Some Perspective: We Are Talking 2% Of 2021 US GDP In Public Investment For A Decade

By Michael Every of Rabobank

The Construct-It Show

“It’s time to face the music; It’s time to tax at new heights; It’s time to finally build stuff, on the Construct-It Show tonight;

It’s time to put pigs in makeup; It’s time to dress it all up right; It’s time to raise the curtain on the Construct-It Show tonight;

Why do we end up here?; I guess we all should know; Will it really be a kind of torture; To have to watch the show?;

And now let’s get things started –Why don’t you get things started?– It’s time to get things started;

On the most sensational, inspirational, celebrational, infrastructurational; This is what we call the Construct-It Show!”

(Gonzo blows his trumpet pathetically)

Roll up, roll up! Today is the day when the White House releases its infrastructure plan. Will it be USD3 or 4 trillion over 10 years? As Professor Bunsens and Beakers do the number crunching, I will be more of a Statler and Waldorf. What I can say from my box seat is that there are several huge questions and implications associated with this Construct-It Show.

Could it pass? Even using reconciliation for a second time this calendar year, it would take ALL Democrats to back it. Is that possible? It seems a stretch – but not necessarily impossible. Of course, if it doesn’t pass, then all we have is the current sugar high…and then the post-sugar crash.

If even some of the proposed tax hikes (corporate taxes up from 21% to 28%; taxing offshore corporate profits; making the wealthy pay income tax, not 20% capital gains tax; raising the top income tax bracket) make it through, it’s going to be *big* stuff for the US and global economy – and US equities. (New Zealand just did it though.) That does make it less likely to pass. So let’s presume it can only get through on the spending side: that would take us from ‘No MMT’ back into MMT territory.

To put the scale of what is being proposed here into perspective, we are talking about either 1.5% or 2% of 2021 US GDP each year in public investment for a decade. Can you see what that is going to do to US growth?! And not only US, as without ‘Buy American’ much of that capital will also flow out to the rest of the world via imports – which isn’t what the White House wants. Yes, it would probably take more than just ‘Buy American’ to stop stimulus leaking – but don’t expect it not to happen over a decade. Shifts in the Overton Window are a key act in this Construct-It show: from free trade to qualified protectionism via Republicans; and from sound money to mega-stimulus via the Democrats. Even the Great Gonzo would be proud – and it’s Gonzonomics to follow, at least as far as neoclassical Bunsens and Beakers are concerned.

For that Sam the American Eagle of the Fed, a new stimulus bill would present a major challenge to its view that nothing needs to be done on rates for years. In which case, would US yields be allowed to rise “because growth”, even if that meant equities went down? Or would the Fed still do YCC (and MMT) “because markets”? Note that despite historical warnings of ‘excessive exuberance’, which Kaplan echoed yesterday, the Fed’s pattern of behaviour has been to ensure that stocks, not bridges, go up. But perhaps the Show is under new management now?

Let’s then imagine where the USD would sit with GDP growth of 4% and 10-year yields at 4%, for a hypothetical example (higher!); and where it would sit if the same stimulus and growth sees yields artificially capped at 1.50% (lower!). Can you see the wild ride markets could be about to set out on? It’s really quite the Show!

It’s unclear how the Swedish Chefs at the ECB (“We pooot de PEPP in de poot”) would be prepared for this US recipe. They can “bork, bork, bork!” all they like, but it’s something they can’t control – just hope any US stimulus lifts their booot.

Likewise, the giant Sweetums of the PBOC, overseeing an economy where there don’t appear any post-2021 GDP growth targets, and some view the sustainable level of GDP growth being as low as 2-3%, could face a US economy outgrowing it for a decade, and potentially with higher yields too. Where would that put CNY? Today’s fixing was 6.5713, so the direction is already clear – in which case those who know think: pork, pork, pork!

Meanwhile, as the Construct-It Show rolls out, bridges are being burnt, not built, in geopolitics:

-

China has introduced sweeping changes to the political system in Hong Kong, which the US press describes as “part of Beijing’s efforts to consolidate its increasingly authoritarian grip over the territory”;

-

The US, UK, Australia, Canada, and 8 other countries have signed a document criticizing the WHO report into the origins of the coronavirus pandemic in Wuhan, implicitly accusing China of “withholding access to complete, original data and samples”. Even WHO head Dr. Tedros has stated the investigation was “not extensive enough”, and that there should be continued examination of the theory that the virus escaped from a lab. Wasn’t that enough to get one censored from social media a few months ago(?);

-

The US has again accused China of “genocide and crimes against humanity” in a human rights report, which also calls out Russia, Saudi Arabia, and Myanmar. The US has also expanded the number of areas it will now call out abuses over;

-

The Inter-Parliamentary Alliance on China suffered a serious cyber-attack yesterday; and

-

China’s Global Times argues that the EU Parliament will still pass the EU-China investment deal because “It is believed that the business community will eventually stand up to the narrow-minded moves of the political class. The CAI may need to go through some rounds of competition and wrestling, but the final adoption of the deal is an inevitable outcome, given the fact that it’ll not only benefit China and Europe but also the entire world.” Yet the GT also warns the EU that “recklessly leaning toward the US would ultimately hurt [them]” – which is counterproductive.

And these are only the acts that made the final cut. In short, globally we are set to see far more of Animal and Crazy Harry. Which makes neoclassical Beakers do this.

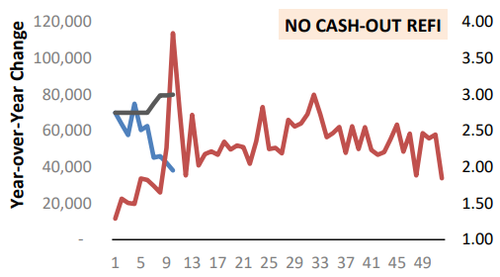

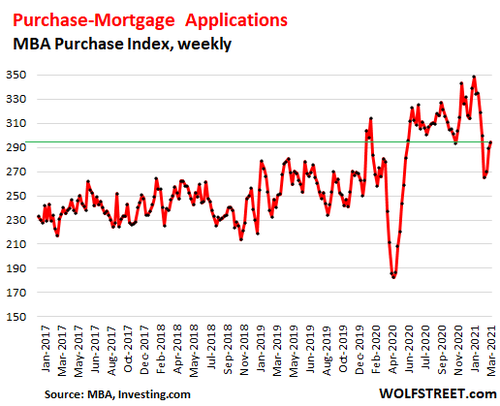

Meanwhile, returning to the Construct-It theme, what is the alternative to either no stimulus, or state-led stimulus? Try Australia, where building permits today were up 21.6% m/m vs. 3.0% expected. What’s an RBA to do? Nothing is the answer. And, tragicomically, the same is true for the Aussie financial regulator APRA, which has now publically added Completely Redundant to its title. In recent testimony it openly claimed that hot house prices, which are so hot it is hard to fathom, are “not our job”(!) Even the Australian Financial Review notes: “Nothing to worry about? Maybe APRA chief should attend an auction.” Honestly, is this really any better/more sustainable a model of capitalism, even if it sells more tickets to some crowds?!

And *there’s* the sound of Gonzo’s pathetic trumpet.

Tyler Durden

Wed, 03/31/2021 – 10:15

via ZeroHedge News https://ift.tt/3m8BhsZ Tyler Durden