Authored by Alasdair Macleod via GoldMoney.com,

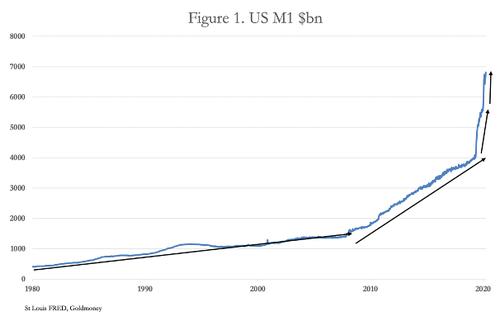

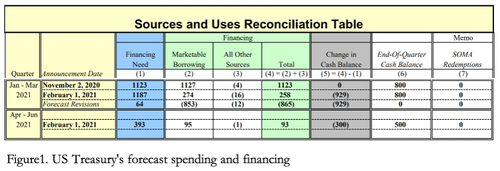

Earlier this month the US Treasury released its plan to flood the financial system with cash by reducing its balance on its general account at the Fed by $1.229 trillion by not renewing an equivalent amount of T-Bills

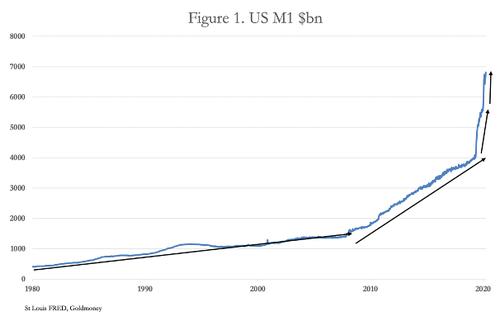

Separately, the Fed will continue with its QE at the rate of $120bn every month, which combined with the Treasury’s plans means an inflation of the money supply totalling $1.829 trillion [(120×5 months)+929+300] is in progress from the beginning of this month until end-June. This does not include the planned stimulus of $1.9 trillion

The banks do not have the balance sheet capacity to take this expansion on board, and if they are forced to turn new depositors away it will almost certainly be by charging for deposits (imposing negative interest rates). That being the case, not only will the US economy be flooded with unprecedented levels of inflated money, but commercial banks will implement negative rates without the Fed having to do so

To prevent this outcome, the Fed will have to extend the temporary exemption from the supplementary leverage ratio due to end in March and remove the $30bn reverse repo limit on money funds, allowing them all to access the Fed’s reverse repo facility and avoid “breaking the buck”. At this late stage there is no sign of the SLR being extended, and a policy with respect to money funds may or might not be forthcoming

But with the Bank of England signalling that it will introduce negative rates later this year, leaving the dollar as the only major western currency at the zero bound, it appears that the solution is indeed to flood the markets with dollars and force the US’s commercial banks to adopt NIRP on the Fed’s behalf

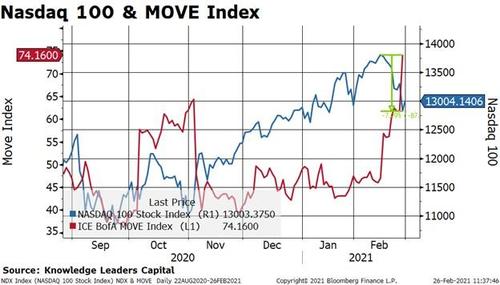

And with dollar term rates already rising, not only is it likely to be too late for the Fed to succeed with an operation twist, but the bubbles in financial markets risk being undermined by rising bond yields, taking the dollar down with it in the style of a John Law combined bubble and currency collapse.

Gold does not discount this outcome and can be expected to drive its fiat price substantially higher.

Introduction

It is extraordinary that anyone who pretends to know something about economics thinks that inflation is something that happens only to prices, loosely connected to changes in the money quantity. And for xenophobes, it is an unfortunate condition which only afflicts minor, foreign currencies.

When so-called economists deny a firm connection between reckless monetary expansion and rising prices, you would have thought that the empirical evidence would act as a check-stop. But no, in support of statist planning economists rely on supressed evidence and economic models which are programmed to assume every extra dollar benefits economic activity without contrary effects, and that every fall in interest rates is an encouragement for the expansion of economic activity.

The parameters which guide policy decisions have become wholly artificial. The CPI is now so tamed that the consequences of monetary inflation for rising prices are barely visible. And GDP, no more than an inflated money total, substitutes for the genuine economic condition. Now that the true consequences of money-printing are suppressed, the mantra has become to inflate or die.

