Apple Sees Promising Boost In Chinese iPhone Demand As Huawei Is Hamstrung By US Sanctions

As it turns out “Tim Apple” – as Trump once famously called him during a press conference – and the consumer tech behemoth he leads just might be the biggest beneficiaries of the Trump Administration’s crackdown on Huawei, which was added to a corporate black list by the Commerce Department during Trump’s term in office, as Washington sought to strangle the firm by depriving it of critical US-made components to use in its handset and telecoms business.

The result? According to the SCMP, without premium 5G Huawei handsets to compete against, the newly unveiled iPhone 13 just might be the new leading premium smartphone in the Chinese market.

Per SCMP, preorders for the iPhone through JD.com have topped 2MM already, more than the 1.5MM iPhone preorders on the same platform for the iPhone 12 a year earlier.

Here’s more from the SCMP:

The iPhone 13, which was introduced on Tuesday in the US, stands out as this year’s go-to high-end smartphone in China because of Huawei’s inability to provide equally compelling premium handsets, as it continues to struggle under US trade sanctions, according to Counterpoint Research senior analyst Ethan Qi.

“There isn’t a smartphone [in the market] which can be a threat to the iPhone 13 above the 5,000 yuan (US$776) price range,” Qi said. “There isn’t a product that is as strong as the old Huawei Mate series.”

Demand for the iPhone 13 line has also been high on Alibaba Group Holding’s Tmall platform, which will start pre-orders on Friday in line with Apple’s official presales kick-off. Many consumers are logging on to chat with customer service agents on Tmall, with some waiting in long lines.

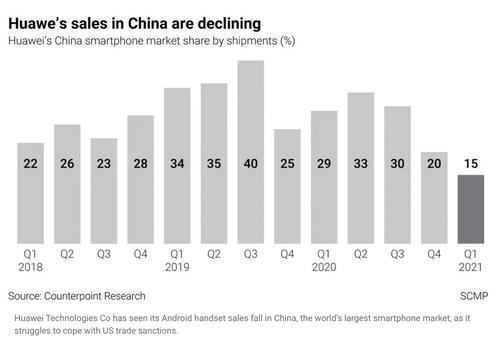

Meanwhile, with Huawei unable to use components that would give its phones access to 5G networks, sales have fallen dramatically over the last two years.

So far, Shenzhen-based Huawei has probably been the biggest casualty of President Trump’s trade war with China, which President Biden has vowed to continue because it’s popular.

The world’s most valuable company, with a market capitalisation of US$2.5 trillion as of Wednesday, recorded revenue of US$14.8 billion in its Greater China region, including Hong Kong and Taiwan, in the quarter ended June 26. That was up 58.2 per cent from US$9.3 billion in the same period last year on the back of strong iPhone 12 sales.

The fact that Apple remains as popular as it is – although Chinese brands Oppo and Xiaomi still sell more units than Apple in Greater China, Apple is the No. 4 biggest smartphone seller in the area – is a testament to CEO Cook’s ability to wheel and deal with the CCP.

He’s of course helped by Apple’s immense consumer appeal as a luxury brand in China, one that’s seen as a status symbol for those Chinese wealthy enough to own iPhones.

But Cook’s ties in China run deeper than many Americans probably realize. In February, Cook staged a virtual talk show with a 22-year-old Chinese influencer in a PR effort to appease young consumers and draw more Chinese to the brand. Cook also remains the chairman of the advisory board at Tsinghua University’s School of Economics and Management.

Bottom line: Analysts whoanticipated slower sales for the iPhone 13 given the lack of new features might soon be proven incorrect.

“There are reasons to believe that the iPhone 13 would sell less because of the lack of new features,” said Counterpoint Research senior analyst Ethan Qi. “But considering Huawei’s plight, we think the iPhone 13 will sell just as well [as the previous line].”

Another important factor that could help boost iPhone sales: lower cost. The new iPhone 13 models have been priced lower than the iPhone 12 iteration of phones, which has pleasantly surprised many Chinese consumers. Pricing for the new models in China starts at 5,199 yuan ($805) for the iPhone 13 Mini, 5,999 yuan ($930) for the iPhone 13 and 7,999 yuan ($1,240) for the iPhone 13 Pro.

The only thing that could seemingly derail this sales slam dunk: another CCP-approved “boycott” of the company’s products, which nearly tanked sales back in 2019. But as one Weibo user put it: “I thought we were supposed to support Huawei and other Chinese brands…But it seems like better products speak louder than patriotism.”

Tyler Durden

Thu, 09/16/2021 – 14:40

via ZeroHedge News https://ift.tt/39cJDu1 Tyler Durden