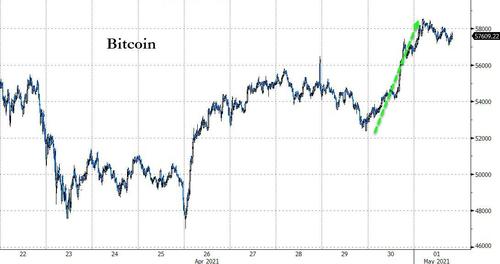

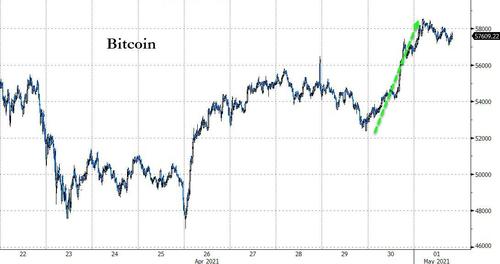

Bitcoin and crypto markets have been rebounding this week after the prior week’s sell off.

Source: Bloomberg

A combination of de-leveraging, Bitcoin falling below its 50-day, notable Wall Street firms forecasted a major correction to $20-30k sparking retail fear and the Biden tax plan were all events that took us lower last week.

But market have stabilized and bounced since then.

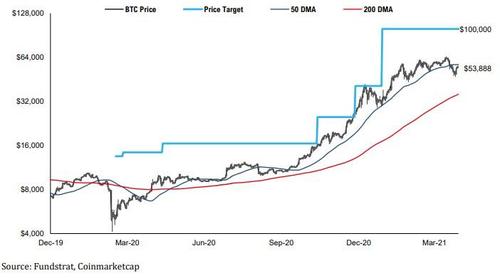

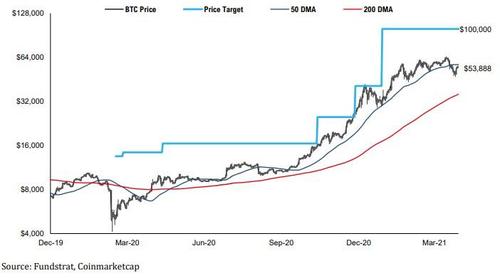

As FundStrat mentioned in a note two weeks ago, we thought a “crypto market cooling off would be healthy”. We’ve seen the price of Bitcoin retrace a little over ~25%, which would qualify as a major correction for traditional markets but is par for the course in crypto during bull market cycles. While we’re not technical traders, Bitcoin falling below its 50 day gives us less concern given this has happened several times during the prior bull market cycle, and it’s the 200 day that Bitcoin has historically maintained during prior bull runs.

As FundStrat discussed in their prior week’s note, they believe the bull market remains intact, and are maintaining our $100k Bitcoin price target.

Via FundStrat.com,

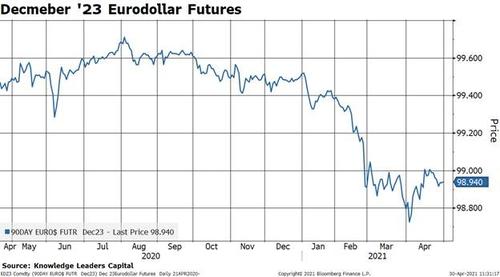

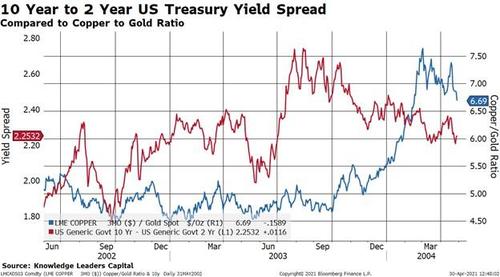

We think the macro backdrop remains bullish for crypto assets. The Fed’s recent guidance that it plans to remain accommodative should be supportive for risk assets like crypto.

