Frenzied Futures Rally Fizzles As All Eyes Turn To Fed’s Taper Announcement

US futures and European bourses retreated slightly from record highs as investors weighed the ever worsening supply crunch and virus curbs in China against strong earnings with all eyes turning to the conclusion of the Fed’s 2-day meeting tomorrow, when Powell will announce the launch of a $15BN/month taper. At 7:20 a.m. ET, Dow e-minis were up 7 points, or 0.02%, S&P 500 e-minis were down 0.50 points, or 0.01%, and Nasdaq 100 e-minis were down 28.75 points, or 0.18%. Iron-ore futures tumbled on shrinking steal output in China. Tesla led premarket losses in New York.

Investors paused to reflect on a rally that’s taken U.S. and European stocks to record highs. With a post-pandemic supply crunch stoking inflation and pushing central banks to tighten monetary policy, they have begun to question valuations. Economic recovery is also under strain as countries from China to Bulgaria report rising Covid cases. Both the S&P 500 Index and the Dow have been scaling new peaks as U.S. companies post another stellar quarter for earnings. Of the 295 companies in the equity benchmark that have reported results, 87% have either met or surpassed estimates.

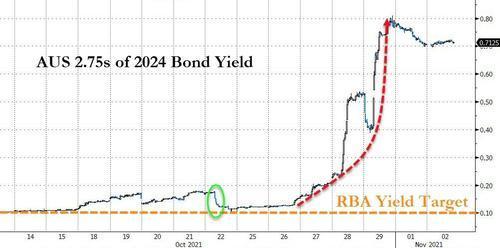

Dow futures slipped after the underlying gauge briefly surged past the 36,000 mark on Monday. Russell 2000 contracts rose. Bonds from Europe to the U.S. jumped after Australia signaled patience with rate increases despite abandoning Yield Curve Control due to “economic improvement.” Yields on the two-year and five-year Treasuries fell as the RBA joined global central banks inching closer to policy tightening. However, the central bank’s insistence on remaining patient with rate hikes pushed traders to pare back hawkish bets in Australia as well as in global bond markets during European hours.

“The Fed meeting could still shake the markets, because even though we know the concrete outcome of the meeting, which is the opening bell of the QE tapering, the risks remain tilted to the hawkish side,” said Ipek Ozkardeskaya, senior analyst at Swissquote. “Still, investors prefer seeing the glass half full.”

In early trading, Tesla tumbled 5%, retreating from a gamma-squeeze record on Monday after Elon Musk said the carmaker hasn’t yet signed a contract with Hertz Global for Model 3 sedans. Chegg slumped 32% after the online-education company cut revenue forecasts and its results missed estimates, prompting a raft of downgrades. Clorox rose 1.6% after the bleach maker posted upbeat first-quarter results. Simon Property Group added 4.2% after the mall operator raised its 2021 forecast for profit and quarterly dividend. Pfizer gained 2.4% after the drugmaker boosted (get it “boosted”?) its full-year sales forecast for the company’s COVID-19 vaccine to $36 billion. Here are some of the biggest U.S. movers today:

- Tesla drops as much as 6.9% in premarket trading after closing at a record on Monday after Elon Musk said the electric vehicle-maker hasn’t yet signed a contract with Hertz Global.

- Chegg slumps 31% after the online education company slashed revenue forecasts and posted quarterly results that missed estimates.

- Novavax gains 5.3%, signaling an extension of Monday’s 16% rally, amid optimism over Covid vaccine approvals.

- Triterras tumbles as much as 20% after the short seller target said it encountered an “unanticipated delay in the finalization” of an independent audit of its financial statements.

- Teva Pharmaceutical Industries depositary receipts rise 7.7% and Endo International (ENDP US) gains 6.3% after the firms joined other former opioid makers in scoring a litigation win.

- Geron gains 4.5% and and SAB Bio (SABS US) soars 39% after Baird starts coverage of both with outperform ratings.

