Stock markets set new record highs on Tuesday as investors ended August in a buoyant mood, confident that the Federal Reserve’s eventual tapering of QE would not knock asset prices anytime soon. S&P futures initially hit a new all time high after the underlying index notched its 12th all-time high in August and 53rd for the year, rising as high as 4,542…

…. before dropping after the ECB’s Holzmann said the ECB should start its own tapering debate as the following Bloomberg headlines show.

- *HOLZMANN: ECB IN POSITION TO THINK ABOUT REDUCING PANDEMIC AID

- *HOLZMANN: ECB SHOULD DE-LINK GUIDANCE ON RATES, APP BOND-BUYING

- *HOLZMANN: APP DOESN’T NEED SAME KIND OF FLEXIBILITY AS PEPP

- *HOLZMANN: WOULD ADVOCATE FOR SLOWDOWN OF PEPP PURCHASES IN 4Q

Nasdaq futures also turned red while Dow Jones futures were modestly in the green at 7am. Oil also fell, along with the dollar. In U.S. premarket trading, Chinese gaming-related stocks listed in the U.S. recovered from Monday’s slump, while Zoom dropped 11% after the video-conferencing company’s guidance confirmed the concerns of bears over a slowdown in pandemic-fueled growth even as bullish analysts say this offers a buying opportunity with the company’s long-term attractions intact. Other notable movers included:

- Spok Holdings (SPOK) soars 21% to about $9.49 after Acacia Research Corp. proposed acquiring all outstanding shares for $10.75 apiece in cash.

- New retail trader favorites Vinco Ventures (BBIG) and Support.com (SPRT) gain 5.2% and 2.6% respectively in premarket trading, continuing the recent rallies for both stocks.

Chinese gaming-related stocks listed in the U.S. recovered from Monday’s drop triggered by Beijing’s move to cut back the amount of time children can play online. Among these were Bilibili +3.4%, Kingsoft Cloud +2.1%, Huya +2%.

“While risks remain, and investors should reflect this in their portfolios, we believe the backdrop for equities remains positive, and we advise investors to position for reopening and recovery. We advise investors to position in stocks that should benefit from strong economic growth,” said Mark Haefele, Chief Investment Officer, UBS Global Wealth Management.

The MSCI world equity index, which tracks shares in 50 countries, rose 0.28%. In Europe, stocks headed for their seventh straight month of gains, their longest monthly winning streak since 2013, as investors embraced a brightening outlook for risk assets on the policy and pandemic fronts.

The pan-European STOXX 600 index initially gained 0.2%, but then quickly turned negative following Holzmann’s comments earlier. The Stoxx 600 Index was supported by gains in utilities and technology shares, while airline stocks slipped after the European Union voted to place fresh restrictions on travelers from the U.S. amid a surge in coronavirus cases in the country. The Stoxx Europe 600 travel and leisure index was down 0.2% dragged down by airlines: Flagship carriers IAG -2.5%, Lufthansa -1.5% and non-SXTP member Air France-KLM -1.1%; low-cost airlines also fall: Wizz Air -2.7%, EasyJet -2.7%, Ryanair -1%. Here are some of the biggest European movers today:

- Ambu shares jump as much as 9.6%, the biggest gain since January, after the CEO bought stock.

- Ackermans rises as much as 6%, hitting the highest since August 2018. KBC (accumulate) says the holding company’s 1H results showed a recovery in all divisions.

- Galapagos gains as much as 6.4%, the most since June 9, after the company said its CEO and co-founder is stepping down.

- Bunzl falls as much as 3.4%, the most intraday since June 4, following interim results in which the firm said it’s seeing a reversal in pandemic-related sales.

- IAG drops as much as 3.5% as the European Union voted to place new restrictions on travelers from the U.S. amid a surge in coronavirus cases in the country.

