Virtually every risk asset including Bitcoin is melting up – while the dollar continues to crumble – on the first trading day of the year when the same FOMO euphoria that slammed stocks to all time high in the last seconds of trading on Dec 31, 2020 continued overnight, when world stock markets hit fresh record highs on Monday, as investors hoped the rollout of vaccines would ultimately lift a global economy decimated by the COVID-19 pandemic. S&P futures were up 0.5%, after touching an all time high of 3,773.25 earlier on the back of broad-based moves higher in Asia and Europe after upbeat manufacturing data and rising commodities prices boosted risk appetite. …

… which also helped push MSCI’s All-Country World Index reach a new record high, up 0.6% on the day.

“The year kicks off as 2020 ended, an everything rally with the double V dichotomy (virus vs. vaccine) seeing the hopes that either things get worse and stimulus ramps up or things get better and, well, things get better so long as there’s no hint of liquidity withdrawal and a taper tantrum,” a trader told Reuters.

In the US, Tesla shares rose 2.4% in premarket trading and are set to open at an all-time high after the electric-vehicle maker posted delivery figures over the weekend, with analysts highlighting that, even though co. just missed its 2020 target of 500,000 auto sales, it still came close and beat expectations with a record number of car handovers in 4Q. Shares in Tesla and other U.S. EV manufacturers like Nikola, Lordstown Motors, Workhorse Group could also be in focus on Monday following vehicle numbers from Chinese peers Nio and XPeng.

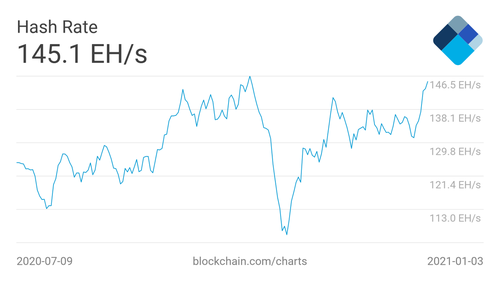

Cryptocurrency-exposed stocks also soared anew in U.S. premarket trading, kicking off the year with gains after Bitcoin set records over the weekend. Ebang International surged 34%, adding to Thursday’s 23% advance, after the communication equipment company said it plans to launch a cryptocurrency exchange in 1Q. Riot Blockchain (+13%), Marathon Patent (+21%), Bit Digital (+35%) all higher.

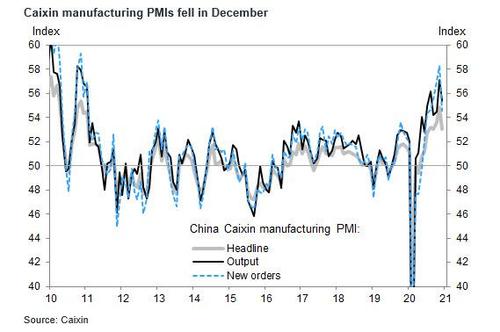

As Bloomberg notes, stocks are starting the new year at rich valuations amid expectations that widespread vaccine distribution in 2021, central bank support and government aid will reignite economic growth and boost corporate profits. Purchasing managers indexes showed factory activity across Asia continued to gain momentum in December, spurred by strong demand for the region’s exports, though China’s recovery is starting to moderate.

“Covid cases and vaccine distribution will remain the key focus for investors for now,” said Kerry Craig, global market strategist at JPMorgan Asset Management. “Without the wide distribution of vaccines, the paths of Covid and the economy are locked together, given the impact on social mobility and economic curtailment. This link will be broken as immunity levels rise into the middle of the year, but until then the economic path will be bumpy over the first quarter.”

In Europe, the Stoxx 600 was up 1.5%, led by miners and other cyclicals. European stock indexes were all higher, with Germany’s DAX up 1.3%, Spain’s IBEX up 1.36% and Italy’s FTSE MIB rising 1%. The pan-European STOXX 600 index was on course for its best day since Nov. 9, up 1.6% after the latest PMI data showed euro-area manufacturing grew the fastest in more than 2 1/2 years in December.