- Cryptocurrency-related stocks gained in premarket trading on Tuesday, as Bitcoin climbed and Etherium hit a record high. NXT-ID up 38.18% premarket, Marathon Digital +4.0%, Riot Blockchain +2.9%, Bit Digital +2.5%, Canaan +3.2%, Coinbase +2.0%, MicroStrategy +1.5%

While stocks continue to trade in a world of their own, just shy of all time highs, bond and currency markets are bracing for the Fed to announce a tapering of asset purchases as an initial step to eventually raising interest rates to contain inflation. Equity markets, on the other hand, are focusing on earnings growth and valuations. Meanwhile, mixed data on the global economic revival is further clouding the picture as the pandemic is making a comeback in parts of the world.

“We expect volatility in financial markets to remain high as not only the Fed, but other central banks around the world, extract liquidity to combat the rise in inflation,” Lon Erickson, portfolio manager at Thornburg Investment Management, wrote in a note. Despite Fed rhetoric, “we’ve started to see the market price in earlier policy rate moves, perhaps losing confidence in the ‘transitory’ nature of inflation.”

In Europe, the Stoxx Europe 600 Index slid 0.1% from a record reached on Monday, led lower by miners and travel companies. Spain’s IBEX and the UK FTSE 100 dropped 0.6%. DAX outperforms. BP dropped 2.8% in London even as the oil giant announced an additional $1.25 billion buyback. HelloFresh jumped 14%, the most this year, after the German meal-kit company raised its full-year outlook. Basic-materials stocks were the weakest of 20 sector indexes in Europe as falling iron ore and steel prices weigh on miners and steel producers. Here are some of the biggest European movers today:

- HelloFresh shares surge as much as 16%, their best day since Dec. 2020, with analysts positive on the meal-kit maker’s guidance hike. Jefferies says that the company’s 3Q results included “little not to like.”

- Demant shares rise as much as 6.5%, the most intraday since March 23, after the hearing-aid maker raised its earnings forecast and topped estimates.

- Fresenius SE shares gain as much as 6.5% after reporting 3Q earnings slightly ahead of analyst estimates, with Jefferies saying the focus lies on the company’s cost-savings efforts and future plans for Kabi.

- Fresenius Medical shares up as much as 4.5% after posting 3Q earnings. Company’s FY22 recovery is “key to share price development from here,” according to Jefferies.

- Sinch shares drop as much as 17%, the most on record, after reporting 3Q results which showed organic growth slowing down, a trend Handelsbanken expects to worsen.

- Standard Chartered shares fall as much as 9.5%, the most since March 2020, as the lender’s third-quarter margins disappointed amid suppressed Asia rates and analysts flagged weakness in its retail operations.

- Flutter shares drop as much as 9% in London, the most intraday since March 2020, after the gaming company cut its profit outlook on unfavorable sporting results and a regulatory change in the Netherlands. Analysts expect ex-U.S. earnings consensus to fall.

- Steel makers underperform, with Kloeckner -5.3%, ArcelorMittal -2.9%, ThyssenKrupp -2.5%, Salzgitter -2.5%

Asian stocks dipped, led by Chinese shares on concerns about the impact of measures to curb Covid-19 infections, while financials underperformed ahead of key central bank decisions this week. The MSCI Asia Pacific Index erased earlier gains of as much as 0.4% to fall 0.2% in afternoon trading. Blue-chip financial stocks including China Merchants Bank and Westpac Banking were among the biggest drags. Traders are focused on this week’s U.S. Federal Reserve meeting amid concerns about elevated inflation. Sentiment turned sour after authorities in Beijing halted classes at 18 schools amid Covid-19 resurgence. China’s benchmark CSI 300 Index fell 1%, while Hong Kong’s Hang Seng Index reversed an earlier gain of 1.9% to close in negative territory.

China’s CSI 300 Index falls by as much as 1.9% after Beijing’s suspension of classes across 18 schools heightened concerns over the impact of the recent Covid-19 outbreak. China Tourism Group Duty Free slumped as much as 9.8%, the worst performer in the benchmark and one of its biggest drags. The Shanghai Composite Index also extends decline to 1.9% while the ChiNext Index pares a 1.2% gain to trade little changed.