Inflating the quantity of money in circulation has become the most important objective for monetary policy. The other stuff about interest rates, quantitative easing and yield curve control is little more than supporting flimflam, even diverting attention from the inflation objective which reeks of confirmation bias. Confirmation bias is reinforced by the increasing dependency of the state on this form of financing. The fact it is apparently free money, justified by its alleged stimulative qualities, makes monetary inflation highly addictive. An understanding of the damage it causes is casually dismissed and along with it the painful alternative of cutting government spending to escape a downward spiral into the financial gutter. As an inflation addict, the US Government is edging closer to that gutter, now with the addition of an intensified socialistic modern monetary theory adopted by the Biden administration.

MMT is just another form of confirmation bias for inflationary financing of government spending, and there is nothing modern about it. Since time immemorial governments and their epigones have sought to escape the limitations of unpopular taxation and justify access to a free money tree. Only the language has evolved. The accumulating evidence is that the US Government, claiming a renewed democratic mandate, has become so addicted to money-printing that its escape from the consequences of debasement has become well-nigh impossible. It is this that led me recently to accuse America of already being in a state of hyperinflation: my definition is that of a state which has embarked upon a course of inflationary financing which accounts for most of its income and becomes practically impossible to reverse. Since last March, both these conditions have been fulfilled.

Unless you are blinded by economic models and neo-Keynesian macroeconomics, you will see that it is now just a matter of recognising the waymarks illuminating the route to monetary and economic ruin. We passed the first, where inflation stimulates the economy – utter nonsense when the hidden consequences are taken into account. We passed the second, where the supposed stimulation has become continual, only succeeding in transferring wealth from the productive economy and savers to the unproductive state. Then there was the third, where the state became dependent for the majority of its finances on money printing — the hyperinflationary condition that happened under the cover of covid. And now we have embarked on the fourth, the final destruction of money and the descent into monetary hell and economic ruin. Virgil’s Facilis decensus averni, indeed. But we can now surmise that the combined ambitions for the Treasury and the Fed to print money are about to exceed the capacity of the banking system to accommodate it.

The Yellen Treasury and negative interest rates

The Biden administration, and in particular its Treasury secretary, Ms Yellen, appears bent on a course of accelerating MMT policies in a desire to rapidly inflate the economy. That comes as no surprise. Follow the dogma, and you understand the next step is negative interest rates as the policy designed to stimulate the US economy out of its post-covid slump. The dollar and sterling are the only two major Western currencies whose central banks are yet to embrace this policy, yet the Fed remains reluctant. This appears to be the immediate objective behind a policy of overdosing the US economy with so much money, that the banks without the balance sheet capacity to absorb it will have little option but to discourage further deposits by charging depositors for the privilege, by moving their rates into negative territory.

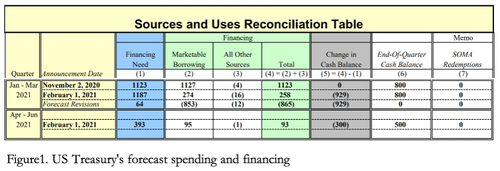

We can’t know what private conversations have taken place between the US Treasury and the Fed, but this new twist to monetary policy bears the hallmarks of a combined operation that permits the Fed to duck the tricky decision to impose negative rates on bank reserves. If there is a plan, then negative rates will be achieved instead by the US Treasury flooding money markets by transferring its accumulated balance on its general account with the Fed into the financial system. Figure 1 below is extracted from the US Treasury’s Sources and Uses Reconciliation Table published earlier this month and illustrates the starting point whereby negative deposit rates can be achieved.

On 1 February the cash balance on the government’s general account at the Fed was $1.729 trillion, and by 31 March the Treasury planned to reduce it to $800bn, implying that $929bn will be injected into the financial system in the first quarter. At the time of writing, the most recent balance available is for 17 February at $1.567 trillion, which tells us that by the end of March $767bn was still to be added into the economy from that date, with a further $300bn in the quarter following.

There are two ways in which the balance on the US Treasury general account at the Fed can be reduced; either by spending it or by reducing outstanding Treasury bills by not renewing them as they mature. Given the very short timeframe between the administration assuming office in late-January these plans are almost certainly a policy of paying down T-bills ahead of the new $1.9bn stimulus, which is likely to be directed entirely at supporting consumers and businesses in the economy.