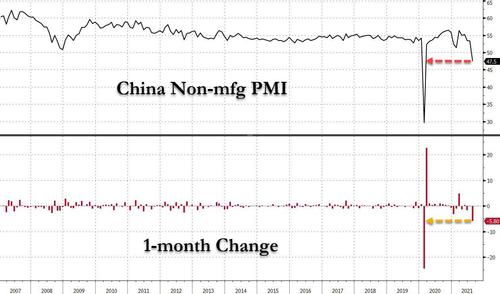

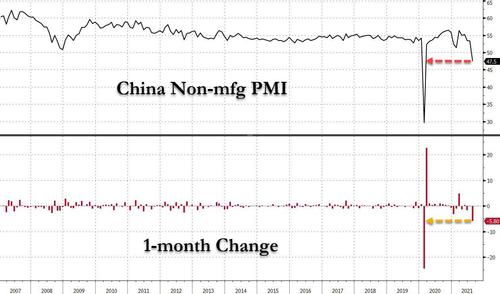

Earlier in the session, Asian stocks climbed, reversing earlier declines and heading for their first monthly gain since May, with Hong Kong technology shares leading the advance. The MSCI Asia Pacific Index jumped as much as 1.2%, erasing an earlier loss of 0.7%. The Hang Seng Tech Index surged more than 3%, with Meituan rising after reporting better-than-expected quarterly sales. Samsung Electronics boosted South Korea’s Kospi Index, while Sony and Keyence lifted Japan’s benchmark. The Asian gauge is poised to climb more than 2% in August. Hardware technology stocks, led by chipmakers, have been in the spotlight as China’s regulatory onslaught casts a shadow over hot software names. Southeast Asian shares are set for their first monthly gain since April as some concerns ease over the delta variant’s spread. The Asian equity benchmark fell earlier in the day, hurt by data from China showing a “shocking” drop in the service sector. China’s economy took a knock from the delta virus outbreak in August, with the services industry contracting for the first time since February last year and manufacturing disrupted by supply-chain problems.

The CSI information technology sub-index slumped 2.67%. The ChiNext Composite start-up board was 2.51% weaker and Shanghai’s tech-focused STAR50 index fell 2.8%. “The Chinese tech sector is under pressure. Divergence should continue when the market faces a lot of uncertainties over Chinese policies,” said Edison Pun, senior market analyst at Saxo Markets.

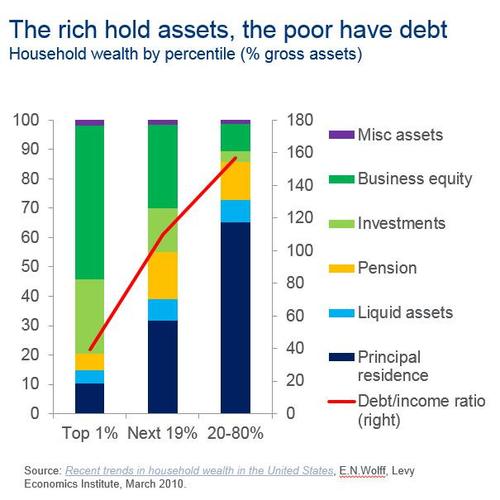

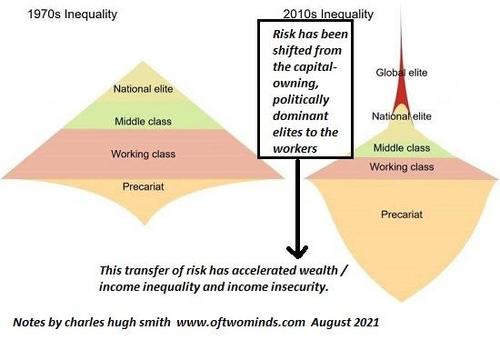

Singapore’s stock benchmark was the day’s worst performer in Asia. “The region’s equities are looking super mixed because of the competing themes driving U.S. equities and China right now,” said Kyle Rodda, an analyst at IG Markets in Melbourne. On U.S. tapering, “the markets are betting they’ll take it slow and steady and that’s good for everyone. But really the big regional theme is this Chinese crackdown on its business sector and wealthy.” Ping An Insurance sank in Hong Kong and Shanghai after Reuters reported that its property investments are being investigated by China’s banking and insurance watchdog. “There’s huge uncertainty about the extent and duration of the crusade, and whether this marks some permanent shift in social and economic policy in the country,” Rodda said.

