4/21/1800: Justice Alfred Moore takes judicial oath.

from Latest – Reason.com https://ift.tt/3elzux7

via IFTTT

another site

4/21/1800: Justice Alfred Moore takes judicial oath.

from Latest – Reason.com https://ift.tt/3elzux7

via IFTTT

Indonesian Submarine Disappears During Routine Naval Drill

An Indonesian Navy submarine has disappeared somewhere in the North Bali waters following a series of naval drills this week. Reuters reported Wednesday that a search party has been dispatched by the Navy to try and locate the lost sub, which was staffed with crew members when it disappeared.

The vessel was participating in torpedo drills when it suddenly failed to report results of an exercise as expected, said First Admiral Julius Widjojono.

According to Reuters, the KRI Nanggala 402 was built in Germany in 1981, has a cruising speed of 21.5 knots and can take up to 34 passengers.

A Navy spokesman, and a spokesman for the defense ministry, weren’t immediately available to respond to questions about how many crewmembers were on board.

Setting aside the potential loss of life, losing a submarine would be a big loss for the Indonesia Navy, since it only has 5 submarines in its fleet. One Twitter user pointed out an interesting coincidence: on April 5, Indonesia laid down a submarine “support station” on a rocky island in the contested South China Sea, which Beijing claims as its own backyard.

Three weeks later, a submarine has mysteriously failed to report back after a routine torpedo drill.

Tyler Durden

Wed, 04/21/2021 – 07:00

via ZeroHedge News https://ift.tt/3tCcikU Tyler Durden

Last fall South Dakota became the first state to simultaneously approve legalization of medical and recreational marijuana. The success of the broader ballot initiative, which passed with support from 54 percent of voters, was especially surprising because the state is mostly Republican and largely conservative. But while voters were ready to legalize marijuana, Gov. Kristi Noem was not. Thanks to a legal challenge backed by Noem, the initiative has been blocked, and it may never take effect.

Seventeen days after the election, Pennington County Sheriff Kevin Thom and Col. Rick Miller, superintendent of the South Dakota Highway Patrol, filed a lawsuit arguing that the marijuana legalization initiative, known as Amendment A, violated the state constitution’s restrictions on voter-approved amendments. Noem later said Miller was acting at her direction. In February, Sixth Judicial Circuit Judge Christina Klinger agreed with Thom, Miller, and Noem, ruling that the initiative violated the “single subject rule” and amounted to a “revision” of the state constitution, which requires a constitutional convention, rather than an amendment.

On the first point, Klinger concluded that Amendment A improperly “embrace[d] more than one subject” because it dealt with industrial hemp as well as marijuana, allocated the proceeds of a marijuana excise tax, created civil penalties for certain marijuana offenses, and barred disciplinary action against licensed professionals for advising the cannabis industry. In her view, these provisions “are not reasonably germane to the legalization of marijuana.”

On the second point, Klinger noted that “the South Dakota Supreme Court has never directly ascertained the difference between an amendment and a revision.” But based on decisions from other states, she concluded that the distinction depends on “the quantitative and qualitative aspects of the enactment.” Although Amendment A “is not a drastic rewrite of the South Dakota Constitution,” she said, it makes “far-reaching changes to the nature of South Dakota’s governmental plan” by restricting the powers of the governor and the legislature with respect to marijuana. It “is therefore a revision.”

Because of those defects, Klinger said, the initiative is “void and has no effect.” South Dakotans for Better Marijuana Laws, the organization that backed Amendment A, has appealed Klinger’s decision to the South Dakota Supreme Court, where oral arguments are scheduled for April 28. An amicus brief filed in support of the appeal by the Cato Institute (and joined by Reason Foundation, which publishes Reason) argues that blocking Amendment A defies the will of voters and undermines federalism.

“This case arises from the efforts of state officials who, having vehemently disagreed with the substance of Amendment A but having failed to persuade the state’s electorate to adopt their views, now seek to set aside the will of the voters and to overturn the constitutional provisions endorsed and enacted by South Dakotans,” the Cato brief says. “This case implicates matters of central concern to amici, not least the interests of all citizens to advance laws that indisputably increase their individual liberties and freedoms even when doing so diverges from the policies, preferences and practices of the federal government.”

Noem praised Klinger’s decision. “Amendment A is a revision, as it has far-reaching effects on the basic nature of South Dakota’s governmental system,” she said. “Today’s decision protects and safeguards our constitution. I’m confident that South Dakota Supreme Court, if asked to weigh in as well, will come to the same conclusion.”

Noem’s determination to block Amendment A seems to be driven more by her anti-pot prejudices than by her commitment to upholding the abstruse rules governing amendments to the state constitution. “I was personally opposed to these measures and firmly believe they’re the wrong choice for South Dakota’s communities,” she said after voters approved the medical and recreational marijuana initiatives. “We need to be finding ways to strengthen our families, and I think we’re taking a step backward in that effort. I’m also very disappointed that we will be growing state government by millions of dollars in costs to public safety and to set up this new regulatory system.”

