world. It is completely possible to require private accountability for hate speech and inciting violence without curtailing the First Amendment. No constitutional rights are limitless—and the repeal of Section 230 has nothing to do with freedom of speech….

Repealing Section 230 is not a threat to the First Amendment. As long as anyone is free to launch their own platform, they must also shoulder the obligation to keep it safe and respectful.

The bulk of the article is indeed about repealing or modifying § 230, and there are perfectly plausible arguments to be had around that. Should Internet platforms be potentially liable for defamatory material posted on them, the way newspapers are potentially liable for defamation in letters to the editor or in advertisements? Should they be liable just on a notice-and-takedown basis, much as bookstores and libraries are (i.e., they would be liable if they keep material up once they’re on notice that it’s allegedly defamatory)? Or should they be entirely immune, the way they are now, and the way telephone companies have long been? (See this post for more on these three options.) I think that on balance the current § 230 regime is the least bad of the alternatives, but there are reasonable arguments for at least a notice-and-takedown position (and reasonable counterarguments).

But that debate is about platform liability for speech that fits within a First Amendment exception, such as libel, or one of a few other categories (such as solicitation of crime, true threats of crime, and the like). There is no First Amendment exception for hate speech. The government can’t make people legally “accountab[le] for hate speech”—whether by imposing liability on them for their own speech, or for third parties’ speech—any more than it can make people legally accountable for “[dis]respectful” speech or unpatriotic speech or rude speech or blasphemous speech or the like.

And this is so, of course, regardless of § 230. Section 230 doesn’t keep posters from being sued or prosecuted for their own speech; but the First Amendment protects them from being held “accountab[le]” for their own “hate speech.” Likewise, with or without § 230, platforms can’t be held accountable for their users’ “hate speech” (whatever that means), either. If what’s driving the calls to repeal or modify § 230 is a broader agenda to suppress people’s expression of supposedly “hate[ful]” ideas, that is all the more reason to resist such calls.

from Latest – Reason.com https://ift.tt/38bXxg5

via IFTTT