US equity futures have continued their Monday rally, rising above 3,800 as the collapse in most shorted stocks continued, with European indices firmer following the positive Asian session…

… while silver slid from an eight-year high as the latest short squeeze reversed.

Sectors are broadly in the green though oil & gas is among the laggards as BP’s update offsets much of the positivity from crude benchmarks themselves. In top geopolitical news, China top diplomat Yang warned the U.S. not to cross the country’s “red line,” in a pointed speech that pushed back against early moves by President Joe Biden to press Beijing on human rights. The Dollar index continues to make ground above 91.00 this morning pressuring major counterparts but particularly so against the EUR which is also hindered via EUR/GBP action in-spite of firmer than expected GDP data. Overnight, the RBA maintained its key rate at 0.10% as expected but unexpectedly announced it is to extend its QE purchases by AUD $100BN. Looking at today’s session highlights include OPEC JTC meeting and speeches from Fed’s Kaplan, Williams, Mester, we also get earnings from Amazon, Exxon, Alphabet.

At 07:00 a.m. ET, Dow E-minis were up 247 points, or 0.82%, S&P 500 E-minis were up 32.5 points, or 0.86% and Nasdaq 100 E-minis were up 109.75 points, or 0.84%, building on the previous session’s momentum, as investors anticipated strong results from Amazon and Google-parent Alphabet while also looking for signs of progress on a pandemic-relief package. Alphabet, which will report the cost and operating profit of its Google Cloud business for the first time, added 1.3% premarket, while retail behemoth Amazon.com Inc gained 1.2%. Both companies, which report Q4 earnings after market close, have jumped more than 7% each after strong earnings from rest of the FAANG group last month. Ford added 2% after the U.S. automaker said it will invest $1.05 billion in its South African manufacturing operations, including upgrades to expand production of its Ranger pickup truck. Shares of Exxon Mobil rose 1.5% ahead of its results scheduled before the bell, which are expected to be marred by a charge of up to $20 billion on the value of its natural gas properties.

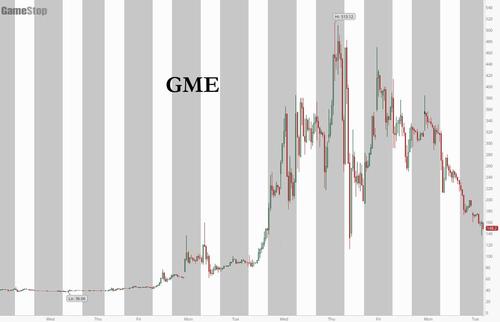

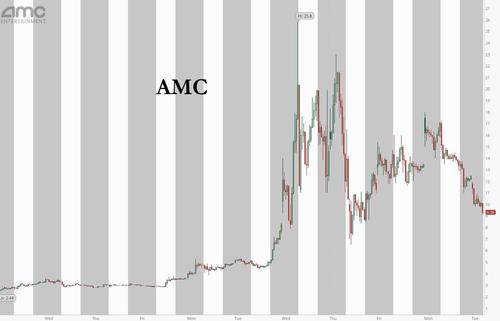

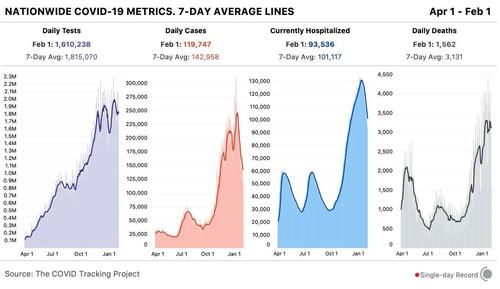

Meanwhile, the massive short squeeze appears over: “meme” stocks GameStop, AMC and Nokia tumbled between 23% and 30%, while miners Hecla Mining Co and Coeur Mining tracked a fall in spot silver prices. This was offset by buoyant mood in the broader market as President Biden and congressional Democrats signaled they’re intent on a large pandemic relief bill, and there’s clear evidence that the virus case numbers are starting to decline. The U.S. has been administering shots at a faster daily rate than any country in the world, giving about 1.34 million doses a day, according to data gathered by Bloomberg.

“We remain positive on risky assets. A combination of easy monetary and fiscal policy when the recovery is gaining momentum should bode well for them,” said Mohit Kumar, strategist at Jefferies International. “While it is still not clear whether the retail-led volatility is behind us, our view is that the impact should be temporary.”