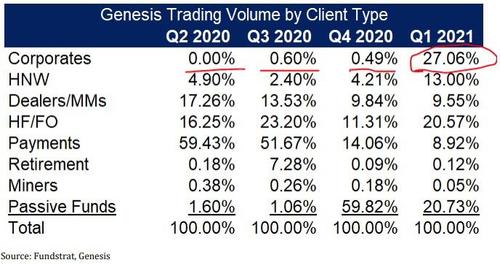

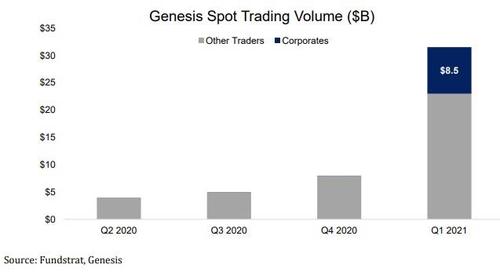

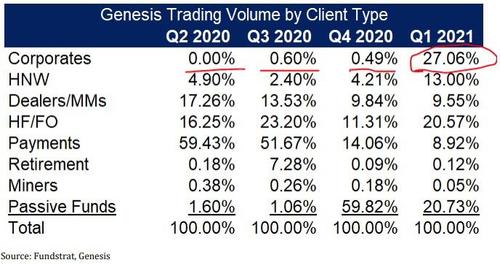

In our January 2021 Crypto Outlook, we predicted corporates would be entering crypto in a bigger way this year.

We think this is starting to happen more and will be one new source for capital flows into the crypto economy.

Tesla grabbed news headlines by announcing it had purchased $1.5B of Bitcoin earlier this year and again drew the spotlight the other day by announcing that they had sold a relatively small amount for a $100M profit to, in Elon’s words, “prove the market liquidity”. Rumors were even flying around that Facebook may be reporting Bitcoin on its balance sheet with its earnings release – this proved to be untrue but we even if Facebook didn’t buy Bitcoin, the corporates are coming, and it may not be reflected in earnings announcements yet.

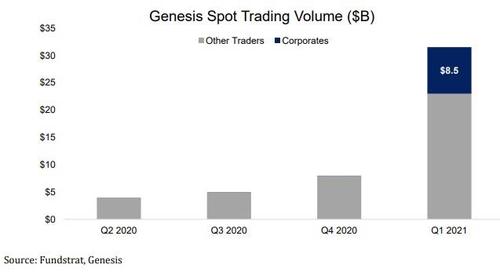

Why do we think this? Based on the Q1 2021 Market Observations Report that was published yesterday, the OTC trading firm reported a notable jump in Corporates as a share of volume to ~27% from ~0% in the quarters prior.

As one of the largest U.S. OTC desks, we think this is telling of what could be to come. Genesis reported a little over $30B in trading volume during the quarter, implying that roughly $8.5B came from corporates. Even if we back out buys and sell from Tesla, MicroStrategy and other corporate, we think this says that more corporates bought crypto this quarter than has been announced, unless Tesla is day trading its position, which we think is unlikely given corporates tend to be longer term holders.

We think announcements from other corporations in the weeks to come could offer catalysts for the market.