The Stoxx Europe 600 Basic Resources Index (SXPP) surged as much as 4.3%, hits highest level since June 2018, thanks to a boost from weaker dollar and a jump in metals prices after expanding Chinese PMI. The FTSE 100 was up 2.8% on the first day of trading outside the European Union for U.K. stocks. The rollout of AstraZeneca’s vaccine boosted optimism that the country will be able to control the spread of the virus, which forced tighter restrictions across the country. With the lag between a full vaccine rollout and a global economic recovery, investors will count on central banks to keep money cheap.

Asian stocks also climbed to a new record, as technology shares remained strong in the first session of 2021, although Japan’s Nikkei 225 index shed early gains, falling 0.4% after Prime Minister Yoshihide Suga confirmed the government was considering declaring a state of emergency for Tokyo and three surrounding prefectures as the coronavirus spreads. Tencent and Samsung Electronics were the biggest boosts to the benchmark MSCI Asia Pacific Index, which advanced for a seventh day. South Korean stocks posted the biggest gains, as names related to Hyundai Motor surged after a broker said the carmaker may unveil its first electric vehicle built on an a dedicated platform sooner than expected. Equities were also strong in Indonesia, Vietnam, Australia, China and Taiwan. Malaysia’s stock benchmark was the region’s biggest decliner, led by glove makers amid Covid-19 vaccine rollouts and a resumption in regulated short-selling in the nation. The New Zealand market was closed for a holiday

“We continue to believe that equities have further room to rise in 2021 as monetary and fiscal stimulus measures provide a tailwind, and we anticipate significant earnings growth as the global economy recovers,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

On the coronavirus front, global infections climbed above 85 million, after U.S. daily cases soared to a record of nearly 300,000 after the New Year holiday. The U.K. is poised to give the first shots of the vaccine from AstraZeneca Plc and the University of Oxford on Monday, in a race against a faster-spreading variant that’s prompted new lockdowns across much of the country.

The data calendar includes a raft of manufacturing surveys across the globe, which will show how industry is coping with the spread of the coronavirus, and the closely watched ISM surveys of U.S. factories and services. Chinese factory activity continued to accelerate in December, though the PMI missed forecasts. Japanese manufacturing stabilised for the first time in two years in December, while Taiwan picked up. In Europe, the mfg PMI hit a 2.5 year high despite the double-dip the economy is suffering.

OPEC+ energy ministers hold their monthly virtual gathering Monday to decide whether to add as much as 500,000 barrels a day to production. Minutes of the Federal Reserve’s December meeting are due on Wednesday and should offer more detail on discussions about making their forward policy guidance more explicit and the chance of a further increase in asset buying this year.

Finally, on the political front, President Donald Trump and President-elect Joe Biden will each make last-minute campaign appearances in Georgia on Monday for candidates in two runoff elections that will decide whether Republicans retain control of the U.S. Senate.

Despite the optimism over vaccines, some investors are still sounding caution over the path of the virus, which continues to spread amidst the discovery of a new strain: “The virus retains the upper hand for a while longer,” said Karl Steiner, chief quantitative strategist at SEB, noting that vaccinations have had an uneven start, characterized by vaccine shortages, vaccine resistance and delays.

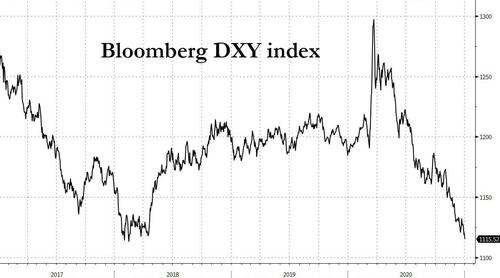

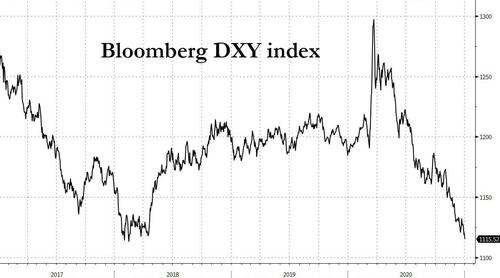

While all risk assets soared the dollar plunge continued, sliding 0.5% to the lowest since Feb. 16, 2018; it fell against all its G-10 peers “The U.S. dollar is trading a bit weaker, nudged on by risk-on proclivities which see the EUR/USD trading back to key resistance area at 1.2250,” said Stephen Innes, chief market strategist at Axi. “The market continues to build in boatloads of optimism for a global growth recovery in 2021 and an accompanying downward trajectory for the U.S. dollar”