“Investors are worried that Beijing’s virus measures may cool down China’s economic activities and hamper its recovery,” said Steven Leung, executive director at UOB Kay Hian in Hong Kong. Asian stocks rose on Monday, a turnaround after a drop of 1.5% during last week, the worst such performance since early October. Shares have been whipsawed by ongoing concern over supply-chain constraints impacting industries such as technology and auto making. Investors are also parsing through earnings data, with more than half of the companies on MSCI’s Asia gauge having reported results. “At this level, it can be said that investors are no longer pessimistic but are not yet hopeful either,” Olivier d’Assier, head of APAC applied research at Qontigo, wrote in a note.

Japanese stocks fell, halting a two-day rally, as some investors adjusted positions after the market jumped yesterday. The Topix index slid 0.6% to 2,031.67 at the 3 p.m. close in Tokyo, while the Nikkei 225 declined 0.4% to 29,520.90. Mitsui & Co. contributed most to the Topix’s loss, decreasing 4%. Out of 2,181 shares in the index, 538 rose and 1,583 fell, while 60 were unchanged. Both the Topix and Nikkei 225 gained more than 2% on Monday after the ruling coalition secured an election victory that was better than many had expected. Japan’s stock market will be closed Wednesday for a national holiday.

Australian stocks slide, with the S&P/ASX 200 index falling 0.6% to close at 7,324.30, after the Reserve Bank of Australia abandoned a bond-yield target, following an acceleration in inflation that spurred traders to price in higher borrowing costs. Banks and miners slumped, while real estate and consumer discretionary stocks climbed. Goodman Group was the biggest gainer after the company raised its full-year guidance. Insurance Australia Group tumbled after the firm cut its reported insurance margin forecast for the full year. In New Zealand, the S&P/NZX 50 index fell 0.3% to 12,992.50.

In rates, Treasuries were higher across both the front-end and belly of the curve, led by bull-steepening gains across European bonds with peripherals outperforming. Treasury yields were lower by 2bp-3bp across front-end of the curve, steepening 2s10s by that amount with 10-year little changed around 1.55%; German 10-year is lower by ~4bp, U.K. by ~1bp. Aussie front-end rallied during Asia session after the RBA abandoned its yield target but maintained its bond buying pace; euro-zone money markets subsequently pared the amount of ECB policy tightening that’s priced in.

European fixed income rallied with curves bull steepening. Belly of the German curve outperforms, trading ~2-3bps richer to gilts and USTs respectively. Peripheral spreads tighten; long-end Italy outperforms, narrowing ~6bps near 170bps.

In FX, the Bloomberg Dollar Spot Index inched up and the greenback advanced versus all its Group-of-10 peers apart from the yen; Treasury yields fell by up to 3bps as the curve bull- steepened. The euro hovered around $1.16 while Italian bonds and bunds jumped, snapping three days of declines and tracking short-end Australian debt. The Australian dollar declined against all Group-of-10 peers and Australian short-end bond yields fell after the central bank dispensed with its bond-yield target and damped expectations of interest-rate hikes. One-week volatility in the Australian dollar dropped a second day as spot pulls back from its 200-DMA of 0.7556 after the central bank’s policy decision. The pound fell for a third day, to nearly a three-week low, as investors weighed up the possibilities for the Bank of England’s policy meeting on Thursday. The yen strengthened ahead of a local holiday in Japan and amid souring market sentiment.

In commodities, crude futures hold a narrow range with WTI near $84 and Brent stalling near $85. Spot gold drift close to $1,795/oz. The base and ferrous metals complex remains under pressure: LME nickel and zinc drop ~1%, iron ore down over 6%.

Looking at the day ahead now, and the data highlights include the October manufacturing PMIs for the Euro Area, Germany, France and Italy. Central bank speakers will include the ECB’s Elderson and de Cos, whilst today’s earnings releases include Pfizer, T-Mobile, Estee Lauder and Amgen. Finally, there are US gubernatorial elections in Virginia and New Jersey. Virginia is the more interesting race from a macro perspective: a big, diverse state that has bounced between Democratic and Republican candidates on the national stage. So it could provide the first read of American voter sentiment heading into next year’s mid-terms.