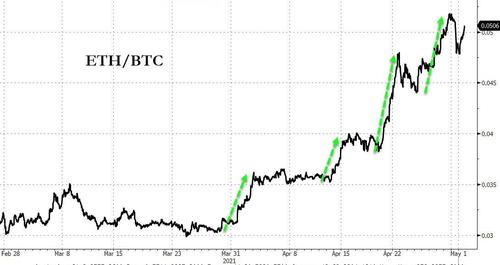

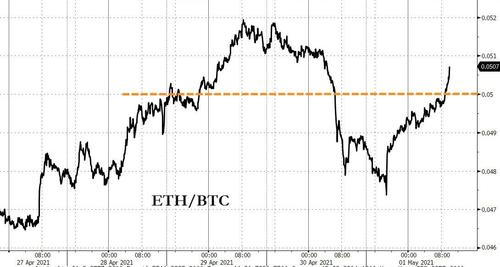

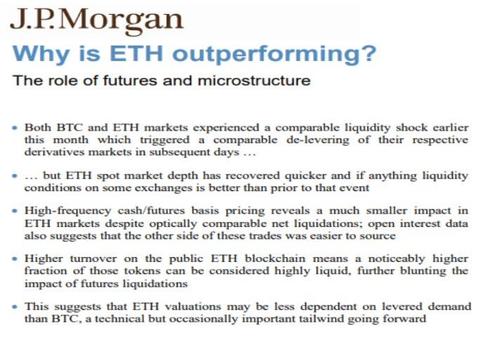

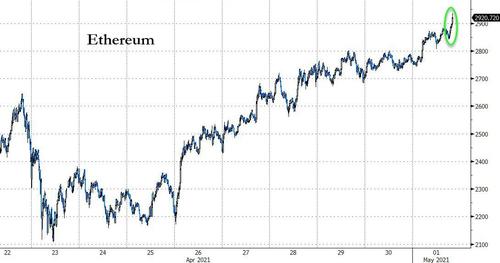

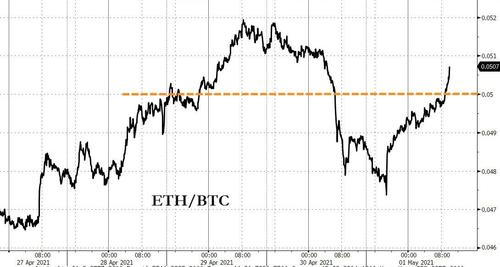

Remaining overweight Ethereum and maintaining a price target of $10.5k as ETH reaches new highs and continues to outperform BTC

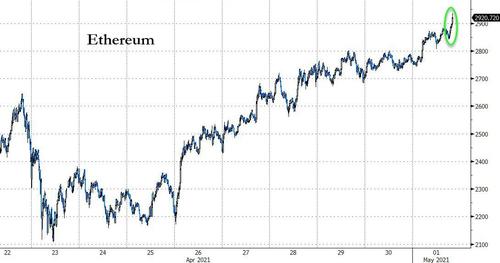

Ethereum reached a new all-time high of $2,900 this week.

We’re maintaining our overweight Ethereum vs. Bitcoin recommendation (as we detailed here) from April 2020 and reiterating our ~$10.5k price target from January this year.

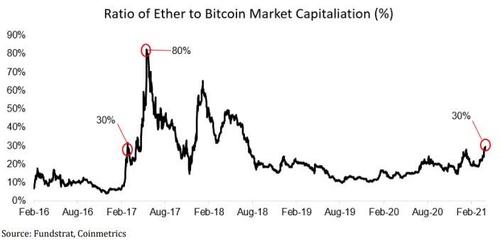

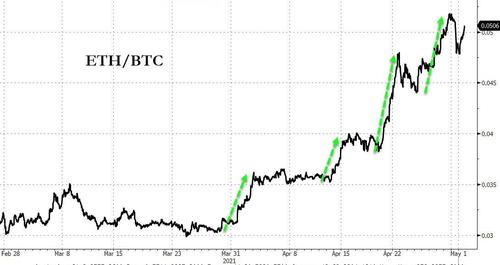

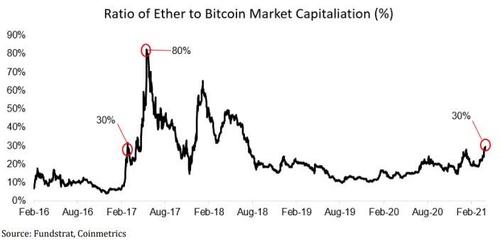

Ethereum’s market cap has risen to ~30% of Bitcoins over recent weeks. During the last market cycle, Ethereum broke this level and head as high as 80% of Bitcoin’s value – we’re not predicting exactly this but its a useful frame of reference.