State legislators proved more willing to set aside their personal views on marijuana in deference to the policy preferred by voters. “In my mind, [legalization is] inevitable because we’ve already seen the support from the public,” Senate Majority Leader Gary Cammack said after Klinger’s decision. “I didn’t vote for recreational marijuana, but my constituents did,” added Greg Jamison, another Republican senator. “Rarely do we get a chance to enact a law and not for sure know what our constituents think of that. Here we know.”

In response to such comments from members of her own party, Noem threatened to veto any legalization bill the legislature might decide to pass. She also has tried, unsuccessfully so far, to stop the medical marijuana initiative from taking effect.

More recently, Noem suggested she might be open to decriminalizing low-level marijuana possession. A proposed bill that she was mulling last month would make possession of an ounce or less, currently a misdemeanor punishable by a maximum fine of $2,000 and up to a year in jail, a petty offense, punishable only by a civil fine, for adults 21 or older. Repeat offenses would remain misdemeanors, although the maximum penalties would be less severe: a $200 fine and 30 days in jail. The Sioux Falls Argus Leader reports that Noem’s chief of staff “said the governor isn’t necessarily in support of the draft proposal.”

Amendment A, by contrast, would eliminate all penalties for adult possession or sharing of an ounce or less while authorizing the licensing and regulation of commercial suppliers. Adults also would be allowed to grow their own pot if they happened to live in a jurisdiction with no licensed retailers. Kristi Noem is not ready for that world, although she might be willing to support a decriminalization policy that was at the cutting edge of marijuana reform in the 1970s.

from Latest – Reason.com https://ift.tt/3tyToey

via IFTTT

Last fall South Dakota became the first state to simultaneously approve legalization of medical and recreational marijuana. The success of the broader ballot initiative, which passed with support from 54 percent of voters, was especially surprising because the state is mostly Republican and largely conservative. But while voters were ready to legalize marijuana, Gov. Kristi Noem was not. Thanks to a legal challenge backed by Noem, the initiative has been blocked, and it may never take effect.

Seventeen days after the election, Pennington County Sheriff Kevin Thom and Col. Rick Miller, superintendent of the South Dakota Highway Patrol, filed a lawsuit arguing that the marijuana legalization initiative, known as Amendment A, violated the state constitution’s restrictions on voter-approved amendments. Noem later said Miller was acting at her direction. In February, Sixth Judicial Circuit Judge Christina Klinger agreed with Thom, Miller, and Noem, ruling that the initiative violated the “single subject rule” and amounted to a “revision” of the state constitution, which requires a constitutional convention, rather than an amendment.

On the first point, Klinger concluded that Amendment A improperly “embrace[d] more than one subject” because it dealt with industrial hemp as well as marijuana, allocated the proceeds of a marijuana excise tax, created civil penalties for certain marijuana offenses, and barred disciplinary action against licensed professionals for advising the cannabis industry. In her view, these provisions “are not reasonably germane to the legalization of marijuana.”

On the second point, Klinger noted that “the South Dakota Supreme Court has never directly ascertained the difference between an amendment and a revision.” But based on decisions from other states, she concluded that the distinction depends on “the quantitative and qualitative aspects of the enactment.” Although Amendment A “is not a drastic rewrite of the South Dakota Constitution,” she said, it makes “far-reaching changes to the nature of South Dakota’s governmental plan” by restricting the powers of the governor and the legislature with respect to marijuana. It “is therefore a revision.”

Because of those defects, Klinger said, the initiative is “void and has no effect.” South Dakotans for Better Marijuana Laws, the organization that backed Amendment A, has appealed Klinger’s decision to the South Dakota Supreme Court, where oral arguments are scheduled for April 28. An amicus brief filed in support of the appeal by the Cato Institute (and joined by Reason Foundation, which publishes Reason) argues that blocking Amendment A defies the will of voters and undermines federalism.

“This case arises from the efforts of state officials who, having vehemently disagreed with the substance of Amendment A but having failed to persuade the state’s electorate to adopt their views, now seek to set aside the will of the voters and to overturn the constitutional provisions endorsed and enacted by South Dakotans,” the Cato brief says. “This case implicates matters of central concern to amici, not least the interests of all citizens to advance laws that indisputably increase their individual liberties and freedoms even when doing so diverges from the policies, preferences and practices of the federal government.”

Noem praised Klinger’s decision. “Amendment A is a revision, as it has far-reaching effects on the basic nature of South Dakota’s governmental system,” she said. “Today’s decision protects and safeguards our constitution. I’m confident that South Dakota Supreme Court, if asked to weigh in as well, will come to the same conclusion.”