China’s yuan strengthened past 6.5 versus the greenback for the first time since 2018. The Chinese currency traded onshore gained as much as 1.08%, the most since Oct. 9, to 6.4579. The move came as the dollar slid to a nearly three-year low. Also supporting the yuan is China’s economic rebound from the pandemic, with official data showing its manufacturing sector expanding for a 10th straight month in December. The Chinese currency’s yield advantage over the dollar, which is near the widest on record, is also driving capital inflows. “China’s growth remains strong while the U.S. and Europe struggle to contain the virus, and that is helping the yuan to extend a rally into the New Year,” said Ken Cheung, chief Asia foreign-exchange strategist at Mizuho Bank Ltd. “We expect the yuan to gain even further from here as China will lead the world in terms of economic recovery in the first half. The currency may test 6.3 in the coming months.”

In rates, Treasuries were slightly cheaper at the long end in early U.S. trading, having pared Asia-session losses as bunds outperformed after weaker-than-forecast Italian and Spanish manufacturing PMI numbers. Yields were cheaper by ~1bp in 10- to 30-year sectors, leaving 10s around 0.925%; bunds outperform by 4bp, gilts by 3bp. Yields reached session highs during Asia session as month-end gains were unwound. Large short position at the 137 strike in 10-year note options may attract attention should yields cheapen toward 1%. European bonds rallied sharply after softer-than-expected manufacturing PMI numbers come alongside the resumption of ECB bond purchases. The German curve bull flattened with 10y yields dropping ~3.5bps, widening the spread to peripheral and semi-core bonds. BTP bounce off the lows, OAT futures rally through 168. Cash USTs are quiet, bear steepening marginally. Gilts drift off the highs trading ~1bps cheaper to bunds at the 10y point

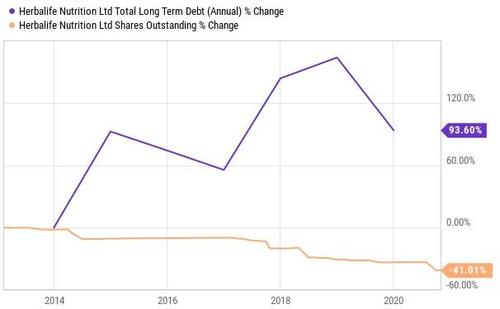

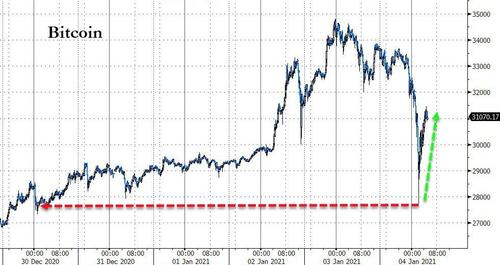

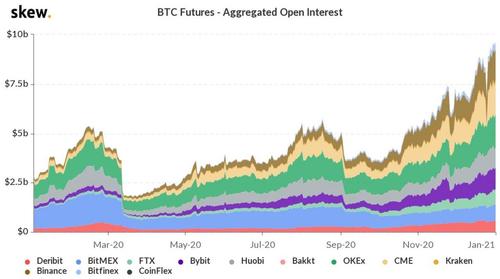

Elsewhere, Bitcoin sank as much as 17% in the biggest intraday retreat since March, wiping out tremendous gains made over the weekend.

Looking ahead, potential catalysts this week include Tuesday’s Georgia run-off elections for two Senate seats that will decide control of the chamber, FOMC minutes on Wednesday and Friday jobs report. Looking at the latter, median forecasts are for only a modest increase of 100,000 jobs, while analysts at Barclays expect a drop of 50,000 in jobs, which would be a shock to market hopes of a speedy recovery.