Global markets were also buoyant: MSCI’s world equity index was 0.4% firmer after posting its strongest day in three months on Monday. European equities rallied from the open; with the Euro Stoxx 50 rising over 1.5% and the Stoxx 600 up 1.1%; the CAC 40 outperformed at the margin. Autos, travel and financial services are the best performers. Miners are the sole sector in the red. Shares in BP lost 3.8% after it plunged to a $5.7 billion loss last year, its first in a decade. The Stoxx 600 Automobiles & Parts index rose as much as 3.1%, the most since Dec. 15, led by gains for parts suppliers and Stellantis after it was initiated with a buy rating at Goldman Sachs. Airbus shares gain as much as 6.6%, the most since November, after Morgan Stanley upgraded the plane manufacturer to overweight on a positive view about its production plans.

Earlier in the session, Asian stocks rose for a second day, following a rally in U.S. peers as concerns eased that the recent turmoil spurred by speculative buying will derail the bull market. MSCI’s index of Asia Pacific stocks outside Japan rose 1.5%, with China’s benchmark CSI300 Index climbing 1.5%, helped by easing concerns about tight liquidity and falling cases of new coronavirus infections. Japan’s Nikkei 225 added 1%. Vietnam, India and Taiwan led gains among national benchmarks. Chipmakers TSMC and Samsung were among the biggest drivers of the MSCI Asia Pacific Index. Hong Kong stocks also advanced, boosted by Tencent after its chairman Pony Ma was praised in state media for his entrepreneurship. India stocks gained more than 2.4%, one day after the nation’s key stock gauges recorded their biggest budget-day gains in at least two decades

Global market are buoyant ahead of negotiations Tuesday between U.S. President Joe Biden and Republican senators on a new COVID support bill. The GOP’s $618bn stimulus plan released early Monday was about a third the size of the President’s proposal. Top Democrats later on Monday filed a joint $1.9 trillion budget measure in a step toward bypassing Republicans.

“If you have the ability to have stimulus compromise it’s going to be very supportive for financial assets in the medium term as it means you will have the ability to have an economic recovery,” said Francois Savary, chief investment officer at Swiss wealth manager Prime Partners. “The $1.9 trillion was set as a high bar of the possibilities and in a way to get into a negotiation to get something that would be smaller and more efficient.”

In FX, the dollar hovered near a seven-week high, benefiting from a euro selloff overnight after coronavirus lockdowns choked consumer spending in Germany, and on short-covering in over-crowded dollar-selling positions. The Bloomberg dollar index slipped for the first time in three days while Treasuries extended declines as progress in U.S. coronavirus vaccine rollout bolstered risk appetite across markets. Reports of productive talks on additional U.S. stimulus also boosted sentiment. Against the U.S. dollar, the euro was trading at $1.2078, just above an early December low of $1.2056 hit in the previous session. The Australian dollar pared gains after the country’s central bank said it will extend its quantitative easing programme to buy an additional $100 billion of bonds. The Aussie last stood at $0.7627, nearly flat on the day. Turkey’s lira firmed more than 1%, extending a rally after the central bank promised tight policy for an extended period last week.

In rates, Treasuries were under pressure led by long-end of the curve amid risk-asset rally in which S&P 500 futures exceeded Monday’s high. Yields cheaper by ~3bp across long-end of the curve, steepening 5s30s by as much as 1.7bp to widest level since November 2016; 10-year yields around 1.11% with gilts lagging by 0.5bp. Thirty-year yield came within 3bp of its YTD high; 5s30s within 2bp of its November 2016 high. Gilts lag following 2026 and 2071 bond sales, with U.S. set to make 1Q refunding announcement Wednesday.

In commodities, silver prices slipped 4.8% to $27.59 per ounce, as investors locked in profits after the precious metal touched a near eight-year peak in the previous session driven by retail investors. Spot gold fell 0.6% Tuesday to $1,847.51 per ounce.

Brent crude was up 1.1% at $56.95 a barrel. WTI gained 1.2% to $54.22 as falling inventories and rising fuel demand due to a massive snow storm in the Northeast United States propped up prices.

Looking ahead, investors will also be paying close attention to earnings, with Amazon.com Inc. and Google parent Alphabet Inc. among companies releasing results on Tuesday. About 84% of the 186 S&P 500 firms that have reported so far have topped estimates for earnings, well above the 75.5% beat rate for the past four quarters, according to Refinitiv IBES data.