Noem’s determination to block Amendment A seems to be driven more by her anti-pot prejudices than by her commitment to upholding the abstruse rules governing amendments to the state constitution. “I was personally opposed to these measures and firmly believe they’re the wrong choice for South Dakota’s communities,” she said after voters approved the medical and recreational marijuana initiatives. “We need to be finding ways to strengthen our families, and I think we’re taking a step backward in that effort. I’m also very disappointed that we will be growing state government by millions of dollars in costs to public safety and to set up this new regulatory system.”

State legislators proved more willing to set aside their personal views on marijuana in deference to the policy preferred by voters. “In my mind, [legalization is] inevitable because we’ve already seen the support from the public,” Senate Majority Leader Gary Cammack said after Klinger’s decision. “I didn’t vote for recreational marijuana, but my constituents did,” added Greg Jamison, another Republican senator. “Rarely do we get a chance to enact a law and not for sure know what our constituents think of that. Here we know.”

In response to such comments from members of her own party, Noem threatened to veto any legalization bill the legislature might decide to pass. She also has tried, unsuccessfully so far, to stop the medical marijuana initiative from taking effect.

More recently, Noem suggested she might be open to decriminalizing low-level marijuana possession. A proposed bill that she was mulling last month would make possession of an ounce or less, currently a misdemeanor punishable by a maximum fine of $2,000 and up to a year in jail, a petty offense, punishable only by a civil fine, for adults 21 or older. Repeat offenses would remain misdemeanors, although the maximum penalties would be less severe: a $200 fine and 30 days in jail. The Sioux Falls Argus Leader reports that Noem’s chief of staff “said the governor isn’t necessarily in support of the draft proposal.”

Amendment A, by contrast, would eliminate all penalties for adult possession or sharing of an ounce or less while authorizing the licensing and regulation of commercial suppliers. Adults also would be allowed to grow their own pot if they happened to live in a jurisdiction with no licensed retailers. Kristi Noem is not ready for that world, although she might be willing to support a decriminalization policy that was at the cutting edge of marijuana reform in the 1970s.

from Latest – Reason.com https://ift.tt/3tyToey

via IFTTT

A novel cannabis drug is popping up in cities across the U.S., eliciting concern from members of the cannabis and hemp industries, state legislators, and a chemist who reviews cannabis drugs for safety. While the newly popular compound of delta-8-THC is not expressly prohibited by the Controlled Substances Act, people I spoke to are concerned that it is being produced unsafely and not receiving the same scrutiny that regulators apply to legal marijuana.

The arrival of delta-8-THC—which is being sold in various places as a tincture, in vape pens, added to food, and sprayed on hemp flower so that it can be smoked—coincided with the passage of the 2018 Farm Bill, in which Congress repealed the federal prohibition on hemp and its byproducts. While delta-8-THC occurs in only trace amounts in hemp and cannabis, it can be synthesized from CBD isolate, the main commercial compound derived from hemp plants.

After the farm bill passed, investment flooded into the hemp industry based on the expectation that it would be only a matter of time until farmers could sell hemp products as nutritional supplements.

“Everyone anticipated that big grocery and pharmacy retailers would line their shelves once hemp and CBD were legal,” Jim Higdon, owner and founder of Cornbread Hemp in Kentucky, tells Reason. But selling to national grocery and pharmacy retailers hinged on the Food and Drug Administration (FDA) classifying hemp-derived CBD, short for cannabidiol, as a nutritional supplement. Instead, the FDA explicitly declared that CBD could not be sold as a nutritional supplement.

“The CBD industry in 2017 and 2018 had this rush with people wanting to get in,” says Eric Steenstra, president of Vote Hemp. “In 2018, we had about 3,500 licenses for growers in the U.S. In 2019, we had over 19,000 licenses for growers.” Then, when the FDA made it clear that hemp-derived CBD could not be marketed as a nutritional supplement, “you had all these people producing all this CBD, and there were suddenly way more producers than purchasers,” Steenstra says. The prices of hemp and hemp-derived CBD isolate plummeted and remain low. “Lots of people couldn’t sell their hemp flower and a lot of producers were sitting on CBD isolate trying to figure out what to do with it.”

That’s when some enterprising chemist found that CBD isolate could be synthesized into delta-8-THC, a cousin of delta-9-THC. While delta-9, the main psychoactive ingredient in cannabis, is prohibited by the Farm Bill and the Controlled Substances Act, neither piece of legislation mentions delta-8. Though it’s not inherently dangerous, says Christopher Hudalla, the founder and chief science officer of ProVerde Laboratories, which provides testing services to state-legal cannabis businesses in Massachusetts and Maine, Hudalla has yet to test a delta-8-THC product that contains only delta-8.

When he first saw products containing delta-8-THC in 2018, Hudalla says, “I thought, ‘This is cool, this is novel.’ But then I was like, ‘What do we know about this?'”