“A number of incoming indicators on activity point to slower momentum as the economy closes out the year, including data on labour markets where initial claims rose during the December survey period,” said economist Michael Gapen in a note. Such a drop would add pressure on the Fed to ease further, another burden for the dollar which is already buckling under the weight of the massive U.S. budget and trade deficits.

In commodities, oil prices reversed an earlier gain that saw Brent crossing $53 a barrel, before sliding as the day’s OPEC meeting begins. The decline in the dollar supported gold, leaving the metal 1.3% firmer at $1,931 an ounce.

Looking at the day’s calendar, US manufacturing data is due later today, while no major earnings release is expected.

Market Snapshot

- S&P 500 futures up 0.6% to 3,769.75

- MXAP up 0.9% to 201.80

- MXAPJ up 1.4% to 671.35

- Nikkei down 0.7% to 27,258.38

- Topix down 0.6% to 1,794.59

- Hang Seng Index up 0.9% to 27,472.81

- Shanghai Composite up 0.9% to 3,502.96

- Sensex up 0.6% to 48,170.90

- Stoxx Europe 600 up 1.6% to 405.20

- German 10Y yield fell 3.4 bps to -0.603%

- Euro up 0.7% to $1.2295

- Italian 10Y yield unchanged at 0.433%

- Spanish 10Y yield fell 1.7 bps to 0.03%

- Australia S&P/ASX 200 up 1.5% to 6,684.25

- Kospi up 2.5% to 2,944.45

- Brent futures up 1.6% to $52.62/bbl

- Gold spot up 1.8% to $1,932.73

- U.S. Dollar Index down 0.5% to 89.45

Top Overnight News from Bloomberg

- President Donald Trump urged Georgia election officials to “find” thousands of votes and recalculate the election result to flip the state to him — an extraordinary effort to strong-arm fellow Republicans

- The U.K. gave the first shots of a Covid-19 vaccine from AstraZeneca Plc and the University of Oxford, in a race against a faster-spreading coronavirus variant that’s prompted new lockdowns across much of the country

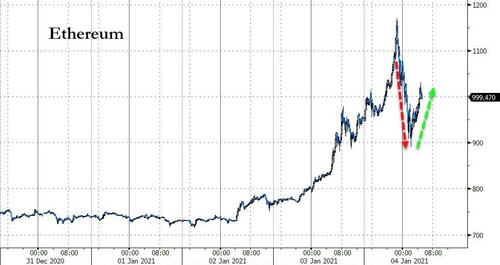

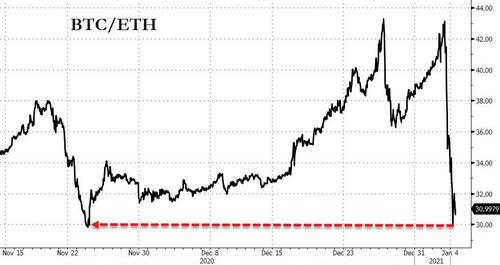

- Bitcoin held near a record a day after breaching $34,000 for the first time while Ether, another digital currency, also surged as the crypto rally continues