Market Snapshot

- S&P 500 futures up 0.8% to 3,797.00

- MXAP up 1.3% to 210.35

- MXAPJ up 1.5% to 711.19

- Nikkei up 1.0% to 28,362.17

- Topix up 0.9% to 1,847.02

- Hang Seng Index up 1.2% to 29,248.70

- Shanghai Composite up 0.8% to 3,533.69

- Sensex up 2.4% to 49,755.65

- Australia S&P/ASX 200 up 1.5% to 6,762.60

- Kospi up 1.3% to 3,096.81

- German 10Y yield rose 3.7 bps to 0.497%

- Euro little changed at $1.2070

- Italian 10Y yield fell 4.1 bps to -0.510%

- Spanish 10Y yield rose 12.6 bps to 0.107%

- Brent futures up 1.2% to $57.01/bbl

- Gold spot down 0.7% to $1,847.26

- U.S. Dollar Index little changed at 90.90

Top Overnight News

- China’s top diplomat warned the U.S. not to cross the country’s “red line,” in a pointed speech that pushed back against early moves by President Joe Biden to press Beijing on human rights

- U.K. Prime Minister Boris Johnson’s government is sticking to an election promise not to hike taxes on wages and sales next month, rejecting pressure to increase revenue to tackle the record deficit run-up during the coronavirus pandemic, according to a person familiar with the matter

- The euro areas GDP declined 0.7% in the fourth quarter, compared with estimates for a 0.9% drop. Germany and Spain both posted surprise economic expansions in reports last week. Italy reported a contraction of 2% earlier on Tuesday

- A fledgling format for selling bonds that ties margins to a borrower’s progress in doing business in ways that protect the planet is set to boom this year — but won’t work for everyone, according to a sustainable debt specialist at HSBC Holdings Plc. Companies trying to configure so-called sustainability-linked bonds can run into technical obstacles such as not being able to meet environmental targets before the debt matures

- After a surge in silver futures to the highest in almost eight years, traders are still trying to solve a mystery: Who penned the Reddit posts that ignited this staggering run-up in prices — and why were they taken down?

A quick look at global markets courtesy of Newsquawk:

Top Asian News

- Hong Kong Retail Sales Plummet After New Virus Restrictions

- Turkey Arrests Dozens of Students Protesting Erdogan’s Pick

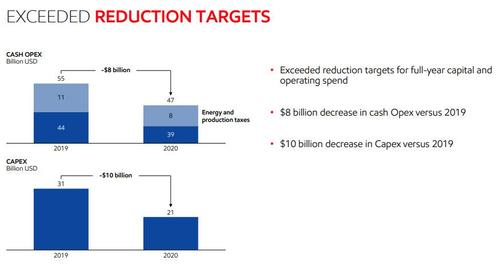

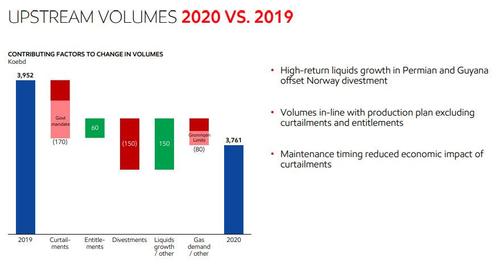

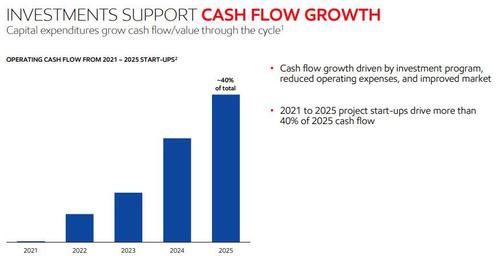

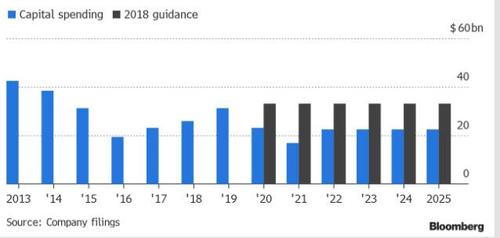

European stocks see another session of gains (Euro Stoxx 50 +1.8%) as the optimism seen in APAC hours echoes into Europe, with the regional sentiment also underpinned amid less severe-than-feared EZ Flash GDP figures; following better than expected releases out of France, Germany etc. This has lead to a mild outperformance in the EZ relative to the US – where futures trade with broad-based gains of around 1% – whilst the UK’s FTSE (+0.8%) and Switzerland’s SMI (+0.9%) tail their Euro-peers. Sticking with the FTSE 100, the index is capped by somewhat unfavourable Sterling dynamics whilst bearing the brunt of losses in heavyweight BP (-3.2%) post-earnings, who missed on adj. net expectations but noted that organic capex last year was in-line with guidance. For reference, BP has around a 3% weighting in the FTSE 100. The downside in the crude giant is also reflected in the Energy sector which underperforms; but, with peers underpinned on the performance of crude itself. Broader sectors are all in positive territory and portray a risk-on bias as cyclicals (ex-oil) outpace defensives – with Auto names leading the gains, closely followed by Travel & Leisure and financial services. Basic resources reside among the laggards as base metal prices pull back before the Chinese Spring Festival and as precious metals unwind a lion’s share of yesterday’s gains. In terms of individual movers, Airbus (+6%) shares soar following an upgrade at Morgan Stanley. On the flip side, Fresenius Medical Care (-13.9%) plumbs the depths as the group anticipates a significant negative impact on 2021 net income from accelerated COVID-19 related mortality of dialysis patients. Fresenius SE (-6%) moves lower in sympathy as it owns some 32% of Fresenius Healthcare – with both companies accounting for around 3% of the DAX (+1.25%).

Top European News

- Euro-Area Economy Shrank Less Than Forecast at End of 2020

- Insider-Trading Suspects Can Stay Silent, EU Top Court Rules

- Italian Economy Shrank at End of 2020, Underperforming Peers

In FX, bullish risk sentiment and hefty 1.4 bn option expiry interest at the 0.7600 strike appear to have rescued the Aussie from a steeper decline in wake of an unexpectedly dovish RBA policy meeting where QE was extended pre-emptively beyond April by another Aud 100 bn and guidance on rates indicated no tightening until 2024 at the earliest. However, 1.0600 in Aud/Nzd may not be impenetrable as the Kiwi rebounds from 0.7150 vs the Greenback on the aforementioned positive market tone ahead of NZ jobs data that could rubber stamp the recent removal of NIRP expectations for the RBNZ or rekindle forecasts for further easing this year. Conversely, more hawkish commentary from the CBRT, including the potential for extra front-loaded and decisive tightening if needed to get inflation back on track, gave the Lira sufficient impetus to extend its recovery through 7.2000 and 7.1500 before waning just above 7.1000 awaiting any backlash from Turkish President Erdogan who has reverted to his anti-rate hike standpoint, and as the Dollar rebounds broadly.

- USD – As noted above, the recovery in high beta rivals and positive market tone sapped some momentum from the Buck that might otherwise have gleaned traction from the relatively pronounced and ongoing loss of attraction in Silver and its fellow precious metals, as Xag/Usd dips under Usd 27.50/oz vs a fraction over Usd 30 at one point yesterday. Nevertheless, the DXY has derived fresh impetus from renewed weakness in the Euro to surpass 91.100 vs 90.805 at one stage and the index has now been up to 91.123 compared to 91.063 late on Monday and an early EU session best of is now hovering midway between peak and 90.805 trough.

- CAD/GBP – Not quite all change, but the Loonie and Pound have pared a chunk of losses against their US counterpart from sub-1.2850 and circa 1.3660 to reclaim the 1.2700 handle and retest 1.3700 respectively, with the former receiving some support from firmer crude prices and latter via improving pandemic and vaccine developments. Moreover, Sterling seems to have survived spill-over RHS demand in Eur/Gbp, albeit with relative Euro underperformance as the cross reverts to type and eyes 0.8800 to the downside.

- CHF/EUR/JPY – All choppy vs the Buck, as the Franc hovers within a 0.8979-48 range mindful of latest verbal intervention from SNB chair Jordan, but Euro fails to keep its head above 1.2050 following another hiccup in efforts to form a new Italian Government coalition or get respite from better than feared EZ GDP data and another rise in inflation expectations via the favoured 5 year/5 year long term metric. Meanwhile, the Yen is struggling regroup after the loss of technical support and slip below 105.00 in advance of Japan’s services PMI and an announcement from the PM about COVID-19 restrictions that is anticipated to extend the state of emergency.