The products Hudalla tested contained delta-8-THC, but also other THC isomers as well as chemical byproducts. “These byproducts are not found in nature. Chemists are using very, very strong reagents—strong acids, strong bases. If you don’t know what you’re doing, it’s very possible to pass along some of those reagents to your customer.”

Hudalla looked at numerous samples, finding not only chemical byproducts unfit for consumption but also chemical isolates he couldn’t identify. He says that when pharmaceutical companies produce a drug and can’t get rid of all the chemical byproducts, they are required to prove that the byproducts are safe. The delta-8 producers he’s spoken with, many of whom are using unsophisticated labs, do not have the resources or the know-how to conduct those studies.

Hudalla couldn’t tell his clients that their delta-8-THC products were pure, so he wrote lab reports for them declaring that the products were not fit for human consumption. The decision has cost him business, and many producers have simply shopped for a lab that will write them a purity report they like. But he stands by the decision, citing lessons learned from the wave of lung injuries caused in recent years by THC vape pens sold on the black market. “I don’t want to be responsible for someone hurting someone else, and I don’t want a certificate of safety with my name on it found in a DEA bust,” Hudalla says.

Steenstra is equally concerned that some members of the hemp industry have turned to producing delta-8-THC. “These products are being produced who knows where, under who knows what conditions,” Steenstra says. “There’s been no research into whether delta-8-THC products are safe.”

Like Higdon, Steenstra is frustrated that the FDA refuses to roll up its sleeves and do the work of regulating hemp and CBD products as nutritional supplements. “These products are not being regulated by the FDA, but they should be,” Steenstra says. “There are lots of good companies making good products, but they’re doing it voluntarily. Which means there’s a lot of poor-quality stuff out there as well.” The thinking among hemp advocates is that smart regulations would give the hemp industry a path toward commercial viability, stabilize prices, and discourage the diversion of CBD isolate toward grey and black market delta-8-THC products.

The adult-use cannabis industry is also concerned about the rise of delta-8-THC. “Very little is known about the health effects of delta-8 and almost all current production is entirely unregulated,” says Morgan Fox, media relations director for the National Cannabis Industry Association. “Until we know more about delta-8, its production and sale should be regulated just like delta-9 under existing state cannabis licensing and oversight systems.”

Fox also says that prohibition in general, not just the FDA’s refusal to regulate hemp, is driving the delta-8-THC trend. “Keeping delta-9-THC—which is naturally present in cannabis at usable levels and has a long history of research and longitudinal data showing its relative safety—either illegal or so heavily regulated that it becomes prohibitively expensive for consumers creates an unnecessary demand for alternative inebriating cannabinoids. We are seeing that even though there is some limited demand for delta-8 in states with regulated cannabis markets, the vast majority of interest is in prohibition states.”

While many defenders of delta-8 insist that it’s perfectly legal under federal law, no one I spoke with thinks the legality is the most pressing issue. “It scares me that hemp is being marketed this way. It’s a black eye for the hemp industry,” Steenstra says. “If you go to a dispensary in a state where medical or recreational cannabis is legal, it’s tested for everything and comes with a data sheet. In places where it’s not legal, you’re buying delta-8 at a gas station and have no idea.”

No one I spoke to objected to the creation of a novel cannabis compound, they just don’t want to harm consumers or erase the goodwill they’ve accumulated by submitting to regulation and oversight. “If someone can produce a delta-8 product that is actually delta-8 and not a garbage product, I don’t have a problem with that,” Hudalla adds. “That’s a regulatory issue. As of right now, we’re using consumers as guinea pigs.”

from Latest – Reason.com https://ift.tt/3nb1Eir

via IFTTT

Market ‘Tsunami’ Warning

Authored by John Mauldin via MauldinEconomics.com,

A tsunami is a wall of water that wipes out everything in its path, typically caused by earthquakes. But first, the water actually disappears from the usual shoreline, leaving land where there should be sea.

If you are on the shore and see that happen, the correct response is to run for high ground. Tragically, though, people often rush toward this new and unusual sight. It’s hard to blame them; we humans are drawn to the unknown. This impulse explains much of our progress, but it has costs, too.

Right now, the stock market is in the land-where-there-should-be-sea phase. What we don’t know is when the wave is coming. Maybe there’s time to venture out and see what treasure was hidden beneath the waves… or maybe not. Prudence would suggest that we go searching for treasure on higher ground.

This is an age-old investor conundrum. How do you balance risk and reward? You have clues, but you can’t be certain of what is coming, or when it will arrive, or what it will look like. You know you need positive returns, but you also need to avoid major losses. The answers are never easy. You take your chances, no matter what you do. Today we’ll see what some of my favorite market wizards see on the horizon.

One sign the water may soon rush out of stocks, indicating tsunami, is the amount of money rushing in. My friend Doug Kass recently shared this staggering chart. It shows the inflows to stock funds since November exceed the total inflows of the last 12 years. Doug helpfully pointed out that one of the legendary Bob Farrell’s rules is that “individuals buy most of the top and buy the least at the bottom.”