Market Snapshot

- S&P 500 futures little changed at 4,605.25

- STOXX Europe 600 down 0.2% to 477.90

- MXAP down 0.2% to 198.29

- MXAPJ down 0.2% to 646.50

- Nikkei down 0.4% to 29,520.90

- Topix down 0.6% to 2,031.67

- Hang Seng Index down 0.2% to 25,099.67

- Shanghai Composite down 1.1% to 3,505.63

- Sensex down 0.3% to 59,984.88

- Australia S&P/ASX 200 down 0.6% to 7,324.32

- Kospi up 1.2% to 3,013.49

- German 10Y yield little changed at -0.14%

- Euro little changed at $1.1603

- Brent Futures up 0.5% to $85.17/bbl

- Gold spot down 0.1% to $1,791.04

- U.S. Dollar Index little changed at 93.89

Top Overnight News from Bloomberg

- Federal Reserve policy makers are expected to announce this week that they will start scaling back their massive asset-purchase program amid greater concern over inflation, economists surveyed by Bloomberg said

- President Emmanuel Macron backed away from his imminent threat to punish the U.K. for restricting the access of French fishing boats to British waters, saying he would give negotiations more time

- The Reserve Bank of Australia’s dovish policy statement and downplaying of the inflation threat is likely to reignite a steepening of the yield curve from near the flattest in a year. The spread between three- and 10-year yields jumped as much as 10 basis points on Tuesday after central bank Governor Philip Lowe cooled expectations for any near-term interest-rate increase even though the RBA scrapped its yield- curve control policy

A more detailed look at global markets courtesy of Newsquawk

Asian equities traded mixed as upcoming risk events kept participants cautious and offset the momentum from the US, where stocks began the month on the front foot in a continuation of recent advances to lift the major indices to fresh record highs. Nonetheless, ASX 200 (-0.6%) was pressured by underperformance in the top-weighted financials sector and notable weakness in mining names, while quasi holiday conditions due to the Melbourne Cup in Australia’s second most populous state of Victoria and the crucial RBA policy announcement in which it maintained the Cash Rate Target at 0.10% but dropped the April 2024 government bond yield target and tweaked its guidance, further added to the cautious mood. Nikkei 225 (-0.4%) was lacklustre as it took a breather from the prior day’s surge after stalling just shy of the 29,600 level and with the index not helped by a slight reversal of the recent beneficial currency flows. Hang Seng (-0.3%) and Shanghai Comp. (-1.4%) were varied as the former initially atoned for yesterday’s losses led by strength in tech and biotech including Alibaba shares with its Singles Day sales event underway. In addition, Hong Kong participants were seemingly unfazed by the recent weaker than expected GDP for Q3 as the data showed it narrowly averted a technical recession, although the gains were later wiped out and the mainland suffered following another substantial liquidity drain and with Chinese commodity prices pressured including iron futures which hit limit down. Finally, 10yr JGBs were flat with price action muted despite the subdued mood for Tokyo stocks and with the presence of the BoJ in the market for over JPY 1tln of JGBs in mostly 1yr-5yr maturities, doing little to spur demand.