Our immediate consideration is the monetary effect on the financial system. With $929bn of T-bills not being rolled into new ones between 1 February and the quarter-end, the same amount of cash is liberated to be placed elsewhere by a combination of foreign central banks, money market funds and commercial banks acting for both domestic and foreign accounts. As Zoltan Pozsar in a note for Credit Suisse points out, a foreign central bank can swap T-bills for deposits at the Fed’s New York branch, or it can use the foreign repo facility. No problem there, then. For money market funds there is little alternative to a reverse repo with the Fed, but these are limited to $30bn for each counterparty and not all money market funds have access to this facility. Furthermore, the rejection of large deposits by the banks lacking balance sheet capacity will encourage inflows into money market funds, which cannot invest in negative-yielding instruments and have the same problem as the funds they attract.

The reduction of holdings of T-bills by central banks and money market funds might push term rates down to the zero bound out along the curve for a year or so, and commercial banks will end up with larger balances in their reserve accounts at the Fed. But it seems likely that a significant portion of this liberated cash will increase customer deposits at the commercial banks anyway. These will include the proceeds of T-bills held by pension and insurance funds. Additionally, we must consider the position of foreign private sector holders of T-bills, reflected in foreign banks holding $1,132bn in UST-bills and certificates, according to figures from the Treasury’s TIC latest available data in December.

There are, therefore, significant balances currently invested in T-bills that cannot access the Fed’s facilities and will end up looking to be deposited in the banking system instead. This will inflate the money supply even further than is already shown in Figure 1. But with all the stimulus money in 2020 plus bank lending to private sector corporations, plus the fact that the repo market blow-up in September 2019 showed a lack of balance sheet capacity even before the covid crisis, the banking system may be unable to absorb further deposits on the scale demanded, particularly if foreigners unable to reinvest into T-bills attempt to shift dollar money into bank deposits.

In that case, it is likely that in the attempt to duck them, commercial banks will be forced to impose negative interest rates on new deposits. In this case, reverse repo rates between commercial banks will also go negative. This will not be something of the Fed’s doing, but a consequence of the US Treasury’s decision to run down the balance on its general account. A further consequence is that the pressure on foreign holders of a trillion in T-bills will encourage them to sell the dollar for another currency, driven by the convergence between short-term dollar rates and those of the yen and euro. But then a weaker dollar is likely to be another ambition of the US Treasury’s desire to stimulate economic activity.

The Fed’s QE continues…

Meanwhile, there is no indication that the Fed will alter its quantitative easing programme of $120bn every month, $90bn of which is earmarked for Treasury bonds. That continues, with the Fed thereby suppressing yields along the curve below where they would otherwise be. This QE is primarily targeted at supplying insurance and pension funds with cash in return for bonds, which they are encouraged to reinvest in higher risk assets, such as corporate debt and equities. The payment flows from the Fed accumulate in the reserve accounts of the funds’ bankers at the Fed. The bond bubble and all assets referenced to it will continue to be inflated.

The commercial banks were granted a temporary suspension from the supplementary leverage ratio (SLR) last March to allow them to add and maintain both government debt and excess reserves on their balance sheets without penalty. That this was necessary was an indication that ratios were already looking stretched a year ago, which should be no surprise, given the repo market blow-up the previous September. The commercial banks, whose expansion of reserves is a consequence of QE targeted at their insurance and pension fund customers, have swollen balance sheets for which the relief from SLR is important. With that facility due to come to an end next month, the banks will face the reimposition of the SLR, requiring them to hold at least 3% base equity relative to their leverage exposure and an extra 2% for the G-SIBs (global systemically important banks). These buffers are supplemental to other regulations and were introduced in the wake of the last banking crisis in 2008.

But with QE continuing at the current $120bn monthly rate and the Treasury set to inject a further $767bn by not refinancing T-bills to that amount by end-March, something will have to give. As things stand, it will result in banks trying to shrink their balance sheets relative to equity capital, unless there is a further extension to the SLR, and even that may not be enough.

This is additional evidence that deposits resulting from the Treasury’s actions will be unwanted and costly to the banks. Another way of looking at the problem is that the scale of intended stimulus is simply too great for the banking system with its current equity base. It is an aspect of inflationary financing that is rarely considered.