Note also, this is just stock funds. It doesn’t include individual trading accounts, and I suspect the amount entering the market via those is equally staggering.

Where is the money coming from? The obvious answer is from the Federal Reserve and government stimulus. But Danielle DiMartino Booth gives us a visual chart to understand just how completely out of historical context the current levels are (from Quill Intelligence):

Yes, some of this is showing up in retail sales (which were gonzo last week), but clearly some of it is showing up in stock purchases (see some reasons why below). We see well over three times the normal tax refund and stimulus number (pushing $700 billion), and I assume this doesn’t even include state unemployment and other indirect stimulus. Also, notice the tiny blip on income tax deposits. The differential is even more stark.

When markets change, as they clearly have in the last two years, you want to ask if something else changed that might explain it. Federal Reserve activity and COVID stimulus payments are obvious factors, but I think something else is contributing. Some history may clarify it.

Way back in ancient times, which some of us can remember, stocks traded in 100-share “round lots.” If the share price was $30, you had to invest $3,000, or $6,000, or some other multiple. You could trade in smaller increments but brokers frowned on it and some charged higher commissions, which back then were already extremely high compared to today. And odd lot orders often got executed at inferior prices, too.

(I have a friend who once ran serious money for a family office, focused entirely on buying bonds in odd lots. He didn’t need to find odd lots, as they had plenty of money. He could simply get 1 to 2% more yield for the little bit of extra work.)

Over time, “odd lot” trading became a sign of amateur activity, to the point some used it as a contrary indicator. More odd lot activity meant uninformed people were entering the market and a top was approaching.

By the 1990s, back office technology had made the whole round lot preference obsolete. Brokers stopped caring how many shares you traded. In effect, a “round lot” became one share. But now it is even less. Robinhood and many other trading platforms let users trade fractional shares, as little as 1/1,000,000 of a share. I believe this may be more consequential than is generally recognized.

Look at the share prices for of some of today’s top companies: Apple (AAPL) is around $130. In the old round-lot world, you would have needed $13,000 to trade it efficiently. Now you need less than a penny. This vastly expands the universe of people who can trade Apple shares. And Apple is low-priced compared to some other popular names like Tesla (TSLA) around $750, or Amazon (AMZN), which is over $3,000 per share.

We have, without really noticing, severed the connection between share price and liquidity. This matters in ways I think we may not fully understand. Combine it with game-like mobile apps that let people buy and sell in individually tiny amounts that add up to the big numbers once reserved for giant institutions. And without any kind of institutional decision-making process to constrain rash moves.

Further add trillions in government cash payments, often to people with time on their hands because they are unemployed, and who need ways to generate income. Of course, some turn to stock trading. It’s an attractive “side hustle” for a time when Uber driving is less attractive. If all you have is $100, that’s okay.

We have raised a generation playing adrenaline-charged video games. For a relatively small stimulus check, they get to play in a game where Dave Portnoy assures them that stocks only go up, or they can “stick it to the man” in GameStop. Sigh….

In the bigger picture, all those small accounts add up to enormous sums of hair-trigger money. Some of it has much higher risk tolerance. The app users don’t see it as a nest egg to preserve. In their minds, it’s more like buying gas to get to work—something you have to burn. The whole concept of a stock being overvalued or undervalued doesn’t apply. They just want it to move.

Where all this leads is uncertain but I suspect it won’t be good.

One of the first rules my mentors taught me: All it takes to create a bull market is for buyers to show up. All it takes to create a bear market is for the buyers to disappear. Just reading the zeitgeist, I don’t think they’re going to disappear for a while.

Dave Rosenberg at Rosenberg Research has also been following these inflows, and finds them problematic. He added another perspective in his latest monthly chartbook. The line in this chart shows current equity exposure in the AAII Asset Allocation Survey going back to 2002.

As you can see, equity exposure dropped in early 2020 as the coronavirus struck, climbed sharply and is now far stronger than it was when the last bull market began in 2009. I’m not sure the AAII survey captures the individuals (it’s hard to call them “investors”) trading small amounts on Robinhood and other apps. But their inclusion would only make the point stronger. A bull market needs fuel and this one has already burned a lot of it.

This is important also because we are talking about percentages, which include whatever money people may have received from the various stimulus programs. That money is already in the woodpile and being burned along with preexisting cash.

Dave has another chart showing the result. Comparing S&P 500 gains in the last four recessions, this one is stronger than the others were.

This market recovery has actually tracked the 2009 one pretty closely. But remember the previous chart: In 2009, investors had pulled out and then spent months furiously reinvesting. The current recovery happened with people closer to fully invested. That means it is even stronger than the price action shows.