Top Asian News

- Bank of Korea Minutes Show Majority Sees Need for Rate Hike

- China’s Gas Prices Are Surging Just as Coal Market Cools Off

- China Shares Fall as Shut Schools Spark Concern on Virus Curbs

- SMBC Nikko Is Working With Securities Watchdog on Investigation

Bourses in Europe have now adopted more of a mixed picture (Euro Stoxx 50 +0.1%; Stoxx 600 -0.2%) Stoxx 600 following the lacklustre cash open and downbeat APAC handover. US equity futures meanwhile are somewhat mixed with the RTY (+0.2%) narrowly outperforming the ES (-0.1%), YM (Unch), and NQ (-0.2%) – with the latter also seeing some pressure from Tesla (-6.0% pre-market) after CEO Musk said no deal was signed yet with Hertz and that a deal would have zero impact on Tesla’s economics. Back to Europe, a divergence is evident with the DAX 40 (+0.4%) outpacing amid post-earnings gains from HelloFresh (+14%), Fresenius SE (+4.6%) and Fresenius Medical Care (+2.0%). The FTSE 100 (-0.5%) meanwhile lags with the Dec futures and cash both under 7,250 – with the index pressured by heft losses in some of its heaviest sectors. Basic resources sit at the foot of the bunch due to softer base metal prices across the board, which saw Dalian iron ore futures hit limit down at least twice in the overnight session. Travel & Leisure closely follows as sector heavyweight Flutter Entertainment (~23% weighting) slipped after cutting guidance. Oil & Gas and Banks closely follow due to the recent declines in crude (and BP post-earnings) and yields respectively. On the flip side, some of the more defensive sectors stand at the top of the leader board with Healthcare and Food & Beverages the current winners. In terms of other individual movers, THG (-6.1%) resides near the bottom of the Stoxx 600 second-largest shareholder BlackRock (9.5% stake) is reportedly planning to sell 55mln shares equating to around 4% of its holding. It’s also worth noting Apple (-0.1% pre-market) has reportedly reduced iPad production to feed chips to the iPhone 13, according to Nikkei sources; iPad production was reportedly -50% from Apple’s original plans, sources added. In terms of broad equity commentary, Credit Suisse remains overweight value in Europe, whilst raising US small caps to overnight and reducing the UK to underweight. Looking at the rationale, CS notes that European value tend to outperform while inflation expectations or Bund yields rise. US small caps meanwhile have underperformed almost all macro drivers, whilst earnings momentum takes a turn for the better. Finally, CS argues UK small caps are much more cyclical than large caps and could face further tailwinds from UK’s macro landscape and with some tightening potentially on the table this week.

Top European News

- BP Grows Buyback as Profit Rises on Higher Prices, Trading

- Ferrexpo Drops as Credit Suisse Downgrades on Lower Pricing

- OPEC+ Gets a Warning From Japan Before Key Supply Meeting

- THG Extends Decline as Key Shareholder BlackRock Reduces Stake

In FX, the Aussie has reversed even more sharply from its recent core inflation and yield induced highs in wake of the RBA policy meeting overnight and confirmation of the moves/tweaks most were expecting. To recap, YCT was officially withdrawn after the Bank allowed the 3 year target rate to soar through the 0.1% ceiling and guidance on rates being held at the same level until 2024, at the earliest, was also withdrawn and replaced by a more flexible or conditional timeframe when inflation is sustainably in the 2-3% remit range. However, Governor Lowe retained a decidedly dovish tone in the aftermath, pushing back against more aggressive market pricing for tightening and stressing that it is entirely plausible that the first increase in the Cash Rate will not be before the maturity of the current April 2024 target bond, though it is also plausible that a hike could be appropriate in 2023 and there is genuine uncertainty as to the timing of future adjustments in the Cash Rate. Aud/Usd is now closer to 0.7450 than 0.7550 and the Aud/Nzd cross nearer 1.0400 than the round number above with added weight applied by weakness in copper and iron ore prices especially (latter hit limit down on China’s Dallian exchange). Meanwhile, the Kiwi also felt some contagion after a drop in NZ building consents and as attention turns to the Q3 HLFS report, with Nzd/Usd eyeing 0.7150 having got to within pips of 0.7200 only yesterday.

- EUR/DXY – Technical forces seem to be having an influence on direction in Eur/Usd amidst somewhat mixed Eurozone manufacturing PMIs as the headline pair topped out precisely or pretty much bang on a 50% retracement of the reversal from 1.1692 to 1.1535 at 1.1613 and subsequently probed the 21 DMA that comes in at 1.1598 today. Moreover, the Euro appears reliant on hefty option expiry interest for support given 1.9 bn rolling off at 1.1585 if it cannot reclaim 1.1600+ status, as the Dollar regroups and trades firmer against most majors, bar the Yen. Indeed, in stark contrast to Monday, the index has bounced off a marginally deeper sub-94.000 low between tight 93.818-985 confines, albeit in cautious, choppy pre-FOMC mood.

- CHF/CAD/GBP – No traction for the Franc via firmer than forecast Swiss CPI or a faster pace of consumption, while the Loonie is on the defensive ahead of Canadian building permits and Sterling is still on a softer footing awaiting the BoE on Thursday alongside what could be a make or break meeting in France where UK Brexit Minister Frost is due to tackle the fishing dispute face-to-face with Secretary of State for European Affairs Beaune. Usd/Chf is straddling 0.9100, Usd/Cad is hovering around 1.2400, Cable pivots 1.3650 and Eur/Gbp is probing 0.8500.