A quick look at global markets courtesy of Newsquawk

Asian equity markets began 2021 mostly higher while US equity futures traded indecisively after stalling at record levels as participants returned from the New Year’s holiday and heading into this week’s key risk events including the Georgia Senate runoffs on Tuesday, FOMC Minutes on Wednesday and NFP jobs data on Friday. ASX 200 (+1.5%) was led higher by outperformance in metal stocks as gold miners were underpinned after the precious metal surged above the USD 1900/oz level and with the top-weighted financials sector also notching firm gains. Nikkei 225 (-0.7%) began positive but then faltered on reports that Japan could announce a state of emergency for Tokyo and surrounding prefectures as soon as this week after their governors requested such action to stem surging COVID-19 infections, while Japan and Tokyo are to ask restaurants to close no later than 20:00 local time as part of measures to address the virus. KOSPI (+2.5%) outperformed with index heavyweight Samsung Electronics posting fresh all-time highs and after better-than-expected trade data which showed all components topped estimates including the fastest growth in exports in more than two years. Hang Seng (+0.9%) and Shanghai Comp. (+0.9%) were positive but with early jitters seen after the recent announcement by NYSE to delist China Mobile, China Telecom and China Unicom following US President Trump’s executive order in November banning investment in companies with ties to the Chinese military, which prompted threats of countermeasures from MOFCOM and large Chinese oil names felt the pressure on speculation that they could be next in the firing line. Furthermore, participants digested the latest Chinese Caixin Manufacturing PMI which fell short of estimates but still printed an 8th consecutive month in expansionary territory and there were also reports that China’s Foreign Minister Wang Yi extended an olive branch to the incoming Biden administration and suggested that a new window of hope is opening. Finally, 10yr JGBs were rangebound with initial upside stalled by resistance near the psychological 152.00 level and with price action contained amid the absence of BoJ purchases in the market today.

Top Asian News

- China Wind Giant May Add Mainland Listing Under Merger Plan

- Banks, Developers Sink as China Caps Loans to Curb Risk

- Hong Kong Extends School Closures as Virus Cases Persist

European stocks kick off the new year with gains across the board, albeit to varying degrees (Euro Stoxx 50 +1.0%) after the region picked up the baton from a mostly higher APAC session, whilst US equity futures inch higher in lockstep ahead of a risk-abundant week. Looking back at 2020 performance, the top global performers mostly resided among APAC bourses, with Shenzhen, KOSPI, China A50 all among the top gainers. State-side, the NASDAQ Comp outpaced, posting 2020 gains of some 42% whilst the S&P 500 and DJIA rose around 16% and 7% respectively in the year. Europe meanwhile saw more of a downbeat year with the FTSE 100 lower by almost 15%, and over in the EZ the Euro Stoxx 50 shed around 5%, CAC declined around 7%, IBEX and FTSE MIB saw losses of around 16% and 6% respectively for the year whilst the DAX eked gains of around 4% in the 12 months. Back to today’s trade, UK’s FTSE 100 (+2.6%) outperforms as Britain undergoes the first trading day following the end of the Brexit transition period, albeit gains are seemingly led by the heavy-weigh energy and material stocks amid price action in oil and base metals (see commodities section), with those sectors the outperformers this morning alongside the travel & leisure space as vaccine rollouts gain traction, whilst some airliners including Ryanair (-1.3%) and easyJet (-0.7%) are calling for airports to cut landing charges in the recovery period from the pandemic. Overall, sectors do not portray a particular risk tone. In terms of individual movers, Entain (+26.5%) – formerly GVC – soars after the Co. rejected a takeover offer from MGM Resorts worth around GBP 8.1bln, stating the offer “significantly undervalues” the Co. Elsewhere, the CAC (+1.6%) is underpinned by Airbus (+4.5%) whose shares are lifted on the back of reports that the group was reportedly close to delivering 560 planes by 2020-end, short of the record 863 in 2019 but close to the top-end of internal forecasts.

Top European News

- Germany Leads European Manufacturing to Best Month Since 2018

- U.K. Bolsters Vaccination With Oxford Shot as Covid Surges

- Airbus Shares Gain With 560-Plane Target in Sight at End of 2020

- England School Returns in Doubt as Johnson Warns on Lockdown

In FX, the Greenback continues to depreciate almost across the board, as the DXY slips through 89.500 after yet another fleeting and seemingly futile attempt to regain composure saw the index fade some distance from the 90.000 mark (at 89.822 to be precise). Meanwhile, oil prices are buoyant ahead of OPEC+. Gold has breached Usd 1900/oz and BTC has extended well beyond the Usd 30k mark to set new record highs, with broad risk sentiment bullish at the start of 2021 irrespective of the ongoing pandemic resurgence and several looming events that could roil markets, like the Georgia run-offs, Fed minutes, Italian coalition head-to-head and US labour data. However, the rot shows little sign of stopping for the Buck and the DXY is now hovering just above a fresh multi-year low at 89.418.