When new investors come to crypto the first asset they generally hear about and buy is Bitcoin before learning about other assets and allocating across the space.

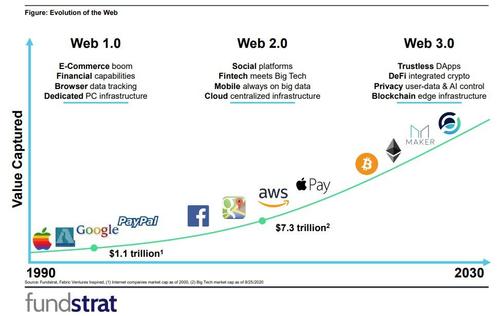

We think the same learning curve is playing out with institutional investors right now where the crypto narrative is shifting from Bitcoin to Ethereum and other segments like DeFi and Web 3 apps.

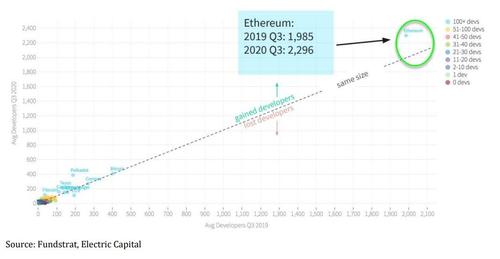

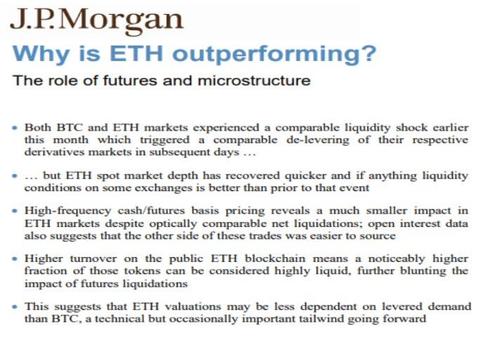

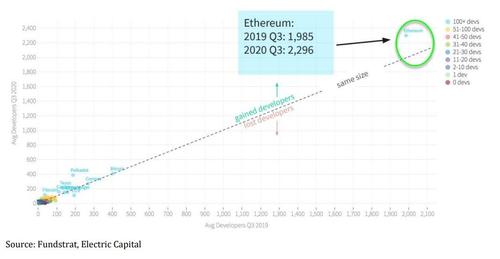

One reason we remain bullish on Ethereum is the large amounts of development happening there and the resulting economic activity in its digital economy

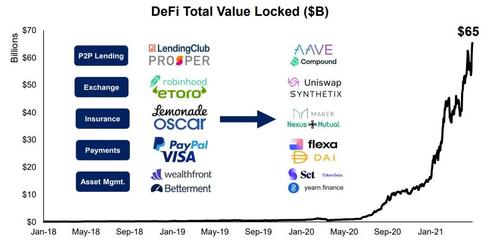

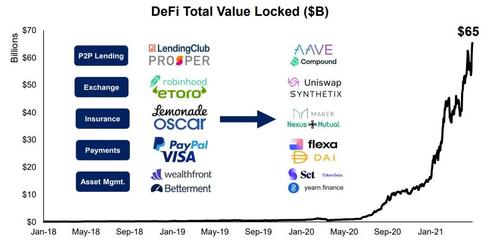

As we discussed in our Bitwise Decentralized Finance (DeFi) report, Ethereum and others are enabling new financial applications which have grown significantly in scale over the last year.