- JPY – As noted above, the Yen is bucking the broad G10 trend with gains vs the Greenback amidst appreciably softer US Treasury and global bond yields, as Usd/Jpy retreats from 114.00+ peaks to test support circa 113.50.

In commodities, WTI and Brent front-month futures are moving sideways ahead of the OPEC+ meeting on Thursday, whereby expectations are skewed towards an unwind of current curbs by 400k BPD despite outside pressure for the group to further open the taps. Ministers, including de-facto heads Russia and Saudi, have been vocal in their support towards a maintained pace of production hikes. There have also been reports of Angola and Nigeria struggling to keep up with the output hikes, which may further dissuade the producer to further ramp up output. The morning also saw macro commentary from BP, whereby the CFO suggested global oil demand has returned to levels above 100mln BPD. The Co. expects oil prices to be supported by continued inventory draw-down, with the potential for additional demand from gas to oil switching. OPEC+ decision making on production levels continues to be a key factor in oil prices and market rebalancing. Gas markets were very strong in the quarter and BP expect the market to remain tight during the period of peak winter demand. In the fourth quarter industry refining margins are expected to be lower compared to the third quarter driven by seasonal demand. WTI Dec trades on either side of USD 84/bbl and Brent on either side of USD 85/bbl. Elsewhere, spot gold and silver are relatively flat with the former in close proximity to its 200 DMA (1,790/oz), 100 DMA (1,785/oz), 50 DMA (1,780/oz) and 21 DMA (1,778/oz). Over to base metals, Dalian iron ore futures were in focus overnight after prices hit limit down at least twice and nearly hit 1yr lows amid high supply and lower demand, with the latter namely a function of China cutting steel output forecasts. LME copper meanwhile has clambered off worst levels (USD 9,430/t) but remains just under USD 9,500/t as prices track sentiment.

US Event Calendar

- Oct. Wards Total Vehicle Sales, est. 12.5mm, prior 12.2mm

DB’s Jim Reid concludes the overnight wrap

The RBA press conference is still going onas we type this but the key outcome has been that they’ve abandoned the 0.1% target for the April 2024 bond. However they seem to be making it clear in the presser that their expectation is only that rate hikes might creep into 2023 rather than 2024 previously. The governor has said that market expectations of hikes in 2022 are “a complete overreaction to recent inflation data”. So they are trying to pull back the market expectations that ran away from them last week. The reality is that they’ll now be hostage to the data. They don’t expect inflation to be a big problem going forward but time will tell. Yield moves have been relatively subdued but are generally lower with a small steepening seen. 2y (-0.2bps), 3y (-4.5bps) and 5y (-3.3bps) are falling but with the 10y (+0.3bps) steadier.

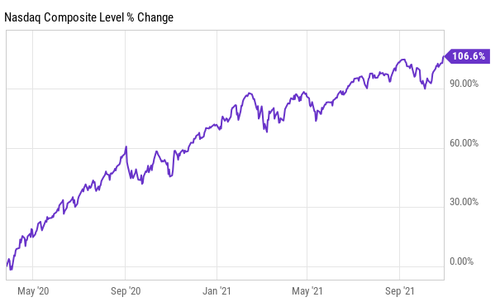

Ahead of the RBA, risk assets got the month off to a strong start as investors awaited tomorrow’s all-important Federal Reserve meeting conclusion. However there was little sign of caution in equities as a range of global indices advanced to all-time records yesterday, including the S&P 500 (+0.18%), the NASDAQ (+0.63%), the STOXX 600 (+0.71%), and the MSCI World Index (+0.50%). Energy (+1.59%) and consumer discretionary (+1.46%) were the clear outperformers in the S&P, with Tesla (+8.49%) doing a lot of the work of boosting the latter sector. While it’s a busy week for earnings, only 2 S&P companies reported during trading hours yesterday, so it didn’t materially drive sentiment. 11 more companies reported after hours, with 7 beating earnings estimates. Elsewhere, the Dow Jones actually crossed the 36,000 mark in trading for the first time. Readers of a certain age may remember an infamous book published in 1999 called “Dow 36,000” during the dot com bubble, which predicted the Dow would more than triple over the next 3-5 years to that level. In reality, even the half way mark of 18k wasn’t reached until late-2014, and of course it took 22 years to get to yesterday’s 36k milestone. So a good case study of the heady optimism many had back then.