- CHF/EUR/CAD – All vying for top spot in the G10 ranks, with the Franc acknowledging an acceleration in Switzerland’s manufacturing PMI plus weekly sight deposit balances suggesting no SNB intervention, while the Euro is benefiting at the expense of the Dollar and upbeat tone rather than somewhat mixed Eurozone PMIs and Loonie is getting a lift from the aforementioned bid in crude. Usd/Chf is testing 0.8800, Eur/Usd 1.2300 and Usd/Cad 1.2675 before Canada’s Markit manufacturing PMI, the final US print and a trio of Fed speakers.

- JPY/NZD/AUD/NOK – The next best majors, or recipients of the Greenback’s frailty, as the Yen eyes 102.70 irrespective of reports that Tokyo may be heading for a month long state of emergency from Saturday, the Kiwi reclaims 0.7200+ status, the Aussie approaches 0.7750 and Norwegian Crown sets on 10.4250 against the Euro even though the single currency is elevated and Norway’s manufacturing PMI missed expectations.

- GBP/SEK – Relative laggards, as Sterling stutters after a peak through 1.3700 in Cable terms and the Swedish Krona runs into resistance ahead of 10.0200 regardless of encouraging manufacturing PMIs to offset some of the coronavirus concerns afflicting both countries. Note also, UK mortgage lending and approvals were much stronger than forecast, but before tighter restrictions to try and quell the pandemic resurgence.

- EM -Widespread gains vs the Usd, with the Cnh and rallying strongly from the PBoC fix beyond 6.5000, the Krw cheering healthy trade data and the Try boosted by stronger than anticipated inflation that should keep the CBRT in aggressive tightening mode. Elsewhere, the Zar, Mxn and Rub also all deriving impetus from strength in underlying commodities, like bullion, WTI and Brent.

- CBRT Minutes stated that they decided to implement strong monetary tightening policy taking into account their end-2021 forecast target, which followed their decision to hike the one-week repo target by 200bps to 17% on Christmas Eve. (Newswires)

In commodities, WTI and Brent front-month futures see a firm session thus far in the run-up to the OPEC+ decision-making and against the backdrop of geopolitical risk and vaccine rollouts. The JMMC meeting is due to start 12:00GMT/07:OOEST followed by the OPEC+ confab slated to at 13:30GMT/08:30EST, as usual subject to delays. As things stand, consensus is split over whether the group will further ease output cuts on account of stable prices and vaccine optimism, or whether to maintain current cuts to see how the COVID-19 situation play out, namely due to lockdown and jet fuel demand risks. The JTC over the weekend did not support further easing of curbs. Russia is seemingly opting for a further ease of cuts, whilst Saudi is likely to take a more cautious approach. Unanimity is needed on deciding the February oil quota. Over the weekend, OPEC SG Barkindo voiced concern over the new COVID-variant whilst emphasising that OPEC is “standing ready to adjust these levels depending on market conditions and developments”. Analysts at ING believe that “in the current environment, where there are real concerns over the latest waves of Covid-19, the best route for OPEC+ to take is to keep output cuts unchanged at current levels. Despite the strength in the flat price and spreads, the market is still clearly vulnerable, and adding further supply risks a pullback in prices.” As a reminder, the exclusive Newsquawk OPEC Twitter dashboard is available on the website. Turning to geopolitics, eyes were on Iran over the weekend amid the anniversary of IRCG Commander Soleimani’s death stoking fears of a retaliation. Hostile Iranian rhetoric has ramped up over the past week, namely against US President Trump and other US govt officials, prompting the US to reverse a decision to bring an aircraft carrier home from the Persian Gulf. WTI and Brent front month futures have declined from best levels after reaching highs of USD 49.80/bbl and USD 53.30/bbl respectively – with focus today likely on the togetherness and sentiment of OPEC+ members over the February output decision. Elsewhere, spot gold and silver continue to grind higher amid a weaker Buck coupled with some reflationary play amid the rollout of COVID vaccines, with spot gold powering past the USD 1900/oz mark to a current high around USD 1934/oz. Shanghai copper and Dalian iron ore saw a firm start to the year amid the softer Dollar, reflationary hopes and broader gains across stocks.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 56.3, prior 56.5