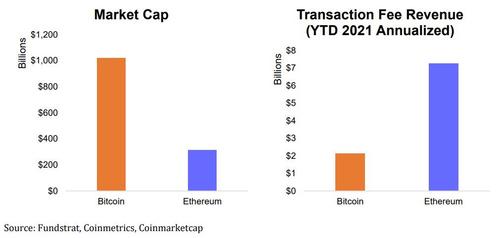

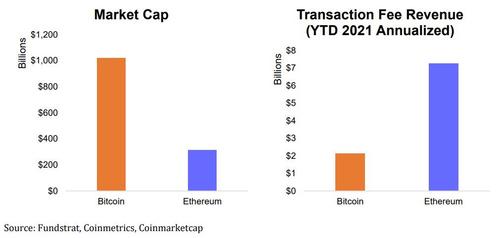

These applications are generating ~3x the fees for the Ethereum network vs. Bitcoin which trades at ~3x the market cap.

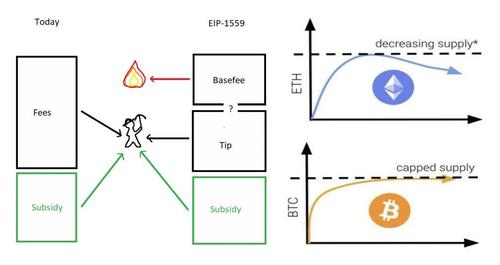

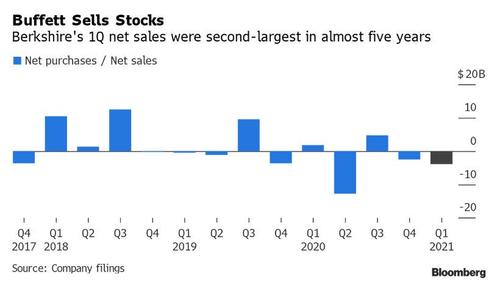

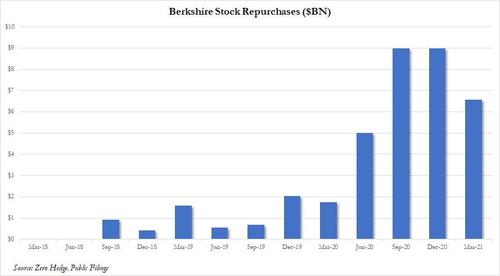

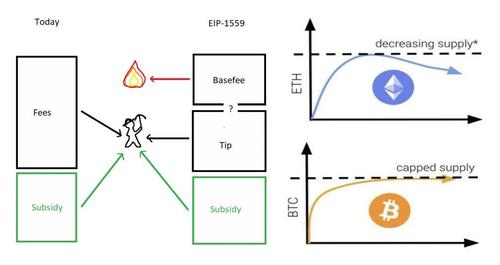

We think fees are an important way to look at Ethereum given the upcoming changes to its network economics with EIP1559. Ethereum is transitioning from a currency like Bitcoin to a crypto capital asset where a portion of the network transaction fees are used to buyback (burn) and retire (treasury stock) ETH supply.

In crypto accounting terms, this is the same as a company using revenue (fees), less operating costs (stock comp supply issuance), and earning profit (net supply burn) that is used to buyback stock (share repurchase). This means the network would become “profitable” like a company once ETH supply reduction from burned fees outpaces inflation.

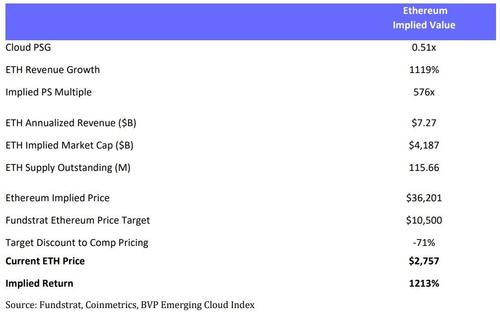

Our price target of $10.5k from January 2021 looks at Ethereum this way and values it on a revenue multiple basis.