None of this means the bull will tire in the near future. Major market trends often persist far longer than we think possible. Precedent is reliable until something unprecedented happens. It is certainly plausible to think the economy will bounce once the pandemic is out of the way, which we all hope will be soon. I’ve noted how crises often generate growth-sparking innovations. Good things may be coming. The question is whether they will both justify today’s valuations and even higher future valuations that justify further price gains.

Let’s think about this. The Fed is adding QE at an ~$1.5 trillion annual pace. They say interest rates won’t rise until 2023 at the earliest. The US government (by my latest count) has thrown, or soon will, $5 trillion of stimulus money, almost 25% of annual GDP, into the economy. Yes, not all of it goes directly to individuals, but it will eventually find a home, creating new jobs or programs.

At some point the government stimulus simply has to stop. Job openings are plentiful and the economy is opening up. Employers are having to pay much higher wages to get someone to come to work. When you can make $20-$30,000 a year staying at home, $10-$12 an hour just isn’t appealing. Ironically, the unemployment checks are actually creating wage inflation.

While we may get a massive infrastructure bill later this year, it will be spread out over a decade. I don’t think we are going to see anything like the current free-for-all, multi-trillion-dollar injections like the last 12 months.

Central banks and governments worldwide are supplying massive amounts of rocket fuel for supercharged markets. The yields on high-yield bonds (junk bonds) are close to the recent all-time lows. Investors are desperate for yield and the only place that seems to offer return, if you’re only paying attention to price momentum, is the stock market. So Baby Boomers and retirees, along with their Millennial children, are taking more risk than they can possibly imagine.

The stock market is trading at more than three standard deviations above its 50-day moving average (courtesy Doug Kass).

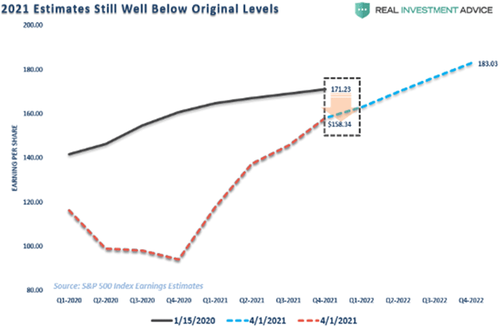

Our friend Lance Roberts at Real Investment Advice offered these two charts

Source: Real Investment Advice

I don’t know of a time when valuations and markets were more stretched than they are right now. I also don’t remember a time when monetary and fiscal stimulus was more than it is right now. I would not be surprised to see the market rise considerably more from here. That being said, let me repeat what I said last week. I do not want to play the stock market or bond market game. There are other, more profitable games with much less risk. I am not bearish. I am 100% invested and as aggressive as I have ever been in my life. Just not in index funds.

CPI inflation has a real chance of approaching 3% and maybe 4% this year. Something could easily become the tipping point (it literally doesn’t matter what it is) that makes the market roll over 20% or more.

In that scenario, I will bet you a dollar to 47 doughnuts the Federal Reserve steps in, and in giant size. QE increases another $50 billion per month? Or Whatever It Takes! If that’s not enough, then some clever lawyer will find a loophole to allow the Federal Reserve to enter the stock market through the back door. Or Janet Yellen walks over to her friend Nancy Pelosi and says we need a bill letting the Fed be more aggressive. It won’t be Hank Paulson on his knees to Pelosi this next time. Literally nothing—I truly mean nothing—will be off the table. When you are in the middle of a crisis, you channel your inner Mario Draghi and do whatever it takes.

Will it work? Who knows? I truly don’t know what will happen. We are exploring brand-new territory this decade. The new era we are entering can bring challenges as well as opportunities. Time to think about changing your game if you are still playing the old one.

* * *

Click here to get Thoughts from the Frontline in your inbox every Saturday… Subscribe Now

Tyler Durden

Wed, 04/21/2021 – 06:30

via ZeroHedge News https://ift.tt/3grxAhf Tyler Durden

A novel cannabis drug is popping up in cities across the U.S., eliciting concern from members of the cannabis and hemp industries, state legislators, and a chemist who reviews cannabis drugs for safety. While the newly popular compound of delta-8-THC is not expressly prohibited by the Controlled Substances Act, people I spoke to are concerned that it is being produced unsafely and not receiving the same scrutiny that regulators apply to legal marijuana.

The arrival of delta-8-THC—which is being sold in various places as a tincture, in vape pens, added to food, and sprayed on hemp flower so that it can be smoked—coincided with the passage of the 2018 Farm Bill, in which Congress repealed the federal prohibition on hemp and its byproducts. While delta-8-THC occurs in only trace amounts in hemp and cannabis, it can be synthesized from CBD isolate, the main commercial compound derived from hemp plants.

After the farm bill passed, investment flooded into the hemp industry based on the expectation that it would be only a matter of time until farmers could sell hemp products as nutritional supplements.