- 10am: Construction Spending MoM, est. 1.0%, prior 1.3%

Central Banks

- 10am: Fed’s Evans Speaks About Economy and Fed Policy on AEA Panel

- 10am: Fed’s Bostic Takes Part in AEA/ASSA Panel Discussion

- 12:15pm: Fed’s Mester Speaks as Discussant in AEA Papers Session

- 6pm: Fed’s Mester Speaks on Economic Outlook at AEA Annual Meeting

DB’s Jim Reid concludes the overnight wrap with his first note of the year

Happy New Year and hope you all had a good Christmas. Jim’s back tomorrow, but before we look ahead to what will hopefully be a brighter 2021, we’ve just published our performance review for December, Q4 and 2020 (link here). In spite of an astonishingly tumultuous year, 28 out of the 38 non-currency assets in our sample actually posted a positive total return over the last 12 months, and the positive vaccine news in Q4 meant that all but one of the 38 assets gained ground over the last quarter.

We’ll have to wait and see for what 2021 holds in store, but as we begin the year, the main news over the weekend has very much stuck to the major theme of 2020, with rising numbers of coronavirus cases leading to further restrictions (and calls for restrictions) across a range of countries. Here in the UK, Prime Minister Johnson warned yesterday that restrictions in England were “probably about to get tougher” as calls mounted for school closures and even another national lockdown, with the UK’s 7-day case average rising above 50k for the first time. In France over the weekend, the government moved forward its curfew from 8pm to 6pm for 15 of the country’s departments. And in Germany, Chancellor Merkel will be meeting with state premiers tomorrow to discuss an extension of the lockdown, with Bavaria’s Markus Söder calling for an extension until the end of January.

Against this backdrop, the big question for the global economy over the year ahead will be how quickly populations are vaccinated, particularly among vulnerable groups like the elderly and those with underlying health conditions who make up the majority of hospitalisations. If the most affected groups can be vaccinated quickly, that could pave the way for a gradual easing of restrictions and a return to something closer to normality. Already the US and the UK have now given at least 1% of their population the first dose, and the UK is hoping to accelerate their vaccination programme as people begin to receive the Oxford/AstraZeneca vaccine from today, while in the US the head of Operation Warp Speed said yesterday that officials were in talks with Moderna and the FDA about giving some people half the dose to speed up vaccinations. However, markets are likely to be closely watching any issues with Covid-19 or the vaccine rollout, not least given the new variants that have been found in the UK and South Africa which spread more rapidly and have been found in increasing numbers of countries. Indeed, among the respondents to our EMR survey back in December, the top 3 risks for the year ahead were all related to Covid-19 or the vaccine rollout, suggesting it’s top of investors’ minds heading into this year.

In spite of the rise in cases over Christmas however, global equity markets soared to new highs while we were away, with the S&P 500, the Dow Jones and the MSCI World index all closing at record levels on New Year’s Eve. Sentiment has been supported by the passage of fresh Covid-19 relief in the US, which President Trump signed on December 27, as well as the agreement of a post-Brexit trade deal between the UK and the EU, which was announced on Christmas Eve, thus removing a couple of tail risks heading into the new year. The moves capped off a strong year for equities (at least outside Europe), which were supported by unprecedented levels of fiscal and monetary policy support following the pandemic, as well as the promising vaccine news that arrived in Q4. Meanwhile the reflation trade has also continued to gather pace over Christmas, with 10-year US break-evens up to 1.99% on December 31, reaching levels not seen since late 2018. And finally, in one of the other stories of the holiday season, Bitcoin has continued to soar to new highs, and is trading at $33,321 this morning. That means it already has a YTD performance of +14.92%, and it’s only January 4. The moves follow its +49.63% return in December, which was its best month since May 2019, as investors have poured into the cryptocurrency in spite of its historic volatility.