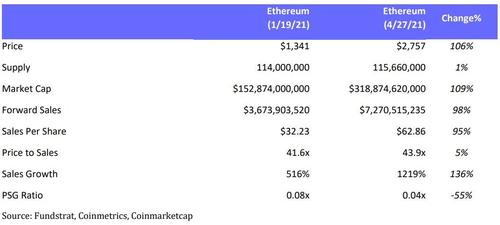

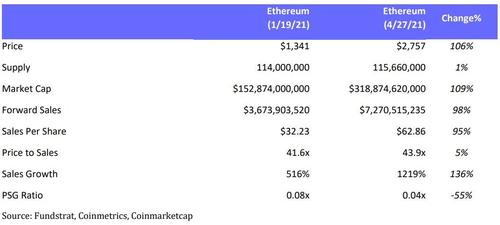

Although the price has doubled since our target was issued, Ethereum annualized fee revenue growth has nearly doubled as well, while the price to revenue multiple has remained roughly the same.

Given the correspondingly strong improvement in fundamentals, we think Ethereum still looks as cheap as it did 3 months ago at half the price.

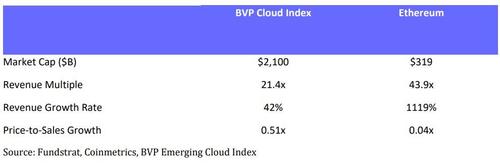

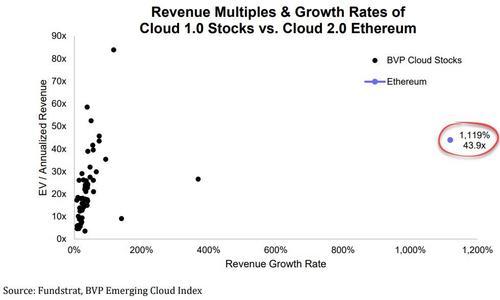

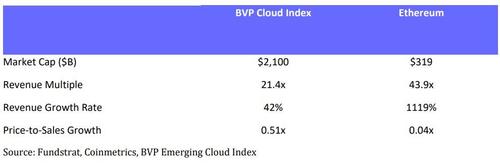

We continue to view Ethereum as a Cloud 2.0 crypto stock as we discussed in our prior ETH report. Given this dynamic, we think it’s reasonable to compare Ethereum against the Bessemer Venture Partners (BVP) Emerging Cloud Index. On a revenue multiple basis, Ethereum is about twice as expensive as the cloud index, but on a growth adjusted basis, its ~13x cheaper.

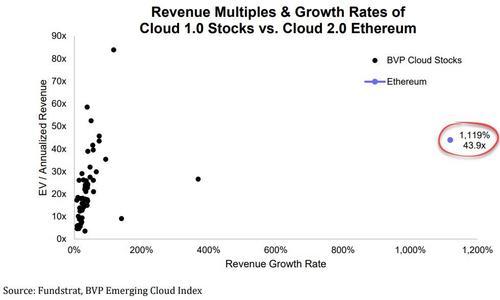

Comparing the individual cloud stocks in the index vs. Ethereum, we can see that on a growth adjusted basis ETH is “off the chart cheap” relative to cloud 1.0 comps.

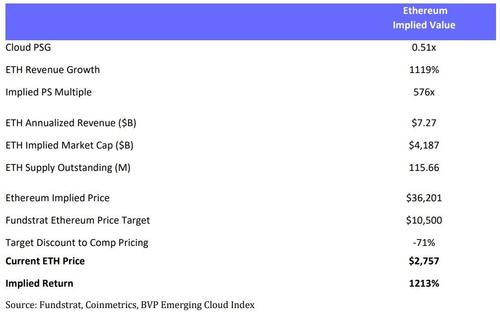

Our $10.5k target from January applied a growth adjusted price to sales multiple based on the cloud index.

