“Looking Backward” – Jeff Gundlach Live Webcast

It’s time for Jeff Gundlach to regale DoubleLine fund investors and assorted hangers on with his views of the economy, the stock market and everything else. The title of the latest webcast is “Looking Backward” although we expect a substantial does of forward looking views and hot takes, including Gundlach’s inaugural assessment of the US economy.

Readers can listen to the webcast by clising on the following link or the image below.

The last time we heard from Gundlach, financials were just starting to take off thanks to surging yields. But that was a much smaller move compared to the action we’ve seen since the start of February. Back then, Gundlach pulled up a chart saying U.S. banks are wearing a “normal scuba vest” whereas their Japanese and European counterparts act as if they have an “aqualung vest.” Why? He says negative interest rates. As we noted earlier, US banks may be forced to adopt negative rates as soon as April 1.

As Bloomberg also reminds us, last month Gundlach tweeted that he had been a long-term gold bull and U.S. dollar bear, but has turned neutral on both. Bitcoin may well be the “Stimulus Asset,” he said, a reference to the cryptocurrency’s rally amid a wave of cash pumped into the financial system during the pandemic.

More recently, he noted the divergence below, with Bitcoin rapidly outpacing both gold and the S&P 500’s gains over the past year, adding ominously, “Great dispersions often precede great reversions.” So will Gundlach announce his full-blown endorsement of the cryptocurrency? Stay tuned to find out.

We’ll update this post with periodic highlights from the webcast.

Gundlach explains the title of today’s webcast “Looking Backward”, which is a nod to a novel written in 1888, and where the protagonist of Edward Bellamy’s socialist-utopian novel goes into a trance in 1887 and awakens in 2000. Gundlach says the novel resembles situations in society today. In the novel the protagonist finds a year 2000 described as having shorter working weeks and equal distribution of goods. In the book, Boston is part of a totally changed world in which the U.S. has been transformed to a socialist utopia, which includes internet and full-benefits retirement at 45.

“So think about this as we go through some of the slides” Gundlach said.

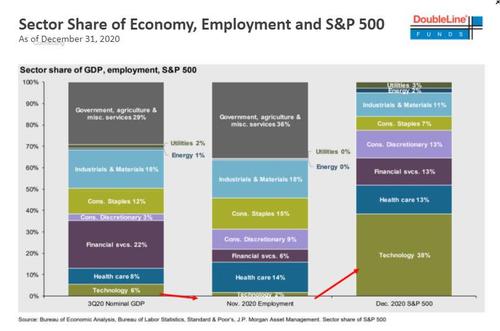

Gundlach starts by showing a chart breaking down the US economy between Nominal GDP, Employment and market cap, with Technology “monopolies” clearly dominating.

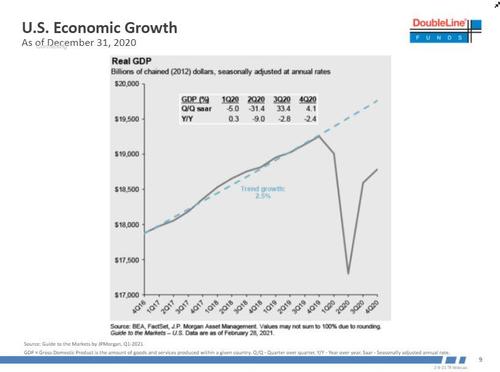

He then shows a chart of US economic growth, saying that the US isn’t fully out of a recession until we regain the economic growth rate.

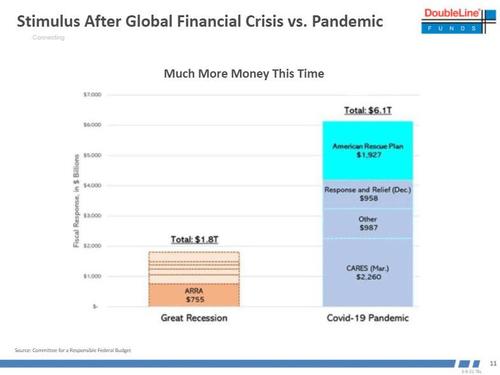

The DoubleLine CEO then shows just how much bigger the stimulus at $6.1TN is compared to the Great recession’s $1.8TN.

Tyler Durden

Tue, 03/09/2021 – 16:21

via ZeroHedge News https://ift.tt/3enHlvS Tyler Durden