Japanese equities gained, reversing an earlier decline, with Japan’s Nikkei 225 bouncing back strongly to stand 1.1% higher despite weak July industrial output data, while the Topix index notching its biggest monthly gain since March. Electronics and chemical makers were the biggest boosts to the benchmark, which rose 0.5%, pushing its August advance to 3.1%. Fast Retailing and Tokyo Electron were the largest contributors to a 1.1% rise in the Nikkei 225. The blue chip gauge closed the month up 3%, its best performance since February. Japanese stocks fell earlier in the day, with both major measures dropping at least 0.6%. Meanwhile, the nation’s factory output fell less than expected in July and the unemployment rate edged lower. Andrew Sullivan, founder of Asian Market Sense, saw signs of “some end of month window dressing or short covering,” noting that stocks were lower in the morning following good Japanese data but then rose in the afternoon despite weak China PMI numbers. With changes to the JPX Nikkei Index 400 becoming effective today, “investors who had been in wait-and-see mode started buying up stocks after the morning drop,” said Eiji Kinouchi, an analyst at Daiwa Securities.

In rates, Treasuries were slightly cheaper, with losses led by the belly and following wider bund-led weakness amid comments from ECB Governing Council member Robert Holzmann. The 10Y yield traded at 1.2869%, slightly higher on the day, and the curve was cheaper by up to 1.5bp across 7-year sector, which underperforms on the curve as 2s7s30s fly extends 2bp on the day; bunds lag by 2.7bp vs. Treasuries in the 10-year sector, while Italian bonds underperform by 4.5bp. “We are now in a situation where we can think about how to reduce the pandemic special programs — I think that’s an assessment we share,” ECB’s Holzmann says in an interview. Confirming that newsflow no longer matters, Treasuries saw little reaction to a huge miss in China’s non-manufacturing PMI in what was a muted overnight session. German 10-year yield rise 3bps, and bunds yield curve bear steepens after Euro-Area inflation for August printed a 3% reading, above the estimated 2.7%, the highest since 2011.

In FX, the Bloomberg Dollar Spot Index fell as the greenback declined against all Group-of-10 peers. Options suggest that traders see further topside risks for the dollar in coming months after August’s gain, though exposure should be selective among Group- of-10 peers. The euro rose a third consecutive day against the dollar to touch a day-high of $1.18 after euro-area inflation jumped to 3%, the highest in a decade, in August, and testing policy makers’ insistence that a post-crisis spike in cost pressures should prove temporary. The Australian and New Zealand dollars climbed as the commodity-linked currencies received a boost in risk-on markets; the Kiwi also advanced after Aussie-Kiwi broke below a slew of option-related bids at 1.0400. The yen was little changed and traded in a narrow range as risk-on sentiment dampened bids for the haven currency.

Meanwhile, oil headed for the biggest monthly loss since October as investors weighed factors including the prospect of additional OPEC+ production and the restoration of crude output in the U.S. after Hurricane Ida. Oil prices fell on concerns that power outages and flooding in Louisiana after Hurricane Ida would cut crude demand from refineries at the same time that global producers plan to raise output. U.S. crude reversed losses to stay flat at $69.22 a barrel. Brent fell to $72.85 a barrel, although it was off its weakest of the day as Hurricane Ida weakened into a Category 1 hurricane within 12 hours of coming ashore as a Category 4.