Although we’re maintaining our current target on Ethereum, updating that same analysis based on the fundamental improvements since would imply an ETH price of ~$35k. Given the high implied multiple due to Ethereum’s rapid growth rate, we’re applying a 70% discount to the comp implied price to let the network continue to grow into its valuation – as it has been. Although the price has risen and we’re being a bit more conservative compared to our prior analysis, we think meaningful upside remains.

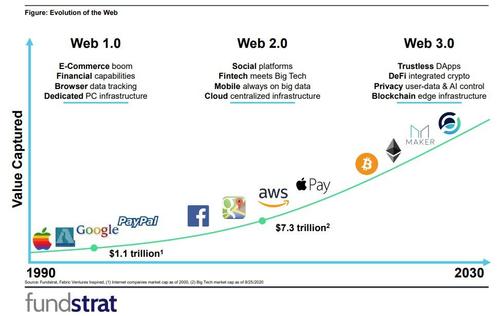

FundStrat continues to see more upside in higher beta altcoins vs. Bitcoin as crypto markets are on pace to hit $5T

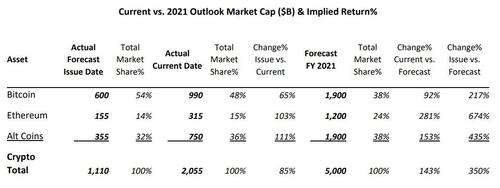

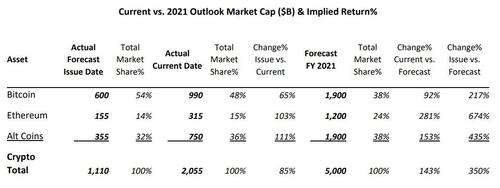

We remain bullish not just on Bitcoin and Ethereum but on the entire crypto space. From our January 2021 Crypto Outlook, we forecasted the total crypto economy reaching $5T in market cap.

We recognize crypto reaching $5T may sound crazy. And we are aware of where this would put the market in relative terms compared to other assets. We haven’t forgotten that the dot.com bubble topped out at $4.5T. But, as we have written about extensively, we think crypto is the next wave of the internet economy and given how much larger that market and every market has become since then (including M2 growth), we humbly think our forecast remains reachable.

Thus far, we’re 3 months into that forecast and we’re on pace to hit $5T with the total crypto market cap having already risen by $1T or 1/4th of the way there. We compare the actual market prices from our forecast issue date against current prices and our forecast below:

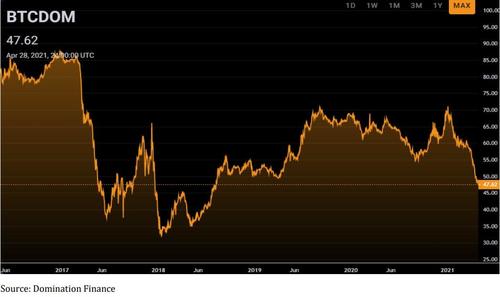

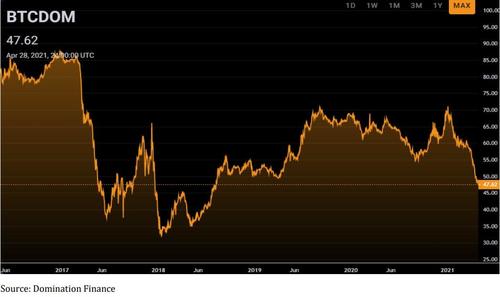

Bitcoin dominance has continued to fall in line with our forecast as Etherum and other alts have had strong performance during 2021. During the prior cycle, bitcoin dominance fell ~55% from 85 to 38 before having a mid-cycle bounce. Thus far this cycle, Bitcoin dominance has fallen ~33% from 70 to 47, implying alts have room to continue outperforming if we see a similar trend as we did during the prior cycle.

We think if Bitcoin can have a healthy consolidation around these levels, capital will continue flowing to smaller assets within the crypto economy and other assets will benefit.