“Everyone anticipated that big grocery and pharmacy retailers would line their shelves once hemp and CBD were legal,” Jim Higdon, owner and founder of Cornbread Hemp in Kentucky, tells Reason. But selling to national grocery and pharmacy retailers hinged on the Food and Drug Administration (FDA) classifying hemp-derived CBD, short for cannabidiol, as a nutritional supplement. Instead, the FDA explicitly declared that CBD could not be sold as a nutritional supplement.

“The CBD industry in 2017 and 2018 had this rush with people wanting to get in,” says Eric Steenstra, president of Vote Hemp. “In 2018, we had about 3,500 licenses for growers in the U.S. In 2019, we had over 19,000 licenses for growers.” Then, when the FDA made it clear that hemp-derived CBD could not be marketed as a nutritional supplement, “you had all these people producing all this CBD, and there were suddenly way more producers than purchasers,” Steenstra says. The prices of hemp and hemp-derived CBD isolate plummeted and remain low. “Lots of people couldn’t sell their hemp flower and a lot of producers were sitting on CBD isolate trying to figure out what to do with it.”

That’s when some enterprising chemist found that CBD isolate could be synthesized into delta-8-THC, a cousin of delta-9-THC. While delta-9, the main psychoactive ingredient in cannabis, is prohibited by the Farm Bill and the Controlled Substances Act, neither piece of legislation mentions delta-8. Though it’s not inherently dangerous, says Christopher Hudalla, the founder and chief science officer of ProVerde Laboratories, which provides testing services to state-legal cannabis businesses in Massachusetts and Maine, Hudalla has yet to test a delta-8-THC product that contains only delta-8.

When he first saw products containing delta-8-THC in 2018, Hudalla says, “I thought, ‘This is cool, this is novel.’ But then I was like, ‘What do we know about this?'”

The products Hudalla tested contained delta-8-THC, but also other THC isomers as well as chemical byproducts. “These byproducts are not found in nature. Chemists are using very, very strong reagents—strong acids, strong bases. If you don’t know what you’re doing, it’s very possible to pass along some of those reagents to your customer.”

Hudalla looked at numerous samples, finding not only chemical byproducts unfit for consumption but also chemical isolates he couldn’t identify. He says that when pharmaceutical companies produce a drug and can’t get rid of all the chemical byproducts, they are required to prove that the byproducts are safe. The delta-8 producers he’s spoken with, many of whom are using unsophisticated labs, do not have the resources or the know-how to conduct those studies.

Hudalla couldn’t tell his clients that their delta-8-THC products were pure, so he wrote lab reports for them declaring that the products were not fit for human consumption. The decision has cost him business, and many producers have simply shopped for a lab that will write them a purity report they like. But he stands by the decision, citing lessons learned from the wave of lung injuries caused in recent years by THC vape pens sold on the black market. “I don’t want to be responsible for someone hurting someone else, and I don’t want a certificate of safety with my name on it found in a DEA bust,” Hudalla says.

Steenstra is equally concerned that some members of the hemp industry have turned to producing delta-8-THC. “These products are being produced who knows where, under who knows what conditions,” Steenstra says. “There’s been no research into whether delta-8-THC products are safe.”

Like Higdon, Steenstra is frustrated that the FDA refuses to roll up its sleeves and do the work of regulating hemp and CBD products as nutritional supplements. “These products are not being regulated by the FDA, but they should be,” Steenstra says. “There are lots of good companies making good products, but they’re doing it voluntarily. Which means there’s a lot of poor-quality stuff out there as well.” The thinking among hemp advocates is that smart regulations would give the hemp industry a path toward commercial viability, stabilize prices, and discourage the diversion of CBD isolate toward grey and black market delta-8-THC products.

The adult-use cannabis industry is also concerned about the rise of delta-8-THC. “Very little is known about the health effects of delta-8 and almost all current production is entirely unregulated,” says Morgan Fox, media relations director for the National Cannabis Industry Association. “Until we know more about delta-8, its production and sale should be regulated just like delta-9 under existing state cannabis licensing and oversight systems.”

Fox also says that prohibition in general, not just the FDA’s refusal to regulate hemp, is driving the delta-8-THC trend. “Keeping delta-9-THC—which is naturally present in cannabis at usable levels and has a long history of research and longitudinal data showing its relative safety—either illegal or so heavily regulated that it becomes prohibitively expensive for consumers creates an unnecessary demand for alternative inebriating cannabinoids. We are seeing that even though there is some limited demand for delta-8 in states with regulated cannabis markets, the vast majority of interest is in prohibition states.”

While many defenders of delta-8 insist that it’s perfectly legal under federal law, no one I spoke with thinks the legality is the most pressing issue. “It scares me that hemp is being marketed this way. It’s a black eye for the hemp industry,” Steenstra says. “If you go to a dispensary in a state where medical or recreational cannabis is legal, it’s tested for everything and comes with a data sheet. In places where it’s not legal, you’re buying delta-8 at a gas station and have no idea.”