On today’s calendar we get the June FHFA house price index, August MNI Chicago PMI, and the August Conference Board consumer confidence. Joe Biden will deliver remarks on the subject this afternoon

Market snapshot

- S&P 500 futures up 0.2% to 4,536.25

- STOXX Europe 600 up 0.2% to 473.83

- German 10Y yield up 2.2 bps to -0.417%

- Euro up 0.3% to $1.1827

- MXAP up 1.1% to 201.48

- MXAPJ up 1.3% to 663.77

- Nikkei up 1.1% to 28,089.54

- Topix up 0.5% to 1,960.70

- Hang Seng Index up 1.3% to 25,878.99

- Shanghai Composite up 0.4% to 3,543.94

- Sensex up 0.7% to 57,262.95

- Australia S&P/ASX 200 up 0.4% to 7,534.90

- Kospi up 1.8% to 3,199.27

- Brent Futures down 1.0% to $72.71/bbl

- Gold spot up 0.3% to $1,816.03

- U.S. Dollar Index down 0.17% to 92.50

Top Overnight News from Bloomberg

- President Joe Biden’s choice of who will lead the Federal Reserve may come down to a debate about regulating Wall Street

- Chinese President Xi Jinping chaired a high-level meeting that “reviewed and approved” measures to fight monopolies, battle pollution and shore up strategic reserves, all areas that are crucial to his government’s push to improve the quality of life for the nation’s 1.4 billion people

- China’s securities regulator said it plans to rein in the country’s private equity and venture capital funds, stop public offerings disguised as private placements and fight embezzlement of assets

- China’s economy took a knock from the delta virus outbreak in August, with the services industry contracting for the first time since February last year and manufacturing hit by supply chain problems. The official manufacturing purchasing managers’ index fell to 50.1 from 50.4 in July, the National Bureau of Statistics said, slightly lower than the 50.2 median estimate in a Bloomberg survey of economists

- German unemployment fell for a fourth straight month as businesses replenished their workforce and continued to recover from Covid-19 lockdowns. The decline of 53,000 in August was more than economists expected. It pushed down the jobless rate to 5.5%, the lowest since March last year

- Austria plans to issue its first ever green bond next year, joining the flock of nations looking to issue debt tailored for investors with an environmentally conscious mandate

- The Taliban called for good ties with the U.S. hours after the last American soldiers flew out of Kabul to end 20 years of war, with the militant group now facing a host of fresh challenges

- Aluminum charged to a 10-year high in London, extending a year-long rebound as demand surges and supply of the usually abundant metal comes under pressure

- Polish inflation surged to 5.4% from a year earlier in August, its highest level in two decades, piling pressure on policy makers to ditch their dovish stance and increase interest rates in the coming months. That exceeded the 5.1% median estimate in a Bloomberg survey

A more detailed look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously as participants digested disappointing Chinese PMI data and with a non-committal tone seen at month-end following the mixed handover from US, where the S&P 500 and Nasdaq extended on record highs led by growth and tech although cyclicals and financials lagged amid a lower yield environment. ASX 200 (+0.4%) was kept afloat by outperformance in tech and health care but with upside limited by soft domestic data releases, as well as ongoing virus restrictions that have been extended in the capital and with Australia’s Victoria State Premier also noting it is too soon to open up from the lockdown. Nikkei 225 (+1.1%) was subdued for most of the session after somewhat varied data releases including a surprise decline in the Unemployment Rate and with Industrial Production back in negative territory albeit at a narrower than expected decline, before staging a late rally to reclaim the 28k level. Hang Seng (+1.3%) and Shanghai Comp. (+0.4%) were initially lower after the miss on key Chinese data in which the headline Manufacturing PMI missed estimates at 50.1 vs exp. 50.2, while Non-Manufacturing and Composite PMI both showed a contraction for the first time in 16 months. The losses in Hong Kong were exacerbated by regulatory concerns with Ping An Insurance the worst hit amid reports China’s banking and insurance regulator is probing the Co.’s property market investments and Tencent is also pressured after China unveiled new restrictions on young people playing online games whereby gaming names are to only allow minors a total of three hours of play for the week. However, as the session progressed and European participants began to enter the fray losses were pared back and bourses ultimately concluded the session positively. Finally, 10yr JGBs were choppy with initial support amid the continued strength in T-notes as Fed Chair Powell’s dovish virtual Jackson Hole appearance continued to reverberate across US treasuries and amid roll activity, although JGBs later gave up their earlier gains as the risk appetite in Japan eventually improved and despite firmer results at this month’s 2yr JGB auction.