The consequences of negative interest rates

Negative interest rates must have been the hottest topic under discussion at the regular bimonthly meetings of central bankers at the Bank for International Settlements in Basel in recent years. Trial balloons have been floated in the UK for months, the latest being by Gertjan Vlieghe, a member of the Bank of England’s Monetary Policy Committee in a speech at Durham University where he said, “It is therefore an important and welcome development that the MPC will be adding negative interest rates to its toolkit from August once banks have made the necessary operational adjustments.” There can hardly be a clearer statement of intent from one of the only two major central banks in the west not to have breached the zero bound.

Given that interest rate policy is a central bankers’ obsession, the introduction of negative interest rates for the two major western currencies yet to do so is surely now no more than a matter of time. But the evidence from those that have imposed negative interest rates is that have not encouraged increased lending activity. A negative rate is a tax on a bank’s deposits at the central bank which cannot easily be passed on to its own depositors. Even with the BoE’s base rate at 0.1%, the turn on paying deposit interest is compressed to the extent that British banks are charging usurious rates of interest on arranged personal overdrafts to compensate: NatWest’s rate is 39.49% APR and the TSB’s is 39.9%.

Admittedly, a determination to reduce lending commitments in these risky times might be partly responsible for overdraft charges. But given that central banks want to stimulate consumption, by cutting rates to zero or even less, commercial banks with limited space on their balance sheets end up discouraging it. And to the extent they try to recoup a negative interest rate tax from their lending to commercial borrowers, they also deter businesses from drawing down credit. Negative rates simply seize up the banking system, and the only beneficiaries are zombie corporations in bare survival mode who hope to see their funding costs fall in the junk bond market. Current zero rate policies in the US and the UK are not therefore achieving the desired effect at the zero bound, let alone with a prospective move to negative rates.

The destruction of savings, which perversely is the policy intention, is a consequence of interest rate policies pursued to their Keynesian endpoint with social implications too important to overlook. Because they are not on any central bank’s radar, the misery of the loss of income for small savers is ignored along with the damage to private sector pensions and the higher insurance premiums compensating for lower investment returns. The whole thing is a deepening morass, but it seems central bankers are determined to continue with these policies nonetheless.

Presumably, the reluctance of the Fed to reduce its funds rate to below zero relates to the dollar’s role as the international currency in which commodities and energy are priced. The imposition of negative dollar rates immediately puts them all in backwardation, an artificial condition that values commodities today more than the money alternative. The way to understand the phenomenon is to look at it from the money side. Negative interest rates mean that the possession of money on deposit today is a cost, while that of tomorrow does not, because you don’t yet own it. This is reflected in a higher value for not owning money and getting rid of it for something else. In commodity markets it is echoed in a higher value for cash settlement than for deferred settlement.

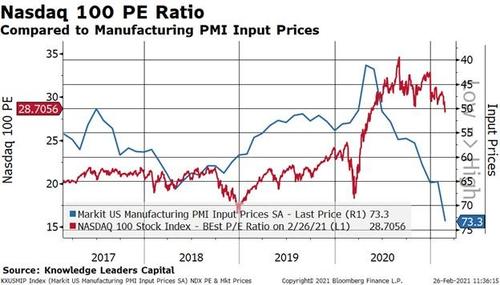

It could be argued that the bull market in commodity prices illustrated in Figure 2, which commenced when the Fed reduced its funds rate to zero last March, is a function of not just the infinite extension of zero rates, but the anticipation that negative rates will be introduced at some time.

If so, we can understand why the Fed is reluctant to embark on a negative rate policy, but Ms Yellen as a card-carrying inflationist can achieve it from her position at the US Treasury.

The consequence for the dollar’s purchasing power

In almost all currency debasements, they start on the foreign exchanges. Foreigners whose primary interest is to maintain an operational liquidity in currencies other than their own accounting medium are super-sensitive to avoiding exchange related losses. Because they use them for international business and the purchases of raw materials, their dollar balances are the largest foreign exchange exposure they have. They will continue to maintain dollar balances, but with $5.29 trillion in bank deposits, T-bills and other short-term instruments, there is significant room for reducing dollar liquidity. To this balance we can add longer term maturities and portfolio investment of $6.134 trillion held by private sector foreigners.

The scope for foreign selling of dollars is therefore substantial, and if these holders get wind of negative rates the run on the exchange rate will be significant. Higher prices for industrial raw materials and imported goods then rapidly follow, exacerbating a lack of domestic production to soak up inflationary demand. It will not go unnoticed by resident Americans, a significant minority of which will have accumulated unaccustomed levels of cash liquidity during lockdowns. There will be a shift from inflation of financial assets to worldly goods, which is already evident in residential property markets and will be accelerated by the initial stages of rising bond yields.