No one I spoke to objected to the creation of a novel cannabis compound, they just don’t want to harm consumers or erase the goodwill they’ve accumulated by submitting to regulation and oversight. “If someone can produce a delta-8 product that is actually delta-8 and not a garbage product, I don’t have a problem with that,” Hudalla adds. “That’s a regulatory issue. As of right now, we’re using consumers as guinea pigs.”

from Latest – Reason.com https://ift.tt/3nb1Eir

via IFTTT

The Vatican Mulls Selling $277 Million West London Office Property

It isn’t just major corporations looking to turn tail from cities…

The Vatican is mulling the sale of a building it owns in West London that has been at the center of a financial scandal. 60 Sloane Avenue in Chelsea is said to be worth about $277 million and is located in one of the most desired zip codes in London, Bloomberg wrote this weekend.

The building was at the center of a 2014 investigation that cost the Vatican money (between 66 million pounds and 150 million pounds) and saw several of its officials brought in for questioning. Among other things, there were questions about high fees paid to middlemen who brokered the city-state’s investment in the property.

Archbishop Nunzio Galantino said that “mistakes or fraudulent acts” at the center of the controversy were being examined by the Vatican. He also blamed high interest rates (we’ll pause for laughter), the pandemic and the depreciation of the pound.

Cardinal Angelo Becciu, who was chief of staff in the Vatican’s secretariat of state and was linked to the deal, resigned, despite not being placed under investigation.

As Bloomberg notes, the controversy stands at stark odds with Pope Francis’ messaging about money, which he once called “the devil’s dung”.

While a sale is being considered there is “no rush” to move the property, the report noted. The 170,000 sq. foot building is a mix of offices and retail space, and can be converted into 49 luxury apartment units.

Tyler Durden

Wed, 04/21/2021 – 05:45

via ZeroHedge News https://ift.tt/3sAf60A Tyler Durden

UK Refuses To Accelerate Re-Opening Despite COVID Deaths Dropping Below Road Accident Fatalities

Authored by Paul Joseph Watson via Summit News,

Despite new figures showing the daily number of COVID-19 deaths in the UK dropping below those from road accidents, the government is still refusing to accelerate the lifting of lockdown restrictions.

The average number of daily deaths now stands at 25 a day with COVID cases dropping 94 per cent from the peak.

On Monday, the UK recorded just four total deaths.

“By comparison, the UK records an average of around five deaths from road accidents daily,” reports the Telegraph.

The government has continually insisted it will prioritize “data not dates” in deciding when the measures should be relaxed, although that argument seems to immediately dissipate when the data favors re-opening quicker.

“We’ve been told regularly, that we are following the data, not the dates, but sadly, it seems to be the other way around,” said Conservative MP Pauline Latham.

“Derbyshire there are huge swathes of villages and towns, that have no Covid whatsoever, and that’s repeated over all sorts of areas of the country.”

“We do need to start getting businesses back to normal. We need to get hospitality businesses fully functioning, and using their indoor spaces,” she added.

Last week, Prime Minister Boris Johnson claimed that lockdown restrictions and not vaccine rates were to thank for the country’s plummeting COVID cases, despite data showing cases were already falling before each successive lockdown.

Many took this as a sign that Johnson will be pressured into placing the country on lockdown yet again in the Autumn if there is another wave of the virus.

The government’s timetable for re-opening promises an end to all restrictions and social distancing measures on June 21, although events are already planned after this date that will require limited attendance, social distancing and masks.

Many fear that the restrictions will never truly be lifted given that the precedent has now been set that the state can place the entire population under de facto house arrest at the drop of a hat.

* * *

Brand new merch now available! Get it at https://www.pjwshop.com/

* * *

In the age of mass Silicon Valley censorship It is crucial that we stay in touch. I need you to sign up for my free newsletter here. Support my sponsor – Turbo Force – a supercharged boost of clean energy without the comedown. Also, I urgently need your financial support here.

Tyler Durden

Wed, 04/21/2021 – 05:00

via ZeroHedge News https://ift.tt/2P6MyOn Tyler Durden

One Loveland, Colorado, police officer has been put on paid leave and another moved to desk duty after a 73-year-old woman sued the department for an arrest in which her attorney says she suffered a broken arm, dislocated shoulder and sprained wrist. The attorney says the woman has dementia. Staff at a local Walmart called cops after Karen Garner reportedly tried to shoplift $13.88 in merchandise. Garner left without the merchandise. Body cam footage shows Officer Austin Hopp calling to her outside the store. When Garner refused to speak to him, he grabbed her and threw her to the ground. As Garner repeatedly says “I am going home,” Hopp and Officer Daria Jalili handcuff her.

from Latest – Reason.com https://ift.tt/2QJEZxu

via IFTTT