Top Asian News

- China Seeks to Cap Rising Home Rents in Latest Equality Move

- China Asked Some Big Banks to Raise August Loan Quota: Reuters

- U.S.’s Kerry on Trip to Japan, China to Discuss Climate Efforts

- Japan Seeks to Draw Banks, Brokers by Boosting Use of English

Stocks in Europe vary but ultimately hold an upside bias, with the Euro-bourses modestly firmer across the board but the UK’s FTSE 100 posting mild losses on its return from the long weekend (Euro Stoxx 50 +0.3%; Stoxx 600 Unch). European equity futures similarly vary, whilst their counterparts across the board are mildly firmer across the board with the NQ (+0.2%) and RTY (+0.3%) narrowly ahead of the YM (+0.1%) and ES (+0.1%). News flow has once again been light in early European hours, with markets treading water ahead of the US open and in the run-up to this week’s ISM metrics and the crucial US jobs report. Back to Europe, Euro-bourses saw a leg higher in conjunction with the bond decline seen after the above-forecast EZ CPI metrics, with the DAX Sep’21 future and cash eclipsing the 16k mark shortly after. The FTSE 100 (-0.2%) initially narrowly outperformed, but Monday’s declines in crude and yields caught up to heavyweight oil and banking names, with BP (-1.2%) and HSBC (-2.5%) among the laggards, with the latter also weighed on by its exposure to China amidst the ongoing crackdown – with the latest suggesting further measures against violations in the property sector. Sectors in Europe are mixed and do no portray any particular theme. Tech outperforms amid tailwinds from Wall Street whilst basic resources glean support from the price action across some base metals and alloys. Banks resided as the underperformer throughout most of the session, although the EZ CPI metric lifted yields off lows and the banking sector with it. In terms of individual movers, Ambu (+7%) resides at the top of the Stoxx 600, with some attributing the strength to reports that the CEO acquired shares in the firm. Rolls-Royce (-2.5%) failed to gain much traction from the noise surrounding a unit sale as shareholder Causeway Capital Management (9% stake) has called for a board shakeup. Finally, Infineon (+1.8%) and Weir Group (+3.0%) are both near the top of their respective bourses following broker upgrades.

Top European News

- FTSE Loses Hot Stock With Just Eat’s Exit: Taking Stock

- Prosus Acquires Additional 2.5% Stake in Delivery Hero

- German Unemployment Falls to Lowest Level Since Virus Outbreak

- U.K. Mortgage Approvals Fall to 75,152 in July Vs. Est. 78,000

In FX, the Buck is buckling again, and arguably succumbing to more than mere month end pressure after attempting to stabilise on Monday when the index recovered from a 92.595 low to trade near 92.800 at one stage. However, momentum faded just ahead of the 21 DMA and the index subsequently lost 92.500+ status to probe recent lows, including an effective double bottom either side of a weekend in mid-August (92.468 and 92.480 to be precise on August 13 and 16 respectively) before finding underlying bids at 92.456 vs 92.716 at best in advance of US house price data, Chicago PMI, consumer confidence and a couple of regional Fed surveys.

- NZD/AUD – Yesterday’s major laggards are taking full advantage of the Greenback’s demise, while the Kiwi also caught the Aussie dwelling on weaker than expected building approvals data plus disappointing Chinese PMIs overnight to the extent that Aud/Nzd hit a 1.0350 trough irrespective of declines in NBNZ’s business outlook and own activity readings. Meanwhile, Nzd/Usd has breached 0.7050 and has the 100 DMA (0.7084) to aim for ahead of NZ terms of trade for Q2 on Wednesday, as Aud/Usd hovers below 0.7350 awaiting August’s manufacturing PMI, Q2 GDP and breakdown, with hefty 1.4 bn option expiry interest at the 0.7400 strike and the 50 DMA (0.7385) also capping the upside.

- CHF/EUR – Some payback for the Franc and Euro as well following weak starts to the week, with Usd/Chf retreating through 0.9150 and Eur/Usd securing a firm grasp of the 1.1800 handle with some stronger than forecast Eurozone data including preliminary HICP, German jobs and French Q2 GDP.