- SCANDI/EM – More Nok outperformance on chart and oil grounds, while the Sek mulls latest dovish Riksbank inferences and EMs beyond the Try are benefiting from the general appetite for risk, with the Czk also acknowledging Czech Q4 GDP defying lowly expectations to a degree.

In commodities, WTI and Brent front month futures trade firmer as the complex tracks gains seen across the stock markets as sentiment remains constructive following the EZ flash GDP figures and heading into the US entrance. The broader environment remains unchanged as participants weigh COVID variants’ impacts against vaccines and OPEC+ supply balancing. On that note, the JTC meeting will take place today ahead of tomorrow’s JMMC confab, with no change expected to current policy given that the producers came to an accord for Q1 in January, whilst fundamentals also remain largely the same since the prior meeting. In terms of commentary, BP expects oil demand to recover this year, but the speed and degree will depend on government policies and individual activity as vaccines are rolled out, “From the oil supply side, limited growth from non-OPEC+ countries coupled with active market management from OPEC+ means that for 2021 we anticipate a normalization of the currently high inventory levels.”, the energy giant says. Looking ahead to today, the weekly Private Inventories after the US close may induce price action ahead of tomorrow’s EIA release – until then, sentiment will likely drive price action barring any major crude catalysts. WTI resides just above USD 54/bbl (vs low USD 54.50/bbl) while its Brent counterpart probes USD 57/bbl (vs low USD 56.20/bbl). Elsewhere, previous metals reverse a bulk of yesterday’s gains, with spot silver losing its shine as it declined from yesterday’s USD 30/oz+ best levels to sub-28/oz in early European trade, with some citing a margin hike by the CME as one of the catalysts. Spot gold meanwhile is slightly more composed on an intraday basis around USD 1850/oz (vs high USD 1862/oz). Base metals meanwhile are trending lower with LME copper eyeing USD 7,750/t to the downside heading into anticipated holiday-induced demand drops as China heads into the Spring Festival.

US Event Calendar

- Jan. Wards Total Vehicle Sales, est. 16.2m, prior 16.3m

- 1pm: Fed’s Kaplan Discusses Economy

- 2pm: Fed’s Mester to Give Remarks on Labor Market

DB’s Jim Reid concludes the overnight wrap

It had to happen. Given its now February, and given I’m not going into the concrete jungle that is London at the moment, my hay fever was always just round the corner. Last night I had a bad sneezing fit and very itchy eyes. Since I moved out of London over a decade ago I now get bad hay fever anytime from mid January to early February. It is the strangest thing when it’s so cold outside. It’s been a little delayed this year as I’ve hardly been outside. However those little pollen bits have penetrated my cocoon. Time for the antihistamine.

Whatever medicine the market took over the weekend it worked as after experiencing their worst week since October, global equity markets got February off to a strong start as concerns eased over the broader market impact of retail investors. Indeed by the end of yesterday’s session the S&P 500 gained +1.61%, recovering almost all of Friday’s losses, as tech stocks led the advance with the NASDAQ up +2.55% ahead of earnings releases from Amazon and Alphabet after the US close today. The rally was broad-based with roughly 80% of the S&P 500 gaining on the day and all but two of the 24 S&P industry groups gaining. It was the best day for the S&P since late November and the best day for the tech-concentrated NASDAQ since early January. With the risk-on tone, equity volatility subsided and the VIX index fell -2.85pts to 30.24. The volatility index has now been above 30 for the past 4 sessions though, for the first time since the run up to the US elections.

It was much the same story in Europe too, where the STOXX 600 (+1.24%), the DAX (+1.41%) and the CAC 40 (+1.16%) all moved higher, while other risk assets like Brent crude (+0.84%) and WTI (+2.59%) oil prices also benefited. A reminder though that a weak January for equities does have omens for the rest of the year if 150 years of US equities returns are to be believed. See here for the CoTD on this from yesterday.