Turning to the present, overnight in Asia equities are trading higher for the most part, with the Hang Seng (+0.84%), Shanghai Comp (+0.91%), Kospi (+2.35%) and the ASX (+1.41%) all posting gains. The exception to this pattern has been the Nikkei, which shed -0.63% after Japanese PM Yoshihide Suga said he’s considering declaring a state of emergency to stem a surge in virus infections. Elsewhere, US equity futures have shown little change with those on the S&P 500 down -0.01%, while Brent Crude (+1.27%) has climbed to a post-pandemic high this morning of $52.46/bbl ahead of the latest OPEC+ meeting. The other main news overnight has been the final December manufacturing PMIs for Asia, with the numbers so far indicating that activity is gaining momentum in the region, as Japan’s 50.0 reading marked the highest since April 2019. China’s recovery showed signs of moderating however, with the Caixin PMI down to 53.0 (vs. 54.9 last month).

In terms of the week ahead, US politics will dominate the calendar, with tomorrow’s runoff elections in the state of Georgia determining which party will control the Senate over the coming 2 years. This is an important one for markets, since the results will affect how much of President-elect Joe Biden’s agenda will be able to pass through Congress, as well as the size of any fiscal stimulus package. As a reminder, in November’s election the Republicans won 50 seats in the Senate to the Democrats’ 48, but 2 seats in Georgia were left unfilled because candidates in that state have to get an outright majority of the votes to get elected, meaning a runoff election is being held. If the Democrats manage to take both seats, the chamber will be split 50-50, and since the Vice President casts the deciding vote, the Democrats will have control following the inauguration of Joe Biden and Kamala Harris on January 20. However, if the Republicans take just one seat or both, that means Biden will have to deal with a Republican-controlled Senate for at least the first two years of his term.

The polls have been on a knife-edge throughout, but the latest polling average from FiveThirtyEight indicates that the Democrats have pulled ahead in recent days with a narrow lead of +1.8pts and +2.2pts in the two races. If they did manage to win both and hence control of the Senate, our US economists think that another large fiscal stimulus package would be likely, possibly including some of the more structural priorities of the new administration such as infrastructure, and thus would represent a material upside to their GDP forecast for this year. However, if they fail to win both, then a Republican-controlled Senate would mean that they can be expected to block the vast majority of Democratic priorities. Either way, the results are unlikely to be known tomorrow, since the state can’t start counting the mail-in ballots until Election Day.

Staying on US politics, on Wednesday the joint session of Congress will take place where the electoral votes from the presidential election are formally counted. Normally this is just procedural, but this year a number of Republican senators have said that they’ll vote to challenge the certification of the results, with a group of Republican senators saying that if an election commission weren’t created to investigate claims of fraud, then they “intend to vote on January 6 to reject the electors from disputed states”. However, given the Democrats control the House and multiple Republican senators have condemned these attempts, this challenge isn’t expected to go anywhere.

On the data front, the two highlights this week are likely to be the December PMIs today and on Wednesday, as well as the US jobs report on Friday. Starting with the PMIs, as mentioned we’ve already had some of the manufacturing numbers from Asia overnight, with the full picture from Europe and the US expected later, before we get the services and composite numbers mid-week. Any surprises should be limited though, given we’ve already had the flash PMIs for a number of the major economies before Christmas, with the flash Euro Area composite reading still at a contractionary 49.8 reading.

Elsewhere, the final US jobs report of 2020 is expected by our economists to show just a +50k increase in nonfarm payrolls, which would be the weakest monthly job growth since the pandemic began, and coincides with renewed lockdown measures in numerous states in response to the recent surge in cases. They expect that the unemployment rate will tick up to 6.8%, in its first increase since the first wave of the pandemic back in April.

Finally, there isn’t a great deal on the central bank front, with no major monetary policy decisions this week. However, we will get the minutes of the December Fed meeting on Wednesday, and hear from a number of speakers including Fed Vice Chair Clarida and Bank of England Governor Bailey over the coming week, along with two new voting members on the FOMC in 2021, in Chicago Fed President Evans and Atlanta Fed President Bostic.