We’ll see if yesterday’s milestones are the first step on the path to Dow 100k, but one asset inching its way to $100 in oil, with yesterday seeing a fresh recovery in many commodity prices after their declines last week. Both WTI (+0.57%) and Brent crude (+0.39%) posted gains, with copper (+0.58%) also seeing a modest advance. Agricultural prices set fresh records, with wheat prices (+3.17%) climbing above $8/bushel in intraday trading for the first time since 2012.

It may be a pretty busy macro week with the Fed, BoE and the US jobs report, but the OPEC+ meeting on output this Thursday could also be a vital one for the global economy in light of the resurgence in energy prices lately. We’ve already heard some frustration at the group from a number of countries, with President Biden saying this Sunday at the G20 that “I do think that the idea that Russia and Saudi Arabia and other major producers are not gonna pump more oil so people can have gasoline to get to and from work for example, is … not right”. So one to keep an eye on, with potentially big implications for inflation and hence central banks.

Staying on an inflation theme, investors got a further glimpse of ongoing supply chain issues from the ISM manufacturing print as well yesterday. The overall reading for October actually came in slightly above expectations at 60.8 (vs. 60.5 expected), but the prices paid order similarly rose to 85.7 (vs. 82.0 expected) in its second successive monthly increase. Bear in mind it’s been above the 80 mark for all but one month so far this year, and there were further signs of supply-chain issues from the supplier delivery time measure, which hit a 5-month high of 75.6.

With markets attuned to inflation and the potential for plenty of central bank action this week, sovereign bonds came under further pressure yesterday on both sides of the Atlantic, even if they finished well off the yield highs. Yields on 10yr Treasuries ended the session up +0.7 bps to 1.56%, which comes as markets are almost pricing an initial full hike from the Fed by the time of their June 2022 meeting. However we were off the day’s high of 1.60%. Meanwhile in Europe, yields on 10yr bunds (+0.4 bps), OATs (+0.3 bps) and gilts (+2.8 bps) moved higher as well, but interestingly we also saw peripheral sovereign bond spreads closing in on their highest levels for some time. Indeed by the close of trade yesterday, the gap between Italian (+4.4 bps) and Spanish (+2.2 bps) 10yr yields over bunds had widened to their biggest level in almost a year. Meanwhile, 10yr breakevens widened +4.5 bps in the UK and +2.0 bps in Germany. US breakevens were the outlier, narrowing -7.5 bps to 2.51% and now -18.0 bps below the highs reached just a week ago.

In Asia, the Nikkei 225 (-0.56%) and the Shanghai Composite (-0.62%) are trading lower, while the Hang Seng (+0.74%) and the KOSPI (+1.36%) are edging higher. Some of the news weighing on Chinese stocks are surging gas prices, which reached a record high today. Elsewhere, the S&P 500 futures (-0.22%) is down this morning and the 10y US Treasury is at 1.55% (-0.9bps).

Heads of state gave their opening salvos at COP26 yesterday. The biggest commitment came from Indian Prime Minister Narendra Modi, who said the world’s third-biggest emitter will have zero net pollution by 2070, while also making more near-term commitments to increase reliance on non-fossil fuel energy sources.

Looking at yesterday’s other data, German retail sales unexpectedly fell by -2.5% in September (vs. +0.4% expected). However, the final UK manufacturing PMI for October was revised up a tenth from the flash reading to 57.8. Over in the US though, there was a downward revision to 58.4 (vs. flash 59.2).

To the day ahead now, and the data highlights include the October manufacturing PMIs for the Euro Area, Germany, France and Italy. Central bank speakers will include the ECB’s Elderson and de Cos, whilst today’s earnings releases include Pfizer, T-Mobile, Estee Lauder and Amgen. Finally, there are US gubernatorial elections in Virginia and New Jersey. Virginia is the more interesting race from a macro perspective: a big, diverse state that has bounced between Democratic and Republican candidates on the national stage. So it could provide the first read of American voter sentiment heading into next year’s mid-terms.

Tyler Durden

Tue, 11/02/2021 – 07:52

via ZeroHedge News https://ift.tt/3byFS3q Tyler Durden