Amidst the broader equity rally, many of the Reddit-fuelled trades from last week lost ground yesterday, with GameStop falling -30.77% as investor interest moved elsewhere. Other darlings of the message board managed to battle back as Nokia (+7.24%) and Blackberry (+3.76%) rose after whipsawing between losses and gains. However more of the focus of the WallStreetBets forum was on silver after starting on this trade in the middle of last week. The metal rose +7.65% in its best day since August, having at one point been on track for its best daily performance (+11.4% at the intra-day highs) since 2008. The surge sent the ratio of gold to silver prices down to its lowest level since 2014. Silver miners like Hecla (+28.30%), First Majestic Silver Corp (+22.08%) and Silver One Resources (+30.43%) saw major gains on the back of the move, with traders again targeting heavily shorted names. Overnight silver is down -1.96% after the CME Group hiked trading margins by c.+17.9% on silver futures contracts. The exchange said that the decision was based on “the normal review of market volatility to ensure adequate collateral coverage.” It’s fair to say it’s going to be easier to move the mining stocks than the underlying metal given the relative deepness of the securities.

Overnight in Asia markets have continued to move higher with the Nikkei (+0.85%), Hang Seng (+1.54%), Shanghai Comp (+0.47%) and Kospi (+1.12%) all up. Futures on the S&P 500 are also up +0.53%. Elsewhere, Brent crude oil prices are up +1.03%.

US 10yr yields are +0.7bps overnight following a +1.4bps increase yesterday as President Biden met with 10 Republicans senators about their $618bn stimulus offer, one that is substantially smaller than Biden’s proposal. The President and Senate Republicans agreed to continue talks, though it was unclear whether either side was ready to budge. The ranking Democrat on the Senate Finance Committee, Mr Wyden, called the Republican plan a ‘non-starter’, indicating that it does not do enough. These comments were echoed by Senate Majority leader Schumer, who again said that Democrats would use budget reconciliation if needed. In case the White House and Senate Republicans cannot find a quick resolution to their differences, House Democrats yesterday moved forward with plans to prepare their own relief legislation. This would be a bill that could pass through both chambers of Congress without Republican support, but would be missing some of the original staples of President Biden’s proposal – most notable the $15 minimum wage and repealing a cap on state and local tax deductions.

Back to fixed income and we did see the 5s30s yield curve climb to its steepest level in nearly 5 years, and the dollar index strengthen +0.44% to a 7-week high. Meanwhile in Europe Italian BTPs were the outperformer, with yields down -2.2bps as investors remained unconcerned by the continued government formation process. In terms of the latest, the lower house speaker, Roberto Fico, has until today to report back to President Mattarella following his consultations with the political parties, but things appear to be moving towards a resolution, with the risk of early elections remaining low. Other government bonds such as German 10yr bunds (+0.2bps), French OATs (+0.1bps) and UK gilts (-0.6bps) were little changed on the day.

In the UK, cases of the South African variant were found amongst those who didn’t have any travel links, leading to residents in a number of areas being asked to take tests, irrespective of whether they’re displaying symptoms. In better news however, the number of new daily cases in the country fell below 20,000 for the first time in over 6 weeks, which comes after 4 weeks of lockdown and a month of excellent vaccine rollouts. Yesterday German Chancellor Merkel promised all Germans would be offered a vaccine by the end of the September even if no new vaccines were approved. Meanwhile in the US, a snowstorm in New York City has led to the cancellation of all vaccination appointments both yesterday and today. The 7-day rolling count of new cases in the US fell to its lowest level since mid-November, as the holiday travel bump subsides and various mobility restrictions show their effect. Also yesterday the US announced that more Americans have now received at least one dose of vaccine (26.5mn) than the total number of residents who have tested positive for the virus over the past year (26.3mn). This comes as the country is now averaging just over one million doses per day.

The main data highlight yesterday were the manufacturing PMIs, albeit there weren’t that many surprises given we’d already had the flash readings from the major economies. In terms of the main numbers, both the Euro Area (54.8) and the US (59.2) manufacturing PMIs were revised up a tenth from the flash readings, while the ISM manufacturing reading fell more than expected to 58.7 (vs. 60.0 expected). One notable thing in that release was the prices paid index, which rose to 82.1 in January (vs. 76.0 expected), which is the highest since April 2011. Elsewhere, German retail sales fell by a larger-than-expected -9.6% (vs. -2.0% expected) in December.

To the day ahead now, and data releases include the Q4 GDP figures for the Euro Area and Italy, along with preliminary January CPI from France. Central bank speakers include the ECB’s Hernandez de Cos, as well as the Fed’s Kaplan and Mester. And earnings releases include Amazon, Alphabet, Pfizer, Exxon Mobil, Amgen, UPS and Alibaba.