Despite the flooding of QE money into pension and insurance funds and the positive effect of their reinvestment into replacement financial assets, a fall in the dollar’s exchange rate will lead to higher yields for US bonds with longer maturities. A new Operation Twist from the Fed, strongly rumoured today, would simply drive the dollar lower, so the Fed’s ability to suppress long-term rates becomes limited. Consequently, and despite the tendency for a move to negative short-term rates, the valuation basis for all financial assets risks being undermined by a greater time preference factor for dollars, reflected in longer bond maturities.

The US will then face John Law’s dilemma. Having issued money to inflate a perpetual asset bubble, its bursting by higher bond yields undermines the currency and must be prevented. The hardest part is retaining the currency’s purchasing power. The only cure, which arguably is already embarked upon, is to increase the pace of monetary inflation to keep the bubble inflated. For the dollar it is a trap worthy of Thucydides: the more QE is used to inflate, the more it has to be increased to keep the inflation going. The more the quantity of money is expanded, the more it has to be expanded. Stopping it brings on a crisis. Not stopping it temporarily defers an even larger crisis. Today, this outcome is not expected, but tomorrow it will be.

Implications for gold

The consequences of negative dollar rates for the gold price will be to drive it higher, probably substantially so. There are several aspects to consider: the effect on the dollar, the backwardation issue, the technical position in the market and the fact that as an asset class it is underrepresented in portfolios.

There can be no question that negative rates, either imposed by the Fed or the commercial banks, will result in a lower dollar. As a currency it is over-owned by foreigners, and the move below the zero bound into similar interest rate territory as the euro and the yen will reverse conditions in the fx swap market with predictable consequences. On Comex, hedge funds in the Managed Money category, whose pair trade is to sell dollar/buy gold or the opposite, hold 67,956 net long contracts (16 February) compared with an average long-term net long position of 110,000, leaving them underexposed to a falling dollar and rising gold price. The slightest indication that overnight rates are heading below the zero bound would rapidly reverse this position, potentially driving them to be record long. And for the pure traders among them a developing slump for the dollar on the foreign exchanges would be enough.

The counterargument concerns rising term rates, the steepening of the yield curve. But the error here is that other than as cash to be unaware that gold has its own interest rate, and the relationship with fiat rates must incorporate shifts in their relative purchasing powers. The only way to take the steam out of the gold price is to raise fiat interest rates to a level that discounts the differential, which is what Paul Volker did in 1980, by raising the Fed’s fund rate to nearly 20%. Today, fiat rates are being forced unnaturally the other way, including the suppression of bond yields by QE. The argument that marginal changes in rate differentials matter is short-term and does not alter the underlying condition.

This leads us to consider the backwardation issue, which in the absence of balance sheet capacity in the banking system is unlikely to result in long gold positions being financed by domestic bank credit. But gold becomes more attractive relatively to foreigners swapping dollars for gold, and importantly for minor central banks as well, which are already net buyers on other grounds. Furthermore, negative dollar rates would almost certainly impel commodity and energy prices higher through a combination of backwardation and weakening dollar issues, tending to take the gold price with them.

But the most important consideration today concerns the relationship between physical and paper markets. Paper markets have led gold prices lower since the price peaked in early August. Driving it has been a concerted attempt by the bullion banks (Swaps) to reduce or eliminate their short positions at a time of accelerating monetary inflation. They were badly caught out by the Fed’s interest rate reduction to zero on 20 March 2020, and the Fed’s statement that QE would be increased to $120bn on the following Monday. Premiums of up to $90 over spot materialised on Comex futures contracts, and the bullion banks’ short positions led to emergency actions by both the LBMA and Comex acting together to contain the fallout. Less obviously, the central banks increased their leasing to supply physical. We know this because the Bank of England ended up as a sub-custodian to the GLD ETF last August.

This time, the dumping of general account balances on money markets could develop into a similar crisis for bullion bank traders, facing a combination of demand for paper gold from hedge funds and an escalation of physical deliveries. And physical silver supplies are already severely constrained.

Lastly, gold ownership in portfolios is almost entirely through physical ETFs, which total 3,765.3 tonnes valued at $225.8bn (source: WGC —end January). With global investment portfolios estimated at about $100 trillion, this leaves a average exposure to gold of only 0.23%, ignoring the lack of clear title to the underlying bullion.