- CAD/GBP/JPY – The Loonie is consolidating after outperforming and scaling 1.2600 pre-monthly and quarterly Canadian growth data today, but further appreciation could be stymied by the proximity of 1.2 bn option expiries at 1.2560. Elsewhere, the Pound failed to get any incentive via BoE consumer credit, mortgage approvals or lending that came in sub-consensus across the board, as Cable touched 1.3800 before waning, and Sterling may also have been conscious of the fact that technical resistance lies just beyond the psychological level in the guise of 200 and 50 DMAs (1.3806 and 1.3813). Similarly, the Yen will be wary about an upside chart marker at 109.66 (100 DMA) as it meanders between 109.98-78 following not as bad as feared Japanese ip and an unforeseen dip in the jobless rate, though also underpinned by 50 DMA support if it slips beneath 110.00 as that stands closeby at 110.11 today.

In commodities, WTI and Brent futures are once again softer but still within yesterday’s ranges in the run-up to today’s JTC meeting and ahead of tomorrow’s JMMC/OPEC confabs (Click here for a full preview). The OPEC+ decision-making meeting will be taking place against potential supply threats from a rampant Delta variant and the US’ desire for lower oil prices. The group have several options on the table for September production: 1) stick with the planned +400k BPD monthly hike, 2) defer the hike and maintain current production for at least September, or 3) increase output by a smaller volume. OPEC+ ministers have been relatively quiet since the mid-July meeting, but sources have suggested that the planned 400k BPD hike will likely go ahead. The Kuwaiti oil minister, however, has indicated that producers could mull halting the planned hike, citing COVID as the main factor, although he added that nothing had yet been discussed among participants. In terms of scheduling, the Joint Technical Committee (JTC) will meet on Tuesday at 12:00BST/07:00EDT to assess oil market conditions and examine its developments and trends. The Joint Ministerial Monitoring Committee (JMMC) will then review this data on Wednesday at 15:00BST/10:00EDT and make a recommendation to OPEC+, with a meeting slated for 16:00BST/11:00EDT. As always with OPEC, timings are indicative and subject to delays. Elsewhere, eyes remain on the damage situation along the Gulf of Mexico following Hurricane Ida’s passing, with focus on whether production can swiftly come back online, with some 1.7mln BPD shuttered according to the latest BSEE release. WTI Sept resides around USD 68.50/bbl (vs USD 68.29-69.34/bbl range) while Brent Nov trades just under 72.00/bbl (vs USD 71.40-72.36/bbl range). Turning to metals, spot gold and silver have largely been moving in tandem with the Buck, with the former still above its 100 and 200 DMAs at USD 1,812/oz and USD 1,809/oz respectively. Turning to industrial metals, LME copper briefly topped USD 9,500/t on its return from the long weekend, although the downbeat Chinese PMI data has capped upside. Elsewhere, aluminium prices hit 10yr highs whilst Japan’s aluminium stocks are three major ports declined 11% M/M in July.

US Event Calendar

- 9am: 2Q House Price Purchase Index QoQ, prior 3.5%

- 9am: June S&P/CS 20 City MoM SA, est. 1.80%, prior 1.81%

- 9am: June S&P CS Composite-20 YoY, est. 18.60%, prior 16.99%

- 9:45am: Aug. MNI Chicago PMI, est. 68.0, prior 73.4

- 10am: Aug. Conf. Board Consumer Confidence, est. 123.0, prior 129.1; Present Situation, prior 160.3; Expectations, prior 108.4;

DB’s Henry Allen concludes the overnight wrap

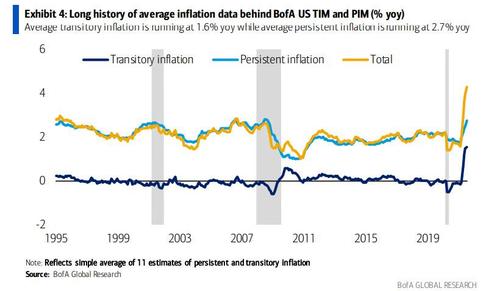

Having spent two weeks on EMR duties whilst Jim’s been away, I’ll finally be handing the reins back tomorrow, which will hopefully give me some much needed time for wedding planning ahead of next summer. Readers may recall our jubilation after my fiancée’s wedding dress came in 50% under budget, but this has since been met by another round of frights on the cost of everything else, with flowers being the latest example. The central bankers might be saying inflation is transitory, but I have to say this experience is struggling to persuade me.

For UK readers coming back to work after the holiday weekend, markets have continued to power forward whilst you’ve been away, with global equity indices reaching new heights thanks to dovish remarks from Fed Chair Powell at Jackson Hole last Friday (more on which below). However, we’re about to approach a much more eventful period on the calendar after a fairly light summer, and the next month alone will feature multiple elections (including Germany and Canada), central bank meetings (including the Fed and ECB), along with fights over US government spending and the debt ceiling. And that comes on top of the regular concerns about the pandemic, which will dominate in the background as the advanced economies approach the limits of where they can get to with their initial vaccination campaigns, and are increasingly debating the use of booster jabs in order to offer their citizens further protection against the virus.

This week, however, the main highlight will be on Friday as we get the August jobs report from the US. This will be in focus after Powell’s speech at Jackson Hole, where he said that there had been “clear progress toward maximum employment”, and that he was in favour of beginning to taper the Fed’s asset purchases this year. In terms of what to expect, our US economists think that the pace of hiring will slow somewhat after the strong report in July, but the +700k increase in nonfarm payrolls that they’re forecasting should be more than sufficient to keep the Fed on track to announce tapering at the November FOMC meeting. In turn, that jobs growth should see the unemployment rate fall to a fresh post-pandemic low of 5.2%.

Ahead of that, however, inflationary pressures in the Euro Area will be in focus, with the flash CPI estimate for August coming out today. Our European economists are of the view that headline HICP should jump up to +2.8% from +2.2% in July, which if realised would be the fastest pace for Euro Area inflation since December 2011, the month after Mario Draghi became ECB President. Furthermore, that follows yesterday’s inflation reading from Germany, which showed HICP rising to +3.4% as expected, which is the highest it’s been since July 2008. The central bankers are still pointing to transitory factors as being behind the inflation spikes lately, but the big worry for them will be that high inflation increases inflation expectations, and it risks becoming a self-fulfilling prophecy.

Staying on Germany, over the weekend and yesterday there were further indications that the centre-left SPD were cementing their newfound hold on first place ahead of the federal election in less than 4 weeks’ time. Firstly, there was an Insa poll that put the party at 25%, ahead of Chancellor Merkel’s CDU/CSU bloc on 20% and the Greens on 16.5%, with that 5-point lead being the biggest SPD lead we’ve seen so far in this campaign. Furthermore, that comes on the back of a weekend TV debate between the three chancellor candidates, where a separate Forsa poll afterwards showed that 36% of viewers judged the SPD’s Olaf Scholz to be the winner, ahead of both Annalena Baerbock for the Greens on 30%, and the CDU’s Armin Laschet on 25%.

Turning to the pandemic, part of the market optimism we’ve seen over recent days has stemmed from increasing signs that the growth rate in new cases has been continuing to slow at the global level. Indeed, looking at data for the last 5 weeks from Johns Hopkins University, the global growth rate in cases has slowed down from +9.4%, to +7.0%, to +3.5%, to +1.1%, and last week to just +0.01%. So at this rate we might even see the first weekly decline in cases since early June. The United States has also witnessed a sharp slowdown in case growth, with last week seeing an increase of just under +8%, which is some way down from over +50% in a week last month and marks the slowest growth we’ve seen since June.

Overnight in Asia, sentiment has been weighed down by weaker-than-expected August PMIs from China, where the non-manufacturing PMI fell to a contractionary 47.5, which is below the 52.0 reading expected and down from 53.3 in July. Although the manufacturing reading was relatively resilient at 50.1 (vs. 50.4 last month and 50.2 expected), the composite PMI was below 50 as well as 48.9, which marks the first sub-50 reading since February 2020. A number of factors are behind the slowdown, including the imposition of lockdowns to control the spread of the delta variant, along with flooding in some regions, and the ongoing regulatory changes that have impacted domestic wealth. Speaking of new regulations, yesterday saw China increase its restrictions on online gaming as the regulators reduce the time children can play online each week to just three hours. Against this backdrop, the Hang Seng (-1.44%) and Shanghai Comp (-0.75%), have both lost ground this morning, although elsewhere in Asia, the Nikkei (+0.21%) and Kospi (+0.60%) have both moved higher. Elsewhere, futures on the S&P 500 are also up +0.11%.

Looking back to yesterday now, the main story was a continuation of the post-Jackson Hole price action, with equities higher and bond yields lower. The S&P 500 rose +0.43%, led by megacap tech stocks as the FANG+ index gained +1.58% to reach its highest closing level since mid-February. The gains there were led by Apple (+3.04%), Amazon (+2.15%), Tesla (+2.67%) and Facebook (+2.15%), as technology and healthcare stocks led the S&P higher and took the NASDAQ up +0.90% higher to another record close. On the other hand, airlines (-3.54%) fell back as the EU voted to reimpose restrictions on non-essential travel from the US. European equities saw little change, with the STOXX 600 seeing a limited +0.07% rise given the UK components in the index weren’t trading, whilst the CAC 40 (+0.08%) and the DAX (+0.22%) also saw modest advances.

As stated above, yields continued to fall yesterday with US 10-year yields declining -2.9bps to 1.279%, as those in Europe saw similar price action with yields on 10-year bunds (-1.6bps), OATs (-1.8bps) and BTPs (-2.1bps) all falling further.

In the US, oil prices have risen further after last week’s gains, following the arrival of Hurricane Ida in Louisiana late Sunday night. Many refiners in the areas already closed last week ahead of the storm, which helped see a strong rise in oil prices, and Brent Crude (+0.98%) and WTI (+0.68%) posted further gains yesterday. In terms of the equity impact, both energy (-1.16%) and insurance (-1.15%) stocks fell back in the US with the storm having already caused major damage in the region.

Looking at yesterday’s other data, the European Commission’s final consumer confidence indicator for the Euro Area in August came in at -5.3, in line with the preliminary reading, as Covid-19 and inflation worries continue to weigh on consumers. Separately, pending home sales for the US in July fell -1.8% (vs. +0.3% expected), underwhelming expectations as June’s reading was also revised down a tenth to -2.0% amidst a further tightening in housing supply. Lastly, the Dallas Fed’s manufacturing activity index for August fell some way below estimates at 9.0 (vs 23.0 expected) as the reading saw its biggest monthly decline relative to the previous month since the height of the pandemic last year.

Recapping last week’s events, the main highlight came from the aforementioned speech by Fed Chair Powell on Friday at the Jackson Hole Symposium. The main headline was that Powell was of the view that tapering could begin this year, given that he felt that there’d been “clear progress” towards the Fed’s maximum employment objective, and that the economy had already passed the test of “substantial further progress” on their inflation objective. However, Powell also struck a dovish tone that was picked up by investors, as he stressed that tapering was not a signal for eventual rate hikes, and warned that monetary policy should not respond to transitory inflation pressures, as any moves to tighten prematurely could needlessly slow hiring and keep inflation too low.

Markets reacted bullishly to the dovish developments, with the S&P 500 rising another +0.88% on Friday to finish the week up +1.52% at a fresh record high. It was also the largest one-day rally for the index in just over a month. At the same time, US sovereign bonds benefited as 10yr yields moved -4.2bps lower on Friday, although for the week as a whole, that still wasn’t enough to overcome the rise in yields earlier in the week, which left the 10yr yield +5.2bps higher overall. European equities experienced a similar rise as well, with the STOXX 600 rising +0.76% over the week to get within 1% of its all-time high.